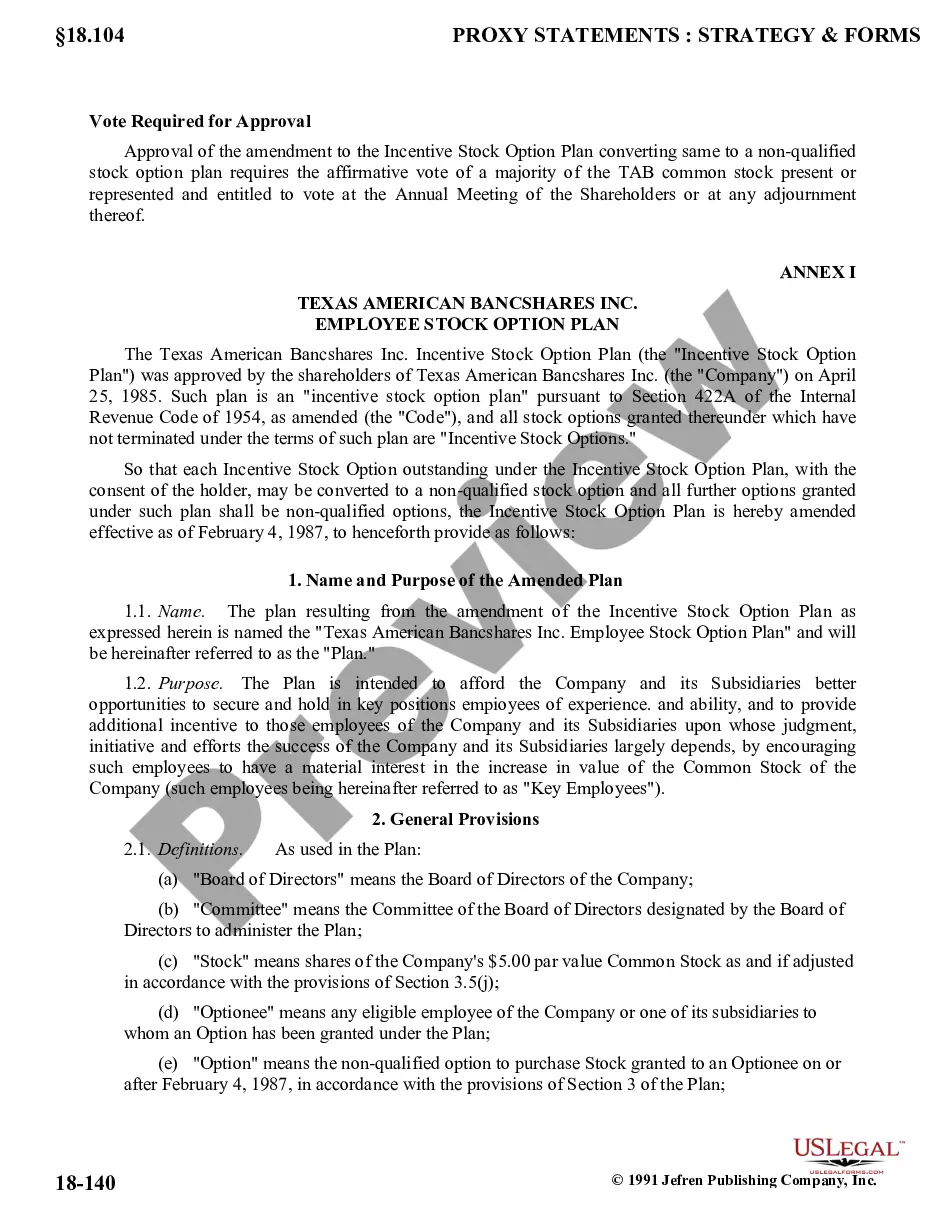

Tennessee Nonqualified Stock Option Plan of the Banker's Note, Inc.

