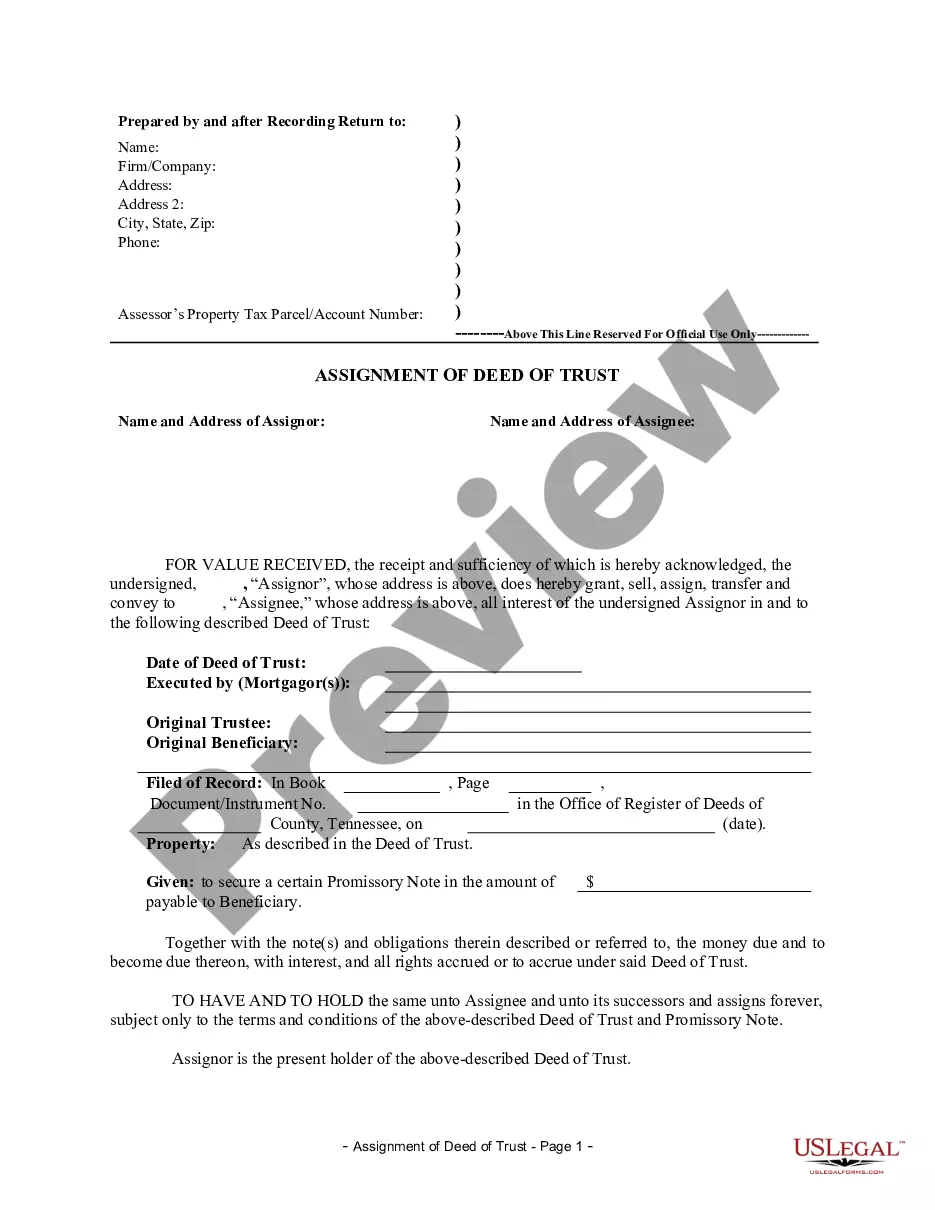

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Tennessee Assignment of Deed of Trust by Individual Mortgage Holder

Description

Key Concepts & Definitions

Assignment of Deed of Trust by Individual Mortgage refers to the legal process wherein an individual mortgagor transfers their rights and obligations under a deed of trust to another party. It typically involves the original borrower (trustor), the lender (beneficiary), and a third-party trustee who holds the real property as security for the loan.

Step-by-Step Guide

- Review the Original Deed of Trust: Verify all the details in the deed, including your obligations and the terms under which an assignment is permissible.

- Obtain Consent from Lender: Most deeds of trust require the lenders approval for assignment. Ensure you communicate with your lender and obtain necessary approvals.

- Prepare Assignment Document: Draft an assignment agreement that specifies the details of the transaction. It is highly recommended to seek legal assistance to ensure the document complies with state laws.

