Tennessee Agreement for the Use of Property of a Named Church

Description

How to fill out Agreement For The Use Of Property Of A Named Church?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or create.

Utilizing the website, you will find a vast array of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest forms such as the Tennessee Agreement for the Use of Property of a Named Church within moments.

If you already have a subscription, Log In and retrieve the Tennessee Agreement for the Use of Property of a Named Church from the US Legal Forms library. The Acquire option will be visible on each template you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the document to your device. Make adjustments. Fill out, modify, and print and sign the downloaded Tennessee Agreement for the Use of Property of a Named Church. Every document you save to your account has no expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Tennessee Agreement for the Use of Property of a Named Church with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that satisfy your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure that you have selected the correct form for your area/region.

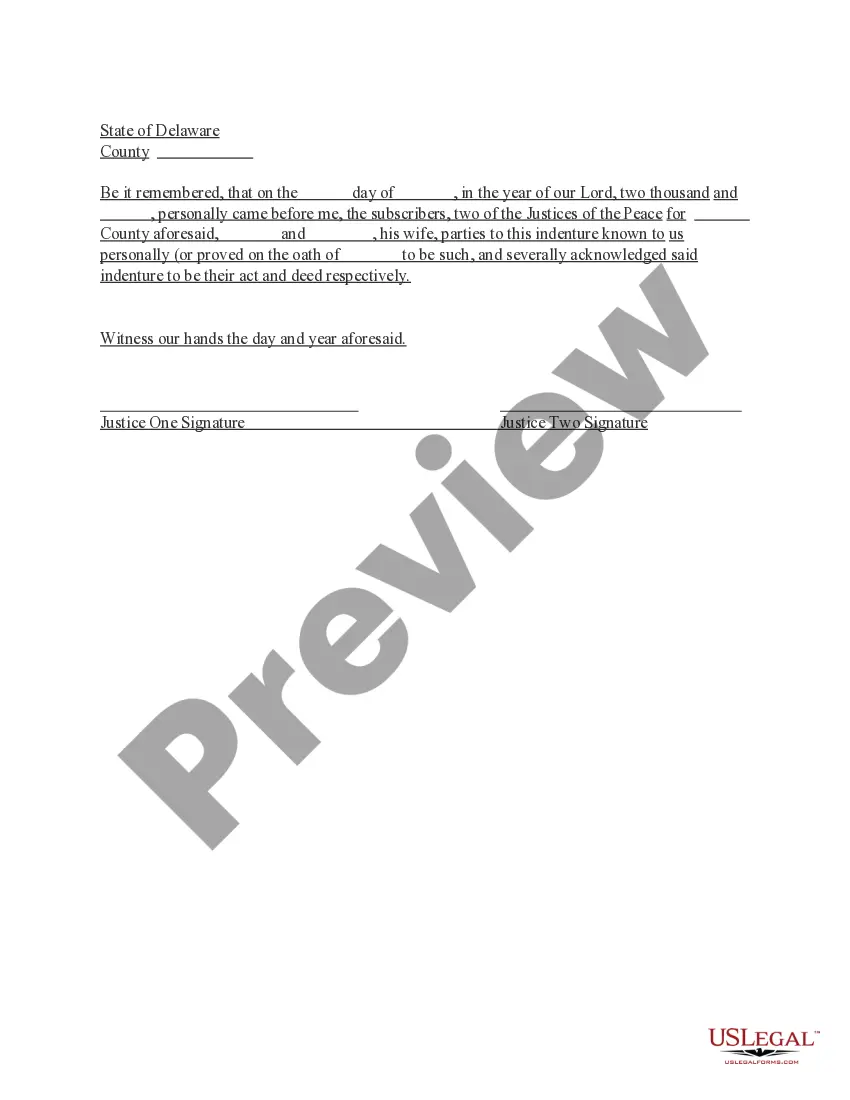

- Click on the Preview button to review the content of the form.

- Check the form details to confirm that you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select the payment plan you prefer and provide your information to sign up for an account.

Form popularity

FAQ

A church is generally classified as a non-profit property under state and federal laws. While this classification allows for various legal protections, it also comes with specific requirements. Understanding your rights and responsibilities is essential, and a Tennessee Agreement for the Use of Property of a Named Church can streamline any property use arrangements.

A church can allow a business to use its property, often through special agreements. This can create a mutually beneficial relationship, providing income for the church while offering a venue for the business. The terms can be effectively structured using a Tennessee Agreement for the Use of Property of a Named Church to ensure clarity and compliance.

Church grounds are typically considered private property, meaning they are not open to the public without permission. This status can allow churches to control who has access and use the space for specific activities. When entering agreements, like a Tennessee Agreement for the Use of Property of a Named Church, clearly define usage rights.

Many churches own rental properties, which can provide additional income. However, the church must ensure that these activities do not interfere with its primary purpose. A clear Tennessee Agreement for the Use of Property of a Named Church can help clarify the responsibilities and expectations in such cases.

Yes, a church can rent space to a for-profit business, but there are regulations to consider. This type of arrangement may impact the church's tax status, so it's crucial to create a clear agreement. Utilizing a Tennessee Agreement for the Use of Property of a Named Church can help outline the terms and protect both parties involved.

Running a business through a church is possible under certain conditions. However, the church must comply with tax laws and maintain its tax-exempt status. It is wise to use a Tennessee Agreement for the Use of Property of a Named Church to formalize any arrangements and ensure that all parties understand the terms.

Yes, church property is considered private property, but it operates under specific legal and tax regulations. The Tennessee Agreement for the Use of Property of a Named Church defines the terms and conditions under which the church can use its property. While churches are private entities, their property may be subject to different laws regarding access and use. Understanding these distinctions can help effectively manage the property.

Various entities may qualify for property tax exemptions in Tennessee, including churches, non-profit organizations, and educational institutions. A Tennessee Agreement for the Use of Property of a Named Church can support churches seeking tax exemptions by documenting their use of property for religious purposes. You should check local regulations to ensure compliance with all requirements. Understanding exemptions fully is vital for managing church finances.

In general, churches can be exempt from local property taxes in Tennessee, but this depends on specific conditions. Typically, the property must be used for religious purposes to qualify for tax exemption. Insuring your property meets all necessary criteria is critical, and a Tennessee Agreement for the Use of Property of a Named Church can help clarify these conditions. Consult with a tax advisor or legal professional for detailed guidance.

The ownership of church property typically resides with the church organization itself. In the case of a Tennessee Agreement for the Use of Property of a Named Church, the terms of property usage should outline ownership rights clearly. This agreement often specifies who maintains and uses the property, helping to prevent disputes. It is essential to have legal clarity in such matters to ensure smooth operations.