Tennessee Overtime Report

Description

How to fill out Overtime Report?

US Legal Forms - one of the largest repositories of legal documents in the country - provides a broad assortment of legal document templates that you can acquire or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can retrieve the latest versions of documents such as the Tennessee Overtime Report in just moments.

If you already have an account, sign in to access the Tennessee Overtime Report in the US Legal Forms database. The Download button will appear on each document you browse.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit, modify, and print out the Tennessee Overtime Report as needed. Each template you have added to your account has no expiration date and is yours forever. So, if you wish to obtain or print another copy, just navigate to the My documents section and click on the form you need. Access the Tennessee Overtime Report with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are new to US Legal Forms, here are some straightforward tips to get started.

- Ensure you have selected the correct form for your region/county.

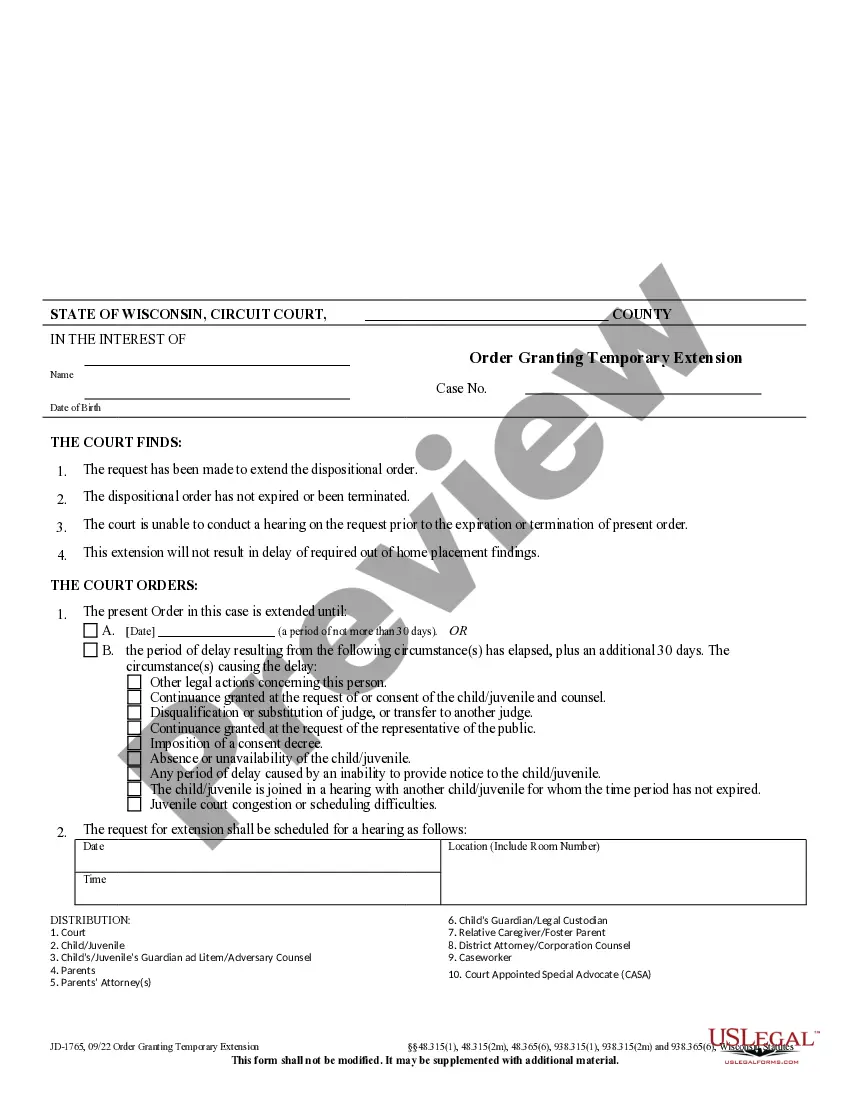

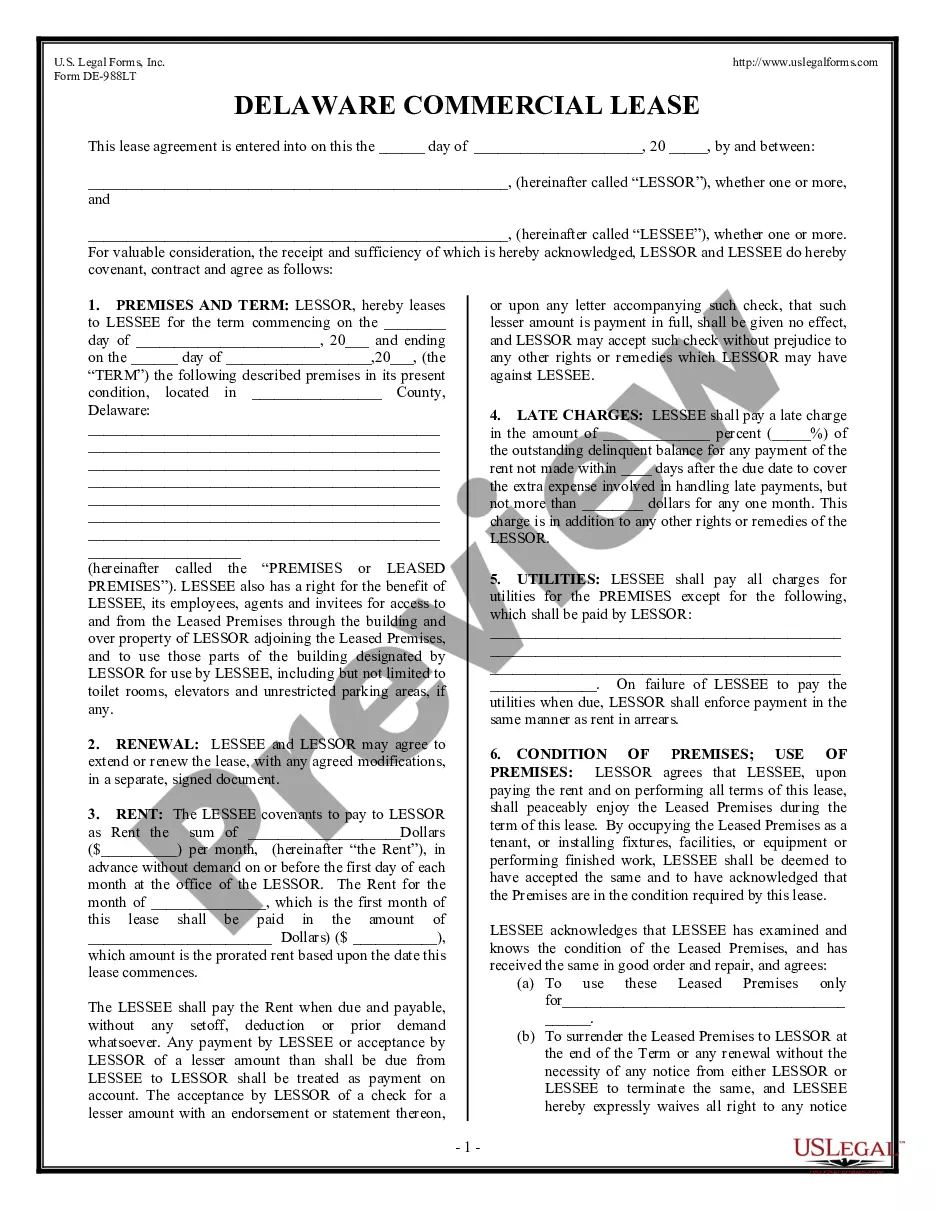

- Click on the Preview option to review the content of the form.

- Check the form details to confirm you have selected the right one.

- If the form does not meet your needs, use the Search tool at the top of the screen to find one that does.

- If you are happy with the form, confirm your choice by clicking the Buy Now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

To pull an overtime report in Workday, access the reporting dashboard and select the appropriate report template for hours worked. You may need to filter by employee or date range to get the information you need. Using a Tennessee Overtime Report can simplify your process and ensure you have an accurate overview of overtime hours recorded.

