Tennessee Designation of Rights, Privileges and Preferences of Preferred Stock

Description

How to fill out Designation Of Rights, Privileges And Preferences Of Preferred Stock?

You may spend several hours on the web trying to find the lawful papers web template that fits the state and federal requirements you will need. US Legal Forms supplies a large number of lawful kinds that are reviewed by specialists. You can easily acquire or print the Tennessee Designation of Rights, Privileges and Preferences of Preferred Stock from the assistance.

If you already possess a US Legal Forms accounts, you are able to log in and click the Download key. Following that, you are able to total, revise, print, or sign the Tennessee Designation of Rights, Privileges and Preferences of Preferred Stock. Each and every lawful papers web template you purchase is the one you have permanently. To get yet another copy of the obtained form, go to the My Forms tab and click the corresponding key.

If you work with the US Legal Forms internet site the first time, keep to the simple recommendations listed below:

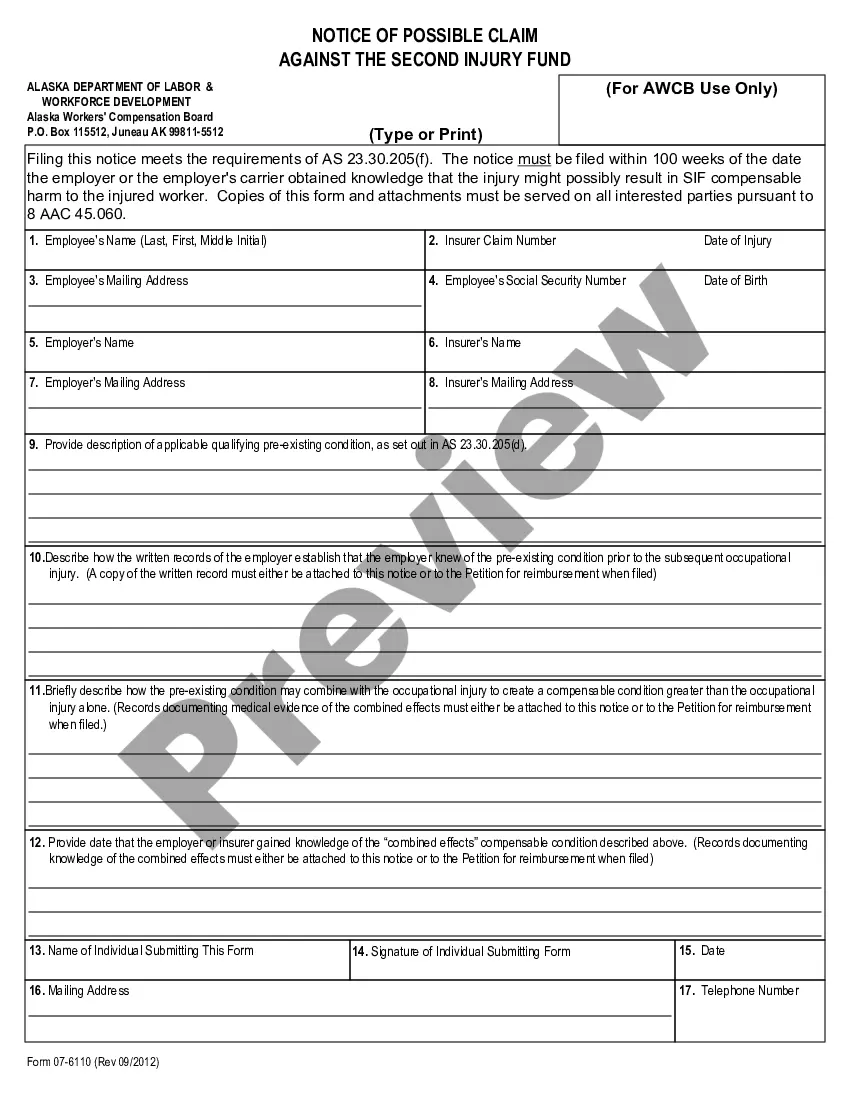

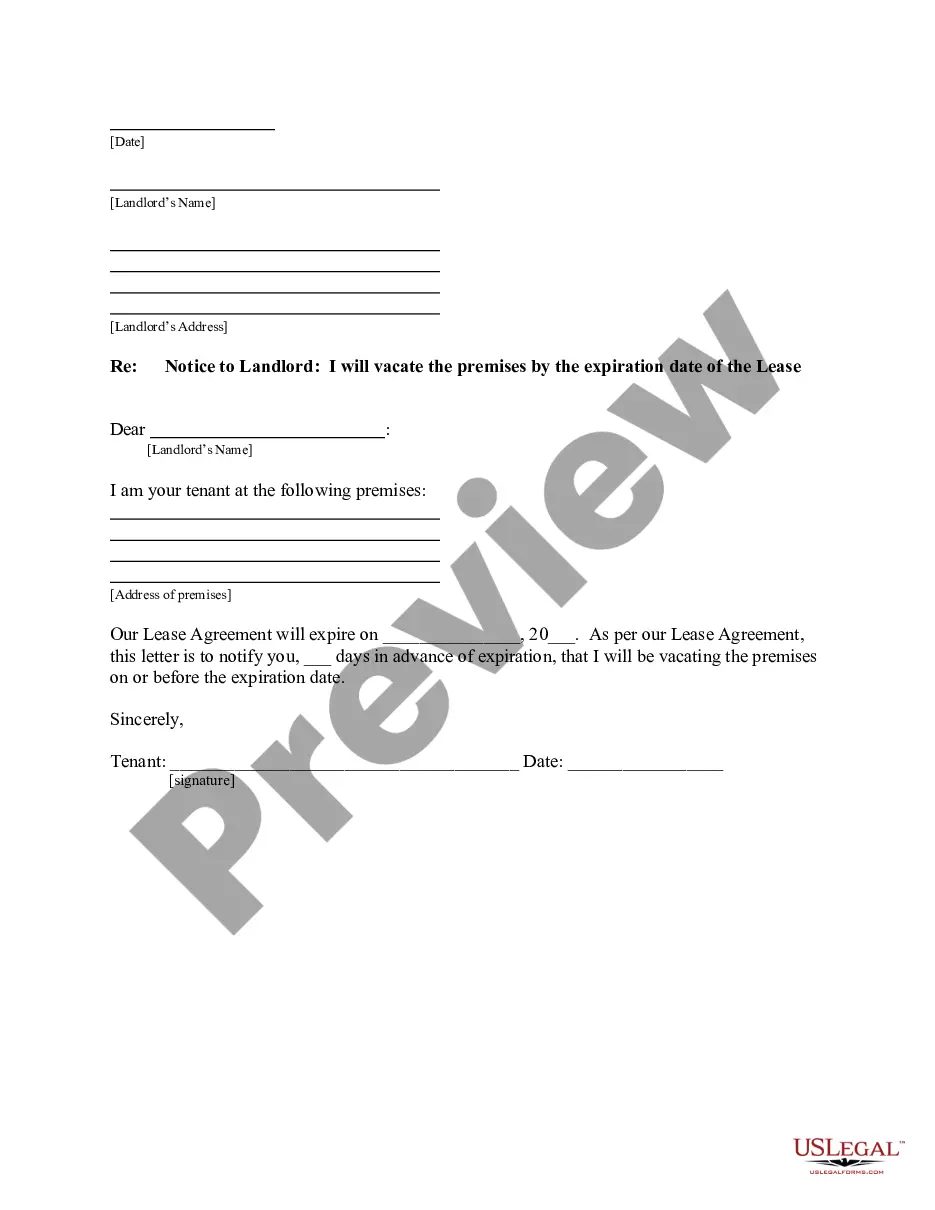

- Very first, make sure that you have selected the correct papers web template for your region/town of your choice. Read the form information to make sure you have picked out the appropriate form. If available, use the Preview key to check with the papers web template also.

- If you wish to locate yet another edition of your form, use the Research discipline to obtain the web template that meets your needs and requirements.

- When you have identified the web template you want, simply click Get now to continue.

- Choose the costs plan you want, type in your accreditations, and sign up for your account on US Legal Forms.

