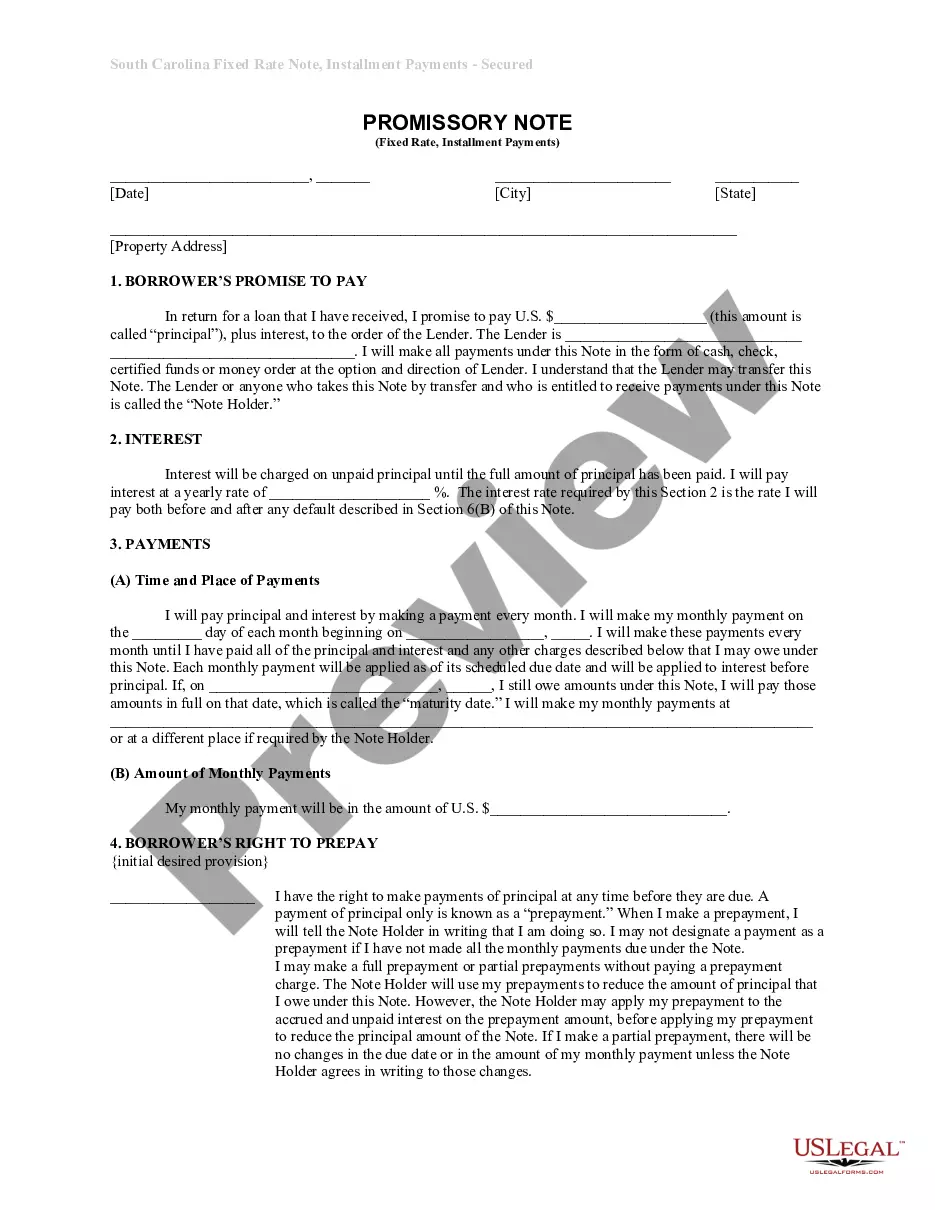

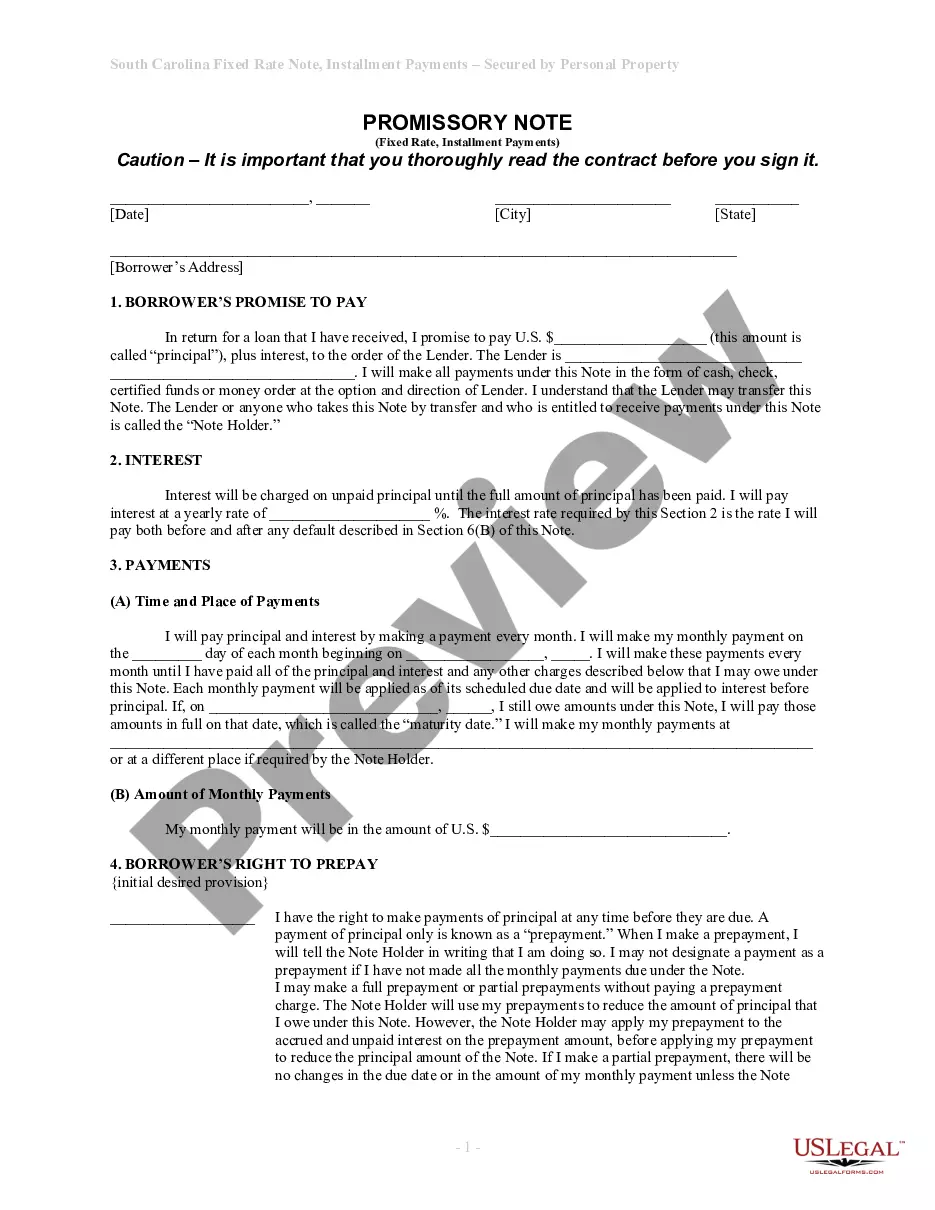

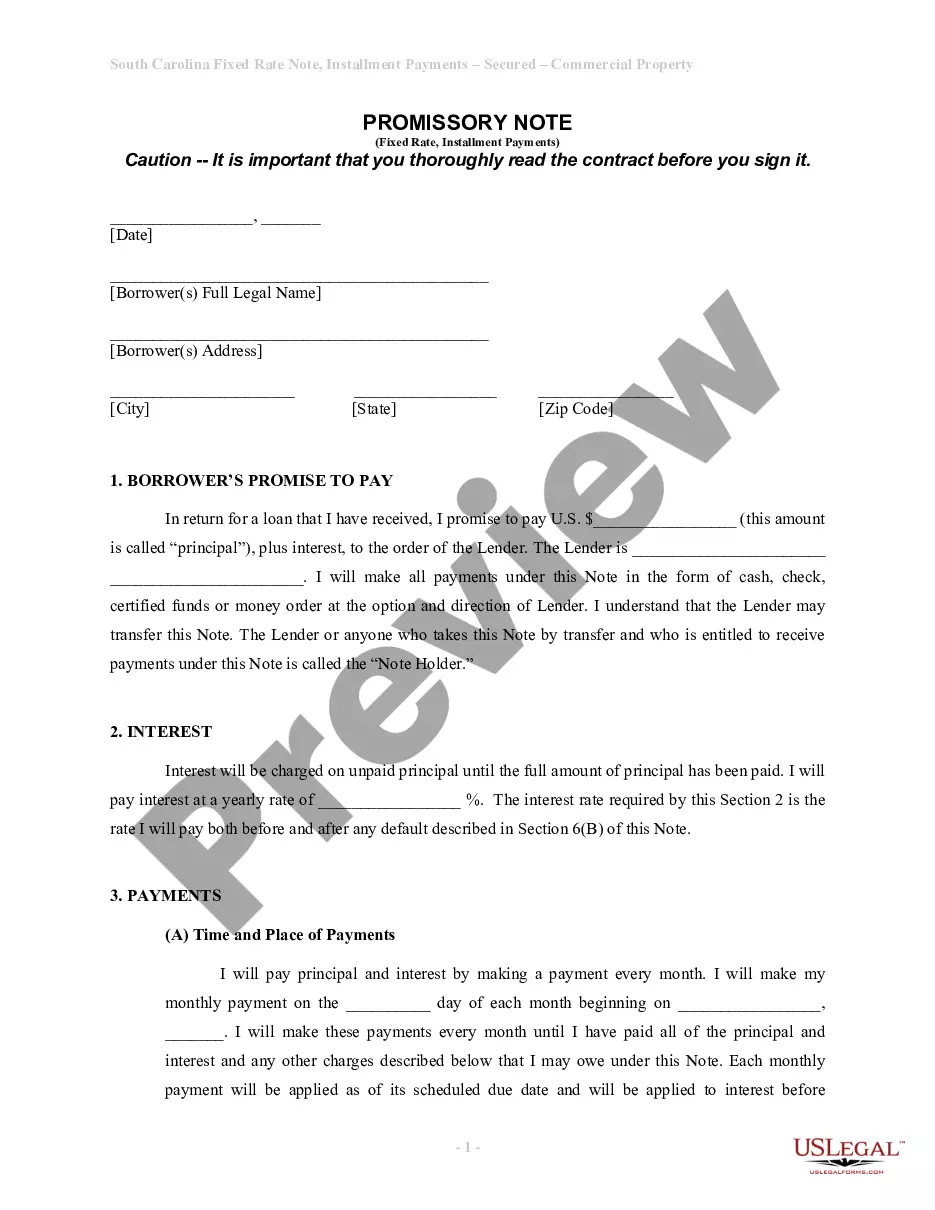

A Tennessee Surety Bond is a type of financial guarantee that provides assurance that a person or business will meet an obligation or fulfill a contract. It is a three-party agreement between a principal (the party requesting the bond), an obliged (the party requiring the bond), and a surety (the party providing the bond). The surety guarantees that the principal will fulfill the terms of the contract and pays any damages incurred if the principal fails to do so. Common types of Tennessee Surety Bonds include Contractor Licensing Bonds, Public Official Bonds, Motor Vehicle Dealer Bonds, and Freight Broker Bonds.

Tennessee Surety Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Surety Bond?

How much time and resources do you typically spend on drafting official paperwork? There’s a greater option to get such forms than hiring legal experts or wasting hours searching the web for an appropriate blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Tennessee Surety Bond.

To acquire and prepare an appropriate Tennessee Surety Bond blank, adhere to these easy steps:

