Tennessee Notice of Completion by Corporation

About this form

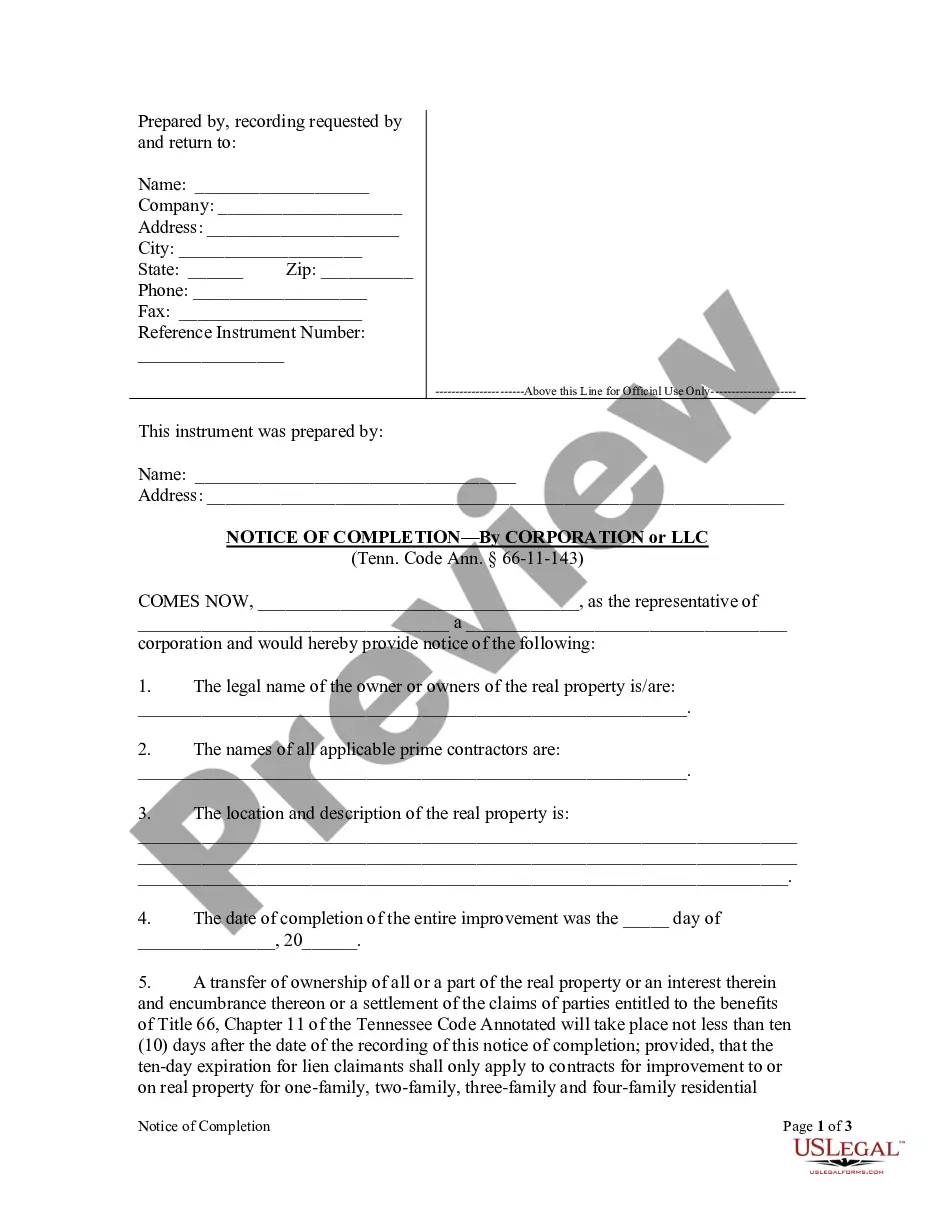

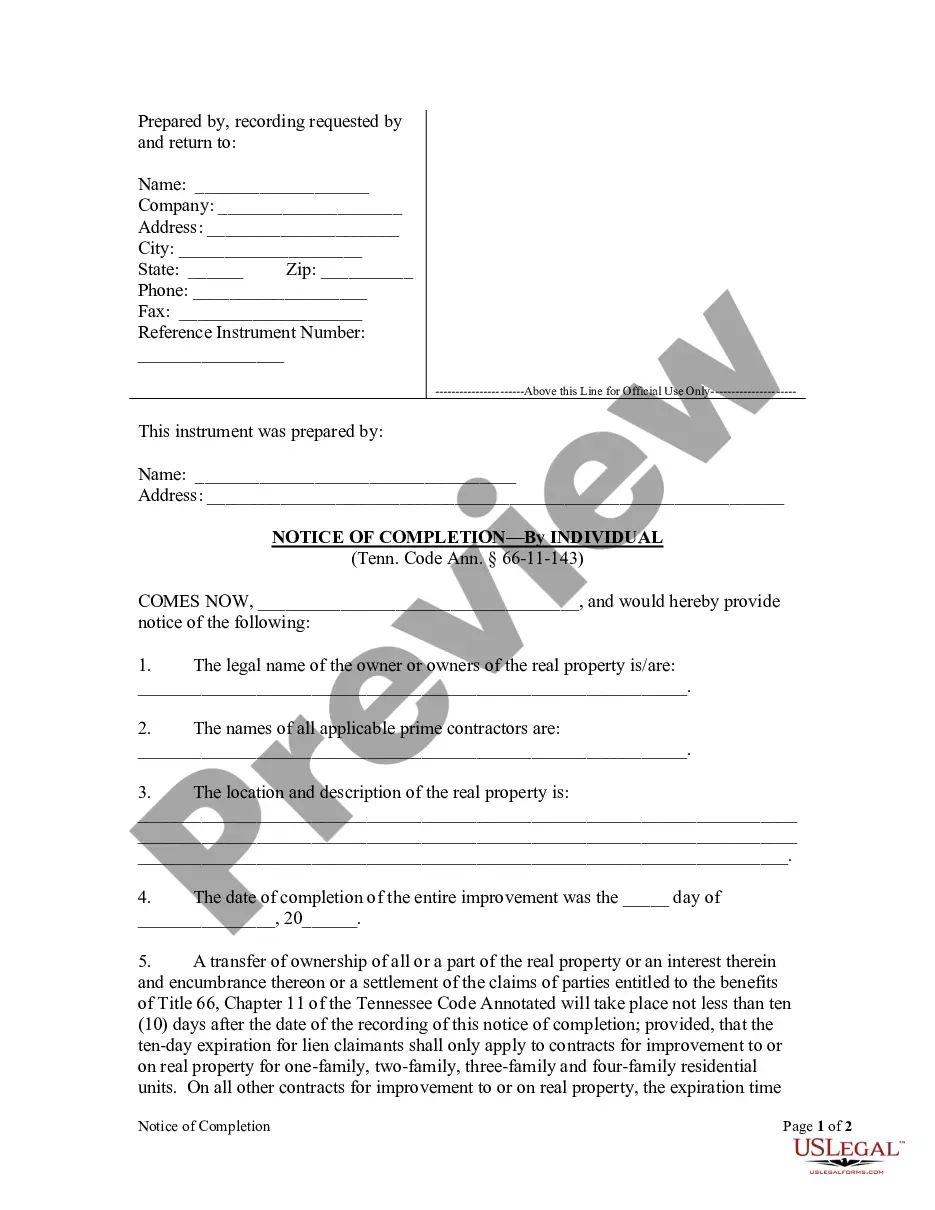

The Notice of Completion by Corporation is a legal document that allows property owners or purchasers to formally notify the county's register of deeds of the completion of construction or demolition work on real property. This notice helps protect the owner from potential lien claims by establishing a date of completion. It is different from other forms as it specifically addresses completion notifications by corporations within Tennessee, as opposed to individuals or other entities.

Key parts of this document

- Identification of the owner or owners of the real property.

- Names of all applicable prime contractors involved in the project.

- Detailed location and description of the real property concerned.

- Date of completion of the improvements or demolition.

- Information regarding subsequent transfers of ownership or encumbrances following the notice.

