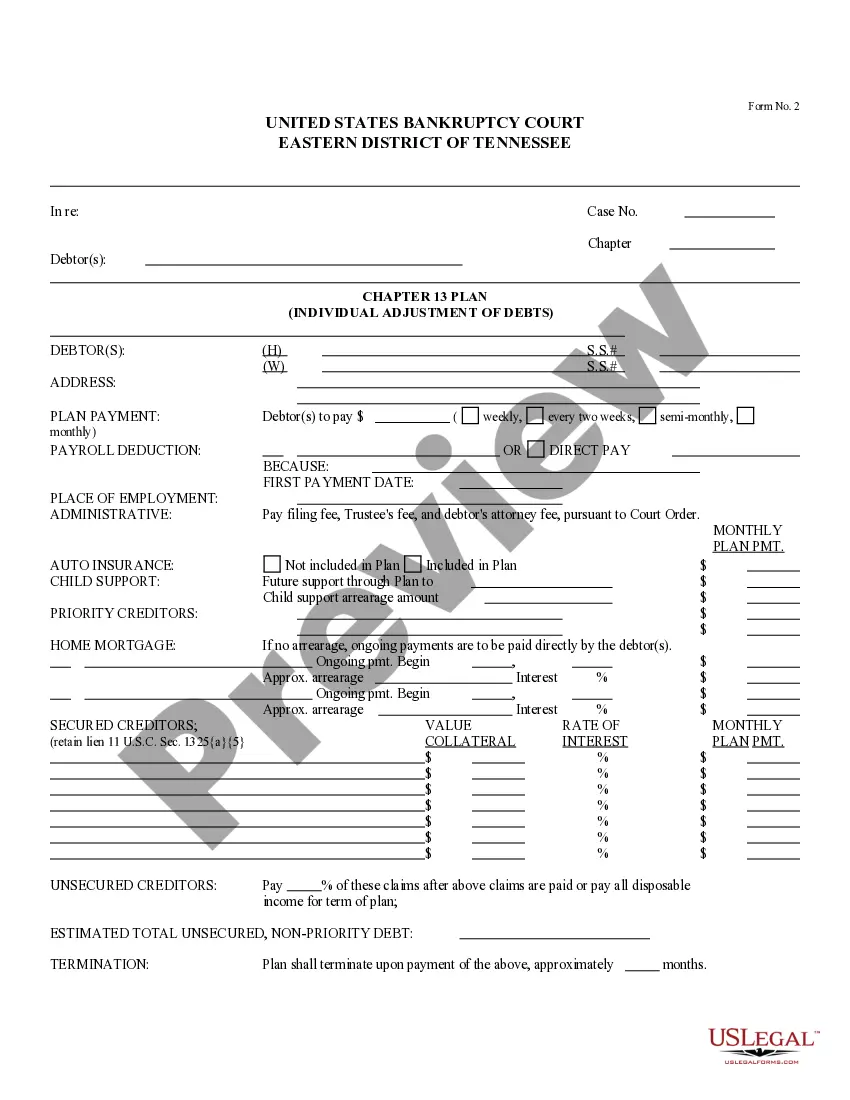

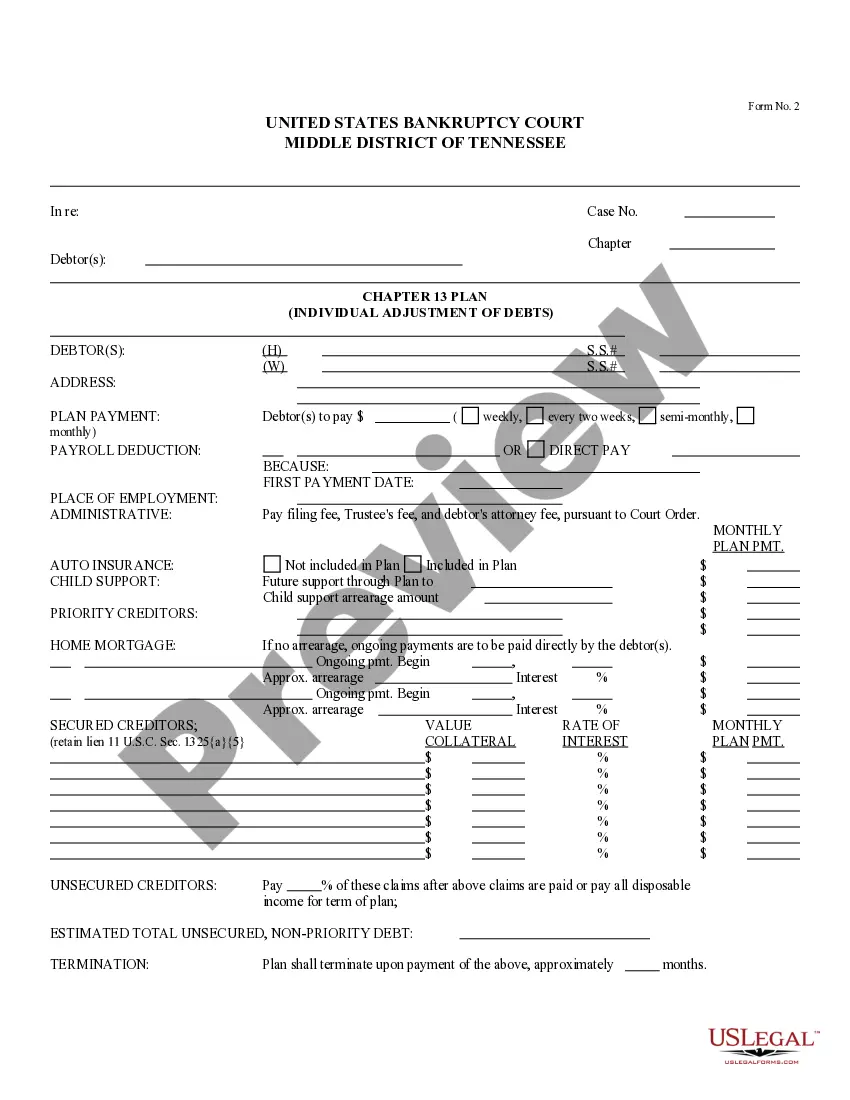

The chapter 13 plan provides that the debtor will pay the trustee a certain sum of money to be distributed among the creditors listed in the plan. The document provides information concerning: secured creditors, unsecured creditors, and the date of plan termination.

Tennessee Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Chapter 13 Plan?

Access to top quality Tennessee Chapter 13 Plan samples online with US Legal Forms. Avoid hours of lost time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Get more than 85,000 state-specific legal and tax templates that you could save and fill out in clicks in the Forms library.

To find the sample, log in to your account and click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- See if the Tennessee Chapter 13 Plan you’re considering is suitable for your state.

- View the sample utilizing the Preview function and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to complete making an account.

- Choose a preferred file format to save the document (.pdf or .docx).

You can now open up the Tennessee Chapter 13 Plan example and fill it out online or print it and get it done yourself. Think about mailing the file to your legal counsel to make sure all things are filled out properly. If you make a mistake, print out and complete application again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more forms.

Form popularity

FAQ

Debts dischargeable in a chapter 13, but not in chapter 7, include debts for willful and malicious injury to property (as opposed to a person), debts incurred to pay nondischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.