Tennessee Assignment and Transfer of Stock

Description

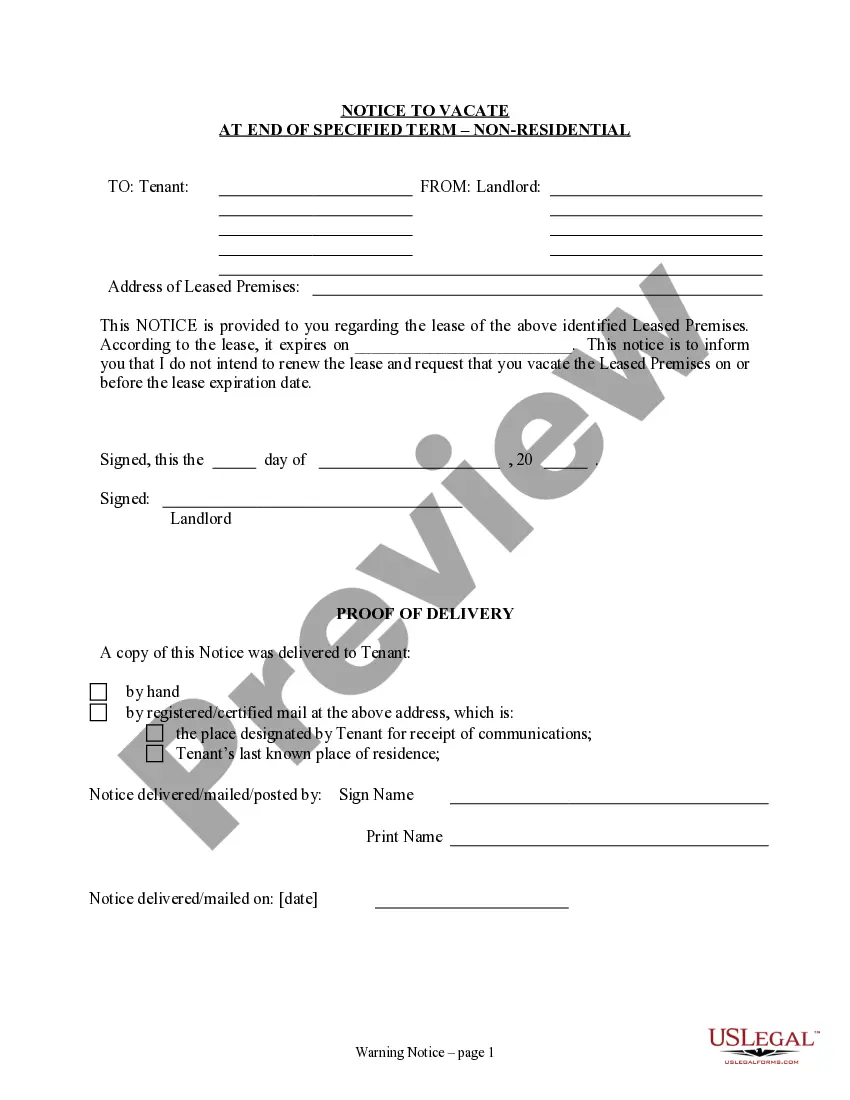

How to fill out Assignment And Transfer Of Stock?

Finding the appropriate legal document template can be quite a challenge.

Certainly, there are numerous templates accessible online, but how can you secure the legal form you need.

Utilize the US Legal Forms platform. The service offers thousands of templates, including the Tennessee Assignment and Transfer of Stock, that you can utilize for business and personal requirements.

You can preview the form using the Preview button and read the form description to confirm it is the right fit for you.

- All of the forms are reviewed by specialists and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Tennessee Assignment and Transfer of Stock.

- Use your account to reference the legal forms you may have acquired previously.

- Navigate to the My documents tab of your account to obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have chosen the correct form for your locality/state.

Form popularity

FAQ

The difference lies in the legal implications and the nature of the rights involved. An assignment of shares allows the original holder to keep ownership while granting rights to someone else. In contrast, a transfer of shares signifies a full change of ownership. It's crucial to grasp these nuances, especially when navigating Tennessee Assignment and Transfer of Stock matters.

A transfer is the act of moving ownership or rights to someone new. Meanwhile, a reassignment involves returning the rights back to a previous owner or another designated party. When handling Tennessee Assignment and Transfer of Stock, understanding these terms ensures that you execute the right actions to protect your investments.

Yes, the assignment of contracts is legal in Tennessee, provided certain conditions are met. In the context of Tennessee Assignment and Transfer of Stock, ensure that the original contract permits assignment and that all parties are aware to prevent any disputes. Platforms like uslegalforms can help you draft these documents correctly to safeguard your interests.

The assignment of shares refers to transferring the rights connected to specific stocks from one individual or entity to another. Within the framework of Tennessee Assignment and Transfer of Stock, this typically involves legally designating someone else as the recipient of those stock benefits, while ownership may stay with the original holder until a full transfer occurs.

An assignment is not always a transfer of ownership. In the realm of Tennessee Assignment and Transfer of Stock, an assignment can simply grant someone the rights to benefit from the shares without fully relinquishing ownership. It's essential to understand these distinctions, especially when dealing with legal documents or contracts.

The terms 'assignment' and 'transfer' often cause confusion. In the context of Tennessee Assignment and Transfer of Stock, an assignment refers to the act of designating someone else to receive the benefits or rights, while a transfer implies a complete shift of ownership. Therefore, while both processes can lead to changes in stock ownership, they signify different legal implications.

To transfer your shares to another person, you will need to prepare a Tennessee Assignment and Transfer of Stock. This document outlines the details of the transaction and must be signed by both you and the recipient. Afterward, submit the signed agreement to the company that issued the shares for processing. This ensures that the transfer is officially recognized.

Yes, you can transfer shares to a different person. The Tennessee Assignment and Transfer of Stock makes this process straightforward. Ensure you have all required information and follow any specific instructions from the stock issuer to avoid delays. This will help both parties agree on the terms of the transfer.

Transferring ownership of a stock involves completing a Tennessee Assignment and Transfer of Stock. Start by gathering the necessary information about the stock and the new owner. After drafting the transfer agreement, have both parties sign it, and then submit it to the issuing corporation. They will update their records to reflect the new ownership.

Yes, you can transfer ownership of stocks, providing you follow the proper process. Utilizing the Tennessee Assignment and Transfer of Stock will help facilitate this transaction. Make sure to check any restrictions or requirements from the issuing company. Proper documentation will ensure a smooth transfer.