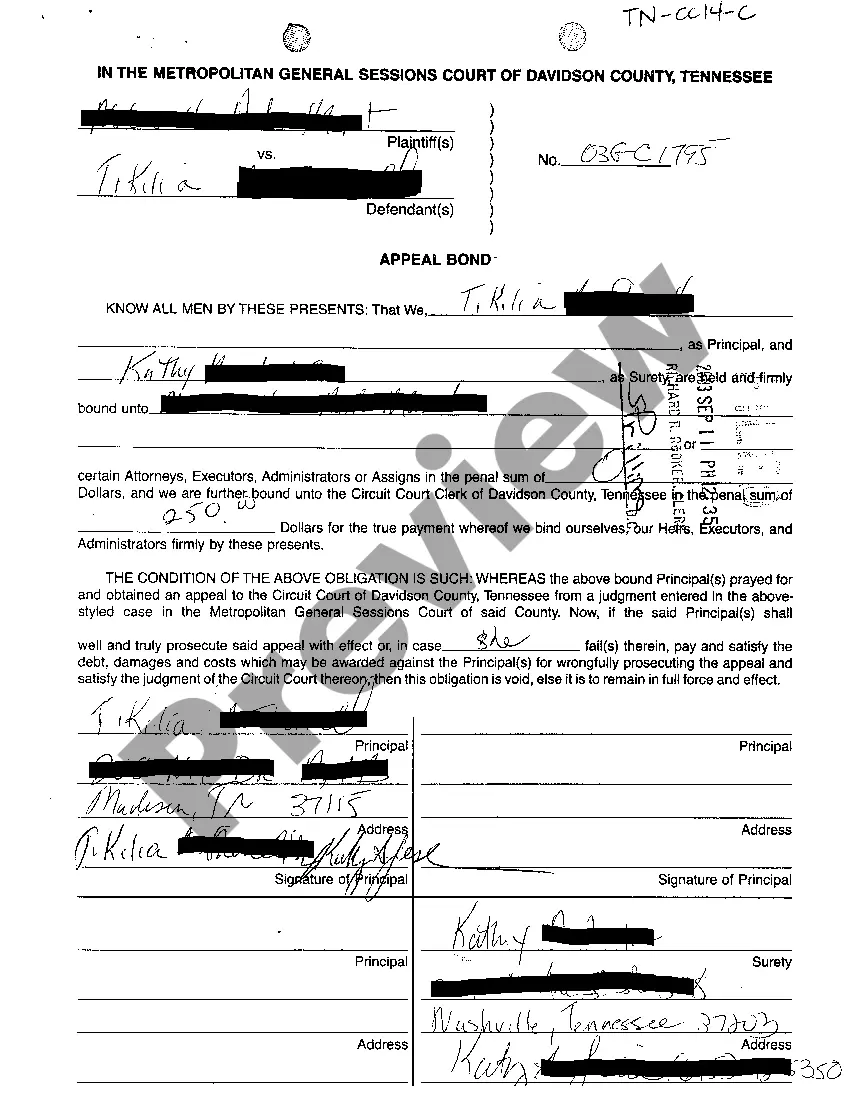

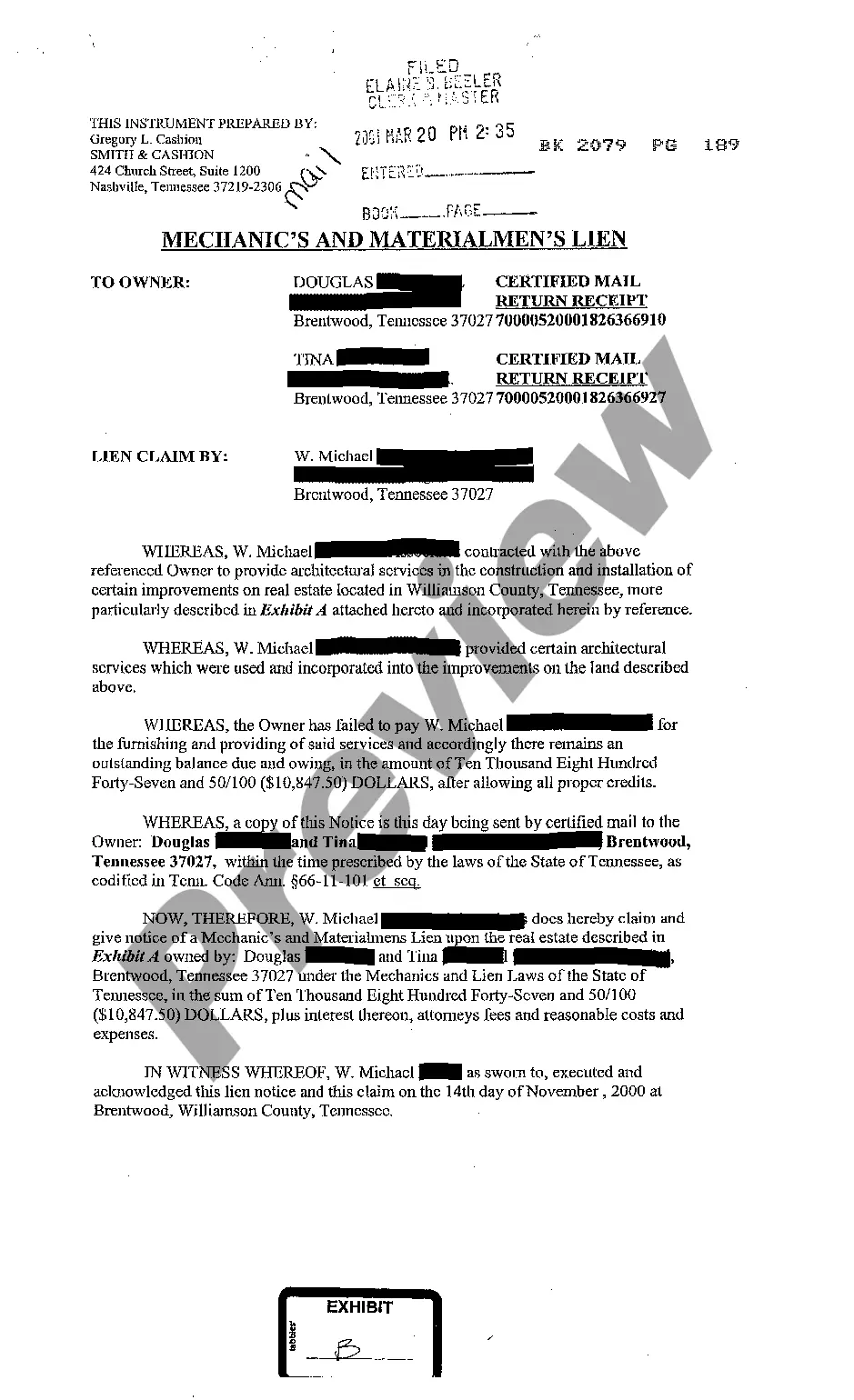

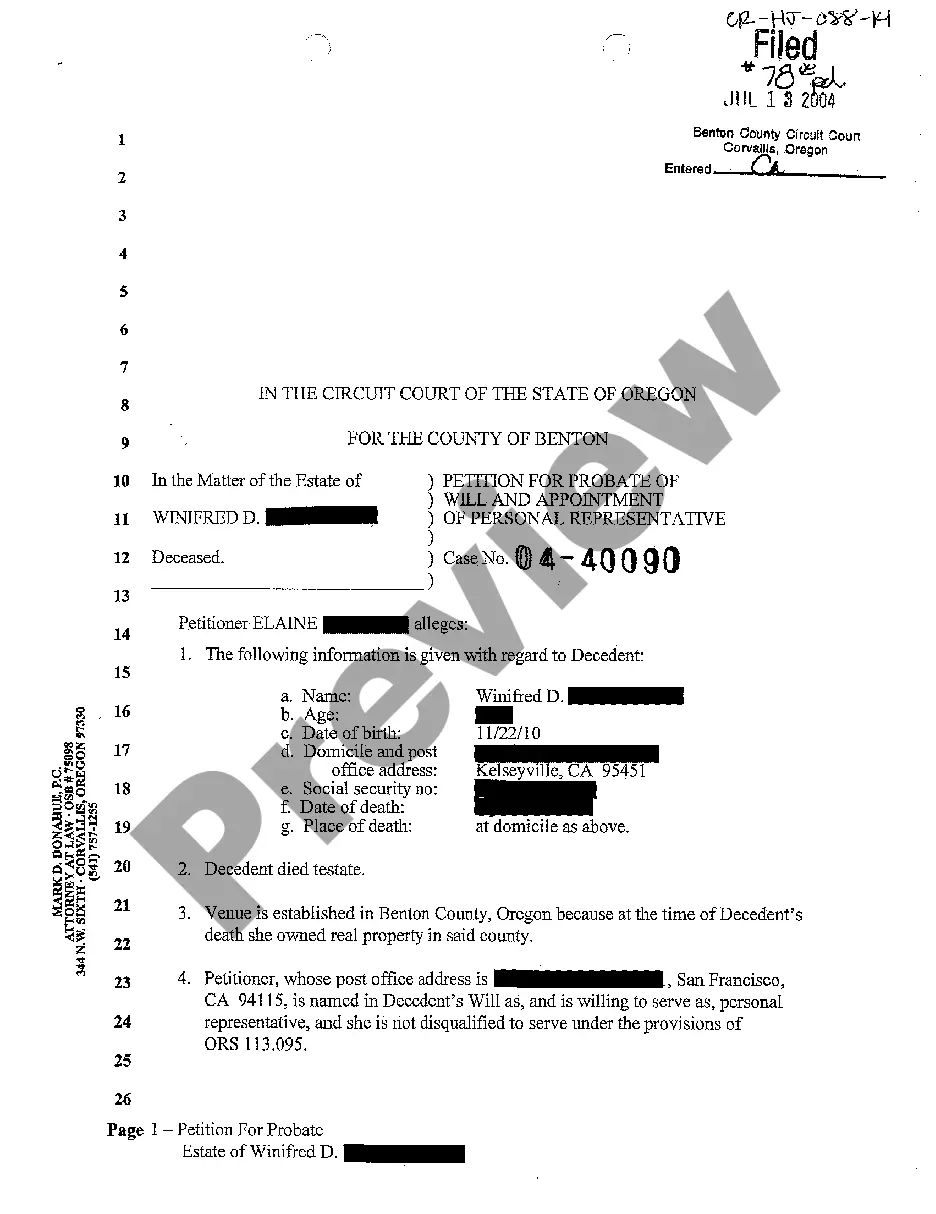

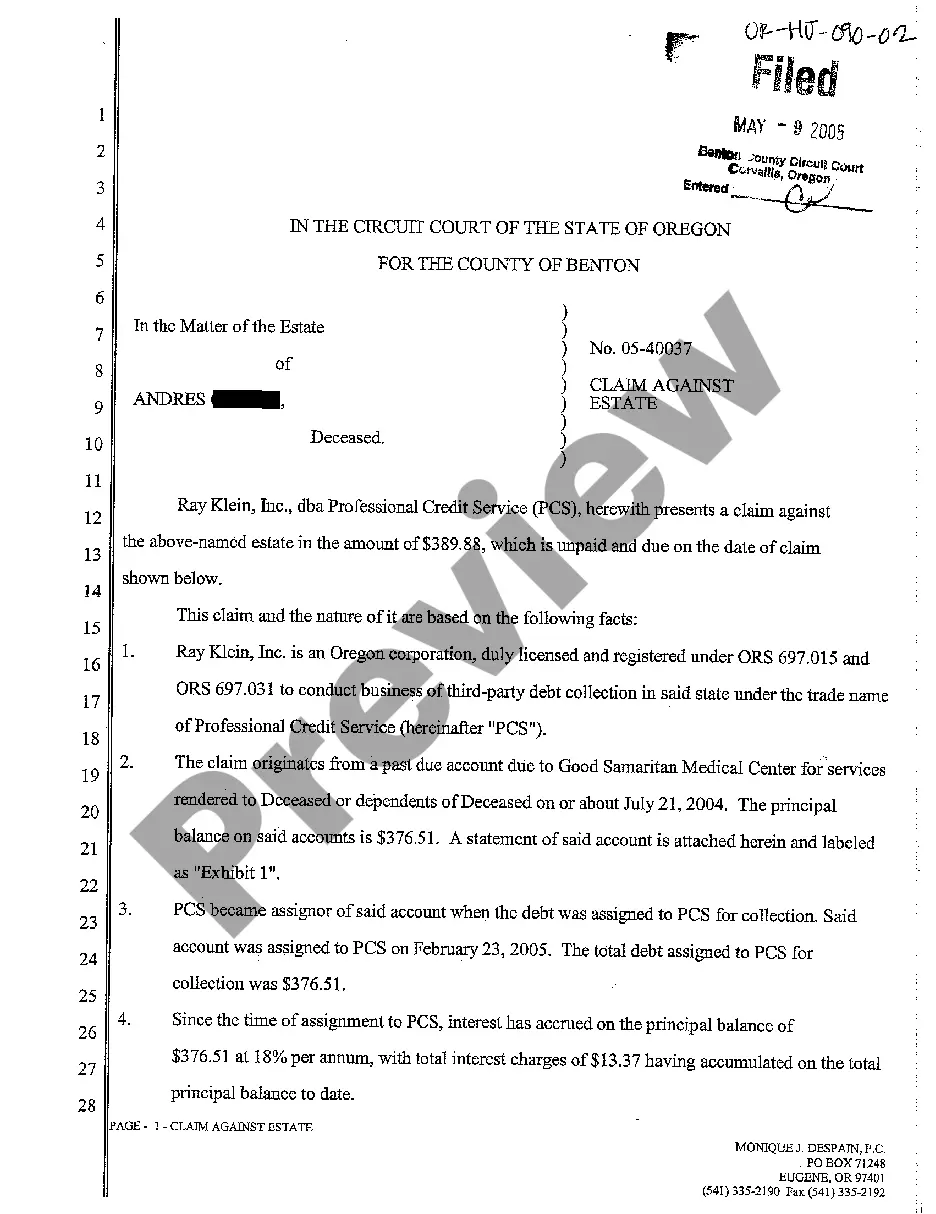

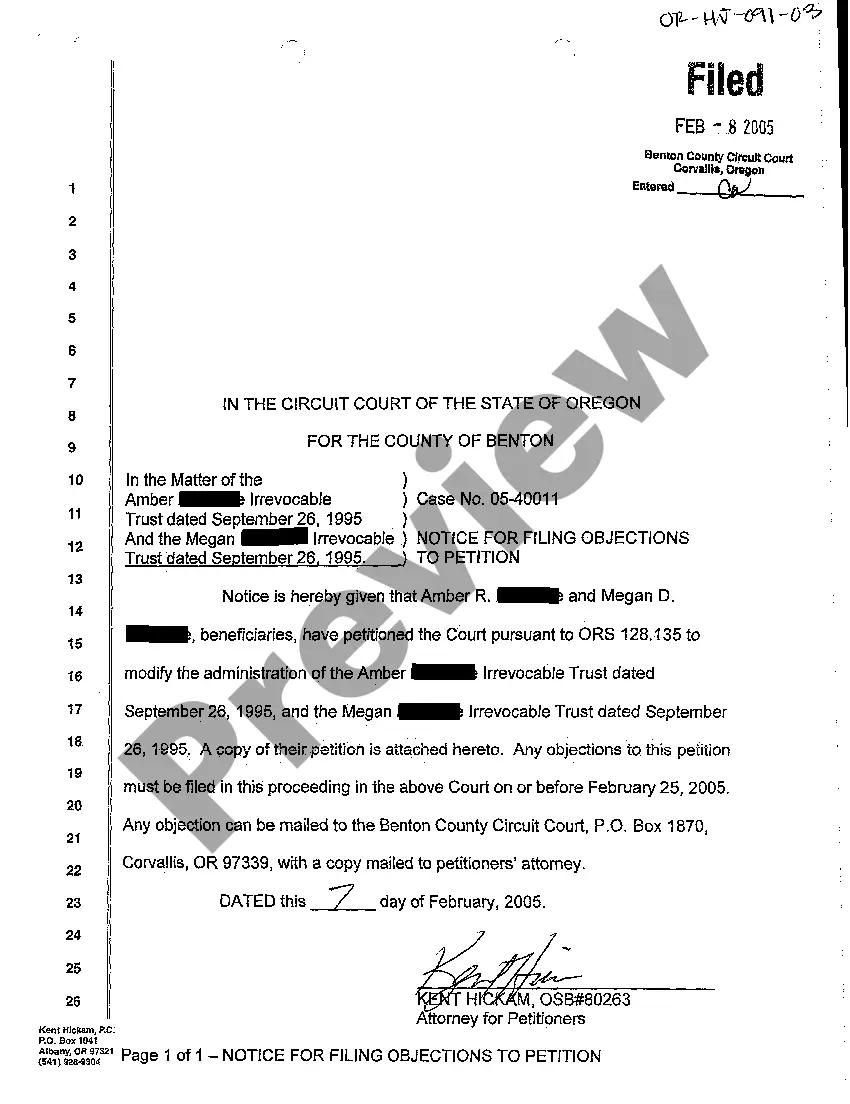

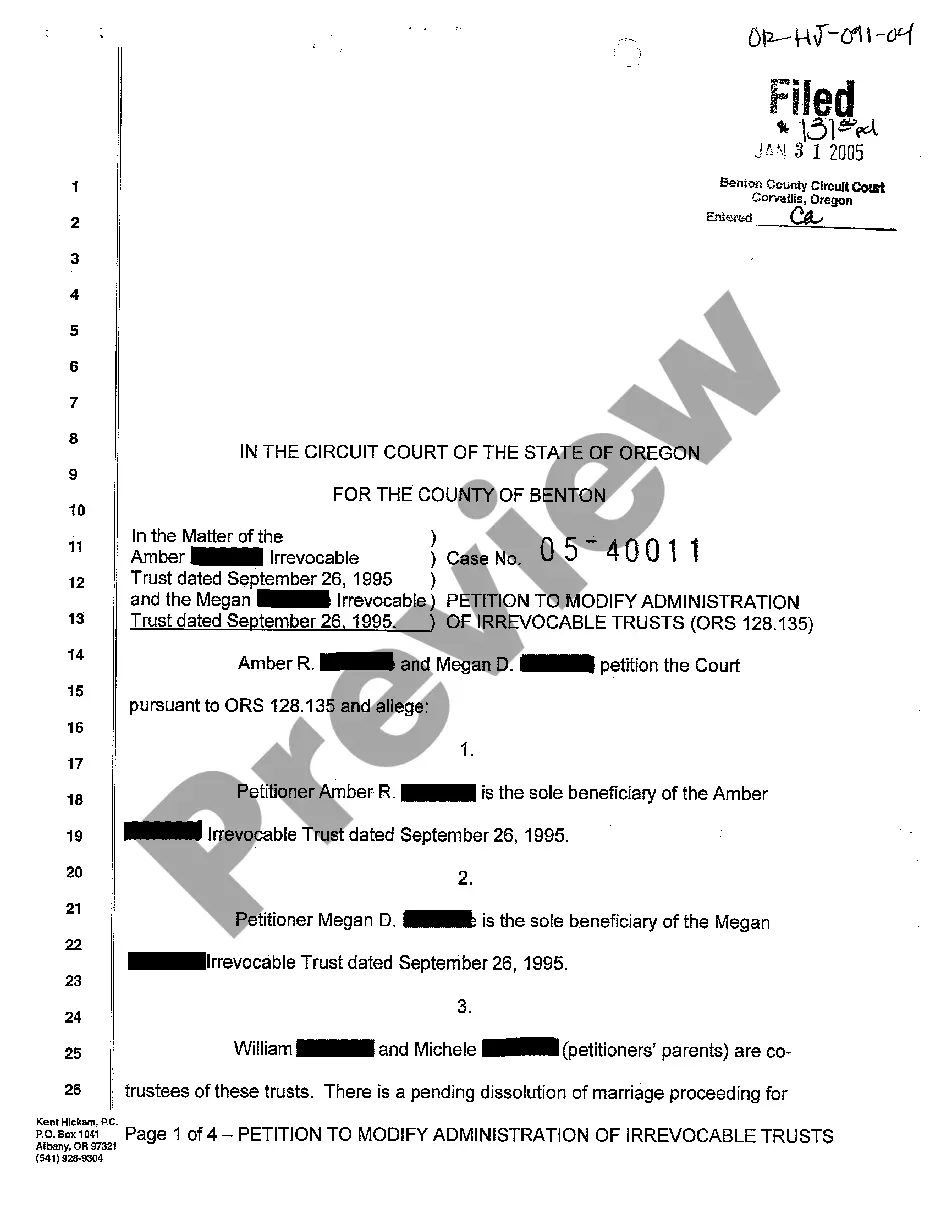

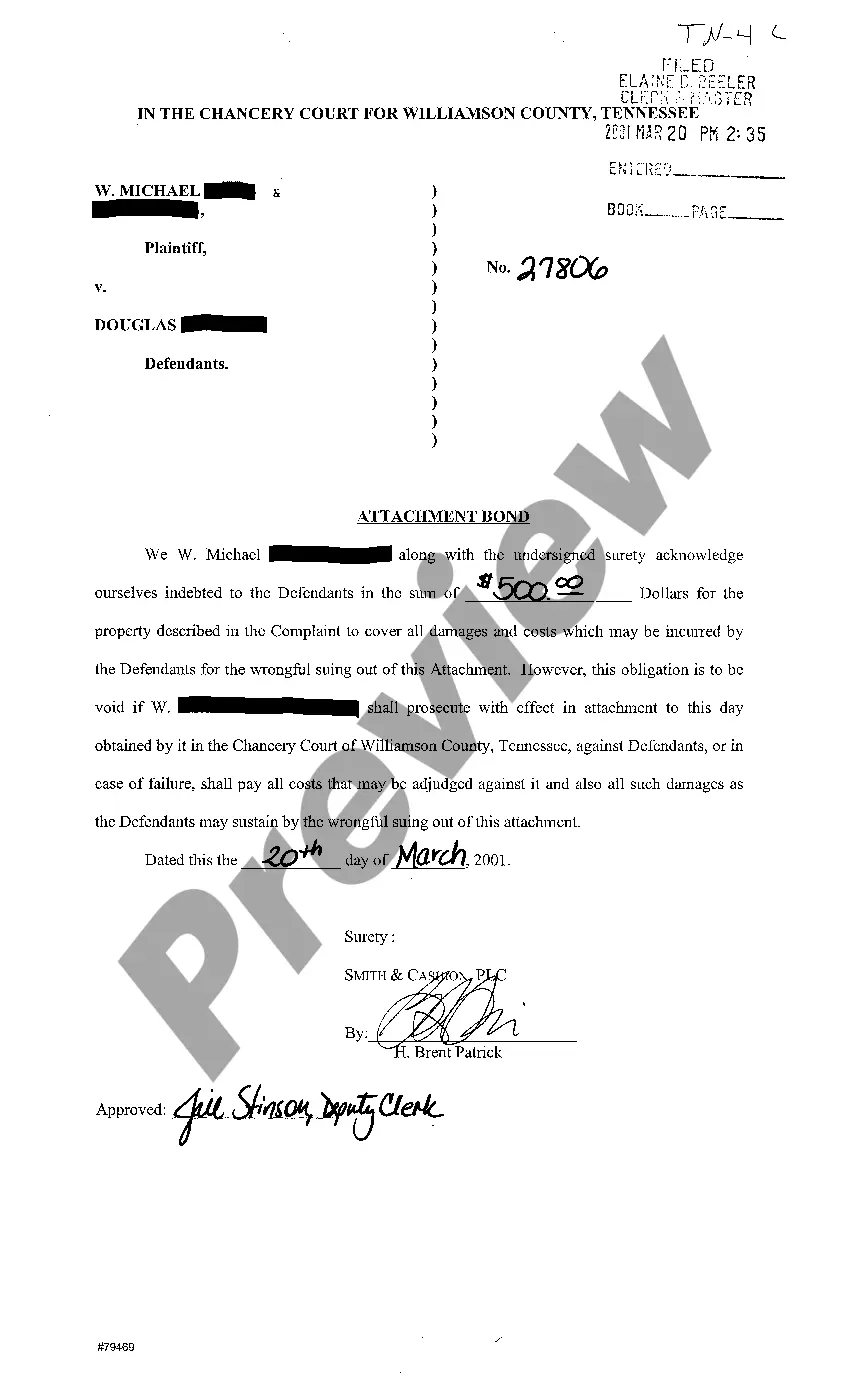

Tennessee Attachment Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Attachment Bond?

Access to quality Tennessee Attachment Bond samples online with US Legal Forms. Prevent hours of misused