Tennessee Sale of Deceased Partner's Interest

Description

How to fill out Sale Of Deceased Partner's Interest?

You can dedicate hours online searching for the legal document template that fulfills the state and federal requirements you have. US Legal Forms offers numerous legal forms which can be evaluated by experts.

It is easy to download or print the Tennessee Sale of Deceased Partner's Interest from their service.

If you already possess a US Legal Forms account, you can Log In and hit the Acquire button. After that, you can complete, modify, print, or sign the Tennessee Sale of Deceased Partner's Interest. Every legal document template you purchase is yours indefinitely.

Complete the payment. You can use your Visa, Mastercard, or PayPal account to buy the legal document. Select the format of the document and download it to your device. Make amendments to your document if necessary. You can complete, modify, sign, and print the Tennessee Sale of Deceased Partner's Interest. Obtain and print numerous document templates using the US Legal Forms website, which offers the widest selection of legal forms. Use professional and state-specific templates to address your business or personal requirements.

- To obtain another version of a purchased form, go to the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your county/city of your choice. Read the form description to verify you have selected the appropriate one.

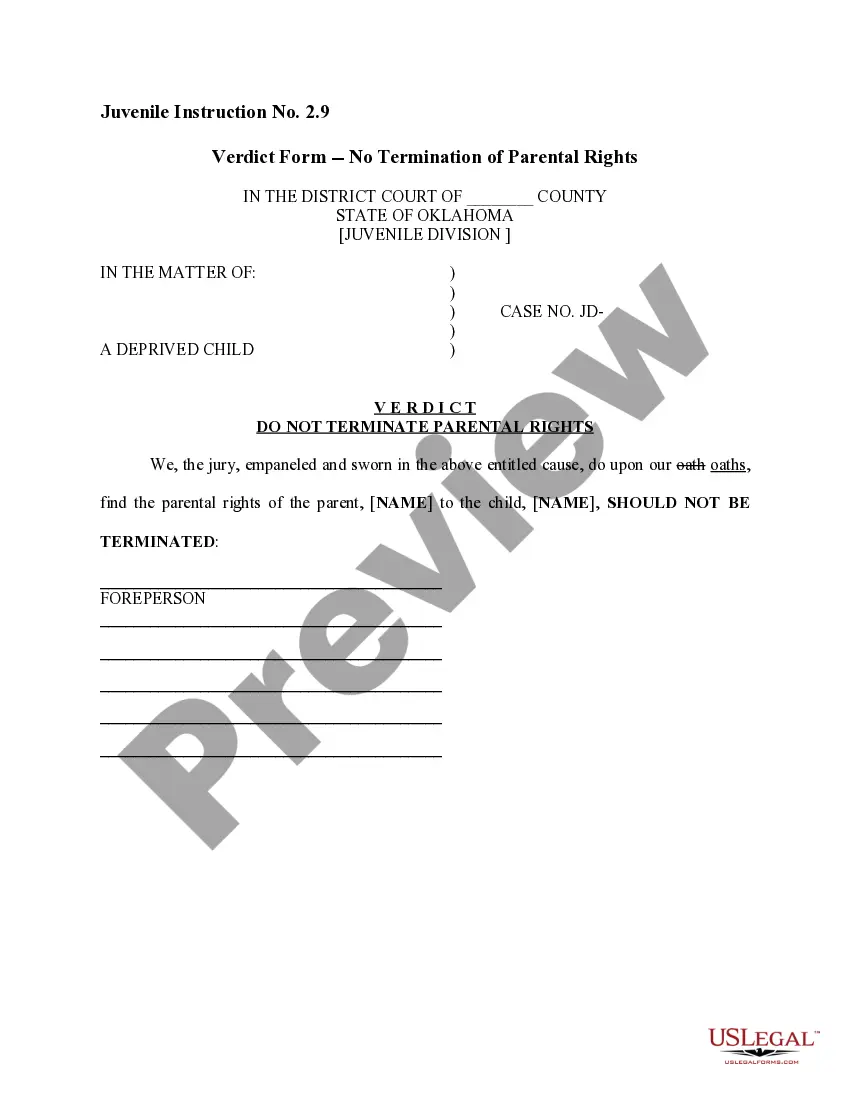

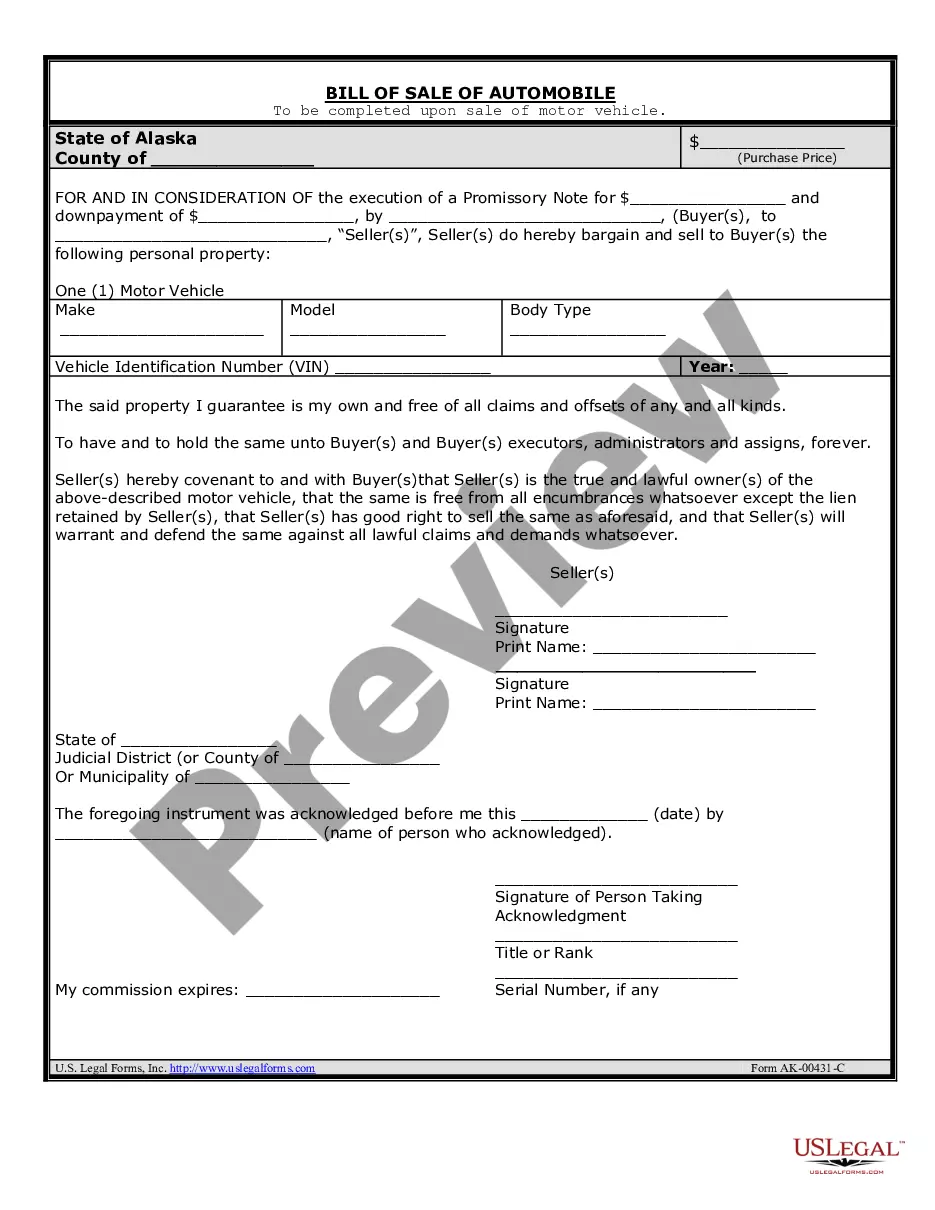

- If available, use the Review button to examine the document template as well.

- If you wish to find another version of the document, use the Search area to locate the template that fits your needs.

- Once you have found the template you want, click on Acquire now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for a free account on US Legal Forms.

Form popularity

FAQ

Under federal income tax law, the mutual fund dividends may be classified as capital gains if the mutual fund earned the income from the sale of investments. There is no such provision in Tennessee law. Such capital gains reported by the mutual fund would be taxable in Tennessee.

