Tennessee Insurance Agents Stock option plan

Description

How to fill out Insurance Agents Stock Option Plan?

If you wish to complete, acquire, or print out legal file themes, use US Legal Forms, the most important selection of legal types, that can be found online. Take advantage of the site`s basic and handy look for to discover the papers you will need. Different themes for enterprise and personal uses are categorized by types and suggests, or search phrases. Use US Legal Forms to discover the Tennessee Insurance Agents Stock option plan in a number of click throughs.

If you are currently a US Legal Forms customer, log in to the accounts and click on the Acquire option to have the Tennessee Insurance Agents Stock option plan. You may also entry types you previously saved within the My Forms tab of your own accounts.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for the proper metropolis/nation.

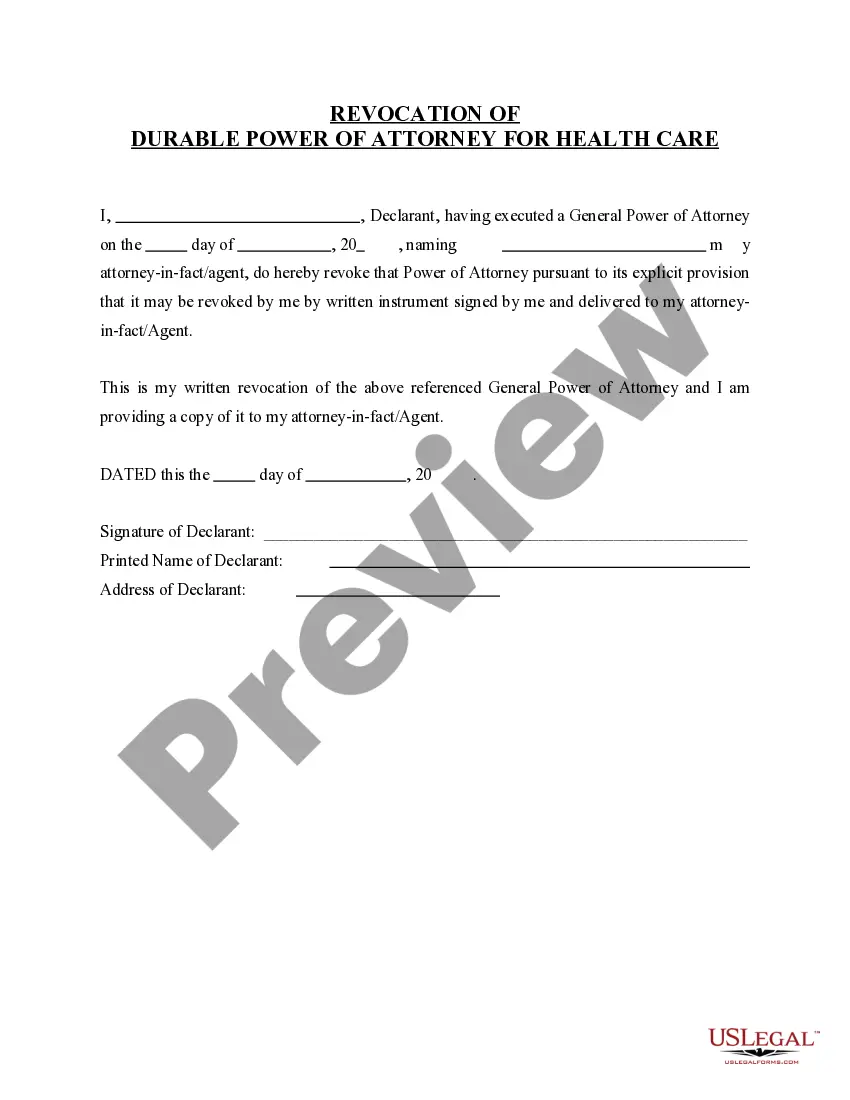

- Step 2. Use the Preview solution to examine the form`s content material. Do not forget to see the explanation.

- Step 3. If you are unhappy with all the kind, make use of the Look for field towards the top of the display to get other models from the legal kind template.

- Step 4. After you have located the shape you will need, select the Get now option. Opt for the costs strategy you choose and add your accreditations to sign up for an accounts.

- Step 5. Process the transaction. You can utilize your credit card or PayPal accounts to perform the transaction.

- Step 6. Choose the formatting from the legal kind and acquire it on your product.

- Step 7. Total, revise and print out or sign the Tennessee Insurance Agents Stock option plan.

Every legal file template you buy is your own property for a long time. You might have acces to each and every kind you saved within your acccount. Go through the My Forms portion and decide on a kind to print out or acquire once again.

Be competitive and acquire, and print out the Tennessee Insurance Agents Stock option plan with US Legal Forms. There are millions of professional and status-particular types you can use for your personal enterprise or personal demands.

Form popularity

FAQ

To put it briefly: A real estate agent is licensed to help people buy and sell real estate, and is paid a commission when a deal is completed. The agent may represent either the buyer or the seller. A real estate broker does the same job as an agent but is licensed to work independently and may employ agents.

Insurance agents and insurance brokers can both help you buy an insurance policy. But insurance agents represent the insurance provider that employs them and help sell policies from that single provider. Insurance brokers represent the consumers who use them and can help them shop for policies from multiple providers.

Insurance agents and insurance brokers can both help you buy an insurance policy. But insurance agents represent the insurance provider that employs them and help sell policies from that single provider. Insurance brokers represent the consumers who use them and can help them shop for policies from multiple providers.

The Department of Commerce and Insurance regulates several hundred thousand Tennesseans in their professions and businesses.

Securities brokers, also often called broker-dealers, are the people responsible for selling securities products to clients. Whereas, in insurance sales, an ?insurance agent? is the most common way to refer to the customer-facing sales role, the world of securities uses the word broker.

The main difference between an insurance broker vs carrier is that an insurance carrier creates and services the insurance policy, whereas a broker helps a customer find the best policy among multiple carriers at the best possible rate.

Tennessee requires each person selling insurance in the state to hold an insurance producer license. You will choose which line of authority you want to be licensed in: health insurance, life insurance, property and casualty insurance, or any combination of those lines.

Although brokers sell insurance, they don't work for one insurance company as an agent does. Instead, they work for you to find the most suitable policy that meets your specific needs. Brokers don't underwrite insurance policies.