Under federal law, most private-sector employees have the right to discuss their conditions of employment, including wages and benefits, without fear of retaliation from their employer.

Calculating Overtime for Hourly and Salaried Workers Calculating overtime for a non-exempt hourly worker is fairly straightforward. If the employee works more than 40 hours, employers should multiply the worker's hourly wage by 1.5 for any of the extra hours.

This bill specifies that it does not require an employer or employee to disclose the amount of wages paid to an employee. Under this bill, an action to redress a violation may be maintained by one or more employees.

This bill specifies that it does not require an employer or employee to disclose the amount of wages paid to an employee. Under this bill, an action to redress a violation may be maintained by one or more employees.

Overtime pay, also called "time and a half pay", is one and a half times an employee's normal hourly wage. Therefore, Tennessee's overtime minimum wage is $10.88 per hour, one and a half times the regular Tennessee minimum wage of $7.25 per hour.

All Tennessee workers are entitled to overtime pay if they work more than 40 hours per week, with a few specific exceptions. Unfortunately, being fairly compensated for extra labor doesn't always happen the way it should. Almost every Tennessee employee is covered under the Fair Labor Standards Act (FLSA).

Your employers can require you to work mandatory overtime. However, if employers do require employees to work more than 40 hours per week, those employees are required to be compensated at overtime rates. Whether the overtime work is voluntary or required, employers still need to follow FLSA overtime rules.

No, you cannot be fired for discussing wages at work. The majority of employed and working Americans are protected from discipline exercised simply due to protected classes, such as age, gender, race, and so forth.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.