Tennessee Employee Evaluation Form for Farmer

Description

How to fill out Employee Evaluation Form For Farmer?

You might spend time online attempting to locate the valid document template that satisfies the state and federal standards you will require.

US Legal Forms offers thousands of valid forms that are inspected by experts.

It is easy to download or create the Tennessee Employee Assessment Form for Farmer from the service.

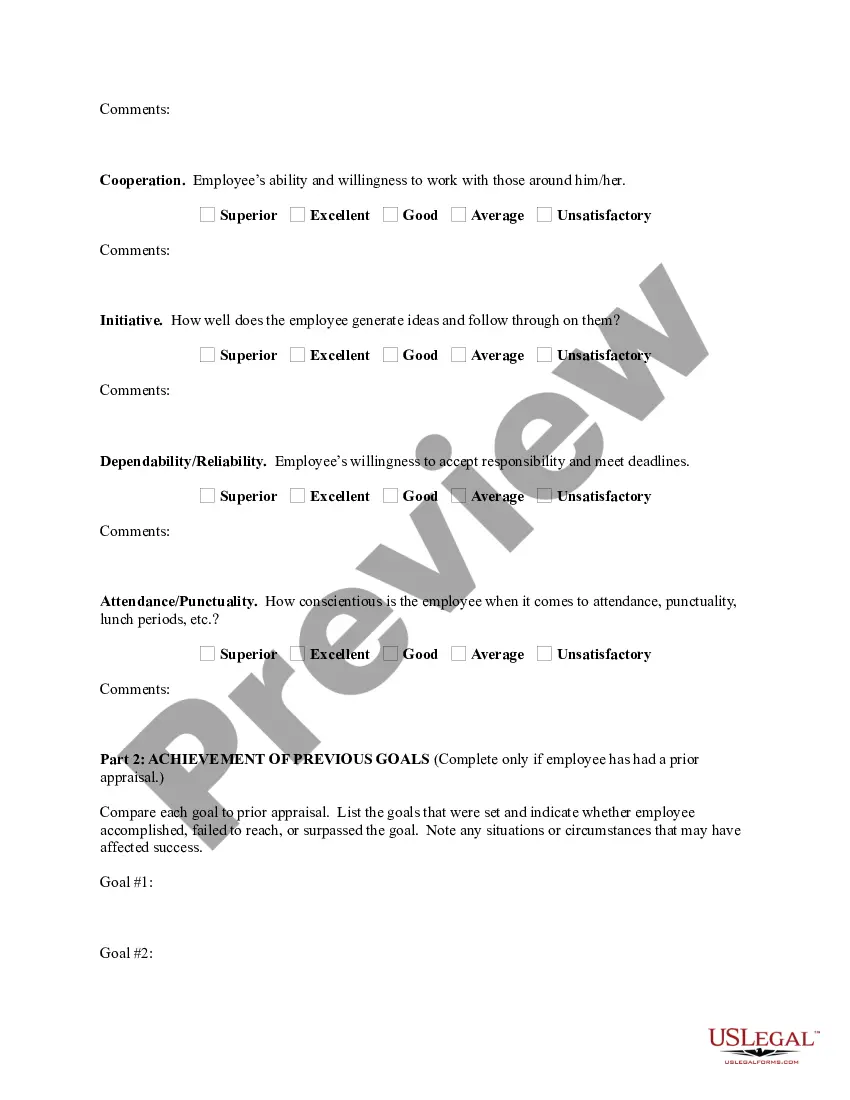

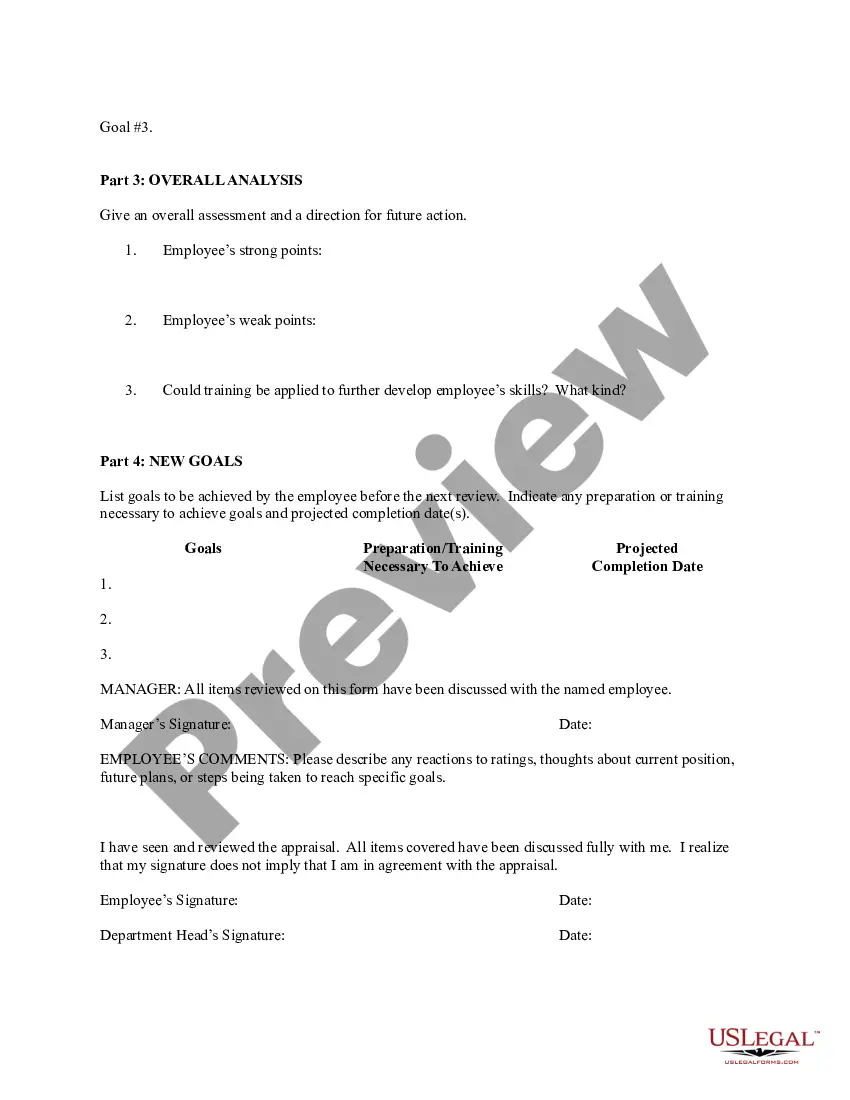

If available, use the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain option.

- After that, you can fill out, revise, generate, or sign the Tennessee Employee Assessment Form for Farmer.

- Every valid document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your county/town that you desire.

- Review the form description to confirm you have chosen the suitable form.

Form popularity

FAQ

The Tennessee Department of Agriculture promotes and supports various agricultural industries, ensuring food safety, protecting natural resources, and providing educational resources. They also facilitate licensing and certification needed for agricultural operations. For farmers, utilizing a Tennessee Employee Evaluation Form for Farmer can help streamline employee evaluations, ensuring that all staff meet the department's standards.

So there are really two ways your farm business can be valued the market value, which is market price less taxes, and an intrinsic value based on the value of past and anticipated future cash flows. A guideline I use to determine the intrinsic value of a privately owned business is five to seven times past earnings.

A farmworker or agricultural worker is someone employed for labor in agriculture. In labor law, the term "farmworker" is sometimes used more narrowly, applying only to a hired worker involved in agricultural production, including harvesting, but not to a worker in other on-farm jobs, such as picking fruit.

A ten (10) acre noncontiguous parcel can qualify if the same owner has already qualified a fifteen (15) acre parcel and both parcels constitute a farm unit. A parcel must actually be engaged in agricultural activity.

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.

To be exempt from paying sales tax on a purchase based on the farm-use exemption, the item must be used by a farmer directly and primarily in the production, handling and preservation for sale of agricultural or horticultural commodities at a farming enterprise.

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.

According to the United States Department of Agriculture, A farm is defined as any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.