Tennessee Proposal to ratify the prior grant of options to each directors to purchase common stock

Description

How to fill out Proposal To Ratify The Prior Grant Of Options To Each Directors To Purchase Common Stock?

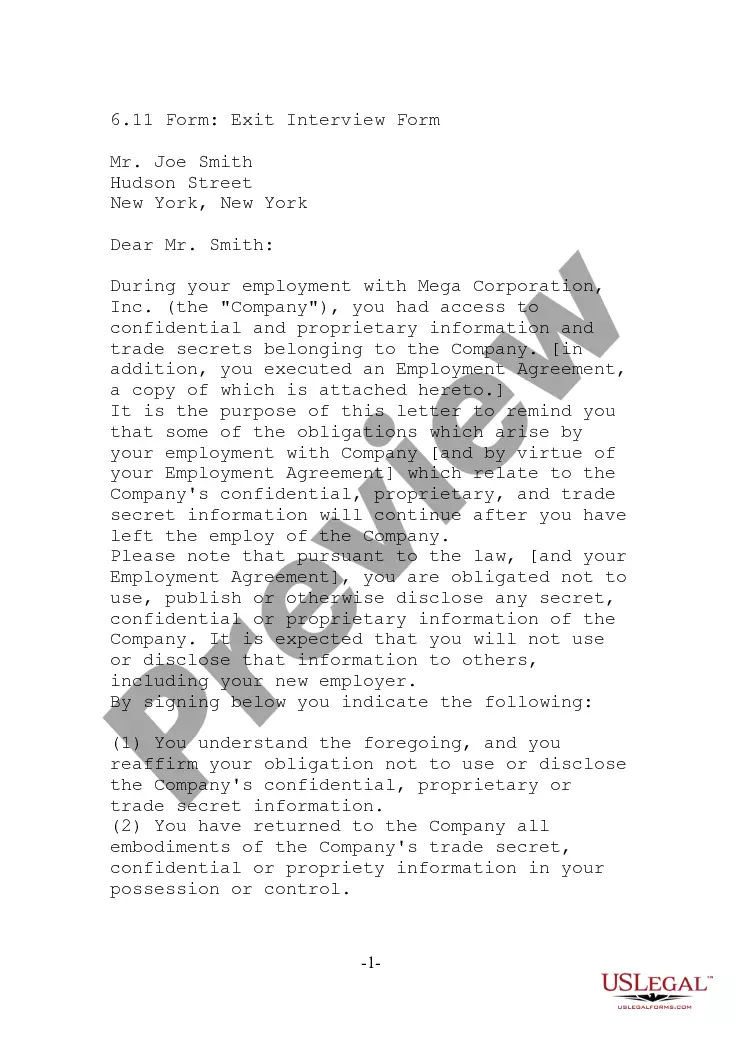

Choosing the best authorized file template can be quite a battle. Of course, there are a variety of themes available on the net, but how will you discover the authorized type you require? Use the US Legal Forms internet site. The support provides a huge number of themes, for example the Tennessee Proposal to ratify the prior grant of options to each directors to purchase common stock, that can be used for enterprise and private requirements. Each of the types are examined by experts and meet up with state and federal specifications.

In case you are currently listed, log in to the accounts and then click the Acquire option to get the Tennessee Proposal to ratify the prior grant of options to each directors to purchase common stock. Utilize your accounts to appear with the authorized types you may have acquired previously. Visit the My Forms tab of your own accounts and get an additional copy of the file you require.

In case you are a fresh end user of US Legal Forms, here are basic instructions so that you can follow:

- Initially, make certain you have chosen the correct type to your metropolis/county. You can check out the form while using Review option and look at the form outline to guarantee this is the right one for you.

- If the type will not meet up with your needs, make use of the Seach discipline to get the correct type.

- Once you are certain the form is proper, click the Get now option to get the type.

- Opt for the rates plan you desire and enter the necessary details. Make your accounts and purchase your order utilizing your PayPal accounts or credit card.

- Choose the data file formatting and acquire the authorized file template to the device.

- Total, revise and printing and signal the received Tennessee Proposal to ratify the prior grant of options to each directors to purchase common stock.

