Tennessee Sample Letter for Return Authorization

Description

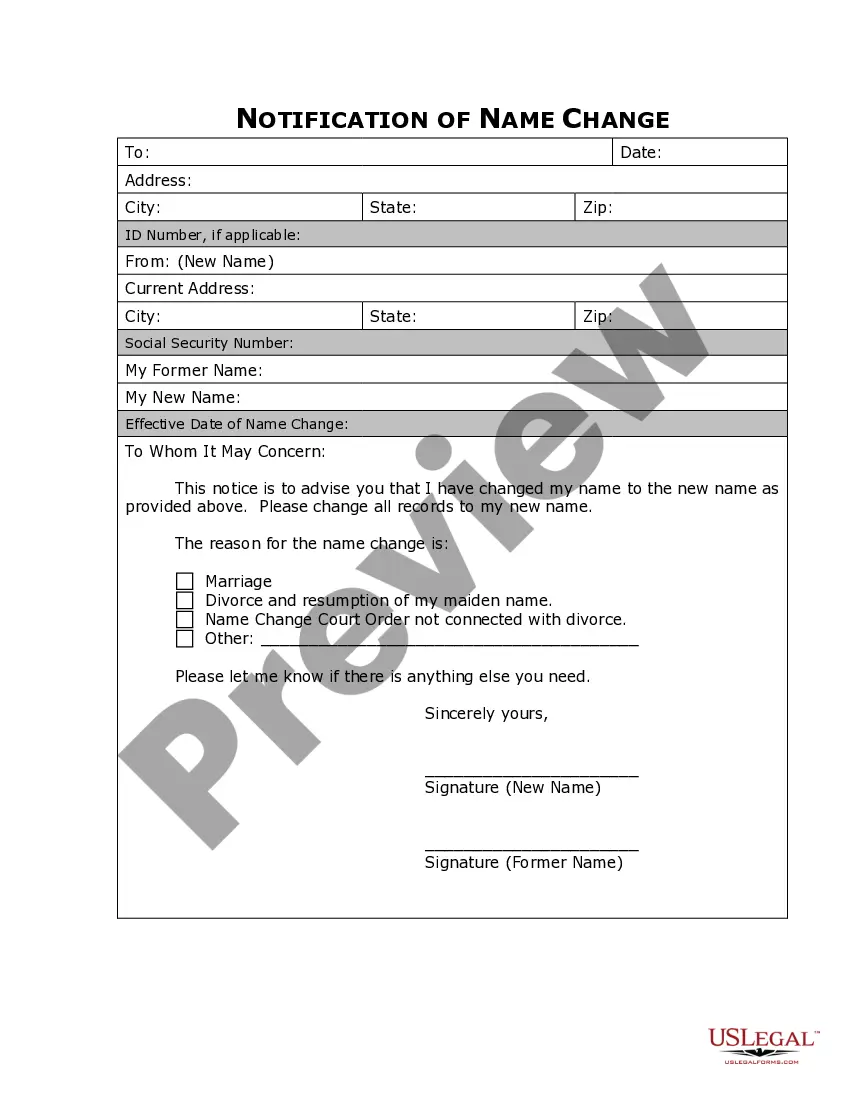

How to fill out Sample Letter For Return Authorization?

If you need extensive, obtain, or print out legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the website's easy and convenient search to find the documents you need.

An assortment of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you find the form you need, click the Purchase now option. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the Tennessee Sample Letter for Return Authorization with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Tennessee Sample Letter for Return Authorization.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to inspect the form's content. Remember to check the explanation.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other templates in the legal form category.

Form popularity

FAQ

To claim your refund from the TN Department of Revenue, complete the required forms and submit them according to the established guidelines. Be sure to include any necessary documentation to support your claim. Utilizing a Tennessee Sample Letter for Return Authorization can streamline this process and clarify the specifics of your request, making it more likely to be processed promptly.

In Tennessee, the statute of limitations for claiming a sales tax refund typically spans three years from the date of the tax payment. Acting promptly is essential to ensure you don’t lose the opportunity for a refund. If you need help drafting your claim, using a Tennessee Sample Letter for Return Authorization can provide you with a solid foundation for your request.

To get your refund back, ensure that you have filed your tax returns accurately and on time. Keep track of the status through the Department of Revenue's online portal. If you encounter delays, having a Tennessee Sample Letter for Return Authorization can assist in communicating your needs more effectively to the Department of Revenue.

Checking your refund status with the Department of Revenue is straightforward. Visit their official website and look for the refund status section. You’ll likely need to enter some personal information like your Social Security number and filing details. Keep in mind that having a Tennessee Sample Letter for Return Authorization at hand can help if you need to clarify your query with their customer support.

To file a tax refund claim, begin by gathering all necessary documents, including your completed tax return and any supporting materials. You can often submit your claim online through the Department of Revenue's website. It may also be beneficial to include a Tennessee Sample Letter for Return Authorization to clarify your request and expedite the process.

A TN tax clearance letter is an official document issued by the Tennessee Department of Revenue confirming that your tax obligations are fulfilled. This letter is often necessary for businesses applying for loans or permits. To ensure a smooth process, consider using a Tennessee Sample Letter for Return Authorization when requesting any necessary tax information.

To claim your refund on Tntap, start by logging into your Tntap account. Next, navigate to the appropriate section for refunds and follow the step-by-step instructions. You may need to attach a Tennessee Sample Letter for Return Authorization if required. This letter can serve as a formal request that outlines your refund details.

Filing only federal taxes while neglecting state tax obligations can lead to significant penalties and interest from state tax authorities. Each state has its own tax laws, and failing to comply can cause complications. Ensure that you understand both federal and state filing requirements to avoid these issues. If you need to communicate with the state regarding your obligations, a Tennessee Sample Letter for Return Authorization can help streamline your correspondence.

Receiving a letter from the Department of the Treasury may signify that they are addressing federal tax matters or issues related to your finances. It’s vital to comprehend the letter's details and respond as needed to prevent further complications. Many find navigating such correspondence challenging, but a Tennessee Sample Letter for Return Authorization can serve as a template for clear communication.

The Department of Revenue may send you a letter to clarify your tax filing, inform you of discrepancies, or notify you of outstanding payments. It’s essential to interpret the content accurately to respond appropriately and manage your tax affairs. If you need assistance in crafting your reply, consider using a Tennessee Sample Letter for Return Authorization to guide your process.