Income from investment trusts and mutual funds, including capital gain distributions and distributions designated as nontaxable under federal income tax law, whether issued in cash or additional stock (Note, the portion of income derived from bonds of the U.S. government and its agencies or bonds of the state of

Tennessee does not have state or local capital gains taxes. The Combined Rate accounts for the Federal capital gains rate, the 3.8 percent Surtax on capital gains, and the marginal effect of Pease Limitations on itemized deductions, which increases the tax rate by 1.18 percent.

Municipal bonds (also known as "munis") are fixed-income investments that can provide higher after-tax returns than similar taxable corporate or government issues. In general, the interest paid on municipal issues is exempt from federal taxes and sometimes state and local taxes as well.

For the sale to be exempt from the capital gains tax, the home must have been considered the primary residence for at least two years of the last five years. That doesn't mean those two years need to be consecutive in the last five years.

If the total amount of your interest income from bonds, notes, and dividends from stock are less than $1,250 (or $2,500 for a married couple), then you are entirely exempt from either having to pay this tax, or filing a Tennessee Hall tax return.

Tennessee is one of nine states that does not collect a general income tax. However, the state does collect taxes on interest and dividends earned on investments a form of income tax known as the Hall tax.

According to Tennessee's intestacy laws, your spouse should inherit the greater share of either one-third or a child's share of your estate. If your surviving spouse received one-third of your $300,000, he/she would receive $100,000, which is less than the child's share of $150,000.

The portion of income derived from bonds of the U.S. government and its agencies or bonds of the state of Tennessee and its counties and municipalities are exempt.