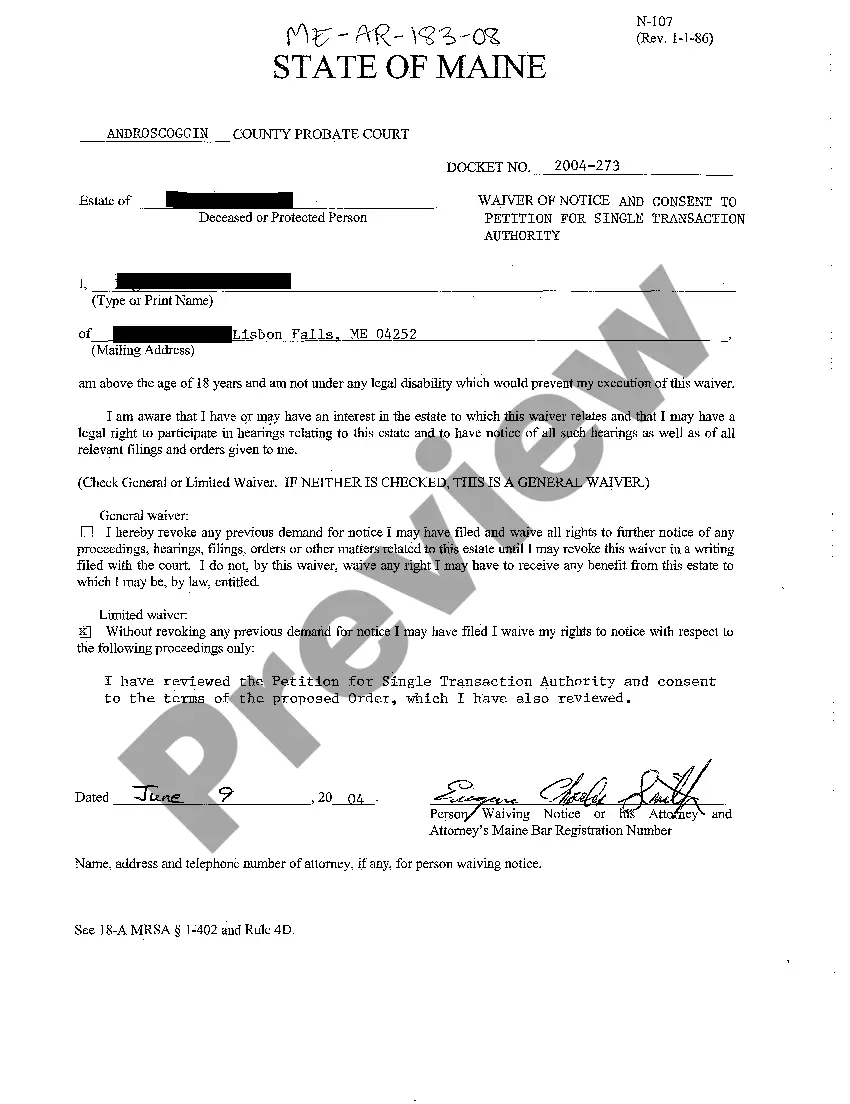

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Demand for Accounting from a Fiduciary

Description

How to fill out Demand For Accounting From A Fiduciary?

You can spend countless hours online searching for the valid document template that satisfies both state and federal regulations you need.

US Legal Forms offers a vast array of valid forms that are reviewed by experts.

You can actually download or print the Tennessee Demand for Accounting from a Fiduciary through the service.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure you have selected the correct document template for your preferred region or area. Review the form description to confirm you have chosen the right form. If available, utilize the Review option to go through the document template as well. To find another version of your form, use the Research field to locate the template that meets your requirements. Once you have identified the template you want, click on Buy now to proceed. Select the pricing plan you prefer, enter your details, and create your account on US Legal Forms. Complete the transaction using your credit card or PayPal account to pay for the valid form. Choose the format of your document and download it to your device. Make changes to your document if necessary. You can complete, alter, sign, and print the Tennessee Demand for Accounting from a Fiduciary. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the Tennessee Demand for Accounting from a Fiduciary.

- Every valid document template you obtain belongs to you permanently.

- To get another version of any acquired form, go to the My documents section and click the corresponding option.

Form popularity

FAQ

Final accounting of an estate is a document that summarizes all financial transactions related to the estate during the administration process. This accounting ensures that all debts are settled, assets are distributed correctly, and beneficiaries receive their proper shares. If you're navigating this complex area, a Tennessee Demand for Accounting from a Fiduciary could be an invaluable resource to ensure transparency and legal compliance in account management.

Tennessee Rules of Evidence 601 addresses the competency of witnesses in legal proceedings. It establishes that every person is presumed competent to testify unless otherwise provided by law. If you are involved in a judicial matter, understanding these rules can be essential. For assistance in legal documentation or inquiries, a Tennessee Demand for Accounting from a Fiduciary can streamline your process.

Tennessee's order of inheritance follows a specific structure established by state law. First, surviving spouses and children have priority, followed by parents, siblings, and then more distant relatives. Understanding this order can be crucial when dealing with estate matters, and a Tennessee Demand for Accounting from a Fiduciary can help clarify your rights in the distribution of an estate.

Not all wills in Tennessee must be probated, but most require it to settle the estate. Probation ensures the will is validated and addresses any claims against the estate. If you have concerns about managing an estate or understanding the probate process, consider seeking a Tennessee Demand for Accounting from a Fiduciary for clarity and assistance.

In Tennessee, individuals typically must serve at least 30 percent of their sentence before becoming eligible for parole. This percentage may vary based on the nature of the crime and the specifics of the sentencing terms. For those facing issues relating to the post-conviction process, a Tennessee Demand for Accounting from a Fiduciary may provide guidance on your rights and options.

To file a petition for probate in Tennessee, you first need to gather necessary documents, including the deceased's will and a death certificate. Next, complete the probate forms required by your county's probate court. Submitting your petition along with the required paperwork initiates the process. You may also consider a Tennessee Demand for Accounting from a Fiduciary to ensure financial transparency throughout probate.

Tennessee Code Annotated 30-2-601 outlines the legal framework for demanding an accounting from a fiduciary. It specifies the rights of beneficiaries to receive detailed financial reports regarding trusts and estates. Understanding this statute can empower you as a beneficiary to exercise your right to a Tennessee Demand for Accounting from a Fiduciary effectively.

Trustees have several key obligations, including managing the trust's assets loyally and in good faith, serving the best interests of the beneficiaries, and providing transparent accounting. They must follow the terms set forth in the trust document and adhere to applicable laws. By fulfilling these obligations, a trustee helps to uphold the principles of the Tennessee Demand for Accounting from a Fiduciary.

To demand an accounting of a trust, beneficiaries should formally request this from the trustee in writing. This can be done through a simple letter that specifies the request for records and documentation related to the trust's finances. Utilizing the Tennessee Demand for Accounting from a Fiduciary can also help clarify the legal expectations, ensuring the request is clear and actionable.

Indeed, both executors and trustees are required to provide an accounting of the estate's finances. This process includes detailing all income, expenses, and distributions to beneficiaries. Adhering to the Tennessee Demand for Accounting from a Fiduciary helps maintain transparency and accountability, thereby fostering trust among all parties involved.