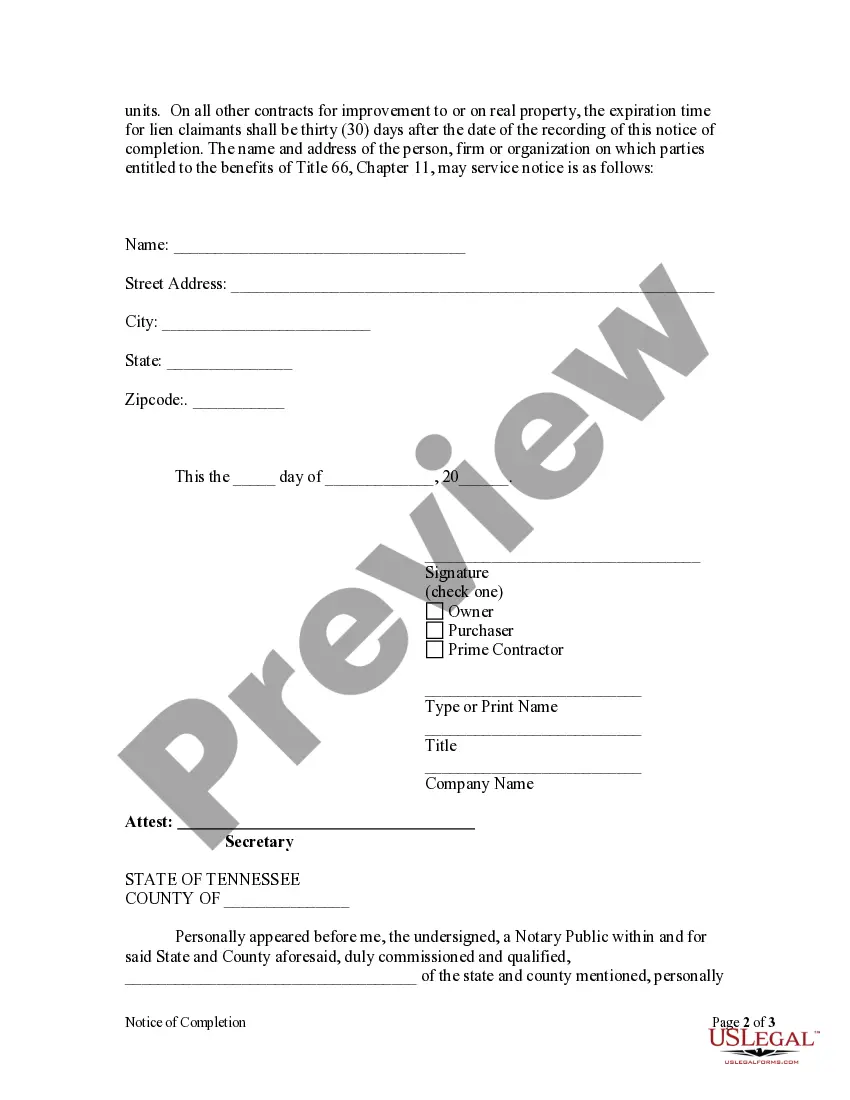

- Signature section for authorized representatives of the corporation and notarization attestation.

Legal requirements by state

This form is tailored for use within the state of Tennessee and adheres to the provisions outlined in Title 66, Chapter 11 of the Tennessee Code Annotated. It specifies the legal obligations of corporations under Tennessee law concerning the filing of notices of completion and the timelines for lien claims based on property types.

Situations where this form applies

This form should be used after the completion of construction or demolition work on a property. It is essential to file this notice to establish a clear record of completion, which serves as protection against future lien claims related to unpaid work or materials. Use this form when you, as a corporation, want to formally declare that a construction project has finished and lessen the risk of liens being placed on your property.

Who needs this form

- Corporations that have completed construction or demolition of real property.

- Property owners who wish to notify the county of project completion to protect against lien claims.

- Designated representatives, such as a corporate officer or an attorney, authorized to execute the notice on behalf of the corporation.

Steps to complete this form

- Identify the corporation and its authorized representative who will file the notice.

- Enter the legal names of the owner(s) of the property and all prime contractors involved in the project.

- Provide a comprehensive description and location of the property being improved or demolished.

- Specify the date when the entire improvement or demolition was completed.

- Include the necessary contact details for anyone entitled to benefits related to the property.

- Ensure the form is signed and notarized where required to validate the notice.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to provide all required information about the parties involved.

- Not including a complete description of the property.

- Neglecting to sign the document or have it notarized when necessary.

- Incorrectly calculating the lien claim expiration dates, leading to potential legal issues.

Why use this form online

- Convenient access to pre-drafted legal templates from licensed attorneys.

- Edit and customize the form to meet specific project details and requirements easily.

- Reliable resource ensuring compliance with state-specific legal standards.

Form popularity

FAQ

Proposed federal tax regulations would treat each series within a series LLC as a separate entity for federal income tax purposes.Each series would be classified as a partnership, disregarded, or as an association taxable as a corporation.

A series LLC is a regular business LLC that is set up to hold several properties or interests underneath one LLC. A series LLC can make distributions as allowed by state law. A restricted LLC, on the other hand, is a vehicle created to transfer assets within a family and is not meant for doing business.

The series LLC is only available in certain states, including Tennessee. A series LLC is a collection of LLCs that are grouped under one parent LLC. This enables businesses to separate different parts of the company into separate LLCs, allowing them to isolate the liabilities of each segment from the others.

A Series LLC can be a great way to separate your business assets and divide the responsibilities for investment and debt in different areas or divisions of your company. A Series LLC allows you to form multiple mini-LLCs, so to speak, and operate them all under a single umbrella company.

A Notice of Completion Is: The Notice of Completion typically comes from the property owner on a private project to notify the participants on a project specifically, the parties that have Mechanics Lien Rights that the project has been completed.

A series LLC is a unique form of limited liability company ("LLC") in which the articles of formation specifically allow for unlimited segregation of membership interests, assets, and operations into independent series.

To start a Limited Liability Company in Tennessee you will need to file the Articles of Organization with the Tennessee Secretary of State, with a starting fee of $300 to file. You can apply online, in-person, or by mail. The Articles of Organization is the legal document that officially creates your Tennessee LLC.

The Notice of Completion is an instrument that can be recorded pursuant to TN statute TCA 66-11-143 in order to protect property interests from unrecorded mechanics and materialmen lien claims.Legal name of the owner or owners of the real property; 2. The name of the prime contractor or prime contractors; 3.

A Request for Copy of Documents may be obtained using one of the following methods: Paper Submission: A blank Request for Copy of Documents form may be obtained by going to sos.tn.gov and entering SS-4461 in the search bar; by emailing the Secretary of State at TNSOS.CERT@tn.gov, or by calling (615) 741-6488.