- Look through the form content to make sure it complies with your state laws. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your needs, find another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Tennessee Surety Bond. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally reliable for that.

- Download your Tennessee Surety Bond on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you securely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

You can obtain a corporate surety through many insurance providers. If your insurance provider does not write corporate surety bonds, there are third-party companies available that can assist you with finding a company to write your corporate surety bond for you.

How Do Contractors Apply for a License in Tennessee? Step 1 ? Designate a Qualifying Agent.Step 2 ? Pass the Exams.Step 3 ? Prepare a Financial Statement.Step 4 ? Purchase a Surety Bond.Step 5 ? Obtain a Letter of Reference.Step 6 ? Purchase Insurance.Step 7 ? Register with the Secretary of State.

Tennessee contractor license bond costs start at $100 annually. Your exact cost will vary depending on the license type and bond amount required by your licensing authority. Contractors working in Tennessee must be licensed with the state and sometimes individual counties and cities.

How to Get a Surety Bond Find the bond requirements in your state for your specific business or industry. Confirm the bond coverage amount needed. Contact a surety company that's licensed to sell bonds in your state. Provide the business details and financial information needed for your quote. Receive your bond quote.

Cost Bond Definition When taking out these bonds, the plaintiff is essentially reassuring the court that they will pay for the costs of the litigation once the case is decided. Those costs can include court fees and expenses related to depositions, attorneys, paralegals and private investigations.

Tennessee certificate of title bond costs start at $100 for the state-required 3-year term. Exact costs vary depending on the surety bond amount required by the Department of Revenue. Bond amounts less than $10,000 cost $100. Bond amounts from $10,001 to $25,000 cost $10 for every $1,000 of coverage, starting at $100.

How much does a Tennessee notary bond cost? Tennessee notary bonds cost $50 for the state-required 4-year term and include $10,000 of errors and omissions insurance.