Tennessee General Form of Warehouse Storage Agreement

Description

How to fill out General Form Of Warehouse Storage Agreement?

Have you ever been in a situation where you need documents for either business or specific purposes almost constantly.

There are many legal document templates available online, but finding forms you can trust isn’t straightforward.

US Legal Forms offers thousands of form templates, including the Tennessee General Form of Warehouse Storage Agreement, that can be tailored to meet state and federal requirements.

If you find the right form, click on Get now.

Choose the pricing plan you wish, fill in the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee General Form of Warehouse Storage Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

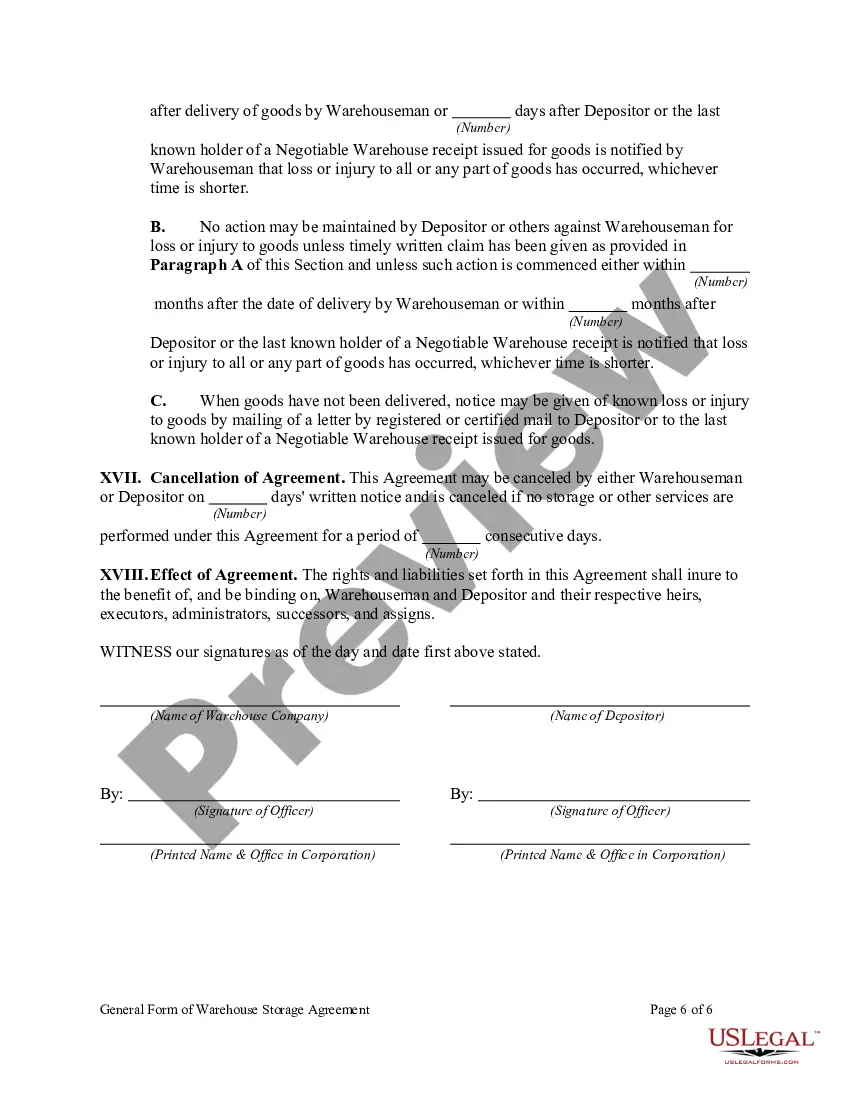

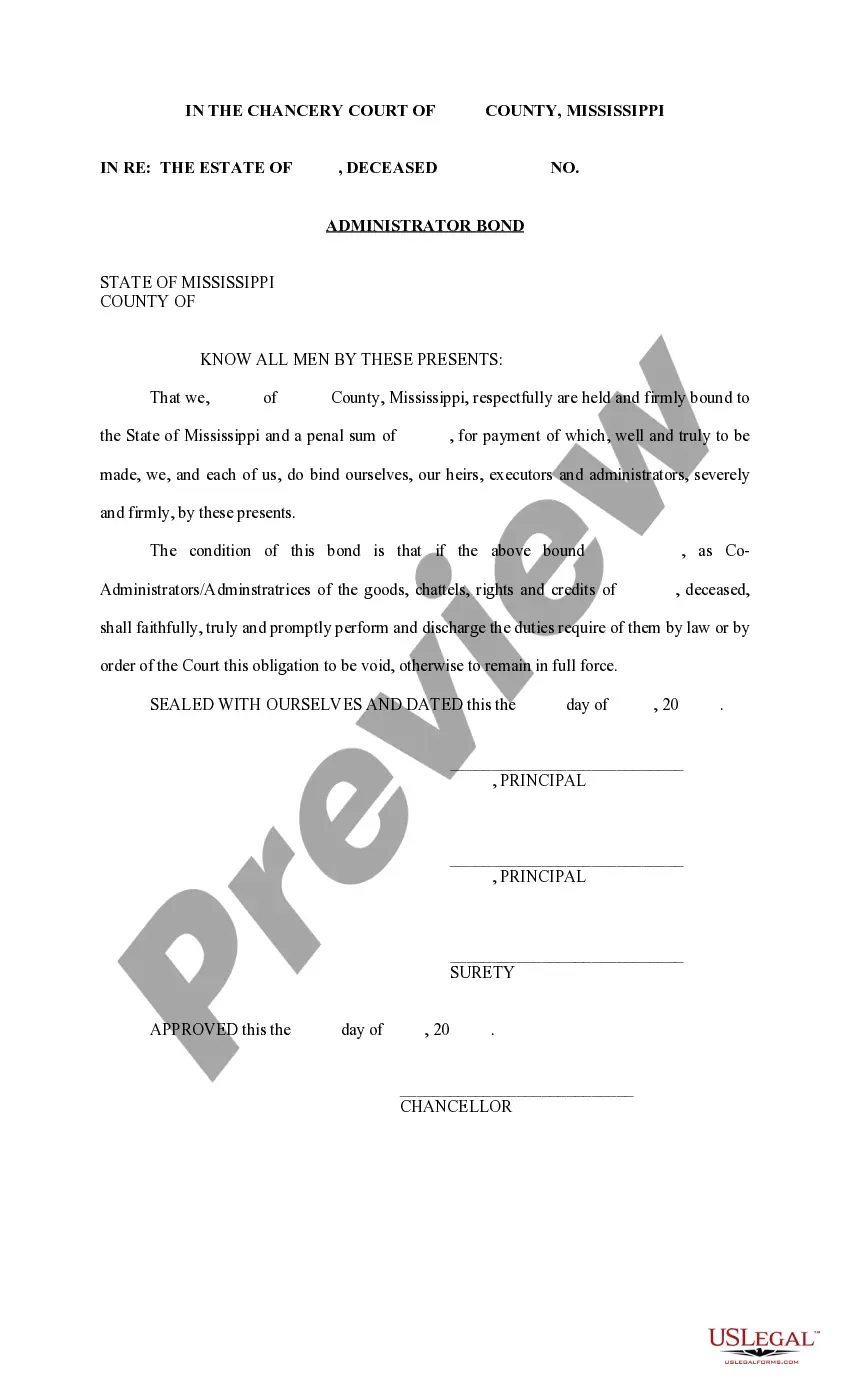

- Use the Preview button to review the form.

- Check the description to confirm you’ve selected the correct form.

- When the form isn’t what you are looking for, utilize the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

The 9.75% tax in Tennessee refers to the state’s combined sales tax rate, which consists of the state, local, and other applicable taxes. This rate can affect various transactions, including those related to warehouse storage. When engaging in contracts like the Tennessee General Form of Warehouse Storage Agreement, businesses should factor in this tax to maintain compliance and avoid unexpected costs.

In Tennessee, some items are exempt from sales tax, including certain food products, prescribed medications, and specific agricultural equipment. Understanding these exemptions can help businesses save on operational costs. When drafting agreements such as the Tennessee General Form of Warehouse Storage Agreement, it's wise to include provisions that take these exemptions into account.

To form an LLC in Tennessee, you need to file your Articles of Organization with the Secretary of State. After your filing is approved, you can create an operating agreement to outline the management of your LLC, which can incorporate strategies for agreements like the Tennessee General Form of Warehouse Storage Agreement, ensuring a solid foundation for your business.

