Full text and statutory guidelines for the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Tennessee Post Assessment Property and Liability Insurance Guaranty Association Model Act

Description

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act?

Are you currently within a position in which you need paperwork for sometimes business or specific functions almost every day? There are tons of authorized papers templates available on the net, but getting types you can trust is not straightforward. US Legal Forms provides thousands of form templates, just like the Tennessee Post Assessment Property and Liability Insurance Guaranty Association Model Act, which are composed to satisfy state and federal specifications.

In case you are already acquainted with US Legal Forms site and have a free account, basically log in. After that, you are able to obtain the Tennessee Post Assessment Property and Liability Insurance Guaranty Association Model Act design.

Unless you have an profile and want to begin using US Legal Forms, adopt these measures:

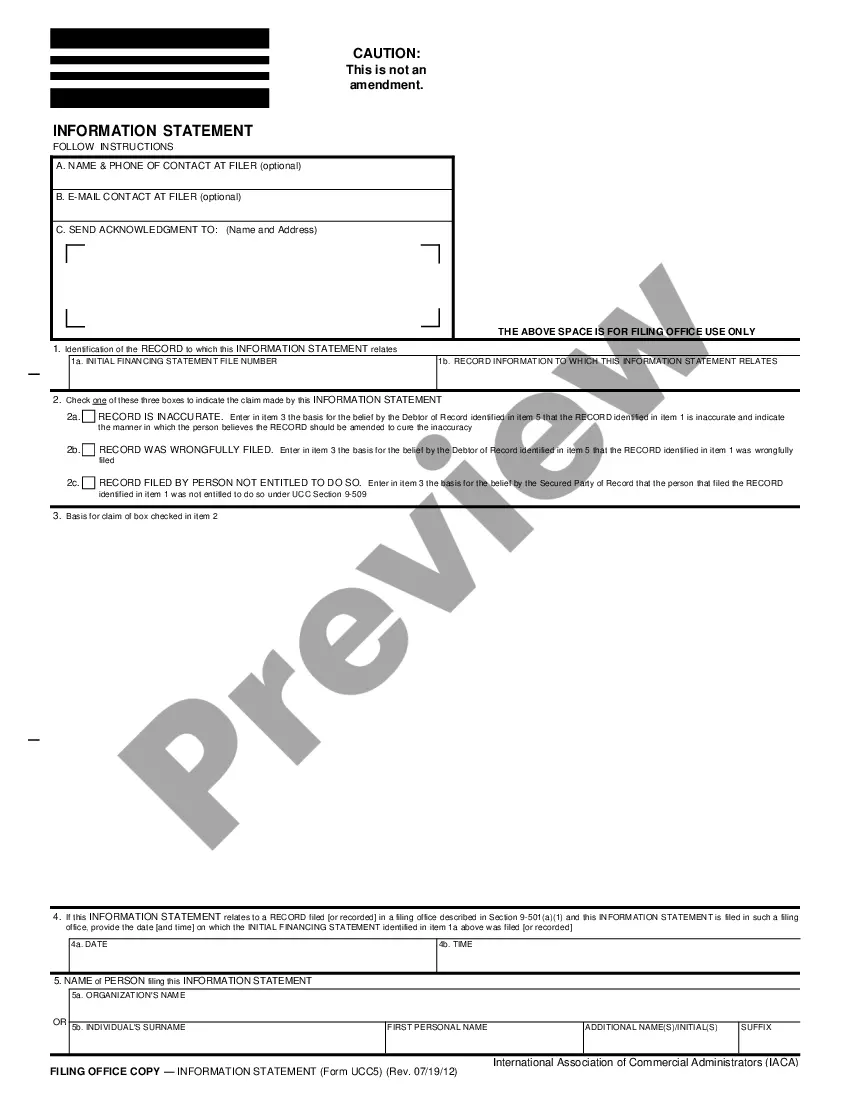

- Obtain the form you require and make sure it is to the proper metropolis/region.

- Utilize the Review option to examine the shape.

- Read the information to actually have chosen the proper form.

- In the event the form is not what you are looking for, make use of the Research field to obtain the form that meets your needs and specifications.

- If you obtain the proper form, click on Purchase now.

- Select the rates prepare you desire, fill in the required info to make your account, and buy the order utilizing your PayPal or credit card.

- Decide on a handy file file format and obtain your version.

Find every one of the papers templates you have bought in the My Forms food list. You can aquire a extra version of Tennessee Post Assessment Property and Liability Insurance Guaranty Association Model Act at any time, if possible. Just select the necessary form to obtain or print out the papers design.

Use US Legal Forms, probably the most considerable collection of authorized varieties, to save some time and avoid mistakes. The services provides skillfully created authorized papers templates which you can use for a selection of functions. Generate a free account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

The Oregon Life & Health Insurance Guaranty Association was created by the Oregon legislature in 1975 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits.

The Tennessee Life and Health Insurance Guaranty Association was created by the Tennessee legislature in July of 1989 to protect state residents who are policyholders and beneficiaries of policies issued by an insolvent insurance company, up to specified limits.

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.

What is the difference between state guaranty associations and FDIC insurance? The FDIC is an independent federal agency that provides deposit insurance for bank deposits. State guaranty associations are nonprofit organizations that operate at the state level to protect insurance policyholders.

§56-12-205 For purposes of administration and assessment, the association shall maintain two (2) accounts: (1) The life insurance and annuity account, which includes the following subaccounts: (A) Life insurance account; and (B) Annuity account, excluding unallocated annuities; and (2) The health account.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.