Tennessee Subscription Agreement

Description

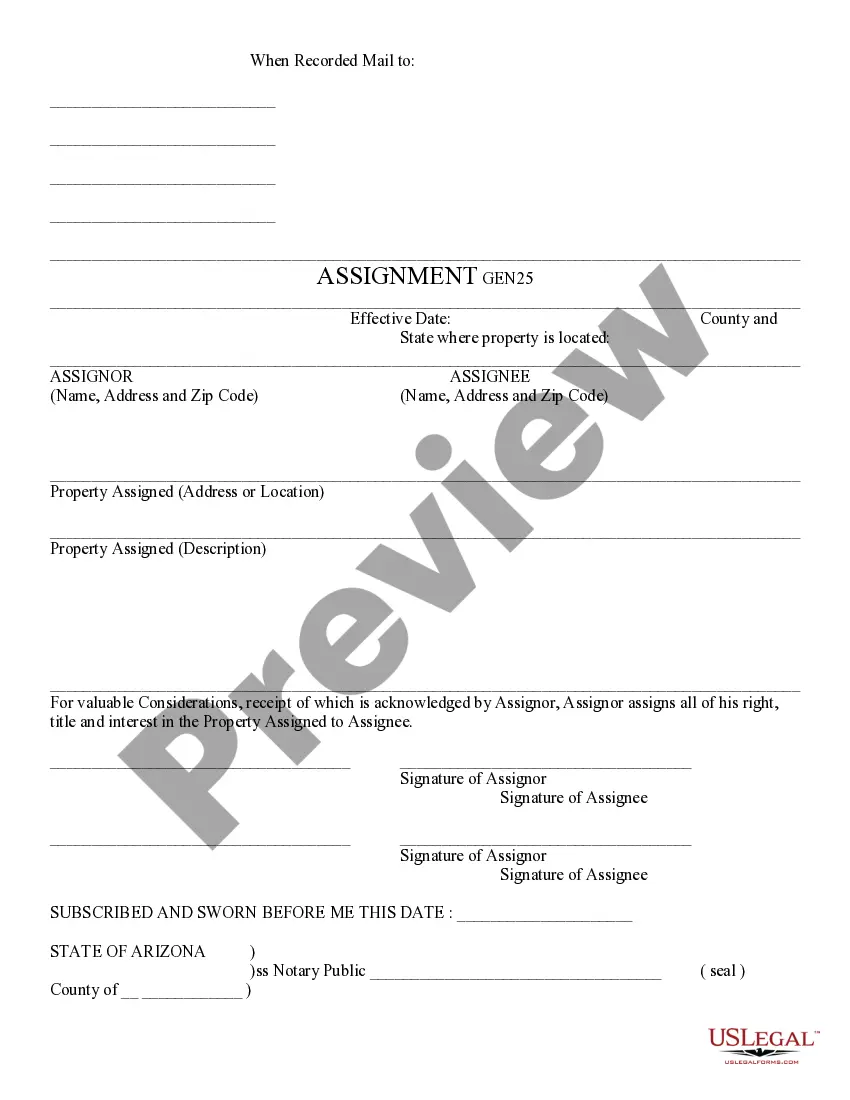

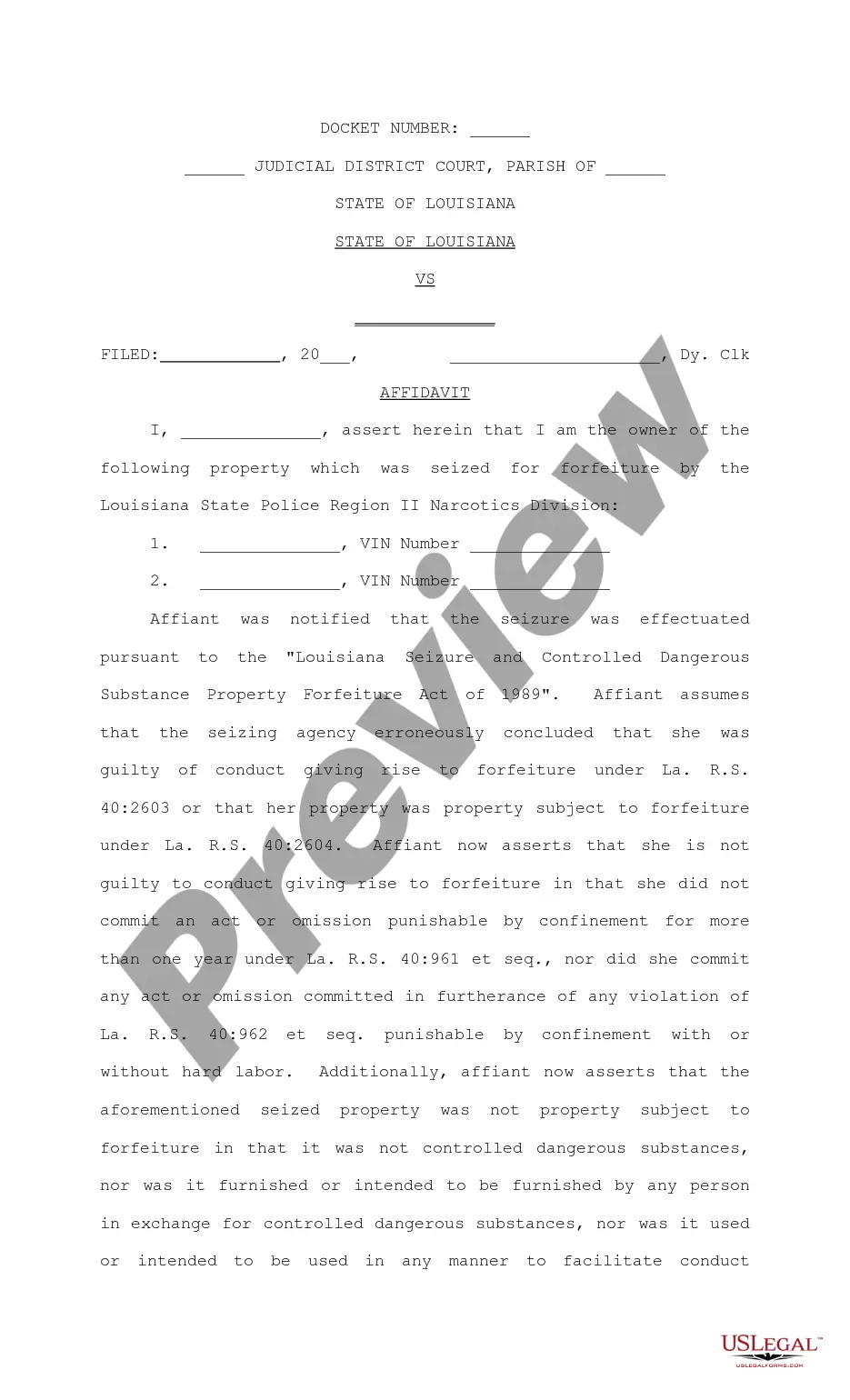

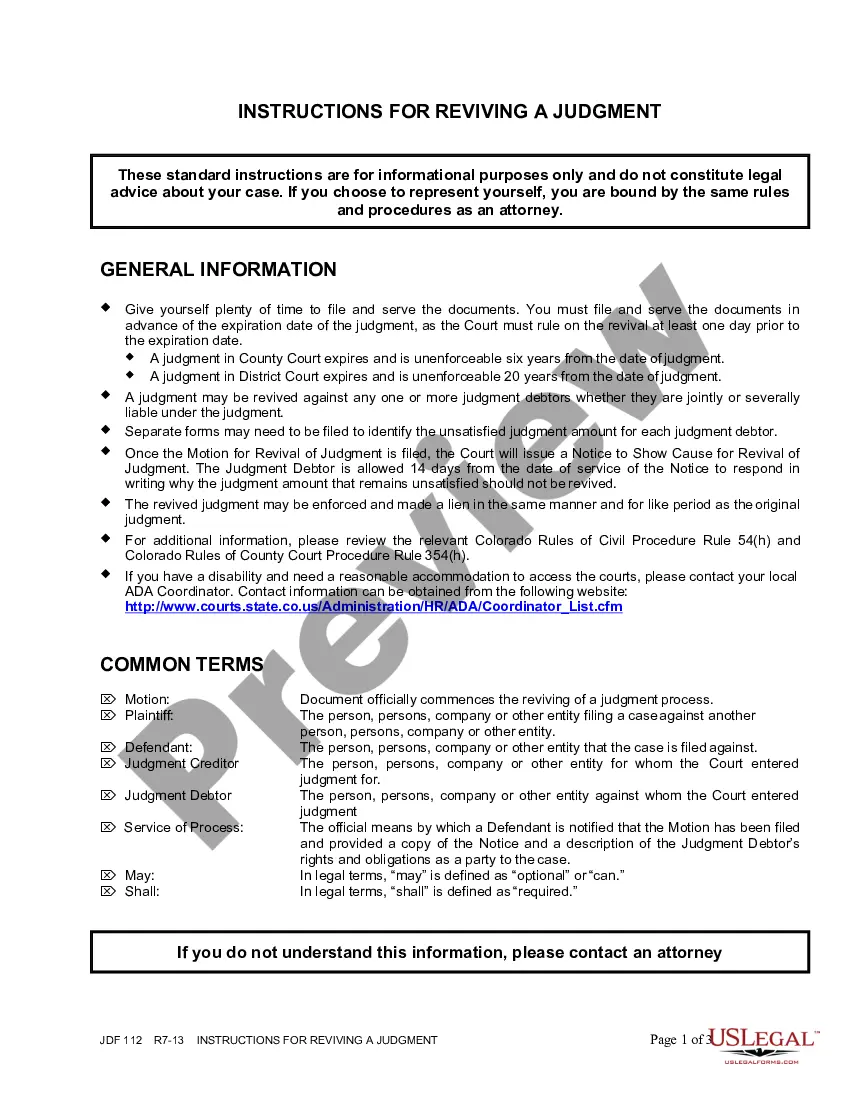

How to fill out Subscription Agreement?

If you need to gather, procure, or generate legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the site's simple and user-friendly search feature to locate the documents you require.

An array of templates for business and personal purposes are organized by category and state, or by keywords.

Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Acquire and print the Tennessee Subscription Agreement with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Employ US Legal Forms to acquire the Tennessee Subscription Agreement with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click the Acquire option to access the Tennessee Subscription Agreement.

- You can also retrieve forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s details. Be sure to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you find the form you need, select the Get now option. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Tennessee Subscription Agreement.

Form popularity

FAQ

Yes, LLCs in Tennessee must file an annual report with the Secretary of State. This report helps keep your business in good standing and ensures that your registered information is up to date. Incorporating a Tennessee Subscription Agreement can aid in keeping your records organized and compliant.