US Legal Forms is the greatest collection of authorized types for which you can see a variety of file themes. Use the service to acquire appropriately-made paperwork that follow express specifications.

Form popularity

FAQ

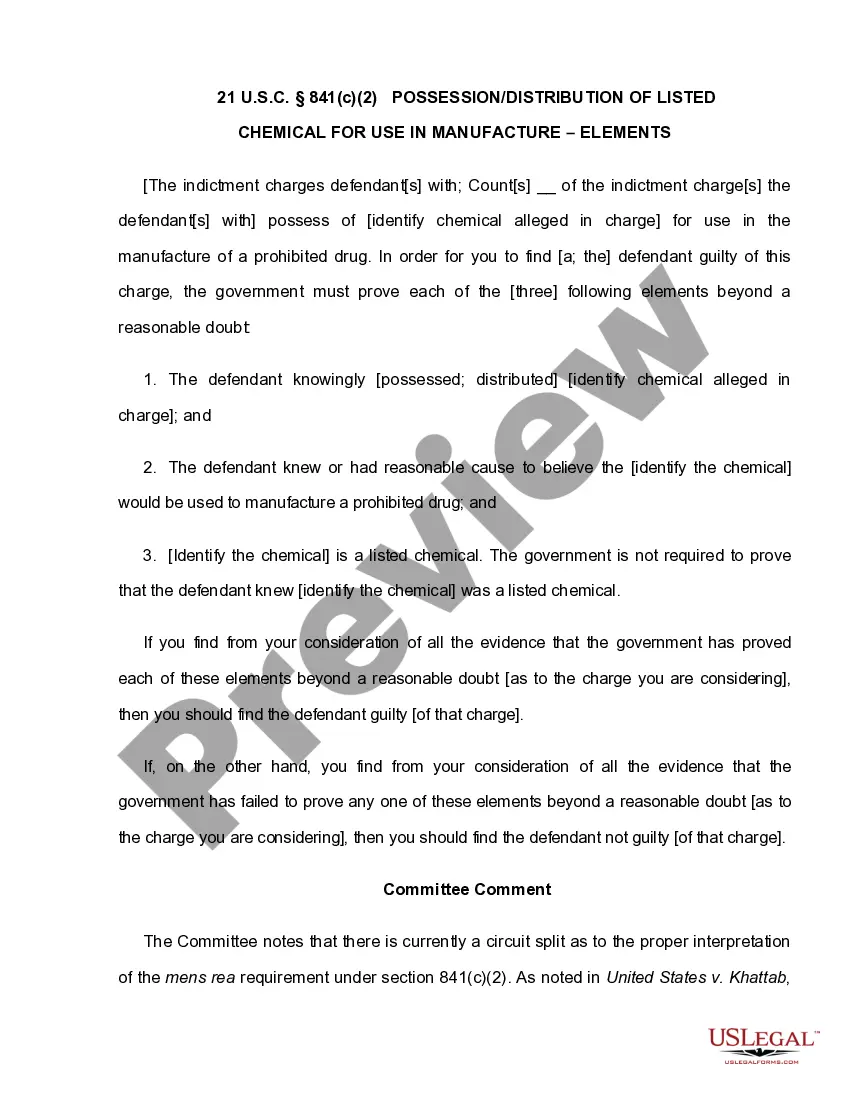

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company. Stock options are the right to purchase shares in a company, usually over a period and ing to a vesting schedule.

What Is a Stock Option? A stock option (also known as an equity option), gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date.

A stock is an ownership stake in a company, and it rises and falls over time depending on the profitability of the business. In contrast, an option is a side bet among traders over what price a stock will be worth by a certain time.

For example, a stock option is for 100 shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $25. He pays $150 for the option. On the option's expiration date, ABC stock shares are selling for $35.

What Is a Stock Option? A stock option (also known as an equity option), gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date.

Before options can be written, a stock must be properly registered, have a sufficient number of shares, be held by enough shareholders, have sufficient volume, and be priced high enough. The specifics of these rules can change, but the general idea is to protect investors.