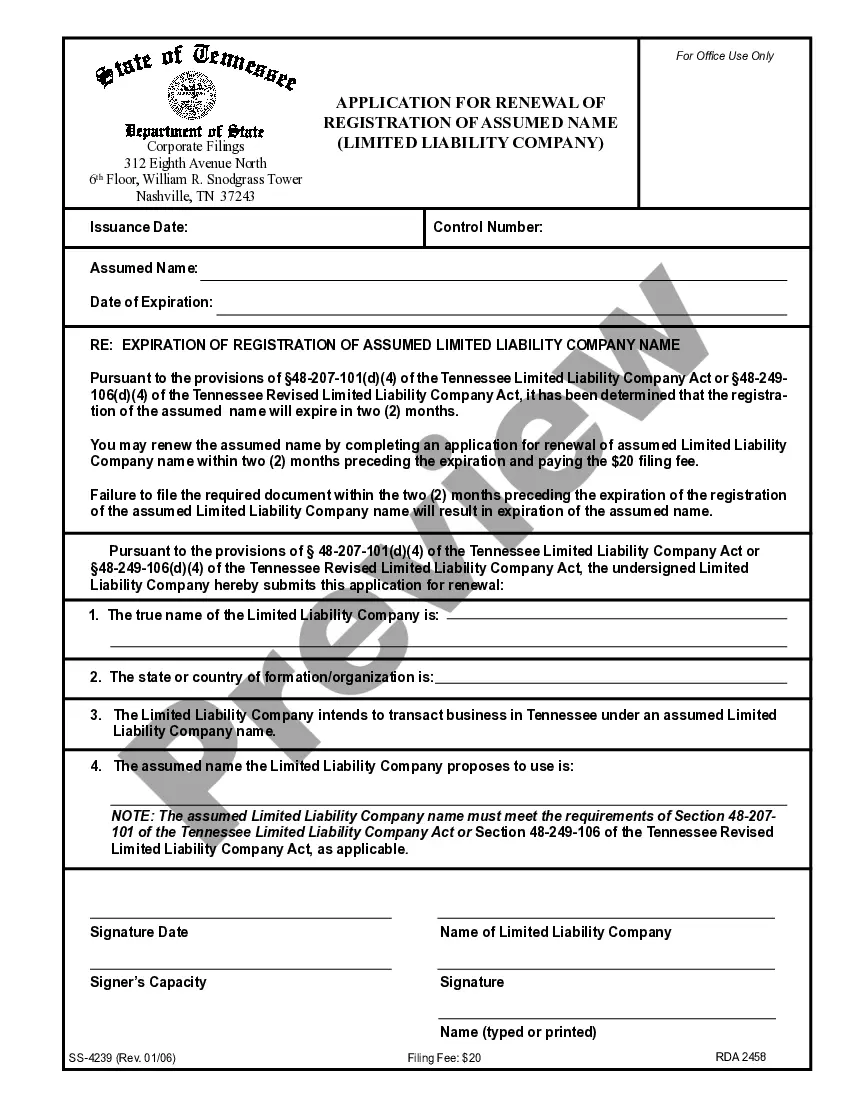

Tennessee Application for Renewal of Registration of Assumed Name

Description

How to fill out Tennessee Application For Renewal Of Registration Of Assumed Name?

How much time and resources do you often spend on drafting formal documentation? There’s a better opportunity to get such forms than hiring legal experts or spending hours browsing the web for an appropriate template. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Tennessee Application for Renewal of Registration of Assumed Name.

To obtain and complete a suitable Tennessee Application for Renewal of Registration of Assumed Name template, follow these easy steps:

- Examine the form content to make sure it meets your state regulations. To do so, check the form description or take advantage of the Preview option.

- If your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Tennessee Application for Renewal of Registration of Assumed Name. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally reliable for that.

- Download your Tennessee Application for Renewal of Registration of Assumed Name on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

(4) The right to use an assumed name shall be effective for five (5) years from the date of filing by the secretary of state. An LLC may reserve or use no more than five (5) assumed names during the same period.

Businesses who have minimal activity business licenses may receive contact from their local county clerk or city recorder's office regarding renewing their annual license. It is the responsibility of the business owner to properly renew their minimal activity business license each year.

An assumed business name, or DBA, is how businesses operate using a name that is the business' legal name in Tennessee. The only difference between a DBA name and an assumed business name is that a DBA is only an alias. A DBA must be associated with a separate legal entity.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

To renew a standard business license, you must file and pay business tax to the Tennessee Department of Revenue using their electronic filing system called . Once the tax is filed and paid, the Business Tax Office in City Hall is notified and will send you a copy of your new license.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

File your Tennessee amendment. You can file your Articles of Amendment by delivering them to the Business Services Division of the Tennessee Secretary of State. You can also file your Articles of Amendment online, using the Secretary of State's online portal. But you don't have to handle this process on your own.

The correct fee is not paid. The annual report fee for a corporation is $20, and an additional $20 is required if any change is made concerning the registered agent/registered office. The annual report fee for LLCs is $300 minimum up to a maximum of $3000.