time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get over 85,000 state-specific legal and tax forms that you can download and fill out in clicks within the Forms library.

To find the example, log in to your account and click Download. The document is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- See if the Tennessee Attachment Bond you’re looking at is appropriate for your state.

- Look at the sample using the Preview option and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to finish creating an account.

- Pick a favored file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Attachment Bond template and fill it out online or print it out and get it done yourself. Think about giving the papers to your legal counsel to make certain all things are filled out appropriately. If you make a mistake, print and complete application once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

To get a Tennessee surety bond, people generally go to a surety bonding company. You are able to get a surety bond through a general insurance company, but choosing a surety bond company often means you can get better quotes. Learn about how to choose the best surety bond company.

Gather the information required to apply for your surety bond. Common necessary details include your business name and address, license number (if you are renewing your bond), and ownership information.

A surety is someone who is often mentioned in a bail undertaking. If the defendant fails to appear, the money or property may be 'forfeited to the court'. Another condition used when defendants apply for bail, is the naming of a surety.

How long will it take to get my bond? In most instances, surety experts can issue a bond within 24 hours of the initial application. The turnaround time can take longer for riskier bonds that require more complicated underwriting processes, such as contract bonds for construction projects.

Tennessee title bonds up to $10,000 cost just $100no underwriting required. Bond amounts between $10,000 and $25,000 will also be issued instantly and cost $10 for every $1,000 of coverage. Bond amounts exceeding $25,000 are subject to underwriting consideration.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

On average, the cost for a surety bond falls somewhere between 1% and 15% of the bond amount. That means you may be charged between $100 and $1,500 to buy a $10,000 bond policy. Most premium amounts are based on your application and credit health, but there are some bond policies that are written freely.

To get a Tennessee surety bond, people generally go to a surety bonding company. You are able to get a surety bond through a general insurance company, but choosing a surety bond company often means you can get better quotes. Learn about how to choose the best surety bond company.

Your Tennessee Notary Surety Bond. Tennessee law requires all Notaries to purchase and maintain a $10,000 Notary surety bond for the duration of their 4-year commission. The Notary bond protects the general public of Tennessee against any financial loss due to improper conduct by a Tennessee Notary.