Tennessee Statement of Reduction of Capital of a Corporation

Description

How to fill out Statement Of Reduction Of Capital Of A Corporation?

You may invest hours on the web looking for the legal record format which fits the federal and state demands you will need. US Legal Forms provides a huge number of legal kinds that happen to be examined by professionals. It is simple to obtain or produce the Tennessee Statement of Reduction of Capital of a Corporation from my assistance.

If you have a US Legal Forms account, it is possible to log in and click the Down load button. Next, it is possible to total, modify, produce, or sign the Tennessee Statement of Reduction of Capital of a Corporation. Each legal record format you purchase is yours for a long time. To have an additional duplicate associated with a purchased develop, proceed to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms site for the first time, follow the straightforward directions beneath:

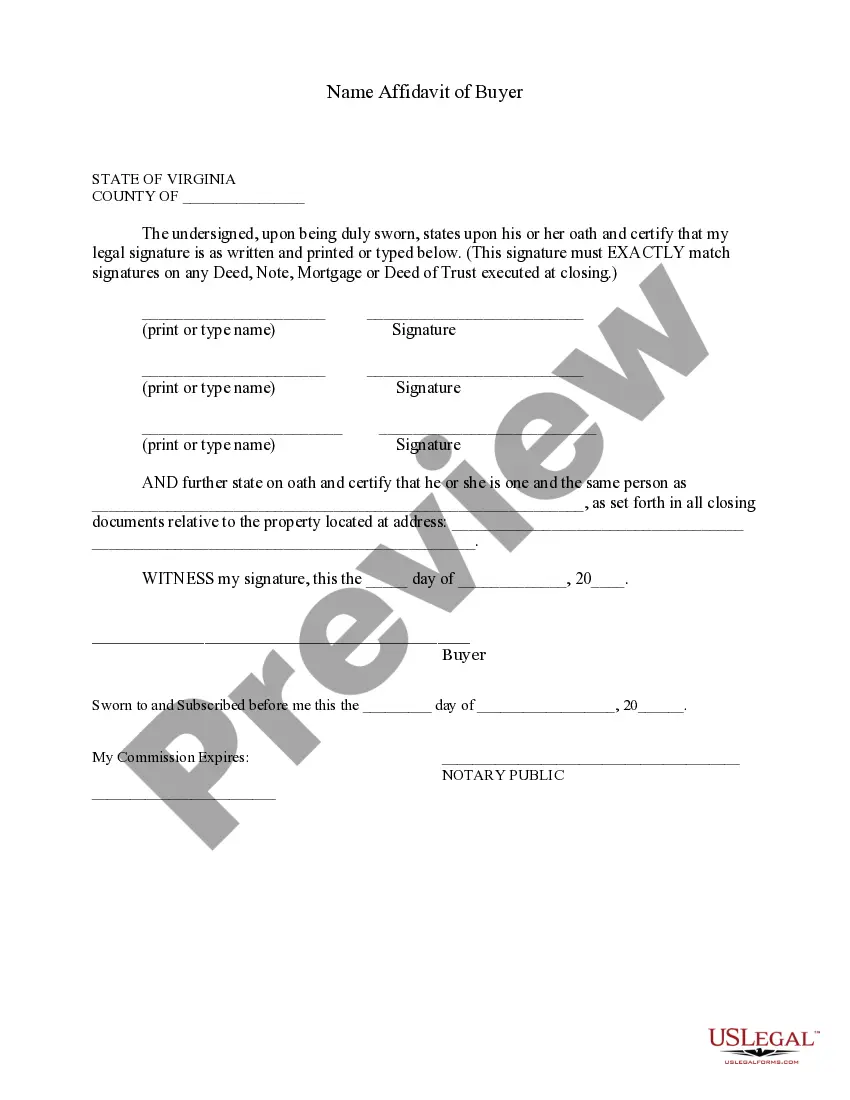

- Initially, make certain you have selected the correct record format for the area/city of your choice. Read the develop outline to ensure you have selected the appropriate develop. If accessible, use the Review button to look with the record format at the same time.

- If you want to get an additional model from the develop, use the Look for industry to find the format that suits you and demands.

- Upon having found the format you want, click Buy now to proceed.

- Select the rates prepare you want, type your accreditations, and sign up for your account on US Legal Forms.

- Full the deal. You can use your bank card or PayPal account to pay for the legal develop.

- Select the format from the record and obtain it to your product.

- Make alterations to your record if possible. You may total, modify and sign and produce Tennessee Statement of Reduction of Capital of a Corporation.

Down load and produce a huge number of record layouts utilizing the US Legal Forms site, that offers the greatest collection of legal kinds. Use professional and state-specific layouts to deal with your business or person demands.

Form popularity

FAQ

Tennessee does not have an individual income tax. Tennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

Products like motor fuel, tobacco, and other heavily regulated goods are subject to excise taxes. Certain activities like highway usage can be subject to excise tax too. Often the cost of the tax is included in the cost of the product, meaning the end consumer doesn't see the excise tax on their receipt.

§ 382 limiting the use of certain losses, including net operating losses, after undergoing a change in ownership where more than 50% of the taxpayer's stock has changed owners within a three-year period. TENN. CODE ANN.

What are the benefits of creating an S corporation in Tennessee? For corporations, a major advantage is being able to avoid double taxation. Usually, a C corporation's profits are taxed at both the business and individual shareholder level, while an S corp's profits are taxed only on the individual level.

Franchise & Excise Tax - Excise Tax All persons, except those with nonprofit status or otherwise exempt, are subject to a 6.5% corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal year.

Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

Therefore, in computing ?net earnings? under Tennessee law, taxpayers are entitled to the full amount of the IRC section 250(a) deduction to which they are entitled under federal law as it relates to FDII.

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.