- Complete the deal. You should use your credit card or PayPal accounts to purchase the lawful form.

- Choose the structure of your papers and acquire it in your gadget.

- Make adjustments in your papers if required. You may total, revise and sign and print Tennessee Designation of Rights, Privileges and Preferences of Preferred Stock.

Download and print a large number of papers web templates making use of the US Legal Forms Internet site, that provides the most important collection of lawful kinds. Use skilled and state-certain web templates to take on your business or personal needs.

Form popularity

FAQ

As part of the termination agreement, TD will pay US$200 million to First Horizon, on top of a US$25 million reimbursement fee. The merger would have made TD the sixth-largest bank in the U.S. by assets.

The Merger Agreement provides termination rights for both TD and First Horizon under certain conditions and further provides that a termination fee of $435.5 million will be payable by First Horizon upon termination of the Merger Agreement under certain circumstances.

Stop payment fee $37 For each stop payment request made by you. Stop payments are generally effective for six months. General overdraft information We pay overdraft transactions at our discretion and we reserve the right not to pay.

In good health: A quick checkup reveals First Horizon is in a healthy place after dealing with the drawn-out merger and the March banking crisis. The bank's deposit levels fell only slightly in H1 2023, which it attributes to consumers spending down their savings as they deal with economic uncertainty.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

$5 quarterly maintenance fee if daily balance falls below $250. Interest is compounded daily and posted quarterly. Account can be linked to a First Horizon Bank checking account to provide 24-hour access to funds through the ATM.