While not all states require an LLC operating agreement, several states highly recommend or suggest having one, including California and New York. An operating agreement serves as a vital framework for your LLC's operations. For a clear understanding of your rights, consider a Tennessee Subscription Agreement regardless of your state.

An operating agreement is not a requirement for LLCs in Tennessee, but having one is beneficial. It helps delineate the management structure and may prevent disputes among members. Implementing a Tennessee Subscription Agreement can enhance the effectiveness of your operating agreement.

Yes, you can technically operate an LLC in Tennessee without an operating agreement. However, this approach leaves you vulnerable to misunderstandings and conflicts. Creating a Tennessee Subscription Agreement can prevent these issues by ensuring that all members are on the same page regarding roles and expectations.

Tennessee does not legally mandate an LLC operating agreement, but it is strongly recommended. This document clarifies the rights and responsibilities of members, offering protection and structure. When establishing your LLC, consider including a Tennessee Subscription Agreement to enhance your operational clarity.

Yes, partnerships must file with the Secretary of State in Tennessee if they choose to register as a limited partnership. While general partnerships do not require registration, having a formal agreement, like a Tennessee Subscription Agreement, can help define the relationship and protect the interests of all partners.

To form an LLC in Tennessee, you must choose a unique name, appoint a registered agent, and file a charter with the Secretary of State. Additionally, you should create a Tennessee Subscription Agreement outlining the management and ownership structure. This agreement is crucial for clarifying roles among members.

To file articles of amendment in Tennessee, you must prepare your articles detailing the changes. You can either access the online filing system through the Secretary of State's website or send the documents via mail. Be sure to include the Tennessee Subscription Agreement when filing to ensure compliance with state regulations.

A subscription agreement typically pertains to the purchasing of shares or interests in a business, detailing the financial commitments of the subscriber. In contrast, a partnership agreement outlines how two or more parties will operate a business together, including profit-sharing and decision-making processes. Understanding the nuances between a Tennessee Subscription Agreement and a partnership agreement can enhance your business dealings and investment strategies.

A subscription agreement is primarily concerned with an investment in a company, such as acquiring shares or units in a fund. On the other hand, a shareholder agreement outlines the rights, responsibilities, and governance of the shareholders once they hold those shares. If you’re entering into a Tennessee Subscription Agreement, it’s crucial to understand how it complements your shareholder obligations.