Tennessee Withdrawal of Assumed Name for Corporation

Description

How to fill out Withdrawal Of Assumed Name For Corporation?

Are you presently within a place that you need to have paperwork for either business or individual purposes almost every working day? There are plenty of legal record web templates available online, but discovering kinds you can rely isn`t effortless. US Legal Forms delivers a large number of form web templates, like the Tennessee Withdrawal of Assumed Name for Corporation, that happen to be written to fulfill state and federal needs.

Should you be currently acquainted with US Legal Forms site and get an account, merely log in. Following that, you are able to acquire the Tennessee Withdrawal of Assumed Name for Corporation web template.

If you do not provide an profile and would like to start using US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for the appropriate city/region.

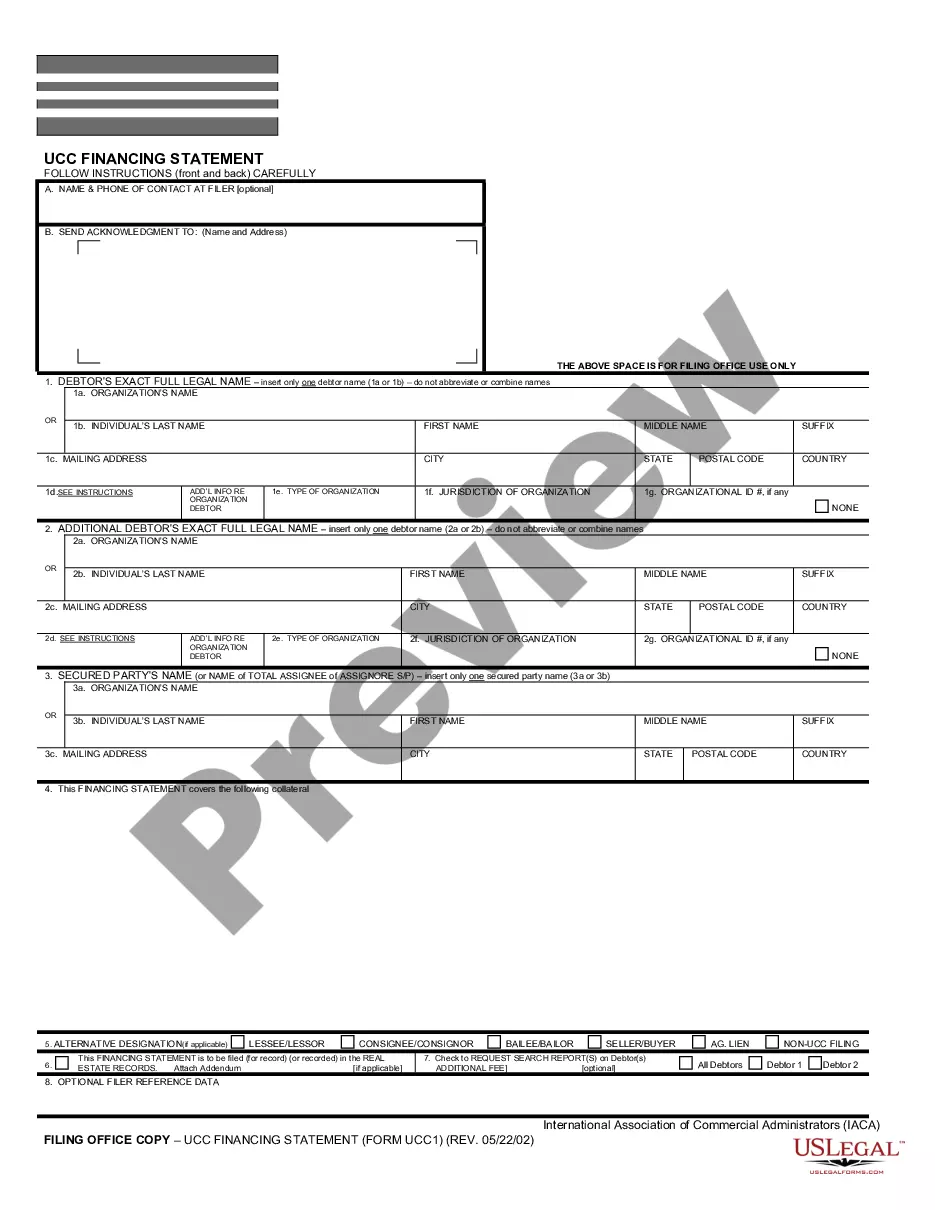

- Utilize the Preview key to check the shape.

- See the description to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re looking for, take advantage of the Lookup area to get the form that meets your needs and needs.

- Whenever you discover the appropriate form, simply click Buy now.

- Select the rates strategy you want, submit the necessary details to create your account, and pay for the transaction utilizing your PayPal or bank card.

- Choose a handy paper formatting and acquire your version.

Discover all the record web templates you may have purchased in the My Forms menus. You can get a extra version of Tennessee Withdrawal of Assumed Name for Corporation anytime, if required. Just go through the required form to acquire or print the record web template.

Use US Legal Forms, one of the most considerable assortment of legal varieties, in order to save some time and stay away from blunders. The service delivers professionally produced legal record web templates that you can use for a selection of purposes. Create an account on US Legal Forms and start making your lifestyle a little easier.

Form popularity

FAQ

How to Close a Corporation in Tennessee Have a board of directors' meeting. ... Have a shareholders' meeting in order to approve the motion to dissolve the corporation. Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State.

Steps to dissolving a corporation or obtaining a corporate dissolution Call a board meeting. ... File a certificate of dissolution with the Secretary of State. ... Notify the Internal Revenue Service (IRS) ... Close accounts and credit lines, cancel licenses, etc.

How do you dissolve and terminate a Tennessee Corporation? First you will file SS-4255, Written Consent to Dissolution and SS-4410, Articles of Dissolution. Then you file SS-4256, Written Consent to Termination and SS-4412, Articles of Termination of Corporate Existence.

You do need a DBA if you are using a business name other than your legal business name, or if you haven't registered your business and operate as a sole proprietorship or partnership.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

Sole proprietors and general partnerships can only make changes to their DBA names by filing a new Business Tax Registration Application with their respective county. They'll need to include the new DBA name on the application and pay a $15 fee.

Business Forms & Fees Domestic Limited Liability Companies (LLC)Articles of Termination of Existence (PDF, 52.9KB)SS-4245$20Articles of Termination Following Administrative Dissolution (PDF, 154.8KB)SS-4243$100Written Consent to Termination of Limited Liability Company (PDF, 587.5KB)SS-4521No Fee32 more rows

To withdraw your foreign Corporation from Tennessee, submit the completed form SS-4437, Application for Certificate of Withdrawal to the Tennessee DBS for filing. Using DBS forms is not required; you may draft your own application for withdrawal.