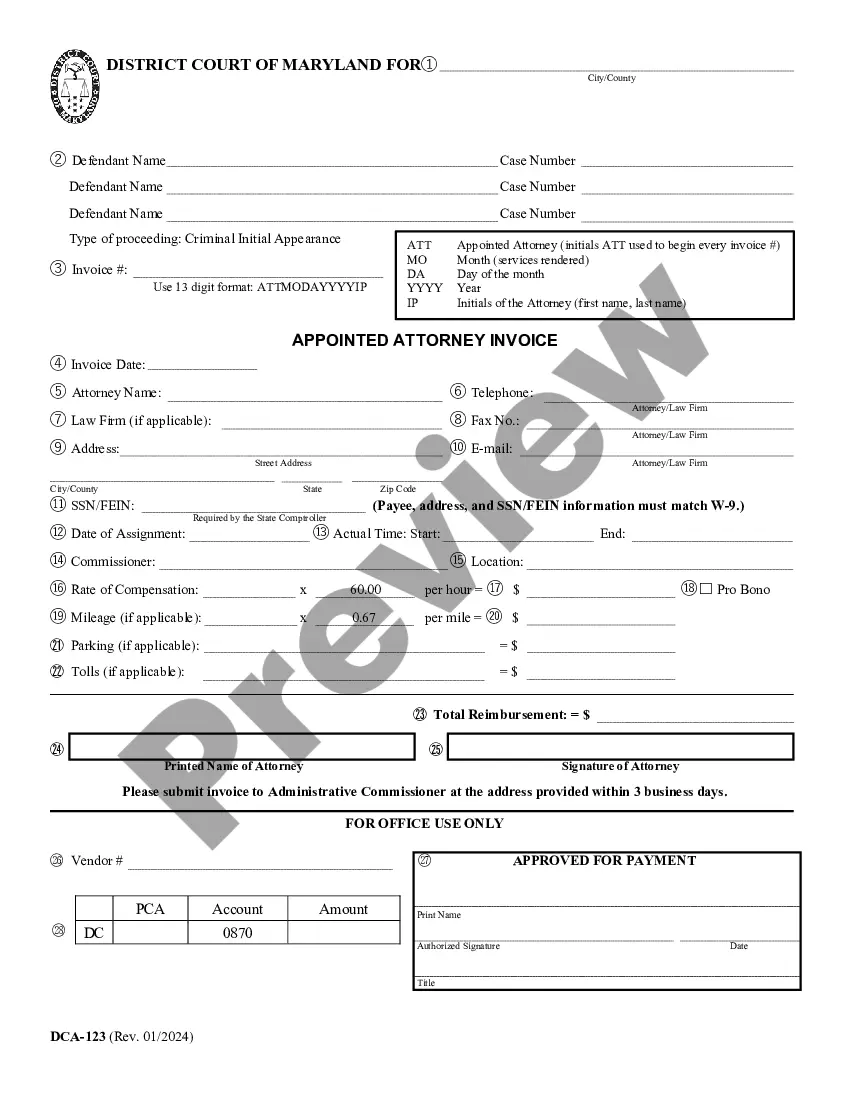

The Maryland Appointed Attorney Invoice (For use on or before 01/04/2017) is an official form that must be completed and submitted to the Maryland Office of the Public Defender in order to receive payment for services provided on behalf of the state. The invoice is used to submit the amount of attorney fees requested for services provided to an accused or convicted person who has been appointed an attorney by the state. There are two types of Maryland Appointed Attorney Invoice (For use on or before 01/04/2017): the Flat Fee Invoice and the Hourly Invoice. The Flat Fee Invoice is used when the attorney charges a flat fee for the services provided and the Hourly Invoice is used when the attorney charges an hourly rate. Both invoices must include the attorney’s name, address, license number, contact information, the client’s name, case number, and the amount requested. The invoice must also include an itemized list of services provided and the date the services were provided. Once the invoice is completed and submitted, the Public Defender will review the invoice and the accompanying documentation and make a decision on whether to approve payment.

Maryland Appointed Attorney Invoice (For use on or before 01/04/2017)

Description

How to fill out Maryland Appointed Attorney Invoice (For Use On Or Before 01/04/2017)?

Drafting legal documents can be quite challenging if you lack accessible fillable templates. With the US Legal Forms online repository of official paperwork, you can trust the blanks you discover, as all of them adhere to federal and state regulations and have been verified by our experts.

Therefore, if you require the Maryland Appointed Attorney Invoice (For use on or before 01/04/2017), our platform is the ideal location to obtain it.

Here’s a quick overview for you: Document compliance verification. You should carefully examine the contents of the form you require to ensure that it meets your needs and adheres to your state regulations. Previewing your document and reviewing its overall description will assist you in doing just that. Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top of the page until you find a suitable blank, and click Buy Now once you identify the one you need. Account registration and form purchase. Sign up for an account with US Legal Forms. After confirming your account, Log In and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available). Template download and further usage. Choose the file format for your Maryland Appointed Attorney Invoice (For use on or before 01/04/2017) and click Download to store it on your device. Print it to manually finalize your paperwork, or utilize a multi-featured online editor to create an electronic copy more quickly and effectively. Have you not yet experienced US Legal Forms? Register for our service today to acquire any formal document swiftly and effortlessly whenever you require it, and maintain your paperwork organized!

- Acquiring your Maryland Appointed Attorney Invoice (For use on or before 01/04/2017) from our directory is incredibly straightforward.

- Previously registered participants with an active subscription only need to Log In and hit the Download button after locating the desired template.

- Subsequently, if desired, users can access the same document through the My documents section of their account.

- Nevertheless, even if you are unfamiliar with our service, registering with a valid subscription will only require a few minutes.

Form popularity

FAQ

A plaintiff must file a response to a motion to dismiss within 15 days after service of the motion (Md. Rule 2-311(b)). If a defendant serves the motion to dismiss on the plaintiff by mail, the plaintiff has 18 days after service to respond (Md. Rule 1-203(c)).

(b) Response. Except as otherwise provided in this section, a party against whom a motion is directed shall file any response within 15 days after being served with the motion, or within the time allowed for a party's original pleading pursuant to Rule 2-321(a), whichever is later.

Rule 2-519 - Motion for Judgment (a) Generally. A party may move for judgment on any or all of the issues in any action at the close of the evidence offered by an opposing party, and in a jury trial at the close of all the evidence.

The Notice of Intention to Defend includes space for you to explain why you should not be required to pay the money the plaintiff claims you owe. You should be prepared to defend this (and other reasons) in court during the trial. Make sure you bring your exhibits and evidence.

You can file a motion to revise or vacate (cancel) the judgment in writing within 30 days after the date of the judgment. This motion is usually filed to correct clerical errors, or to vacate a judgment if you believe that you were not served with the court papers or were not notified of the court date.

You can file a motion to revise or vacate (cancel) the judgment in writing within 30 days after the date of the judgment. This motion is usually filed to correct clerical errors, or to vacate a judgment if you believe that you were not served with the court papers or were not notified of the court date.