A Tennessee Non-Disclosure Agreement for Merger or Acquisition is a legally binding document that outlines the terms and conditions regarding the sharing of confidential information during the process of merging or acquiring businesses in the state of Tennessee. Such agreements are crucial to protect the sensitive information of the parties involved and ensure its confidentiality. Keywords: Tennessee, non-disclosure agreement, merger, acquisition, confidential information, sensitive information, parties involved, confidentiality. There are several types of Tennessee Non-Disclosure Agreements for Merger or Acquisition, each catering to specific requirements and scenarios. These types may include: 1. Mutual Non-Disclosure Agreement: This type of agreement is signed between two or more parties involved in a merger or acquisition, and it ensures that all parties are obligated to keep each other's confidential information confidential. 2. One-Way Non-Disclosure Agreement: This agreement is typically used when only one party is disclosing sensitive information during the merger or acquisition process, while the other party is restricted from sharing it with anyone else. 3. Employee Non-Disclosure Agreement: In some cases, employees of the merging or acquiring companies might be required to sign an NDA to ensure that they do not disclose any confidential information regarding the transaction to outside parties. 4. Vendor or Supplier Non-Disclosure Agreement: When vendors or suppliers are involved in the merger or acquisition process, they may be required to sign a separate NDA to protect the sensitive information they come across during the negotiation or due diligence process. 5. Investor Non-Disclosure Agreement: If investors are involved in the merger or acquisition, a specific NDA may be necessary to ensure that the confidential information shared with them remains secure and is not disclosed to others. Overall, Tennessee Non-Disclosure Agreements for Merger or Acquisition play a crucial role in protecting the vital information exchanged during the consolidation of businesses, safeguarding the interests of the parties involved, and minimizing the risk of unauthorized disclosure. It is essential that these agreements are carefully drafted, reviewed, and understood by all parties before signing to ensure their enforceability and effectiveness in safeguarding confidential information.

Tennessee Non-Disclosure Agreement for Merger or Acquisition

Description

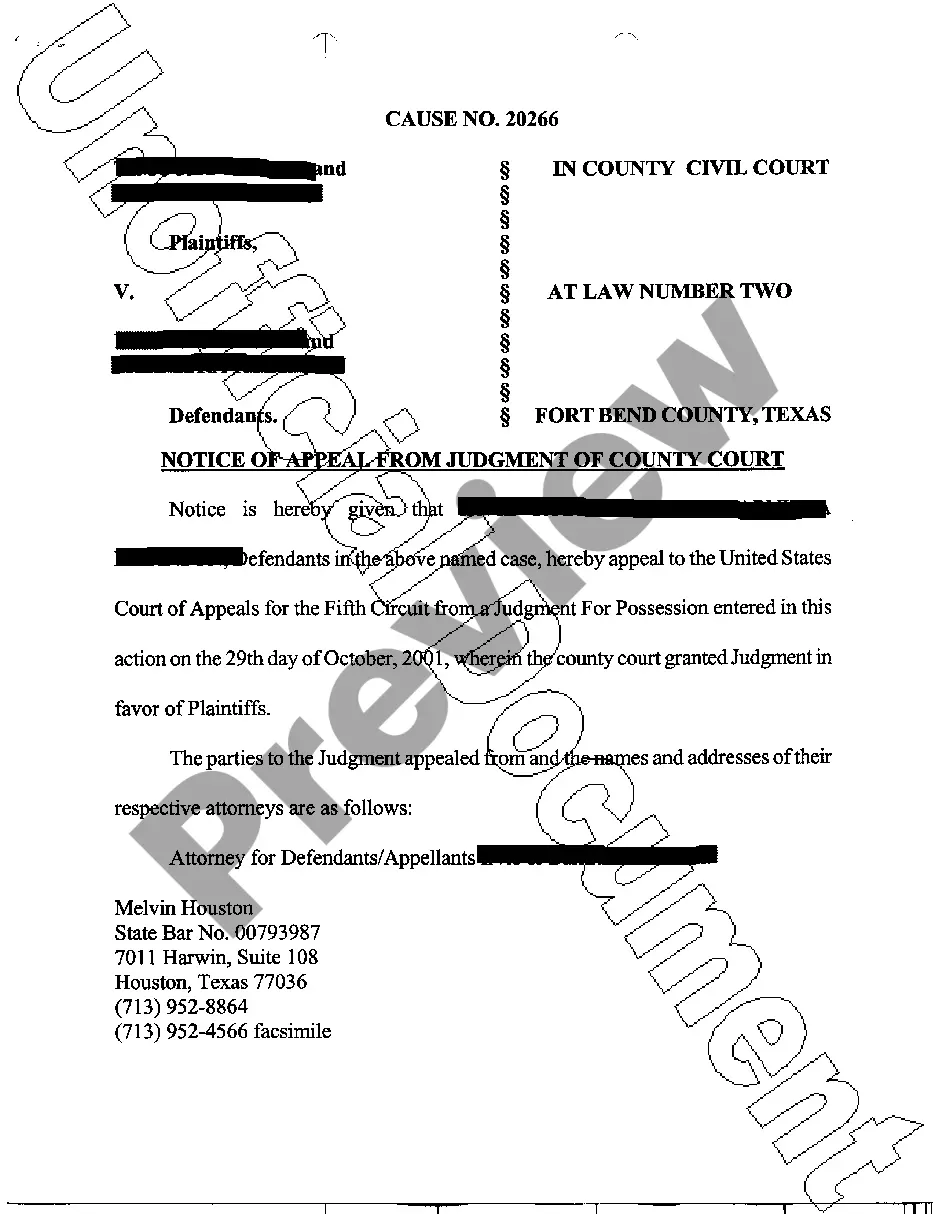

How to fill out Tennessee Non-Disclosure Agreement For Merger Or Acquisition?

