Tennessee Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

Are you presently in a position where you consistently require documents for either business or personal reasons? There are numerous legal document templates accessible online, but locating those you can rely on is challenging.

US Legal Forms offers a vast collection of form templates, such as the Tennessee Direct Deposit Form for IRS, which can be tailored to meet federal and state requirements.

If you're already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Tennessee Direct Deposit Form for IRS template.

Select a convenient file format and download your copy.

You can access all the document templates you have purchased in the My documents section. You can obtain another copy of the Tennessee Direct Deposit Form for IRS at any time, if needed. Simply select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

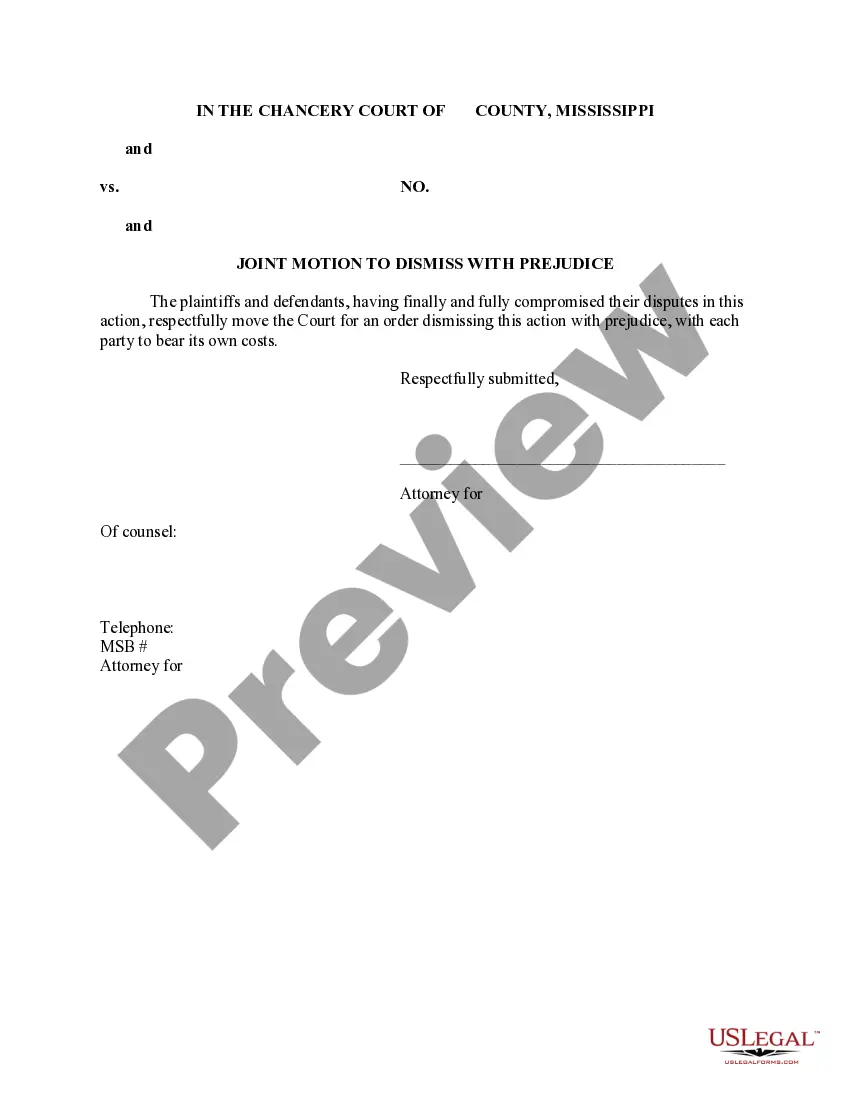

- Use the Preview feature to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form does not meet your needs, utilize the Search area to find the form that suits your requirements.

- Once you find the correct form, click Get now.

- Choose the payment plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

To update your direct deposit information with the IRS, you must complete a new Tennessee Direct Deposit Form for IRS when you file your next tax return. Make sure to provide your new bank account details clearly. If you need guidance, uSlegalforms can provide the tools and resources you need to complete the update efficiently.

IRS Form 945 is required for employers who have withheld federal income tax from nonpayroll payments. This includes payments such as pensions and annuities. If you are in this situation, ensure that you complete the necessary documentation accurately, including the Tennessee Direct Deposit Form for IRS if applicable. uSlegalforms can assist you in understanding your filing obligations.

Yes, Direct File is available in Tennessee, allowing taxpayers to file their returns electronically. Utilizing this option helps expedite the process and can make it easier to set up your Tennessee Direct Deposit Form for IRS. You can file your taxes online and choose direct deposit to receive your refunds quickly. For more information, visit uSlegalforms for user-friendly resources.

Yes, you can update your direct deposit information with the IRS. You will need to submit a new Tennessee Direct Deposit Form for IRS when you file your next tax return. Ensure that you provide the updated bank details to avoid any delays in receiving your refund. If you have questions about the process, uSlegalforms is here to help.

To set up direct deposit with the IRS, fill out the Tennessee Direct Deposit Form for IRS during your tax filing process. You will need to provide your bank information, including your account number and routing number. This ensures your tax refund goes directly into your account. If you need assistance, consider using uSlegalforms for a straightforward experience.

Generally, you can expect to receive your direct deposit from the IRS within 21 days after your return has been accepted. Factors such as the complexity of your return or any errors can affect this timeline. By using the Tennessee Direct Deposit Form for IRS, you can help streamline the process. For quicker access to your funds, ensure all information is accurate.

To set up direct deposit with the IRS, you need to complete the Tennessee Direct Deposit Form for IRS. You can do this when you file your tax return, either electronically or on paper. Make sure to provide accurate bank account details to ensure your refund is deposited correctly. If you are unsure about the process, uSlegalforms can guide you through it.

Not everyone will receive $3,000 from the IRS; this amount pertains to specific tax relief measures that may apply to certain individuals. Eligibility often depends on your income, family size, and other factors. To stay updated on IRS payments, check the IRS website for the latest information. If you are eligible and want to ensure you receive your payment quickly, consider using the Tennessee Direct Deposit Form for IRS to set up direct deposit.

To set up direct deposit for your refund check, fill out the Tennessee Direct Deposit Form for IRS with your bank account information. You can do this when you file your tax return, or you can submit the form separately if you have already filed. It is essential to ensure that your bank details are correct to avoid any delays. Using direct deposit is a secure and efficient way to receive your refunds promptly.

Setting up direct deposit on the IRS can be done easily by completing the Tennessee Direct Deposit Form for IRS. You can submit this form electronically through the IRS website or by mailing a paper copy. Ensure you provide accurate bank details to facilitate smooth transactions. Once your form is processed, the IRS will deposit your refunds directly into your specified bank account.