Tennessee Assignment of Partnership Interest

Description

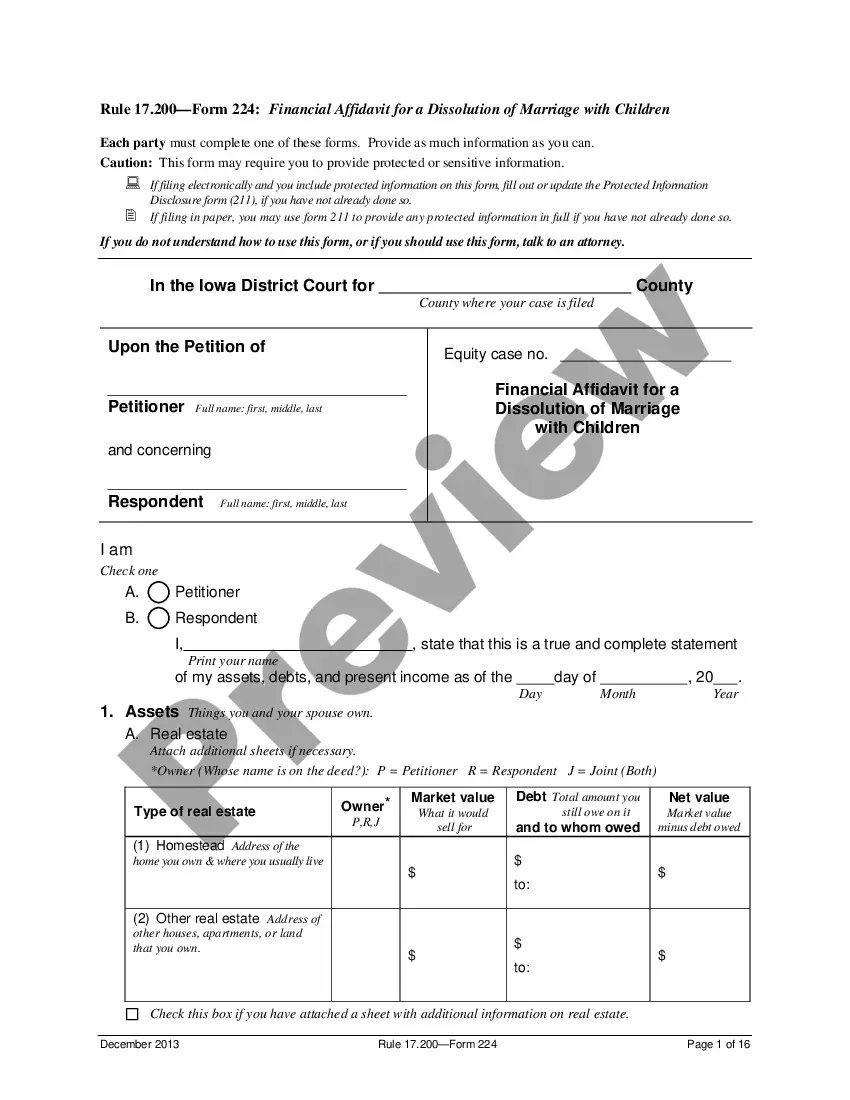

How to fill out Assignment Of Partnership Interest?

If you need to obtain comprehensive, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the site's straightforward and user-friendly search tool to find the documents you require.

A range of templates for business and personal applications are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Download now button. Select your preferred pricing plan and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of your legal document and download it to your device. Step 7. Complete, modify, and print or sign the Tennessee Assignment of Partnership Interest. Every legal document template you purchase is yours indefinitely. You have access to every form you've downloaded through your account. Go to the My documents section to either print or download a document again.

- Utilize US Legal Forms to quickly access the Tennessee Assignment of Partnership Interest.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to retrieve the Tennessee Assignment of Partnership Interest.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first experience with US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the content of the form. Don’t forget to review the details.

- Step 3. If you’re dissatisfied with the document, use the Search field at the top of the page to find other versions of the legal document template.

Form popularity

FAQ

The Tennessee Partnership Act governs the formation and operation of partnerships in Tennessee. This legislation outlines the legal framework for issues such as capital contributions, profit sharing, and partnership management. Familiarity with the Tennessee Partnership Act is crucial when considering assignments under the Tennessee Assignment of Partnership Interest. For comprehensive resources and legal forms, consider using USLegalForms to assist with your partnership needs.

Assignment of interest means transferring the rights and responsibilities of one partner to another. This action does not dissolve the partnership but alters the ownership structure. Ensuring compliance with the Tennessee Assignment of Partnership Interest safeguards both parties' interests during this transition. Using services from platforms like USLegalForms can guide you in preparing the necessary documents clearly and efficiently.

The assignee of a partner's interest is the individual or entity receiving the rights associated with that partnership interest. This transfer permits the assignee to enjoy the benefits, like profits and losses, without engaging in the partnership’s management unless otherwise specified. Understanding who the assignee is and their role under the Tennessee Assignment of Partnership Interest can clarify rights and obligations. USLegalForms provides resources to help navigate these assignments smoothly.

An assignment of a member's interest refers to the transfer of a partner's ownership rights in a partnership. This process allows one partner to assign their financial and managerial rights to another party. To create this assignment in compliance with the law, it is vital to follow the guidelines outlined in the Tennessee Assignment of Partnership Interest. It is beneficial to consult a legal expert or platform, such as USLegalForms, to ensure all aspects are correctly addressed.

Assignment and transfer are often used interchangeably, but they have distinct meanings. Assignment specifically refers to the transfer of benefits and burdens without altering the original agreement, while transfer usually implies a broader exchange that may involve changing the terms or parties involved. In the context of Tennessee Assignment of Partnership Interest, understanding these differences is crucial for maintaining clear partnership lines and legal obligations.

An assignment in business generally refers to the act of transferring rights, responsibilities, or interests from one party to another. This can occur in various business situations, such as sales contracts, lease agreements, or partnership arrangements. Businesses often explore options like a Tennessee Assignment of Partnership Interest to effectively manage partner contributions and maintain operational effectiveness.

An assignment of partnership interest is the act of a partner transferring their stake in the partnership to another party. This process can affect voting rights, profit distribution, and overall partnership dynamics. Engaging in a Tennessee Assignment of Partnership Interest can provide flexibility for partners looking to bring in new members or reorganize their investment in a partnership.

Assignment in partnership involves the process where a partner transfers their interest in the partnership to another individual or entity. This transfer could involve both the financial rights to profits and the responsibilities tied to the partnership. When considering a Tennessee Assignment of Partnership Interest, it is essential to understand how this transfer impacts both the partnership's operations and its existing partners.

In a contract, assignment refers to the transfer of rights or obligations from one party to another. This means that one party, the assignor, hands over their rights or responsibilities under the contract to another party, the assignee. Understanding this concept is crucial when dealing with Tennessee Assignment of Partnership Interest, as it allows partners to rearrange their interests within a partnership situation while abiding by legal standards.

Yes, assigning a partnership interest is possible, but it often requires the consent of the remaining partners unless the partnership agreement states otherwise. This process allows for new partners to join and can impact the dynamics of the existing partnership. When considering a Tennessee Assignment of Partnership Interest, understanding the assignment terms in your agreement is crucial.