Storage services in Tennessee may be taxable depending on the nature of the services provided. If you're renting space for tangible goods, then charges for storage could incur sales tax. By utilizing a Tennessee General Form of Warehouse Storage Agreement, you can explicitly outline your storage terms while being mindful of any applicable tax regulations.

In Tennessee, sales tax applies to the sale of tangible personal property and certain services. This includes physical goods and some digital products unless exempted. It's important to consider these taxable items when drafting agreements like the Tennessee General Form of Warehouse Storage Agreement to clearly define any tax obligations related to goods stored.

In Tennessee, inventory is typically not subject to sales tax. However, businesses should be aware that certain conditions may apply, especially if the business has storage agreements that affect the status of the goods. When utilizing a Tennessee General Form of Warehouse Storage Agreement, firms should consult with a tax professional to ensure compliance with local regulations.

To form an S corporation in Tennessee, you first need to establish a standard corporation by filing founding documents with the Secretary of State. After that, you can elect S corporation status by submitting Form 2553 to the IRS. Incorporating properly ensures that your business can create effective agreements, like the Tennessee General Form of Warehouse Storage Agreement, that are advantageous in protecting your assets.

TN bus 428 refers to a specific section in Tennessee law that pertains to warehouse storage agreements. It sets forth the regulations and framework that govern these types of contracts. By understanding TN bus 428, businesses can effectively draft their Tennessee General Form of Warehouse Storage Agreement to ensure compliance and protect their interests.