Tennessee Bond To Discharge Liens

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Bond To Discharge Liens?

Get access to top quality Tennessee Bond To Discharge Liens forms online with US Legal Forms. Prevent hours of lost time seeking the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get more than 85,000 state-specific authorized and tax forms you can save and fill out in clicks in the Forms library.

To find the example, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- See if the Tennessee Bond To Discharge Liens you’re considering is suitable for your state.

- View the sample using the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to continue on to register.

- Pay by credit card or PayPal to complete creating an account.

- Pick a favored file format to save the document (.pdf or .docx).

You can now open the Tennessee Bond To Discharge Liens sample and fill it out online or print it and get it done yourself. Think about giving the papers to your legal counsel to make certain everything is completed properly. If you make a error, print out and fill application again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

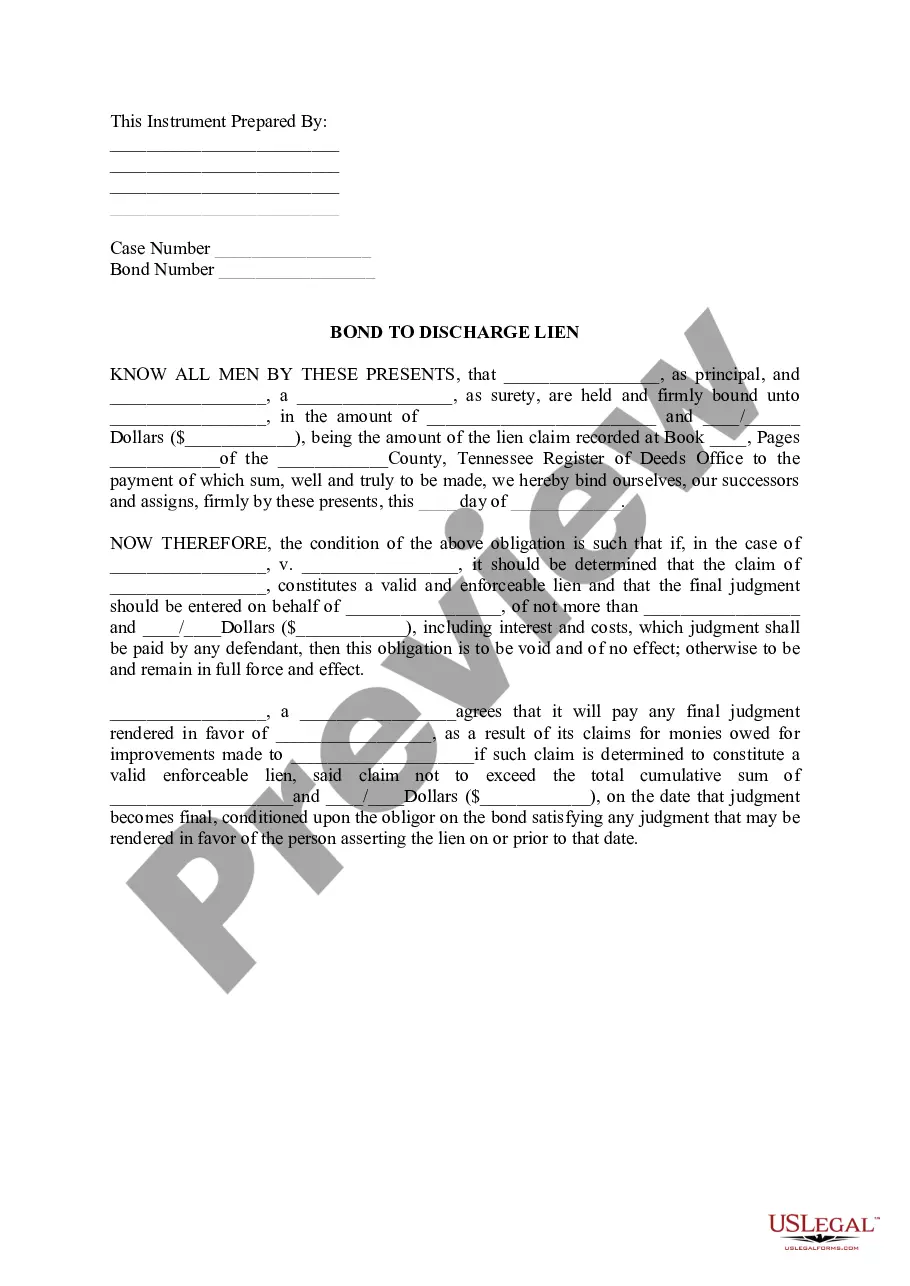

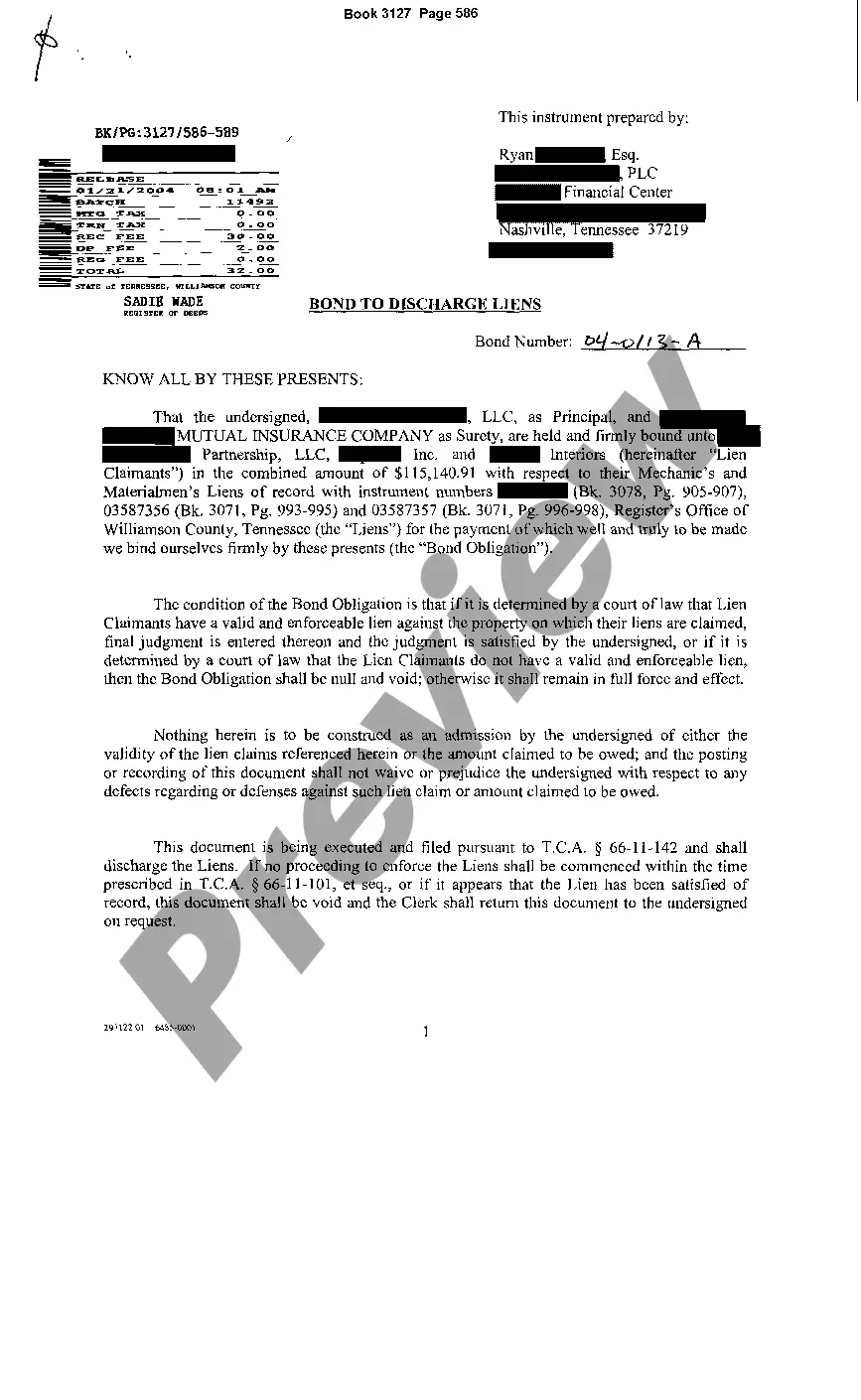

The process of bonding off a mechanics lien starts after a claimant has filed a mechanics lien. After the claim is made, a general contractor or a property owner can contact a surety bond company to purchase a surety bond that replaces the value of the lien that was filed against the property.

When the lien is bonded off, the surety company (or, in the case of a general contractor bonding off the lien itself, the general contractor) is guaranteeing payment of a claim if the claimant prevails in court enforcing the claim.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

A payment bond is like a wall of money that protects the property itself from lien claims. If a construction party isn't paid, they can make a claim against the bond.

