Tennessee Receipt for Payment of Account

Description

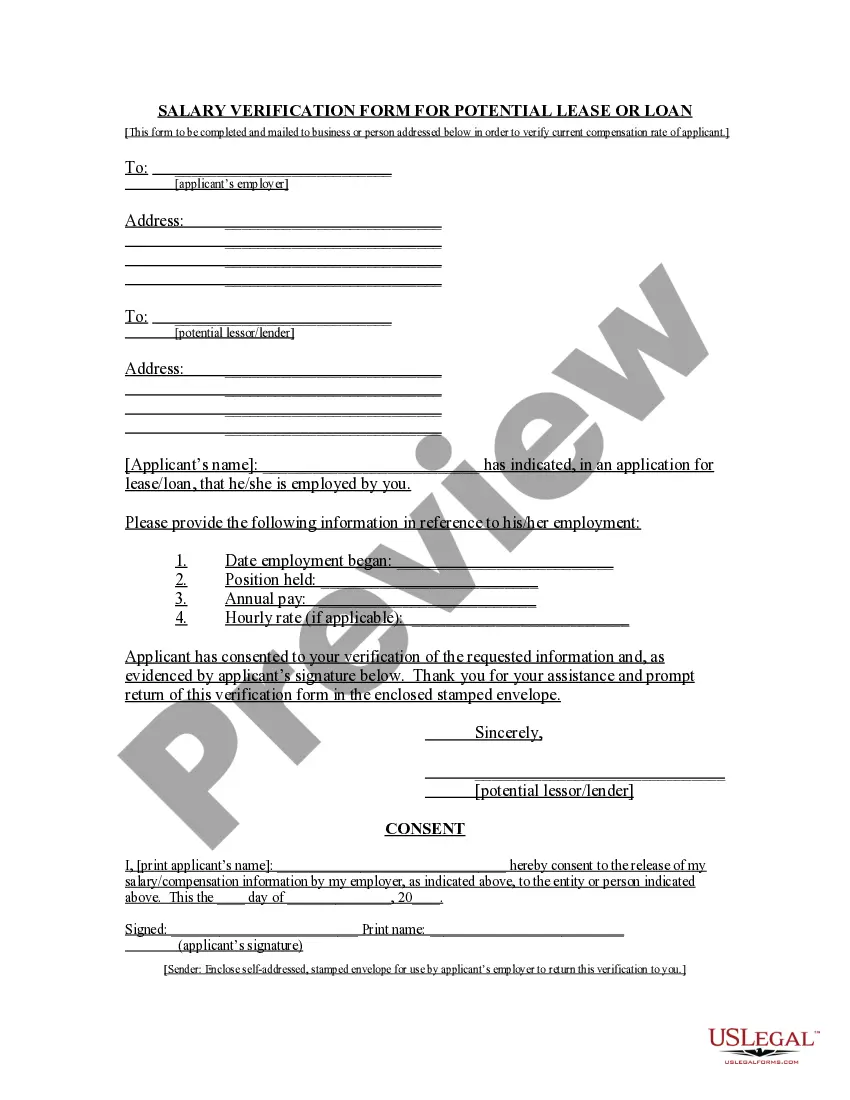

How to fill out Receipt For Payment Of Account?

Finding the right authorized file design can be quite a struggle. Needless to say, there are a lot of templates available online, but how do you find the authorized kind you will need? Make use of the US Legal Forms site. The support provides 1000s of templates, including the Tennessee Receipt for Payment of Account, that you can use for enterprise and private requires. Each of the types are checked out by pros and fulfill federal and state needs.

If you are already listed, log in to the accounts and click on the Download option to get the Tennessee Receipt for Payment of Account. Make use of your accounts to appear through the authorized types you have ordered earlier. Check out the My Forms tab of the accounts and have one more duplicate of the file you will need.

If you are a new end user of US Legal Forms, listed below are straightforward instructions that you can follow:

- Very first, be sure you have chosen the proper kind for the town/state. You may check out the shape making use of the Review option and read the shape explanation to ensure this is the right one for you.

- In case the kind is not going to fulfill your needs, take advantage of the Seach field to obtain the right kind.

- Once you are sure that the shape is acceptable, click the Purchase now option to get the kind.

- Choose the costs plan you need and type in the required info. Create your accounts and pay money for the order utilizing your PayPal accounts or charge card.

- Opt for the file structure and download the authorized file design to the gadget.

- Comprehensive, revise and print and signal the obtained Tennessee Receipt for Payment of Account.

US Legal Forms is the greatest library of authorized types for which you can find various file templates. Make use of the company to download appropriately-manufactured paperwork that follow express needs.

Form popularity

FAQ

Professionals who are subject to the tax may file and pay the tax online at . The Department is also happy to answer taxpayer questions and encourage taxpayers to the Department's online help application, called Revenue Help ( ).

Individual filers in TN do not have to file estimated quarterly payments. Businesses, including Tennessee LLCs, with a combined franchise and excise tax payment of more than $5,000 are required to make quarterly payments.

Tennessee Tax Rates, Collections, and Burdens Tennessee has a flat 6.50 percent corporate income tax rate and levies a gross receipts tax. Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent.

Taxpayers owing $10,000 or more in connection with any return may be required to make payment by electronic funds transfer (EFT). The threshold for making sales and use tax payments and Tennessee business tax payments by EFT is $1,000.

Taxpayers that require assistance with TNTAP may contact the Department using Revenue Help, , or contact the Taxpayer Services Division at (800) 342-1003 or (615) 253-0600.

The minimum combined 2023 sales tax rate for Memphis, Tennessee is 9.75%. This is the total of state, county and city sales tax rates. The Tennessee sales tax rate is currently 7%. The County sales tax rate is 2.25%.

EFT payment (electronic funds transfer) is a term that includes many types of electronic payments, including ACH transfers and wire transfers. EFT payments are also called e-Payments because each transaction is completed online and doesn't include paper checks in the payment process.