Tennessee Lease of Machinery for use in Manufacturing

Description

How to fill out Lease Of Machinery For Use In Manufacturing?

If you require to aggregate, obtain, or generate legal document templates, utilize US Legal Forms, the largest compilation of legal documents available online.

Employ the site’s straightforward and user-friendly search to locate the paperwork you require.

Various templates for business and personal objectives are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded within your account. Visit the My documents section and select a form to print or download again.

Stay competitive and download, and print the Tennessee Lease of Machinery for use in Manufacturing with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to acquire the Tennessee Lease of Machinery for use in Manufacturing within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Tennessee Lease of Machinery for use in Manufacturing.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

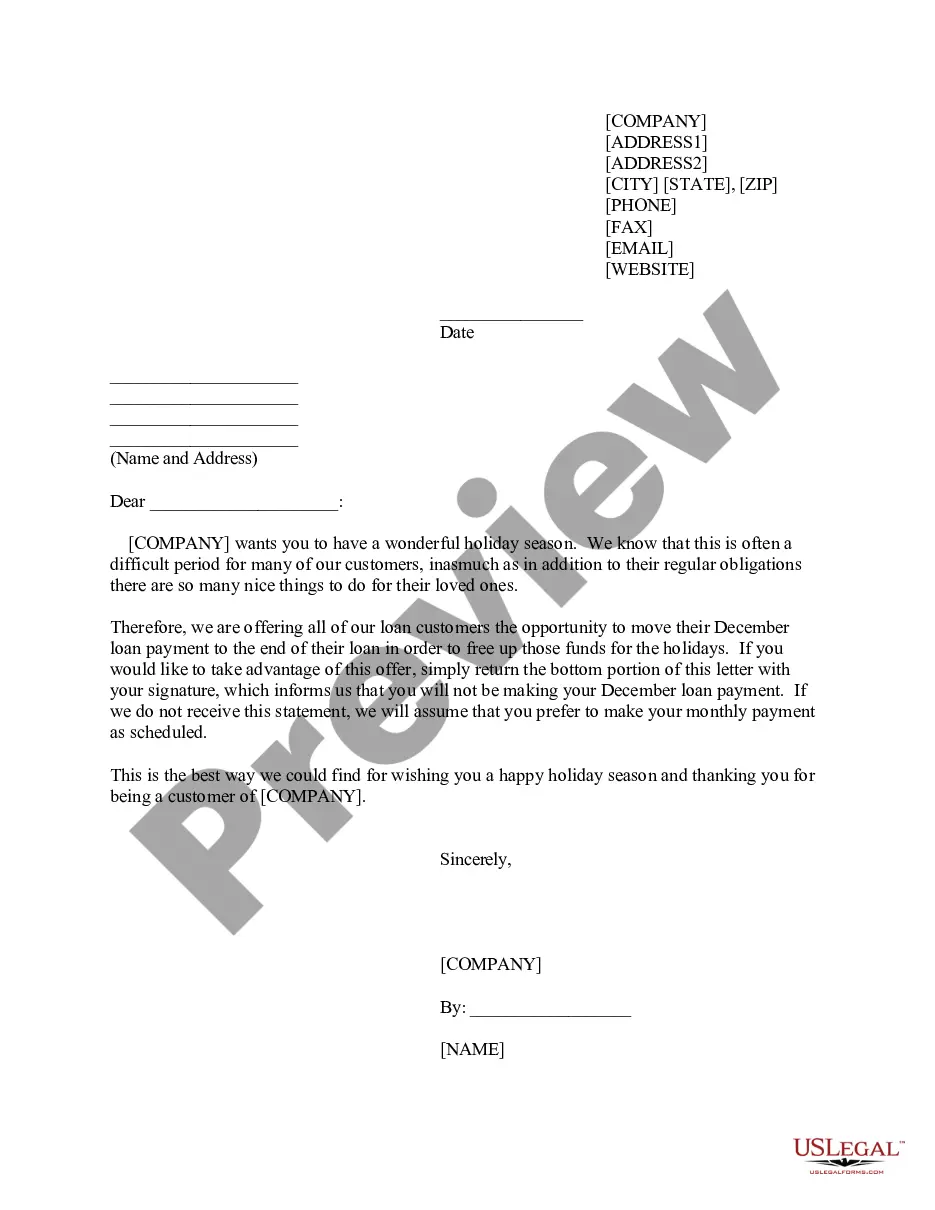

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, take advantage of the Search field at the top of the screen to find other forms from the legal document template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the financial transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify and print or sign the Tennessee Lease of Machinery for use in Manufacturing.

Form popularity

FAQ

The ag tag in Tennessee is a special license plate designed for farmers and agricultural producers. It signifies that the vehicle is associated with agricultural activities, which can include those involved in the Tennessee Lease of Machinery for use in Manufacturing. Obtaining an ag tag can provide tax benefits and help promote agricultural interests across the state, making it a valuable asset for producers.

Recently, Tennessee expanded its agricultural sales tax exemption to include more types of equipment and supplies necessary for farming and manufacturing. This change enhances the financial relief for producers engaging in the Tennessee Lease of Machinery for use in Manufacturing. It is advisable to stay updated on the specific criteria and benefits that apply to your equipment purchases.

In Tennessee, certain transactions related to agriculture and manufacturing may qualify as tax-exempt, including sales of specific equipment used in these sectors. If your machinery supports the manufacturing process, it may be eligible for tax exemption under the Tennessee Lease of Machinery for use in Manufacturing. It's essential to review the current regulations to ensure compliance, and uslegalforms can provide relevant insights.

