Tennessee Account Stated for Construction Work

Description

How to fill out Account Stated For Construction Work?

Finding the correct legal template can be a challenge. Of course, there are numerous templates accessible online, but how can you obtain the legal document you require? Utilize the US Legal Forms website. The platform offers a multitude of templates, including the Tennessee Account Stated for Construction Work, that can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to locate the Tennessee Account Stated for Construction Work. Use your account to search for the legal forms you have previously purchased. Visit the My documents section of your account and download an additional copy of the document you require.

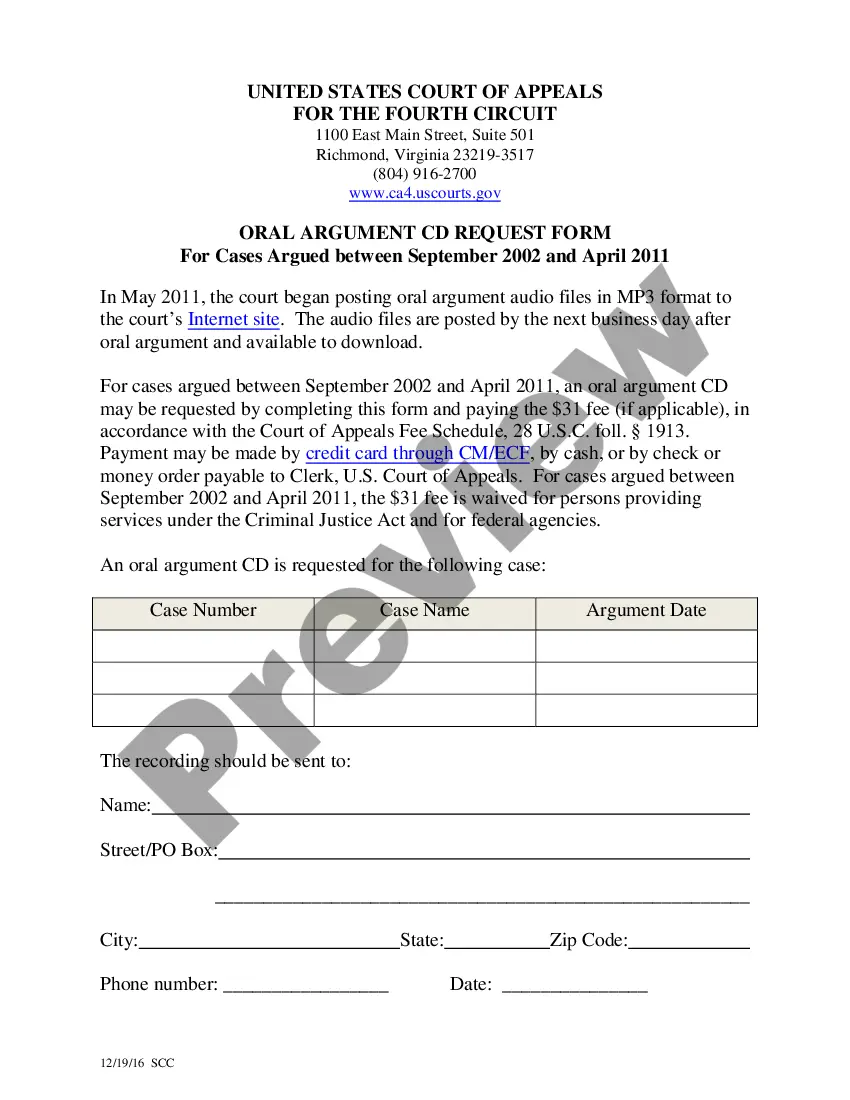

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, ensure that you have chosen the correct form for your specific city/state. You can review the form using the Preview option and read the form description to confirm this is suitable for you. If the form does not fulfill your needs, utilize the Search field to find the appropriate form. Once you are certain that the form is correct, select the Buy now button to acquire the form. Choose the pricing plan you prefer and enter the necessary details. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal template to your device. Complete, modify, print, and sign the downloaded Tennessee Account Stated for Construction Work.

US Legal Forms is the largest collection of legal templates that you will find various document themes. Utilize the service to obtain properly crafted paperwork that adhere to state requirements.

- Finding the correct legal template can be a challenge.

- The platform offers a multitude of templates.

- All of the forms are reviewed by professionals.

- If you are already registered, Log In to your account.

- Visit the My documents section of your account.

- Ensure that you have chosen the correct form.

Form popularity

FAQ

(a) All construction contracts on any project in this state, both public and private, may provide for the withholding of retainage; provided, however, that the retainage amount may not exceed five percent (5%) of the amount of the contract.

In Tennessee, construction defect cases are subject to a statute of repose of four years. Generally speaking, except in cases of fraudulent concealment, a construction defect claim is barred, regardless of when the defect is discovered, if not brought within four years of substantial completion of the improvement.

Under the Tennessee Trust Fund Statute, any contractor or subcontractor who, with intent to defraud, uses monies paid to it for any purpose other than to pay for labor, materials, services, equipment, machinery or for related overhead or profit, while any subcontractor remains unpaid, has violated the Statute (subject ...

In Tennessee, construction defect cases are subject to a statute of repose of four years. Generally speaking, except in cases of fraudulent concealment, a construction defect claim is barred, regardless of when the defect is discovered, if not brought within four years of substantial completion of the improvement.

Under the Tennessee Trust Fund Statute, any contractor or subcontractor who, with intent to defraud, uses monies paid to it for any purpose other than to pay for labor, materials, services, equipment, machinery or for related overhead or profit, while any subcontractor remains unpaid, has violated the Statute (subject ...

? The person/entity installing or repairing the real property is subject to sales or use tax on the purchase of property being installed and any materials used in the installation or repair.

Before beginning work on any project, the Truth in Construction and Consumer Protection Act previously required a contractor to deliver a written notice to the owner it was about to begin improvements and there would be a lien on the property to secure payment.