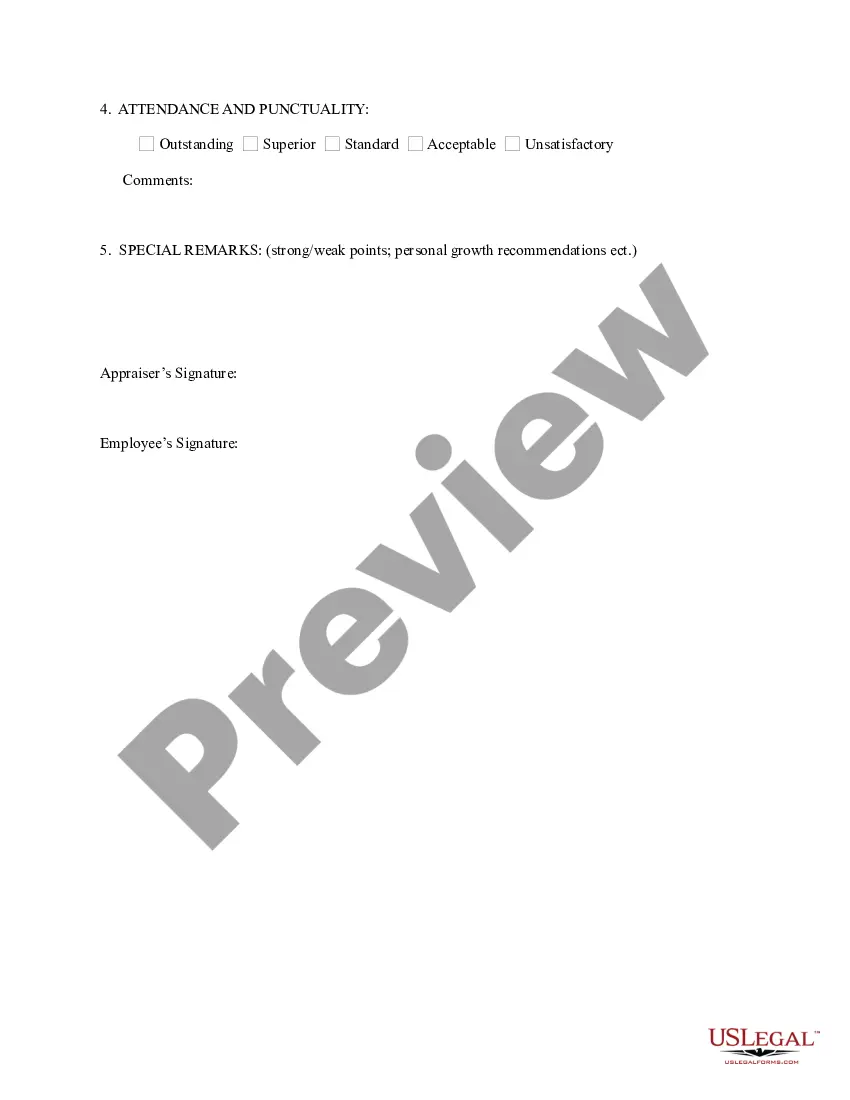

Tennessee Salaried Employee Appraisal Guidelines - Employee Specific

Description

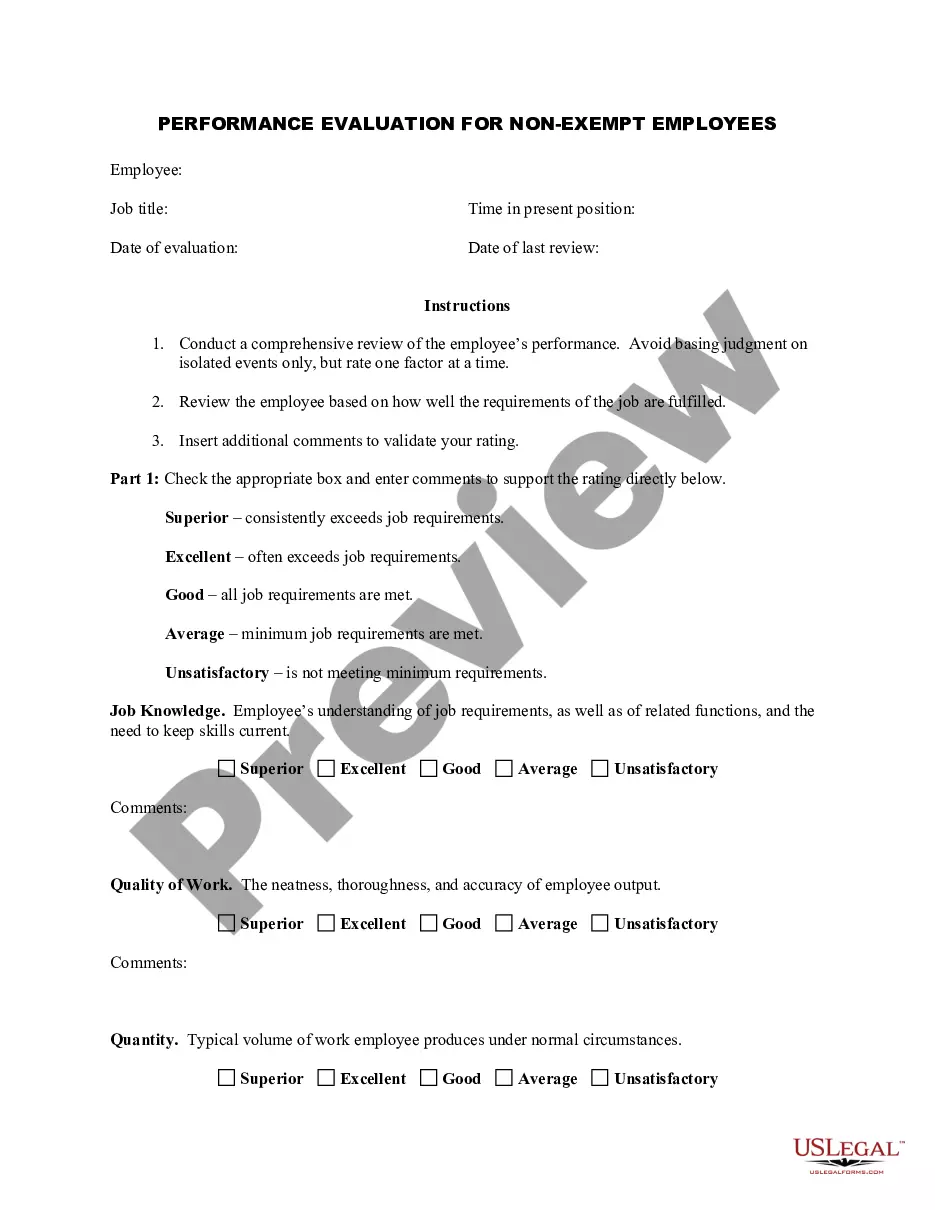

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

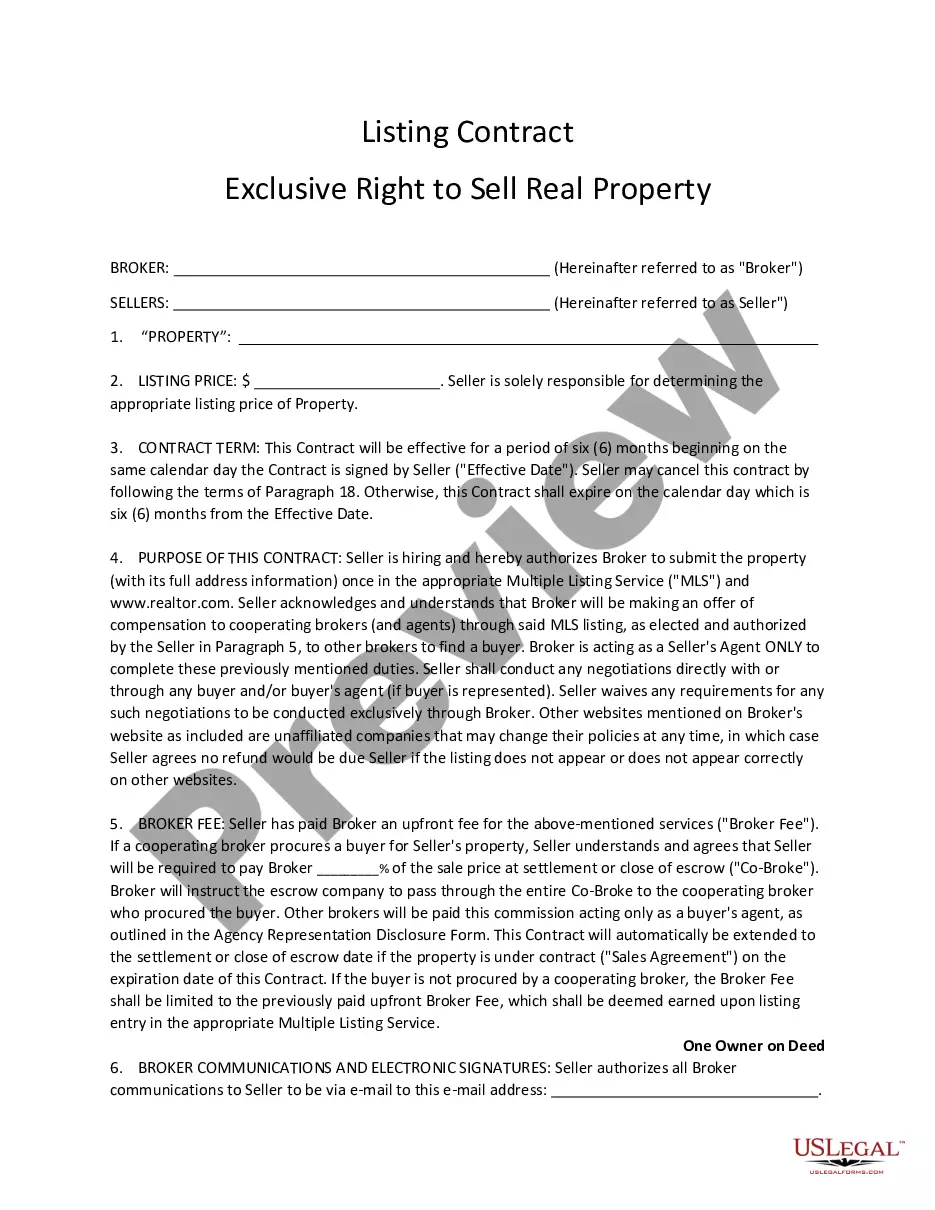

If you desire to be thorough, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site’s straightforward and convenient search to obtain the documents you require.

Various templates for commercial and personal uses are organized by categories and states, as well as keywords.

Step 4. When you have found the form you need, select the Buy now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Tennessee Salaried Employee Appraisal Guidelines - Employee Specific in just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Download button to acquire the Tennessee Salaried Employee Appraisal Guidelines - Employee Specific.

