Tennessee Notice of Meeting of LLC Members To Consider Dissolution of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Dissolution Of The Company?

It is feasible to spend hours online attempting to find the official document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are assessed by experts.

You can effortlessly download or print the Tennessee Notice of Meeting of LLC Members To Consider Dissolution of the Company from our service.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Next, you can complete, modify, print, or sign the Tennessee Notice of Meeting of LLC Members To Consider Dissolution of the Company.

- Every legal document template you obtain is yours permanently.

- To get an extra copy of a purchased form, access the My documents section and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for your desired state/city.

- Check the form details to confirm you have chosen the appropriate document.

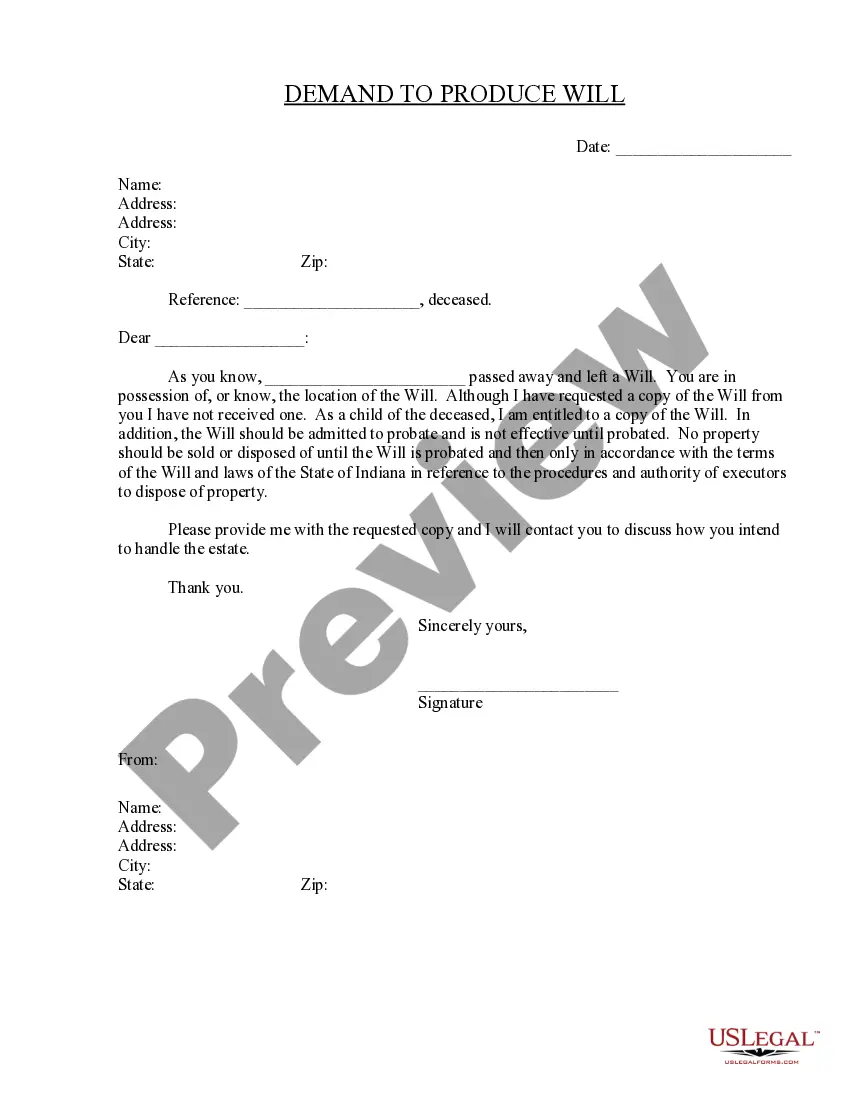

- If available, use the Preview button to view the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that meets your needs.

- Once you've found the template you want, click on Purchase now to proceed.

Form popularity

FAQ

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

Tennessee's statutory definition of doing business is very broad and encompasses any activity purposefully engaged in within Tennessee by a person with the object of gain benefit, or advantage. Tenn.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

What is a 'Notice of Determination'? You may have received, from the Office of the Tennessee Secretary of State (TN SOS) a 'Notice of Determination,' if the authorized member(s) of your LLC failed to file an Annual Report on the LLC's behalf (or for some other reason listed in T.C.A. § 48-245-301).

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year.

Dissolution generally occurs when the business purpose of the LLC is completed or ceases to be economically viable. The members may also agree to dissolve the LLC if they are at an impasse regarding fundamental decisions concerning the LLC's business operations.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization.

Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence.

How to Close a Corporation in TennesseeHave a board of directors' meeting.Have a shareholders' meeting in order to approve the motion to dissolve the corporation.Submit a written Consent to Dissolution to the Tennessee Secretary of State.Submit any required annual reports to the Tennessee Secretary of State.More items...