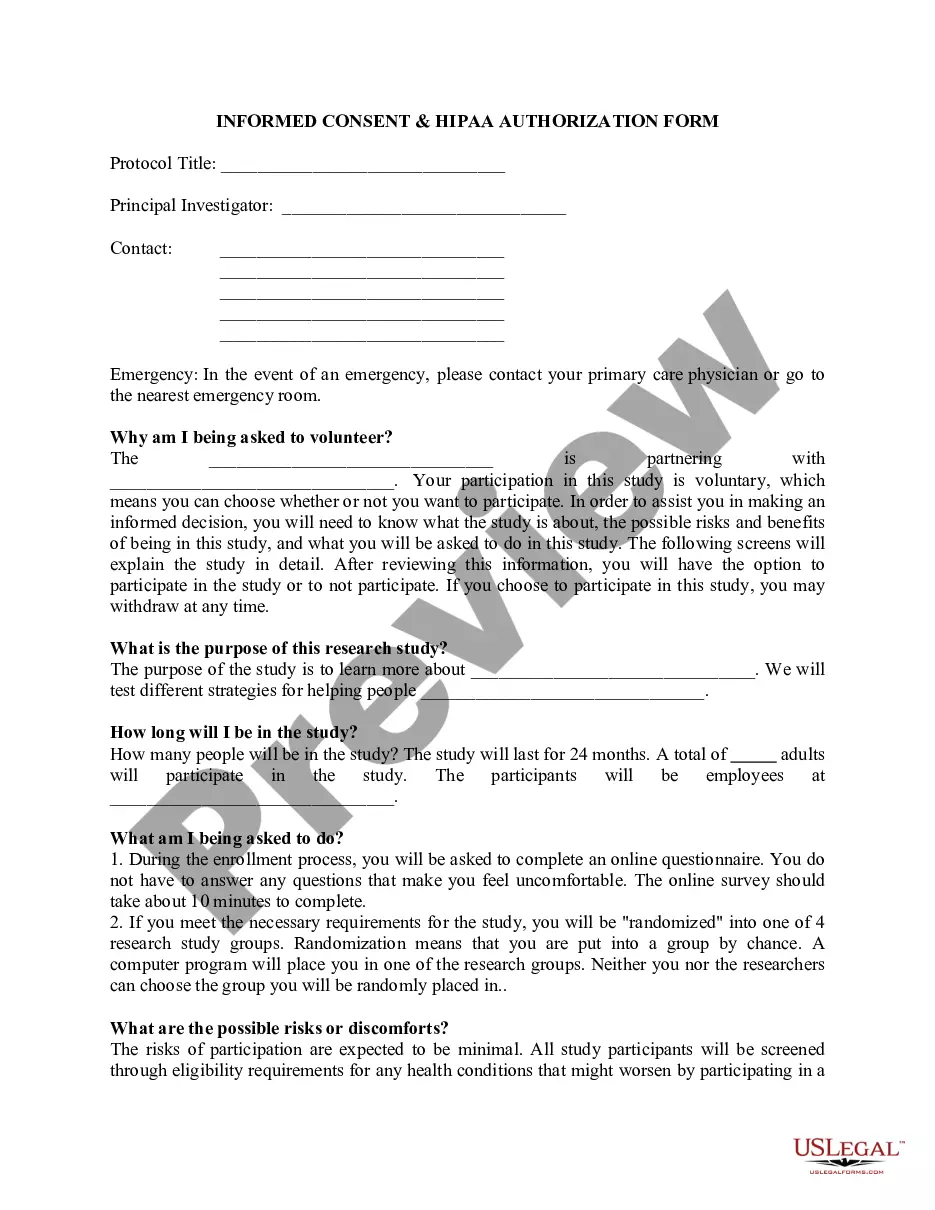

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

Tennessee Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

Finding the right legitimate record design might be a battle. Obviously, there are plenty of layouts accessible on the Internet, but how would you discover the legitimate kind you want? Make use of the US Legal Forms website. The services gives a huge number of layouts, for example the Tennessee Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency, which can be used for enterprise and private demands. All of the types are examined by pros and fulfill state and federal specifications.

Should you be presently registered, log in in your profile and click on the Down load button to get the Tennessee Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency. Make use of profile to look from the legitimate types you may have bought previously. Go to the My Forms tab of your profile and get an additional duplicate from the record you want.

Should you be a fresh end user of US Legal Forms, listed here are simple directions so that you can adhere to:

- First, make certain you have selected the proper kind for your area/county. You may look over the form using the Preview button and browse the form information to guarantee this is basically the right one for you.

- When the kind is not going to fulfill your needs, use the Seach field to discover the appropriate kind.

- When you are certain that the form is proper, go through the Acquire now button to get the kind.

- Choose the prices strategy you need and enter the essential details. Build your profile and pay money for an order utilizing your PayPal profile or charge card.

- Choose the document formatting and acquire the legitimate record design in your gadget.

- Full, change and printing and sign the obtained Tennessee Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

US Legal Forms may be the most significant catalogue of legitimate types where you will find various record layouts. Make use of the service to acquire skillfully-manufactured paperwork that adhere to state specifications.

Form popularity

FAQ

Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

Section 1681a of the Fair Credit Reporting Act defines an ?investigative consumer report? as ?a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or ...

Sections 623(a)(1)(A) and (a)(1)(C). If at any time a person who regularly and in the ordinary course of business furnishes information to one or more CRAs determines that the information provided is not complete or accurate, the furnisher must promptly provide complete and accurate information to the CRA.

The Fair Credit Reporting Act or (FCRA) is a federal law and requires creditors, also known as furnishers, and the crediting reporting agencies to do several things regarding the accuracy of the credit reports. In Tennessee, you have the right to sue them for damages and get your day in court.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

If you receive an Adverse Action Notice, it doesn't necessarily mean you also receive a hard credit inquiry. The notice may simply mean that the lender was unable to provide a personalized offer to you. The notice itself is not reflected on your credit report and doesn't impact your credit score.

Section 623(a)(5): Duty of furnishers to provide date of delinquency on charge-off, collection or similar accounts | Federal Trade Commission.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.