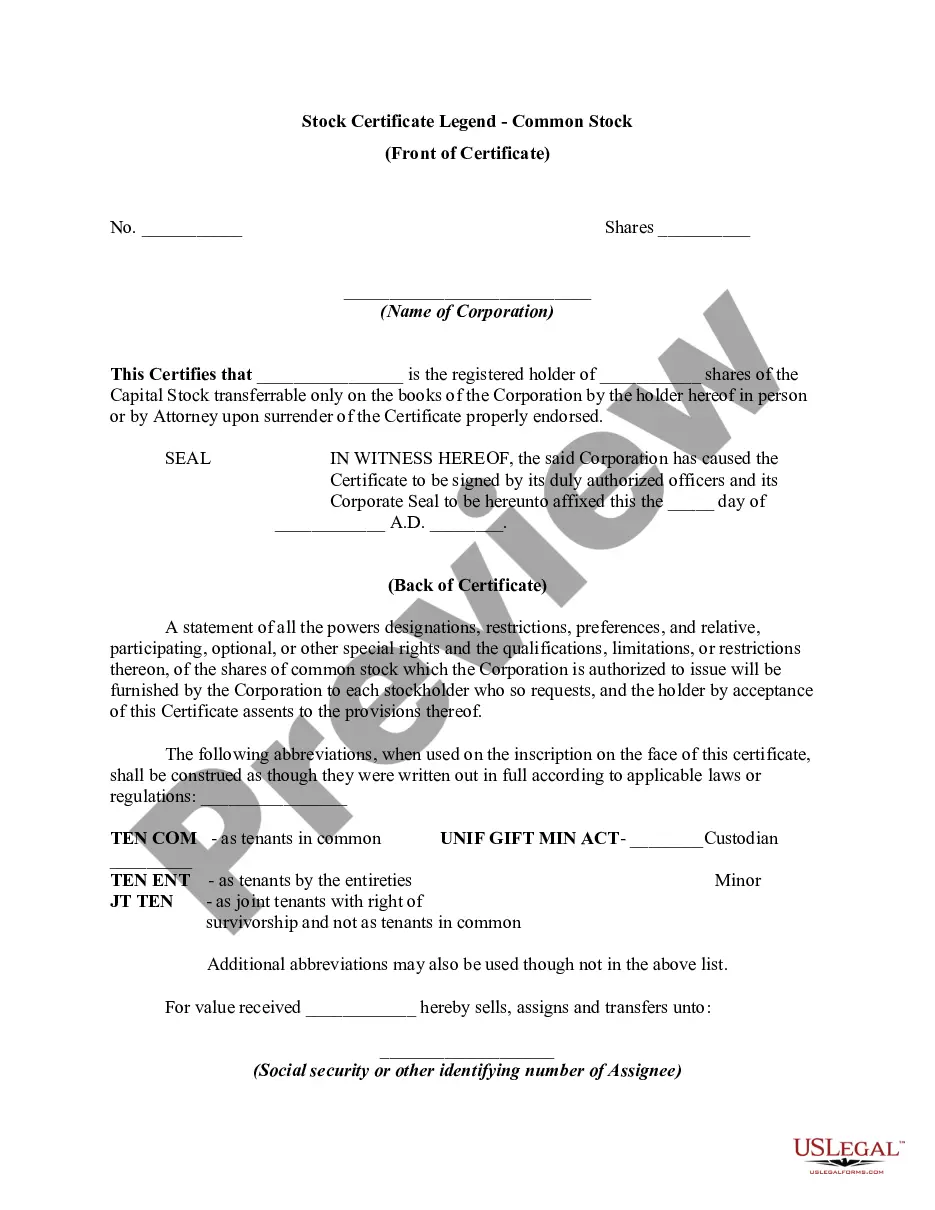

Tennessee Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

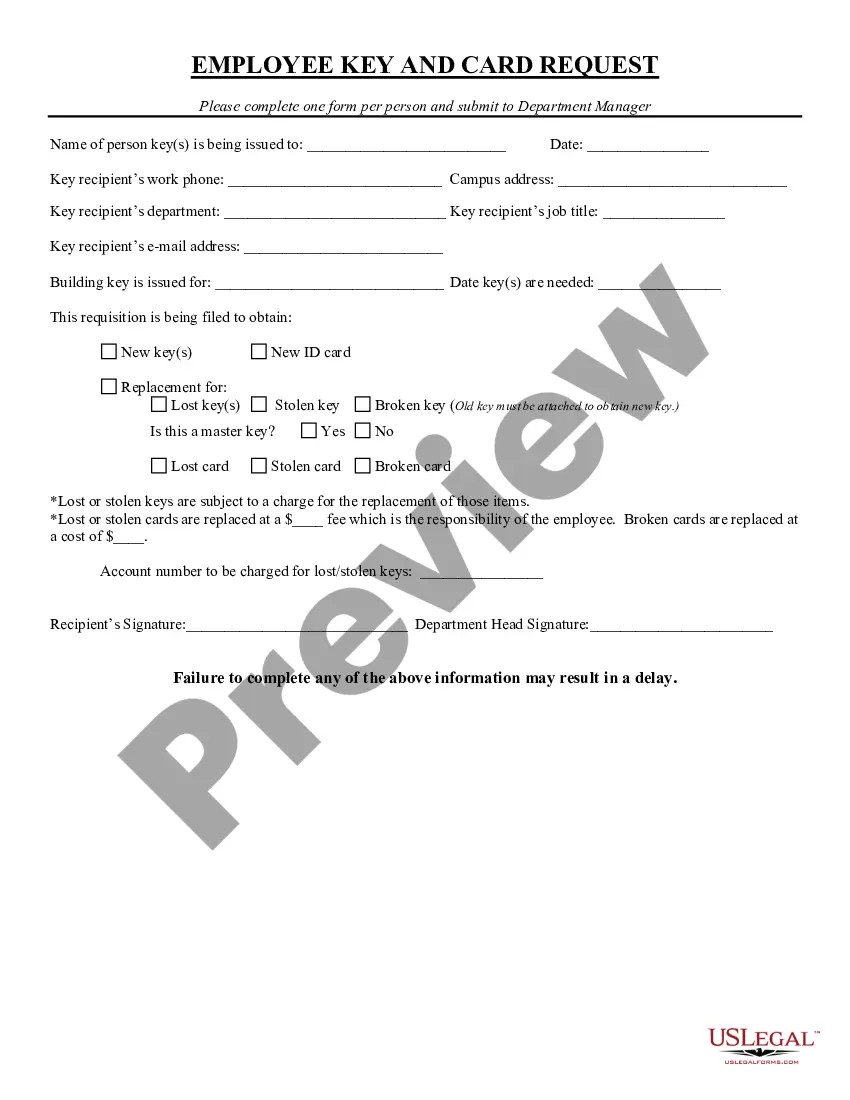

You are able to commit hours on the Internet attempting to find the authorized file format that meets the federal and state requirements you want. US Legal Forms offers 1000s of authorized varieties which can be evaluated by experts. You can easily download or print the Tennessee Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders from our service.

If you currently have a US Legal Forms account, you can log in and click on the Obtain switch. After that, you can comprehensive, edit, print, or sign the Tennessee Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders. Each authorized file format you buy is the one you have for a long time. To get an additional copy of the acquired develop, check out the My Forms tab and click on the related switch.

If you are using the US Legal Forms site for the first time, stick to the straightforward recommendations below:

- Initially, make sure that you have chosen the best file format for that state/metropolis that you pick. See the develop outline to make sure you have picked out the correct develop. If accessible, use the Review switch to search throughout the file format as well.

- If you want to find an additional variation from the develop, use the Look for field to find the format that fits your needs and requirements.

- When you have identified the format you would like, just click Purchase now to move forward.

- Select the prices program you would like, key in your qualifications, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal account to pay for the authorized develop.

- Select the structure from the file and download it to the product.

- Make alterations to the file if required. You are able to comprehensive, edit and sign and print Tennessee Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Obtain and print 1000s of file layouts utilizing the US Legal Forms website, that provides the greatest variety of authorized varieties. Use skilled and state-distinct layouts to take on your business or person requirements.