In Tennessee, you typically need a minimum of 10 acres to be classified as a farm. This designation can influence various regulations, tax incentives, and exemptions related to agriculture. Understanding the requirements for the Tennessee Lease of Machinery for use in Manufacturing can help you align with farming qualifications. For more detailed guidelines, consider consulting with uslegalforms.

To file the TN form FAE 170, you should submit it to the Tennessee Department of Revenue. This form is associated with the Tennessee Lease of Machinery for use in Manufacturing, and filing it correctly ensures compliance with state regulations. You can file this form online through the department's website or send a paper copy to the appropriate address. For assistance with the filing process, consider using platforms like uslegalforms, which offer guidance and resources for efficient completion.

Industrial machinery includes equipment used in manufacturing, production, or extraction processes. If you plan on engaging in a Tennessee Lease of Machinery for use in Manufacturing, knowing which types of machinery qualify under this definition is crucial. Proper categorization can secure you valuable tax credits and aid your operational efficiency.

The agricultural exemption in Tennessee allows certain agricultural businesses to avoid sales and use tax on purchases directly related to farming operations. This exemption can be applicable if your operation involves a Tennessee Lease of Machinery for use in Manufacturing in related agricultural activities. It’s beneficial to determine whether your business qualifies for this exemption to optimize your tax strategy.

The Tennessee machinery tax credit provides businesses with a sales and use tax exemption on specific machinery and equipment used in manufacturing and production. If you are considering a Tennessee Lease of Machinery for use in Manufacturing, this tax credit can significantly reduce your financial burden. Understanding the eligibility requirements is essential to leverage this valuable incentive effectively.

Tennessee offers a Research and Development (R&D) tax credit that incentivizes businesses to invest in innovation and technological advances. By incorporating a Tennessee Lease of Machinery for use in Manufacturing, companies can explore R&D projects that enhance their production capabilities. This credit can further support manufacturing firms in achieving their growth objectives while minimizing tax liabilities.

Yes, manufacturers may qualify for exemptions from the Tennessee business tax under certain conditions. Engaging in a Tennessee Lease of Machinery for use in Manufacturing can help businesses take advantage of these exemptions, resulting in significant savings. Companies should consult with a tax advisor to ensure compliance and proper understanding of these potential benefits.