If you wish to be thorough, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legitimate forms that are available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Tennessee Non-Disclosure Agreement for Merger or Acquisition with just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Obtain button to access the Tennessee Non-Disclosure Agreement for Merger or Acquisition.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form's details. Don’t forget to review the content.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

Disclosure Agreement (NDA) and a Mutual NonDisclosure Agreement (MNDA) serve distinct purposes in the context of confidentiality. An NDA typically protects one party's information, while an MNDA safeguards the interests of both parties involved. When considering a Tennessee NonDisclosure Agreement for Merger or Acquisition, it's essential to choose the right form that aligns with your needs. By using the USLegalForms platform, you can easily find and customize the appropriate agreement that fits your situation.

Creating your own Tennessee Non-Disclosure Agreement for Merger or Acquisition is certainly possible. Start with a clear understanding of what information needs protection and the terms involved. While a self-created NDA can work, remember that legal advice can help you avoid pitfalls. Tools like uslegalforms can aid you in developing a comprehensive agreement tailored to your needs.

Yes, you can create your own Tennessee Non-Disclosure Agreement for Merger or Acquisition, especially if your needs are straightforward. However, it's crucial to include all necessary components and comply with legal requirements. Missteps in crafting an NDA may lead to difficulties later on. For peace of mind, consider using services like uslegalforms, where you can access customizable NDA templates.

Typically, a legal professional should write a Tennessee Non-Disclosure Agreement for Merger or Acquisition to ensure that it meets all legal standards. An attorney knowledgeable in business law can best protect your interests. However, business owners can also draft their own agreements if they clearly understand their needs and risks. Platforms like uslegalforms provide templates that simplify this process.

A Tennessee Non-Disclosure Agreement for Merger or Acquisition may be deemed invalid if it lacks essential elements, such as mutual consent, clear terms, or lawful purpose. If the agreement is overly broad or vague, it can also be challenged in court. Additionally, if one party does not provide consideration, the NDA could be void. Understanding these factors is essential for ensuring your NDA stands up legally.

The purpose of the NDA in acquisition is to protect the sensitive information shared between parties considering a business transaction. A Tennessee Non-Disclosure Agreement for Merger or Acquisition plays a vital role in ensuring that proprietary business information remains confidential throughout the evaluation process. This security allows potential buyers to assess the target company without the risk of losing competitive advantages. Ultimately, the NDA helps to facilitate trust and openness, crucial elements in successful acquisitions.

The confidentiality clause of M&A is a key component of the agreements used during the merger or acquisition process. This clause typically falls within the Tennessee Non-Disclosure Agreement for Merger or Acquisition and outlines the specific information that must remain confidential. It clearly states the duration for which this confidentiality must be maintained and the penalties for breaches. This clause helps create a secure environment that encourages transparency in negotiations.

An NDA in M&A is a legally binding document that ensures confidentiality between parties involved in a potential merger or acquisition. Specifically, a Tennessee Non-Disclosure Agreement for Merger or Acquisition prevents the unauthorized sharing of proprietary information, trade secrets, and other sensitive details. This agreement is crucial for fostering trust, as it allows both sides to discuss strategic business matters without fear of information leaks. Having an NDA in place promotes a smoother transaction process.

The NDA process in M&A involves several key steps to protect the interests of both parties. Initially, potential buyers or investors sign a Tennessee Non-Disclosure Agreement for Merger or Acquisition before accessing confidential business information. This legally binding document outlines what information is protected and the obligations of both parties. With the NDA in place, parties can confidently share sensitive information required to evaluate the merger or acquisition.

To obtain a Tennessee Non-Disclosure Agreement for Merger or Acquisition, you can start by visiting online legal service platforms like USLegalForms. They provide customizable templates that meet your specific needs. After selecting the right template, you can fill it out with pertinent details and have it professionally reviewed. This process ensures that you have a valid and enforceable agreement to safeguard sensitive information.

Interesting Questions

More info

News Search Strategy View Profile Forum Community Calendar Blogs Copyright © 2006 John Brown, Ph.D. All Rights Reserved. John Brown, Ph.D. has been writing about international politics, economics and psychology since 1997. He is a former editor of the online magazine “Political Research Bulletin”, which is published by the Political Research and Intelligence Unit of the University of Sheffield in the United Kingdom. His books include “Understanding Politics: Principles, Process & Critique”, “Understanding Economic Development” and “Understanding Strategic Behavior”.