Tennessee Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

How to fill out Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

If you want to complete, down load, or produce authorized document templates, use US Legal Forms, the most important collection of authorized types, which can be found on the web. Make use of the site`s basic and practical look for to find the files you require. Numerous templates for business and individual purposes are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the Tennessee Agreement of Shareholders of a Close Corporation with Management by Shareholders with a couple of clicks.

When you are currently a US Legal Forms customer, log in to the profile and then click the Download switch to get the Tennessee Agreement of Shareholders of a Close Corporation with Management by Shareholders. You may also entry types you previously delivered electronically from the My Forms tab of your profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that appropriate metropolis/land.

- Step 2. Make use of the Review choice to check out the form`s articles. Don`t overlook to read the information.

- Step 3. When you are unhappy with the develop, take advantage of the Research discipline on top of the screen to find other models from the authorized develop web template.

- Step 4. When you have found the shape you require, go through the Purchase now switch. Pick the costs plan you favor and put your accreditations to register for the profile.

- Step 5. Process the purchase. You may use your bank card or PayPal profile to perform the purchase.

- Step 6. Find the format from the authorized develop and down load it on your system.

- Step 7. Total, change and produce or indicator the Tennessee Agreement of Shareholders of a Close Corporation with Management by Shareholders.

Every authorized document web template you purchase is your own forever. You may have acces to every single develop you delivered electronically with your acccount. Select the My Forms segment and choose a develop to produce or down load yet again.

Be competitive and down load, and produce the Tennessee Agreement of Shareholders of a Close Corporation with Management by Shareholders with US Legal Forms. There are many professional and express-distinct types you can use for your business or individual requires.

