Tennessee Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

In case you need to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest compilation of official forms available online.

Take advantage of the website's straightforward and user-friendly search option to locate the documents you need.

Various templates for commercial and personal purposes are sorted by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Tennessee Sample Letter for New Business with Credit Application.

Each legal document template you purchase is yours indefinitely. You will have access to every form you downloaded with your account. Explore the My documents section and select a form to print or download again.

Stay competitive, acquire, and print the Tennessee Sample Letter for New Business with Credit Application with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Tennessee Sample Letter for New Business with Credit Application in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the Tennessee Sample Letter for New Business with Credit Application.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the guidance below.

- Step 1. Ensure you have selected the form for your specific city/state.

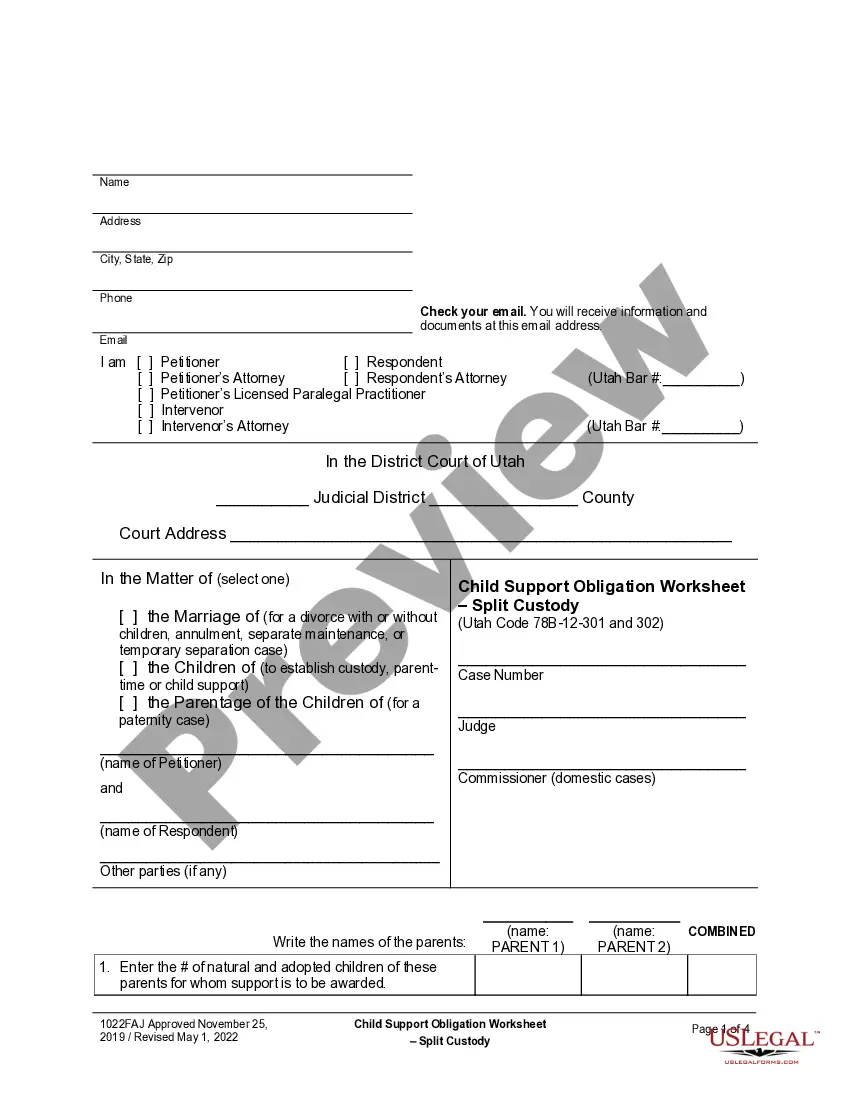

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms within the legal form template.

- Step 4. Once you find the form you need, click on the Purchase now button. Select your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

Starting a small business in Tennessee involves several key steps, such as choosing a business structure, registering your business name, and obtaining any necessary licenses and permits. It's also crucial to draft essential documents, including the Tennessee Sample Letter for New Business with Credit Application, to secure credit and build business relationships. By following these steps, you can lay a solid foundation for your new venture while navigating the legal requirements effectively.

A letter of credit is a document that a bank issues to guarantee that a buyer’s payment to a seller will be received on time and for the correct amount. For a new business, obtaining a letter of credit can help reassure suppliers and partners that payments will be made reliably. When you create a Tennessee Sample Letter for New Business with Credit Application, it can serve as a formal request for such a guarantee, helping to establish trustworthiness with potential creditors.

You might receive a letter from the Department of Revenue for reasons like tax assessments, inquiries about your business activities, or notifications regarding your business status. These letters are crucial for keeping your business compliant with state tax laws. To avoid surprises, consider preparing a Tennessee Sample Letter for New Business with Credit Application, which can help facilitate communication with the department.

The Tennessee Department of Revenue may send you a letter for various reasons, including clarifying tax obligations, notifying you about filings, or confirming business registration details. If you recently started a business, such letters often pertain to compliance with state laws. Engaging with a Tennessee Sample Letter for New Business with Credit Application can help streamline your credit processes and address any concerns raised in their correspondence.

A letter from the Tennessee Department of Revenue typically relates to tax information or compliance issues. They may contact you about your business permits or tax filings. Be proactive in understanding their communications, and use resources like the Tennessee Sample Letter for New Business with Credit Application to address any credit or tax inquiries efficiently.

Receiving a letter from the IRS can be concerning, but it is often part of routine correspondence. This letter might provide information regarding your tax obligations or confirm that a certain application is received. To ensure that your new business operates smoothly, consider having a Tennessee Sample Letter for New Business with Credit Application on hand to manage credit requests effectively.

The Tennessee Department of Revenue is responsible for administering and enforcing tax laws in the state. This includes collecting various taxes, issuing permits, and overseeing compliance for businesses. If you are starting your new business, they may send you a Tennessee Sample Letter for New Business with Credit Application to guide you on important requirements.

To obtain a tax clearance certificate in Tennessee, you'll need to ensure that your business is compliant with all state tax obligations. Start by filing all necessary tax returns and paying due taxes. Once your account is in good standing, you can request the clearance certificate through the Tennessee Department of Revenue. Using a Tennessee Sample Letter for New Business with Credit Application can help streamline communication with the department and clarify your business status.

To establish an LLC in Tennessee, you must choose a unique name that includes 'Limited Liability Company' or its abbreviation. Additionally, designate a registered agent to receive legal documents on behalf of the LLC. You must file the Articles of Organization with the Secretary of State, and it's beneficial to prepare a Tennessee Sample Letter for New Business with Credit Application to outline your business intentions and approach potential creditors.

LLCs in Tennessee are typically taxed as pass-through entities, meaning business income is reported on the owners' personal tax returns. However, LLCs that elect to be taxed as corporations will have different taxation rules. Staying informed about your LLC's tax status is crucial for good financial management. A Tennessee Sample Letter for New Business with Credit Application may also help clarify your business' financial responsibilities to creditors.