Description

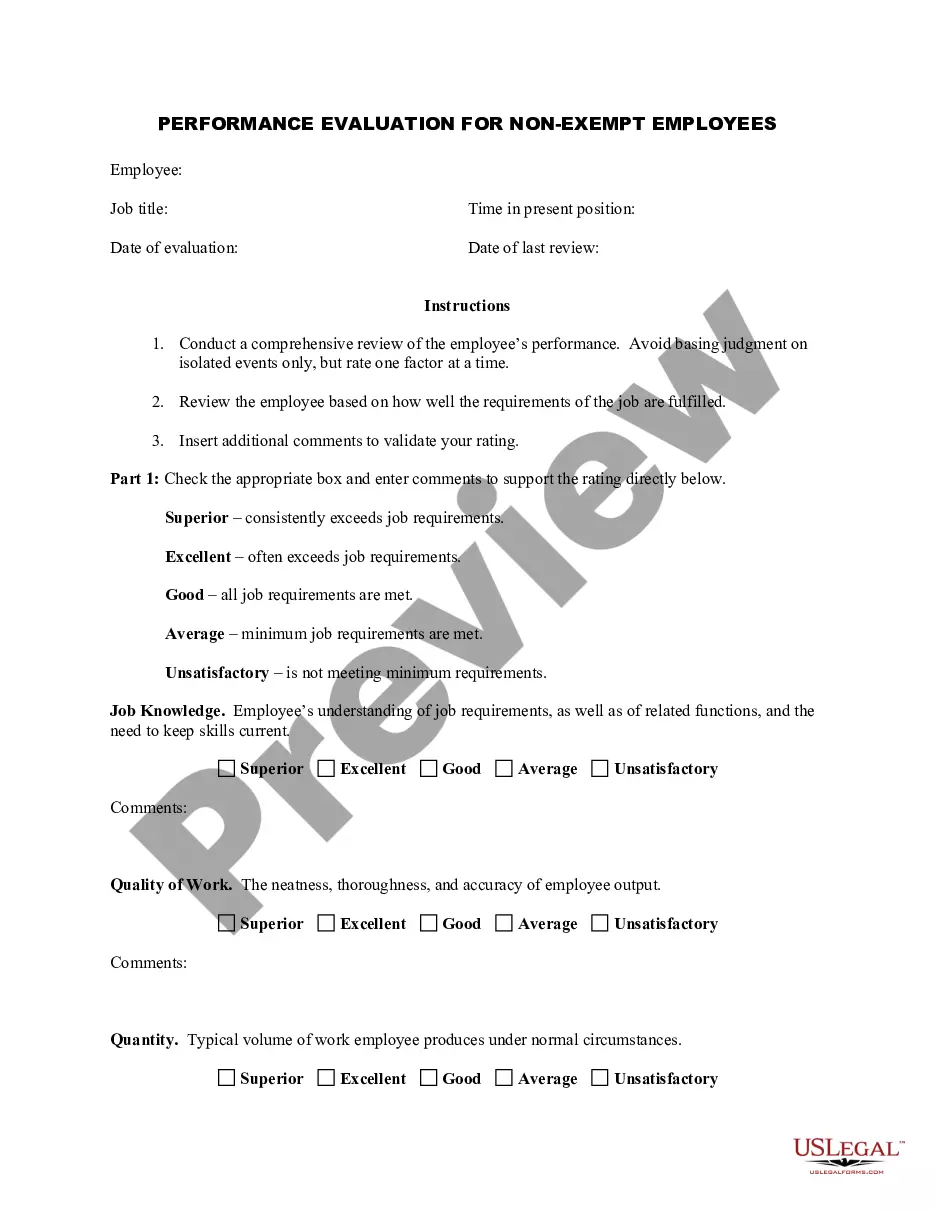

How to fill out Nonqualified Stock Option Plan Of The Banker's Note, Inc.?

US Legal Forms - among the greatest libraries of lawful varieties in America - provides a wide array of lawful papers layouts you are able to acquire or produce. Making use of the site, you may get 1000s of varieties for organization and specific reasons, categorized by classes, claims, or key phrases.You will find the most recent variations of varieties such as the Tennessee Nonqualified Stock Option Plan of the Banker's Note, Inc. in seconds.

If you currently have a subscription, log in and acquire Tennessee Nonqualified Stock Option Plan of the Banker's Note, Inc. in the US Legal Forms local library. The Down load key will show up on every single develop you look at. You get access to all formerly delivered electronically varieties inside the My Forms tab of the bank account.

If you wish to use US Legal Forms the first time, allow me to share easy guidelines to help you get started off:

- Be sure you have selected the right develop for your personal metropolis/region. Click the Review key to analyze the form`s content. Look at the develop outline to actually have chosen the proper develop.

- In case the develop does not fit your specifications, use the Research field on top of the monitor to obtain the one who does.

- If you are happy with the form, verify your selection by clicking on the Get now key. Then, select the prices plan you prefer and give your accreditations to sign up to have an bank account.

- Method the deal. Utilize your charge card or PayPal bank account to finish the deal.

- Pick the structure and acquire the form on the product.

- Make adjustments. Load, revise and produce and indication the delivered electronically Tennessee Nonqualified Stock Option Plan of the Banker's Note, Inc..

Each and every design you added to your bank account lacks an expiration time and it is your own property forever. So, if you wish to acquire or produce one more backup, just go to the My Forms segment and click on about the develop you want.

Gain access to the Tennessee Nonqualified Stock Option Plan of the Banker's Note, Inc. with US Legal Forms, one of the most substantial local library of lawful papers layouts. Use 1000s of expert and state-certain layouts that satisfy your business or specific requirements and specifications.

Form popularity

FAQ

What would cause a nonstatutory stock option to be taxable upon grant? Nonstatutory stock options are never taxable upon grant. If the value of the stock option was readily determinable at the time of grant. If the stock option was fully vested at the time of the grant.

NSOs are taxed when you exercise them, and then later when you make money with them (when your company exits and you sell your shares). They don't get taxed either when the company first grants you them, or when they vest. Assuming that the company you work for: Keeps growing (so its 409A valuation increases over time)

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

Tax treatment of NSOs Typically, NSOs are taxed at the date of exercise rather than the date of grant. The amount subject to ordinary income tax is the difference between the fair market value (FMV) at the time of exercise and the strike price.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.