Form popularity

FAQ

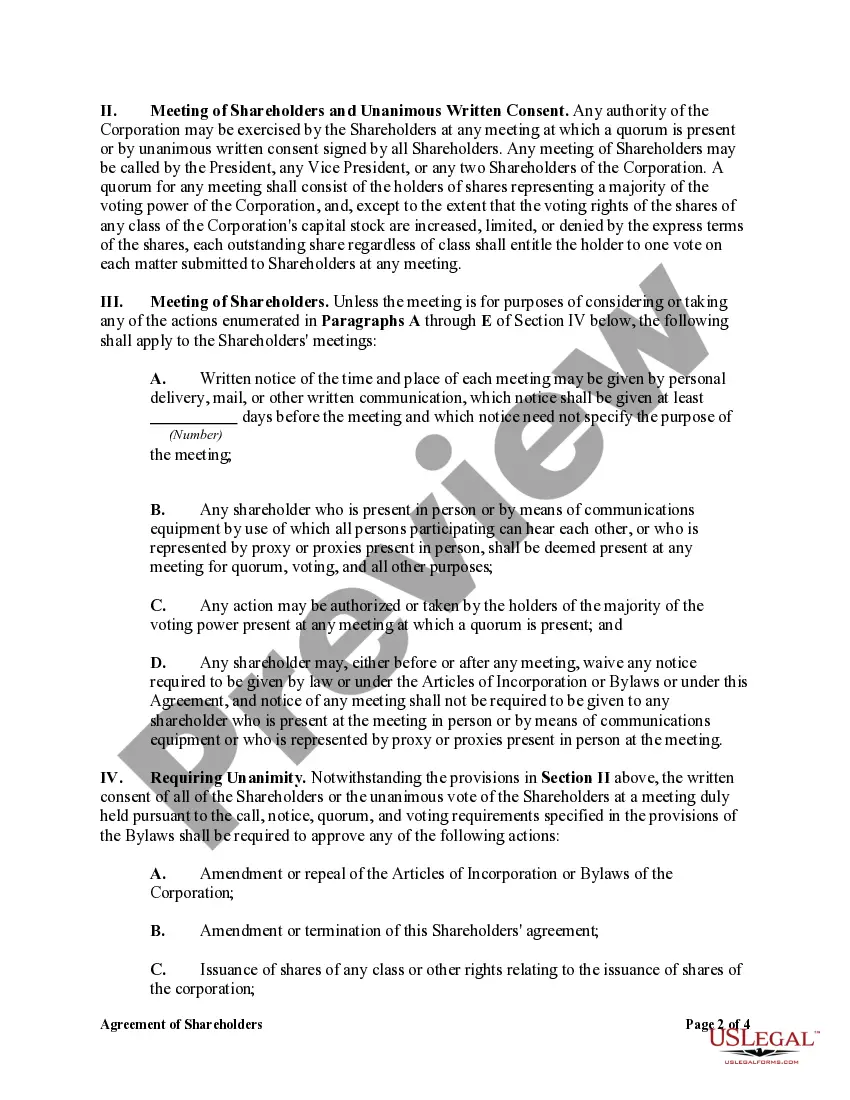

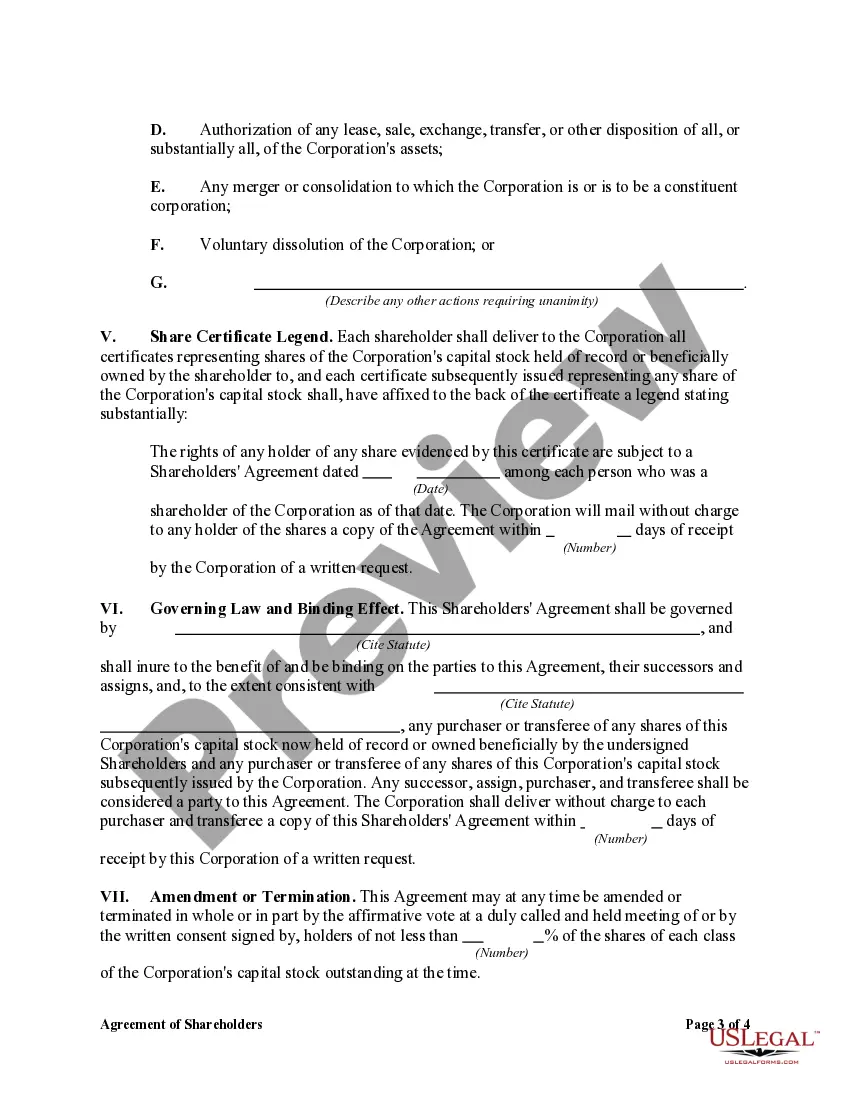

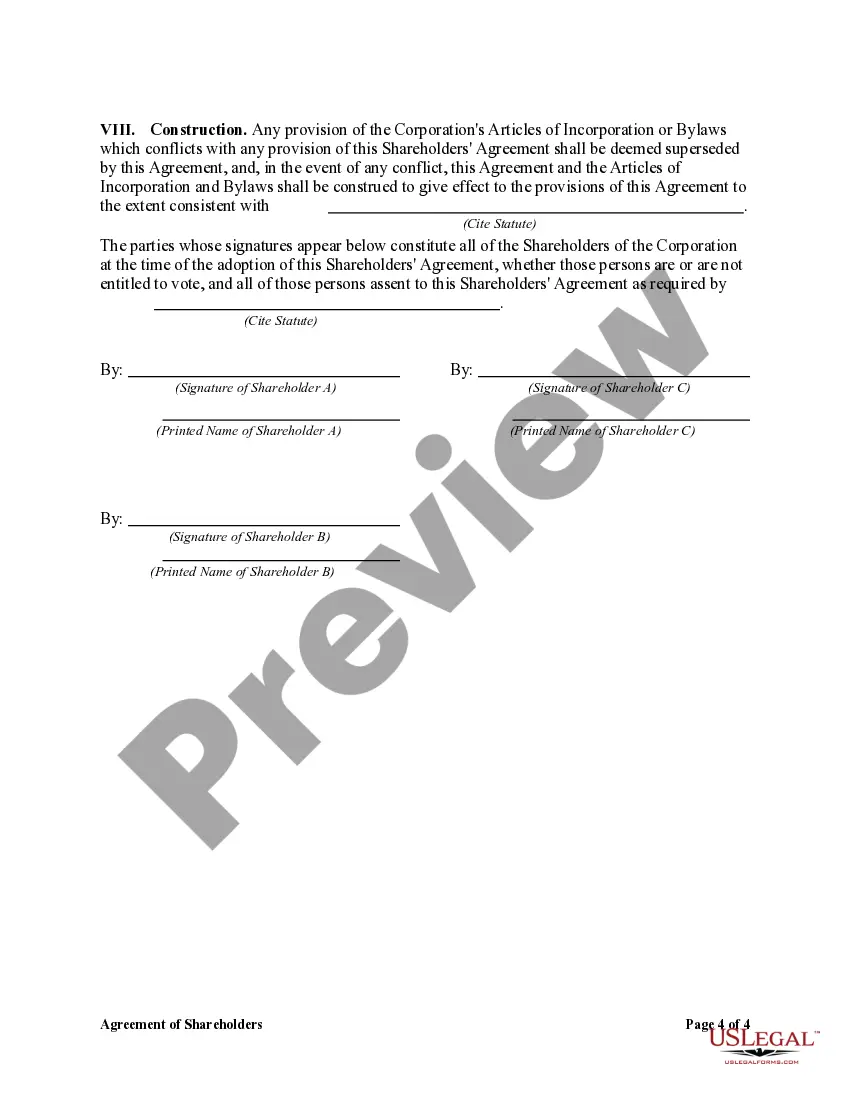

The purpose of a shareholder agreement is to ensure that shareholders are protected and treated fairly, and it allows them to make decisions on the third parties who may become shareholders in the future.

A shareholder agreement is an arrangement that defines the relationship between shareholders and the company. The agreement safeguards the rights and obligations of the majority and minority shareholders, and it ensures all shareholders are treated fairly.

WHO SHOULD SIGN THE SHAREHOLDERS AGREEMENT? The shareholders agreement should be signed or executed by the company and each shareholder. Remember the legal requirements for a company and an individual to sign documents is different, so make sure that you review the execution blocks correctly and sign the right one!

A shareholders' agreement is an arrangement among a company's shareholders that describes how the company should be operated and outlines shareholders' rights and obligations. The shareholders' agreement is intended to make sure that shareholders are treated fairly and that their rights are protected.

A shareholders agreement will usually contain provisions requiring directors and shareholders keep confidential all matters relating to company business. In addition, it may contain provisions preventing shareholders starting competing businesses or dealing with customers of the company.

A shareholders' agreement is optional. The contents and provisions vary in different cases. The details depend on the nature of the entity, the class of shares, and many other factors. There are basic components that every shareholder's agreement contains.

In the modern publicly held corporation, ownership and control are separated. The shareholders ?own? the company through their ownership of its stock, but power to manage is vested in the directors.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...