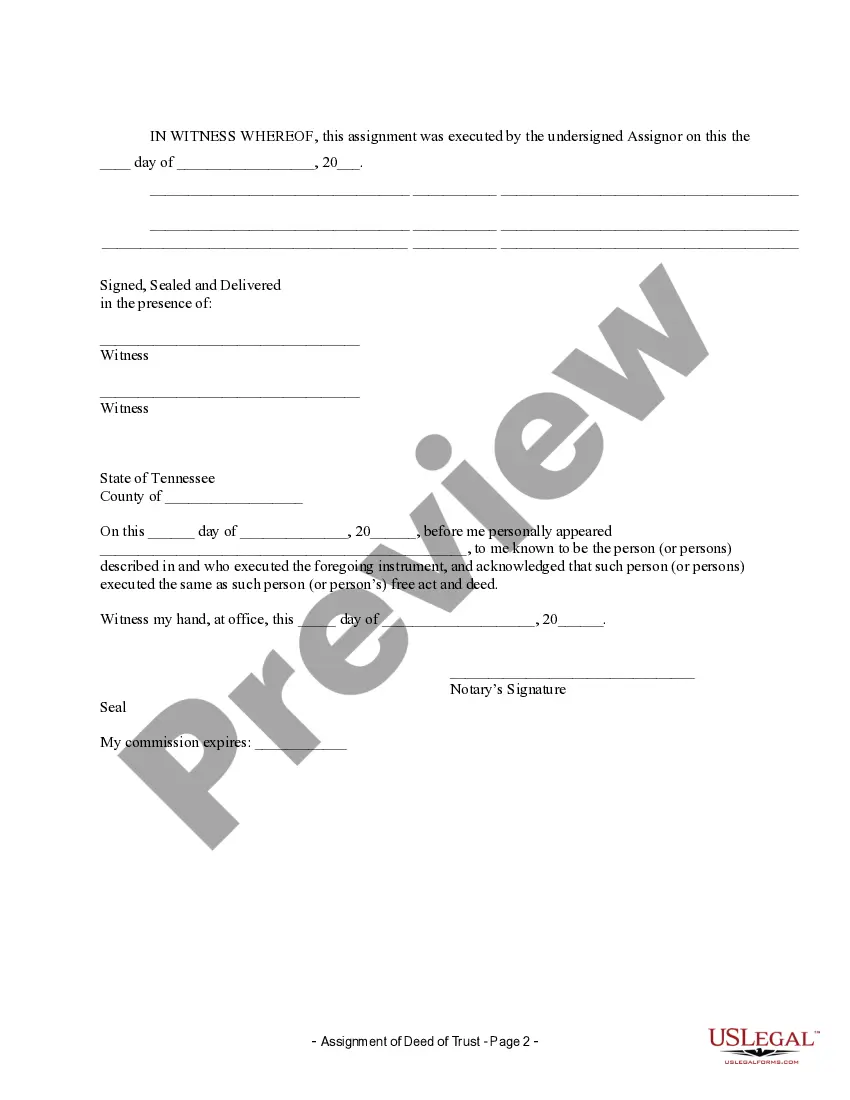

- Execution of Assignment: Both parties should sign the assignment document, preferably in the presence of a notary public for legal sanctification.

- Record the Assignment: File the executed assignment with the county recorders office where the property is located to make it a public record, thus protecting the rights of the new beneficiary.

Risk Analysis

- Legal Risks: Improperly executed assignments may lead to disputes or legal challenges, particularly if the borrower has not fully complied with the terms required for assignment in the deed of trust.

- Financial Risks: The assignee takes over all risks associated with the original mortgage, including the possibility of borrower default. Detailed due diligence is necessary.

- Compliance Risks: Each state has specific laws and requirements for recording assignments. Failure to adhere to these can invalidate the transfer.

Key Takeaways

- Legal Assistance: Always consult with a legal professional before proceeding with an assignment of deed of trust.

- Due Diligence: Conduct thorough research and documentation reviews to mitigate risks.

- Lender's Approval: Seek and secure the lender's consent to avoid any contractual breaches.

Best Practices

- Verify All Details: Scrutinize all documents for accuracy and completeness.

- Transparent Communication: Maintain open lines of communication with all parties involved in the assignment.

- Secure Archival: Keep copies of all correspondences and filings pertaining to the assignment process for future reference.

Common Mistakes & How to Avoid Them

- Failing to Record the Assignment: Always record the assignment at the local recorders office to avoid disputes about property rights.

- Lack of Legal Review: Obtain legal counsel to draft or review your assignment to ensure legal validity and protect against potential legal issues.

- Overlooking Lender Approval: Ensure the assignment is in accordance with the terms of the initial agreement and with lenders consent to prevent contract breaches.

How to fill out Tennessee Assignment Of Deed Of Trust By Individual Mortgage Holder?

Get access to quality Tennessee Assignment of Deed of Trust by Individual Mortgage Holder templates online with US Legal Forms. Avoid days of misused time browsing the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find over 85,000 state-specific legal and tax templates that you can download and submit in clicks in the Forms library.

To find the example, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Find out if the Tennessee Assignment of Deed of Trust by Individual Mortgage Holder you’re considering is appropriate for your state.

- View the sample utilizing the Preview option and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete creating an account.

- Choose a favored format to download the document (.pdf or .docx).

You can now open the Tennessee Assignment of Deed of Trust by Individual Mortgage Holder template and fill it out online or print it and get it done by hand. Consider mailing the papers to your legal counsel to be certain everything is filled out correctly. If you make a mistake, print and complete sample again (once you’ve created an account all documents you download is reusable). Create your US Legal Forms account now and access more samples.

Form popularity

FAQ

Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note. Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.

Key Takeaways. A deed of trust is a type of security for a loan that names a third party called the trustee to hold the legal title until you pay it off. The trustee is typically an entity such as a title company with "power of sale" in the event that you default on your loan payment.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

If you or another party to the deed of trust already own the property and you enter into a deed of trust to regulate an arrangement there is usually no reason to inform your mortgage lender.Therefore the mortgage company's position is secure and they need not be concerned with a deed of trust.