Tennessee Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

Are you currently in a situation that requires you to have documents for either business or personal matters frequently.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the Tennessee Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, which can be completed to comply with federal and state regulations.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Tennessee Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift at any time if needed. Just click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Tennessee Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/area.

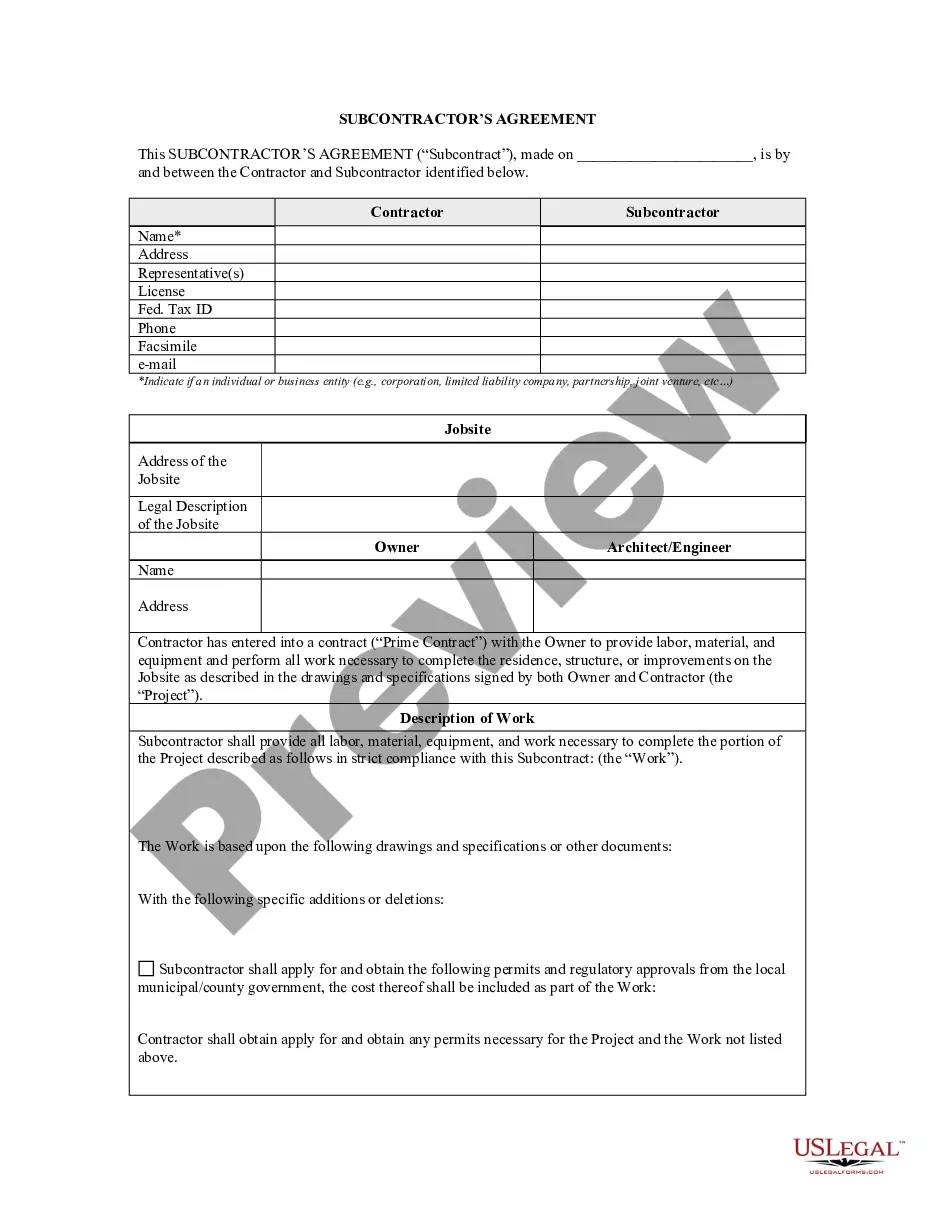

- Use the Preview button to view the form.

- Check the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Search area to find the form that meets your needs and requirements.

- Once you locate the correct form, click Purchase now.

Form popularity

FAQ

To help you tackle pledge reminder letters, keep in mind these key takeaways: Remember what differentiates pledge reminders from solicitation letters. Avoid sounding too impersonal or templated. Get straight to the point. Always be grateful ? stewardship, stewardship, stewardship! Make it easy for donors to make a payment.

Sample Donor Acknowledgement Letter for Non-Cash Donation On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

Express gratitude. Though you haven't yet received funds from the supporter, it's important that you thank the constituent for their pledge. Provide details of the pledge. Include the pledge amount and pledge date, as well as the dates and amounts of expected payments.

Pledge gift: Send a thank you letter to individuals or organizations who make a pledge ? a promise to donate a certain amount over a certain number of years. Don't forget to send a separate thank you note after each of the installments comes in.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Since pledges are commitments to give, and not gifts of actual funds, the initial correspondence should contain information thanking the donor, information about the pledge, and other appropriate information. You should also include payment instructions, such as your website address and how to mail in a payment.

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.