Form popularity

FAQ

Section 109 provides for transfer of the Shares by the Legal Representative of the deceased Member. Section 109A provides for nomination by an individual in respect of his Shares. Where a Nominee has been appointed, the Shares shall vest in the Nominee on the death of the Member.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

This is an agreement that, if a shareholder dies, the existing shareholders can require the deceased's shares to be transferred to them, while the executors could require the remaining shareholders to buy the shares held by the estate.

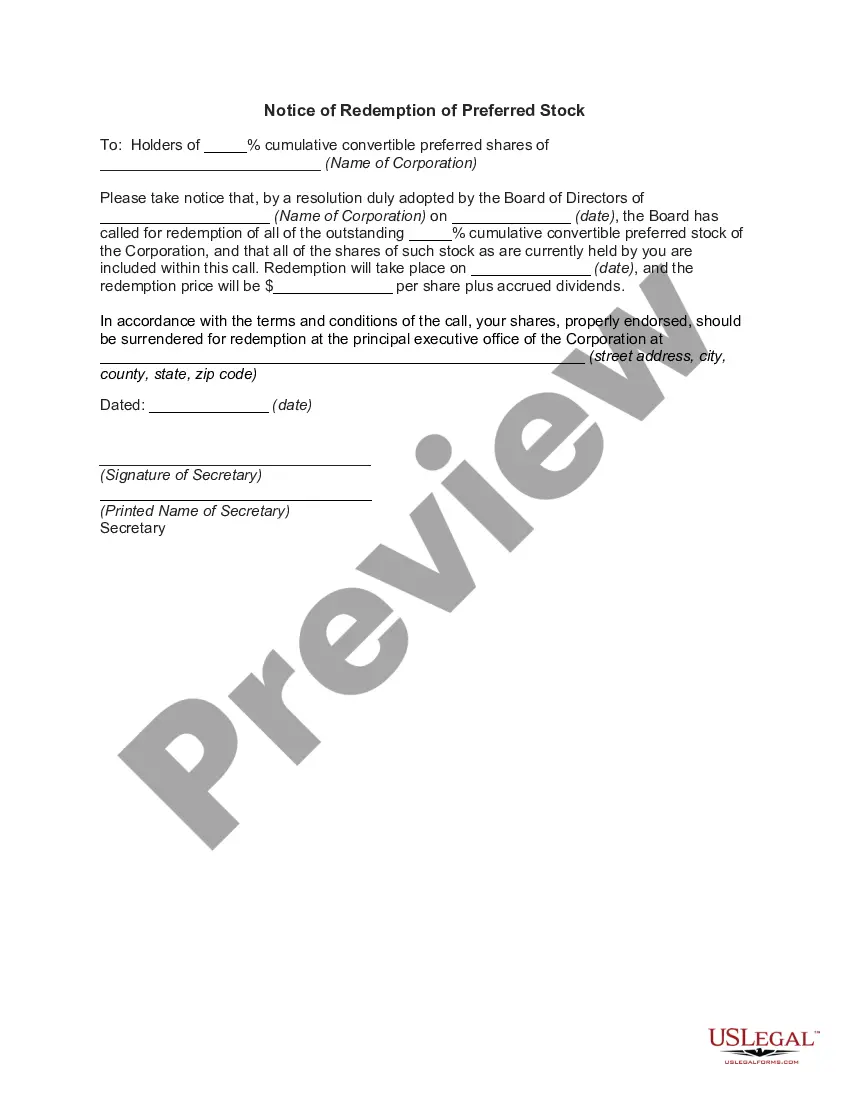

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

Upon the death of the Shareholder, all of the shares of stock in the Corporation owned by said Shareholder and to which he or his personal representatives shall be entitled shall be sold to and purchased by the Corporation from his personal representatives at the net book value and as hereinafter provided, or pursuant ...

The shares may form part of a specific legacy or fall into the residue of the estate. Either way, the representatives of the estate need to contact the company to initiate the transmission of shares. The PRs should approach the company with a grant of probate or letters of administration.

What Happens to Shares When a Shareholder Dies. If a shareholder dies their estate, including their shares, passes under the terms of their Will. If the deceased did not leave a Will the shares and estate pass by intestacy rules.