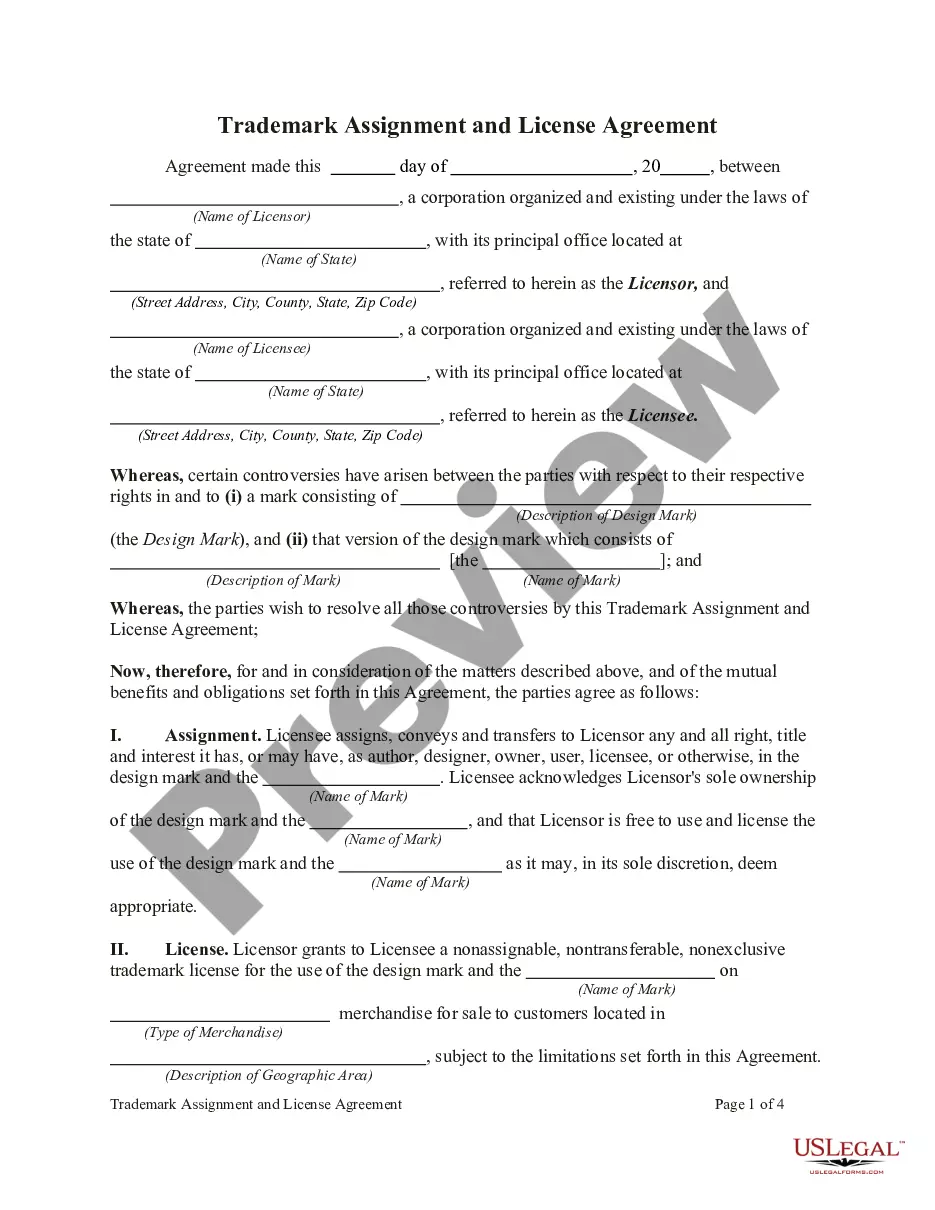

- You may also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Utilize the Review option to browse through the form’s content. Don’t forget to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Waiver of Overtime Hours In these cases, an employee can work beyond the 8 hours a day and 40 hours a week threshold and must be paid at the FLSA mandated overtime rate.

Your employers can require you to work mandatory overtime. However, if employers do require employees to work more than 40 hours per week, those employees are required to be compensated at overtime rates. Whether the overtime work is voluntary or required, employers still need to follow FLSA overtime rules.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

Under federal overtime law and Texas overtime law, salaried employees must receive overtime pay for hours worked over 40 in any workweek unless two specific requirements are met: (1) the salary exceeds $455 per workweek; and (2) the employee performs duties satisfying one of the narrowly-defined FLSA overtime

Salaried employees cannot have their pay deducted by their employer if they work less than 40 hours per week or the employee may be seen as nonexempt and entitled to overtime compensation when working more than 40 hours a week.

Salaried Employees: Often times employers will tell employees because they receive a salary they are not entitled to overtime. This is not true. Except for certain specific exemptions all employees are entitled to overtime, regardless if they are paid hourly or receive a salary.

Generally, Tennessee salaried employers who make more than $23,660 are not due overtime, but new rules and new interpretations under the federal Fair Labor Standards Act (FLSA) have qualified more salaried employees for overtime pay.

These exemptions also apply in Texas. So if you're paid an annual salary and earning more than a certain amount set by law, you are considered "exempt" and not covered by the FLSA. This means exempt employees are not entitled to overtime pay for working more than 40 hours in a week.