Tennessee Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of documents like the Tennessee Sample of a Collection Letter to Small Business in Advance in just a few minutes.

If you already have an account, sign in and retrieve the Tennessee Sample of a Collection Letter to Small Business in Advance from the US Legal Forms library. The Download button will be available on every document you view. You can find all previously downloaded documents within the My documents section of your profile.

Select the format and download the document to your device.

Edit the document. Fill out, modify, print, and sign the downloaded Tennessee Sample of a Collection Letter to Small Business in Advance. Every template you save to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Tennessee Sample of a Collection Letter to Small Business in Advance using US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or individual needs.

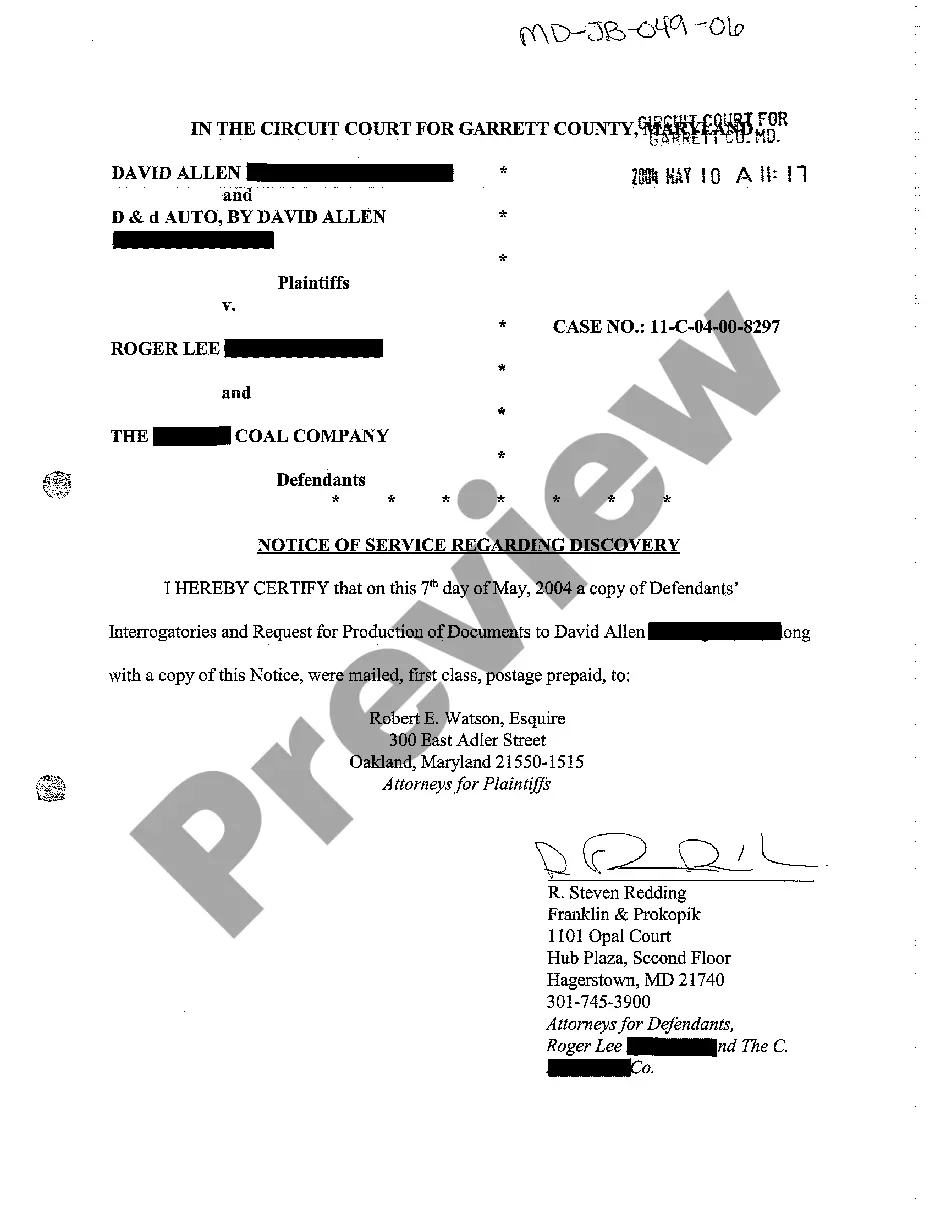

- Ensure you have selected the correct document for your region/area. Click on the Preview button to review the document's details.

- Examine the document description to confirm that you have chosen the correct document.

- If the document does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the document, finalize your choice by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

To compose a collection letter, begin with a clear and concise introduction that states the purpose of the letter. Include the debtor’s information, the outstanding amount, and any relevant dates. A Tennessee Sample of a Collection Letter to Small Business in Advance can serve as an excellent guide, ensuring you cover all necessary components in your letter.

Writing a collection statement involves outlining the debtor's account balance, payment history, and any agreements made. Start with a brief introduction, then provide a detailed account of the outstanding debt along with payment options. Utilizing a Tennessee Sample of a Collection Letter to Small Business in Advance can enhance the effectiveness of your communication.

The required language in a debt collection letter is clear and direct, with a focus on the details of the debt. Use assertive phrases that encourage immediate action while maintaining professionalism, such as reminders of past agreements and obligations. For reference, check out a Tennessee Sample of a Collection Letter to Small Business in Advance to find suitable language that fulfills legal requirements.

When writing a good collection email, start with a professional greeting, then succinctly outline the purpose of your message. Include details such as the amount owed and payment deadlines, and keep the tone courteous but assertive. Using a Tennessee Sample of a Collection Letter to Small Business in Advance can help structure your email effectively.

A collection letter is a formal communication sent to a debtor requesting payment for an outstanding debt. It should clearly state the amount due, provide a due date, and include instructions on how to make the payment. For insight, consider looking at a Tennessee Sample of a Collection Letter to Small Business in Advance as a template when crafting your own communication.

To write a good collection letter, start with a clear subject line that includes the purpose of the letter. Use a polite yet firm tone, and make sure to include important details such as the amount owed, due date, and any prior payment discussions. Referencing a Tennessee Sample of a Collection Letter to Small Business in Advance can guide you in structuring your letter effectively.

A properly written collection letter must clearly identify the amount owed and any applicable fees or penalties. Additionally, it should specify a deadline for payment to avoid further action. Incorporating a Tennessee Sample of a Collection Letter to Small Business in Advance can help ensure these crucial elements are included, making your communication more effective.

The structure of a collection letter should include an introduction, a body, and a conclusion. Begin with a clear statement of the debt, followed by details about payment options and deadlines. End with a courteous closing statement inviting further communication. Referring to a Tennessee Sample of a Collection Letter to Small Business in Advance can help you visualize this format.

Writing a good debt settlement letter involves being straightforward while expressing your intention to settle the debt for less than owed. Clearly state your offer, and provide a brief rationale for your proposal. It is also beneficial to mention your willingness to discuss potential terms. A Tennessee Sample of a Collection Letter to Small Business in Advance can ensure your letter presents your position effectively.

To write an effective collection letter, focus on being clear and concise. State the purpose of the letter early, and outline the payment details, including any relevant history of the debt. Empathize with the recipient, but maintain a strong call to action, urging them to settle the debt promptly. Using a Tennessee Sample of a Collection Letter to Small Business in Advance can provide you with a framework for your letter.