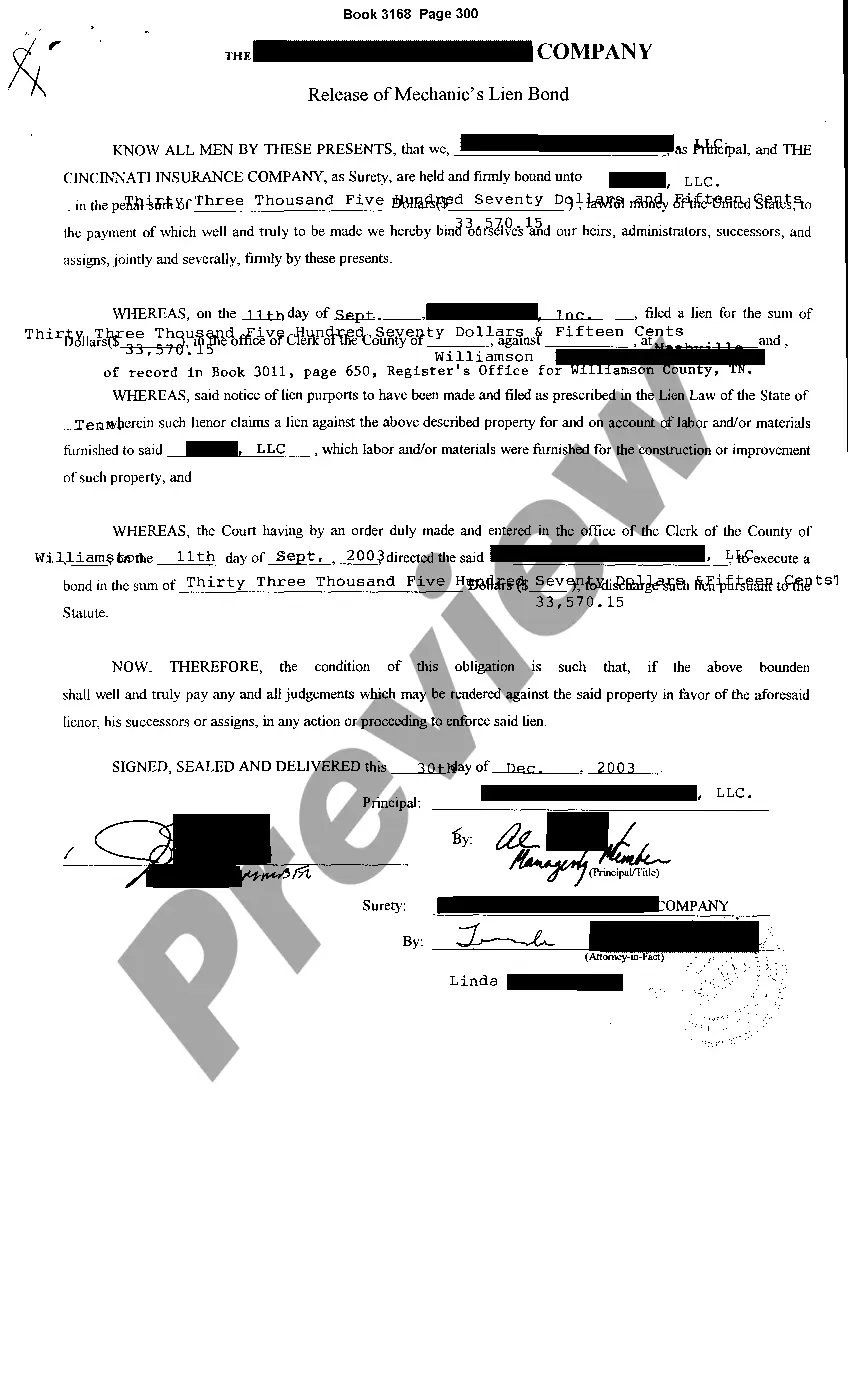

A Release of Mechanic's Lien Bond is a type of surety bond that clears the mechanic's lien from the property. These bonds can also be called a Discharge of Mechanic's Lien Bond.The Principal on the bond is usually the property owner or general contractor. The obligee is the court and the surety is the bond company.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

Maximize the Homestead Exemption. Protect the Home with Tenancy by the Entirety. Implement an Equity Stripping Plan. Create a Domestic Asset Protection Trust (DAPT) Put the Home Title in the Low-Risk Spouse's Name. Purchase Umbrella Insurance.

The most common way to reduce or even eliminate mechanic's lien risk is through the use of lien waivers. A lien waiver is a private agreement in which a party surrenders the right to file a lien in exchange for payment.

The release of lien bond allows the owner to discharge the mechanic's lien and returns the legal right to sell or deal with the property to the owner. The bond guarantees the contractor who placed the lien any payment that is still due to them with interest and cost should they win the case in a court of law.