South Dakota Limited Liability Company LLC Agreement For General Partner

Description

How to fill out Limited Liability Company LLC Agreement For General Partner?

US Legal Forms - one of the most significant libraries of lawful types in the United States - offers an array of lawful papers themes you can acquire or produce. Using the internet site, you can find thousands of types for company and personal purposes, categorized by classes, says, or keywords and phrases.You will discover the most recent versions of types like the South Dakota Limited Liability Company LLC Agreement For General Partner within minutes.

If you have a monthly subscription, log in and acquire South Dakota Limited Liability Company LLC Agreement For General Partner in the US Legal Forms local library. The Download option can look on every form you see. You get access to all previously delivered electronically types from the My Forms tab of your bank account.

If you would like use US Legal Forms initially, listed below are simple guidelines to help you began:

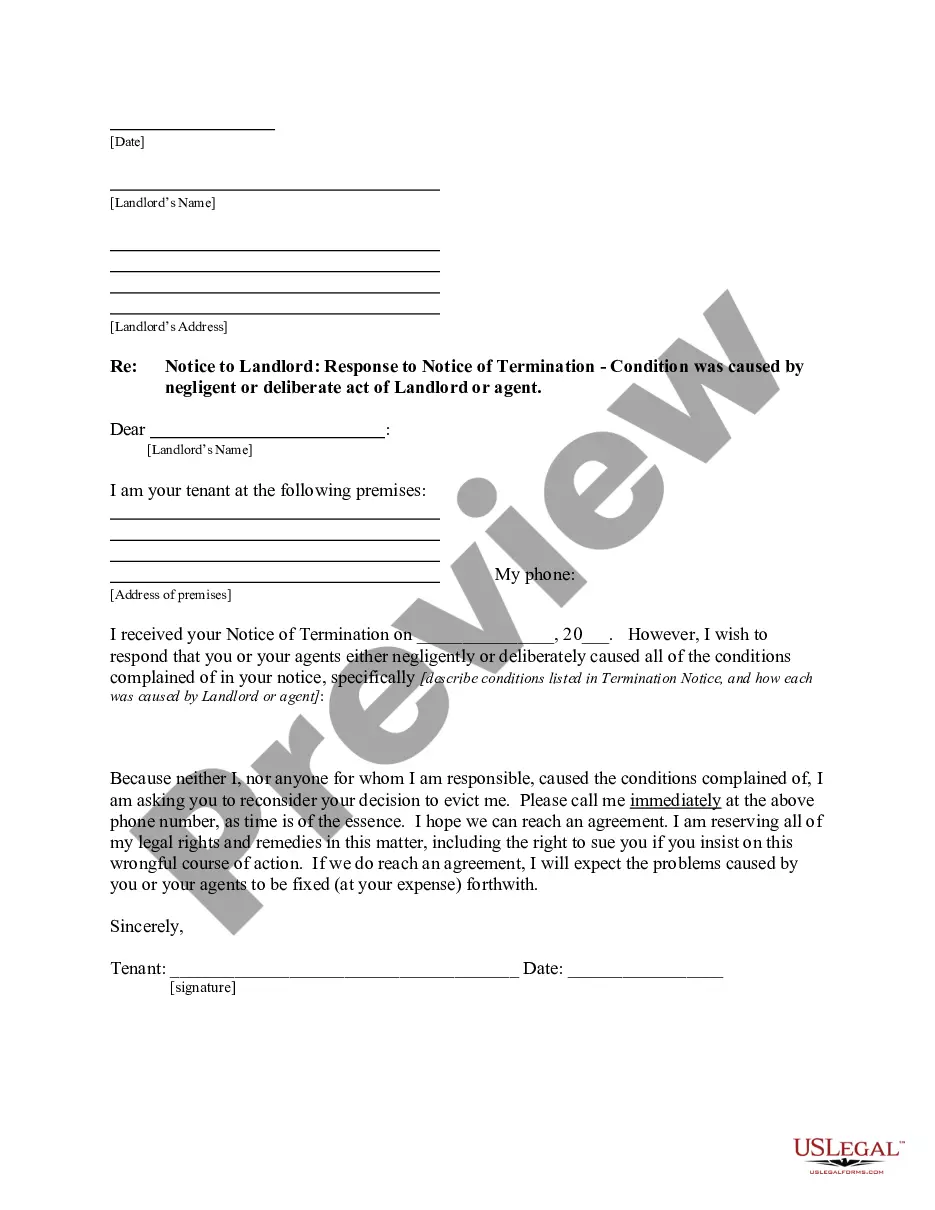

- Be sure you have chosen the best form to your metropolis/region. Click on the Review option to analyze the form`s content material. Look at the form explanation to ensure that you have chosen the correct form.

- If the form does not match your specifications, utilize the Look for industry towards the top of the display to find the one that does.

- Should you be satisfied with the shape, affirm your selection by clicking the Buy now option. Then, choose the costs plan you favor and offer your references to sign up for an bank account.

- Process the purchase. Utilize your bank card or PayPal bank account to perform the purchase.

- Choose the formatting and acquire the shape on the product.

- Make adjustments. Load, edit and produce and indicator the delivered electronically South Dakota Limited Liability Company LLC Agreement For General Partner.

Each and every format you included in your account lacks an expiry particular date and is yours forever. So, if you would like acquire or produce another copy, just visit the My Forms section and click on the form you want.

Get access to the South Dakota Limited Liability Company LLC Agreement For General Partner with US Legal Forms, probably the most extensive local library of lawful papers themes. Use thousands of specialist and status-distinct themes that meet your small business or personal demands and specifications.

Form popularity

FAQ

Your operating agreement is an internal document, kept on file at your business location. You don't need to file it with the South Dakota Secretary of State, but it is still an essential document for your LLC.

In South Dakota partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes.

South Dakota does not impose a corporate income tax. If you have questions regarding your federal tax return, please contact the Internal Revenue Service (IRS) at (800)829-1040 or visit their website at .

LLC members' income is taxed at the federal self-employment tax rate of 15.3% (12.4% for social security and 2.9% for Medicare). South Dakota does not levy state personal or corporate income taxes, though the LLC will most likely need to pay state sales and local taxes, as well as industry-specific taxes.

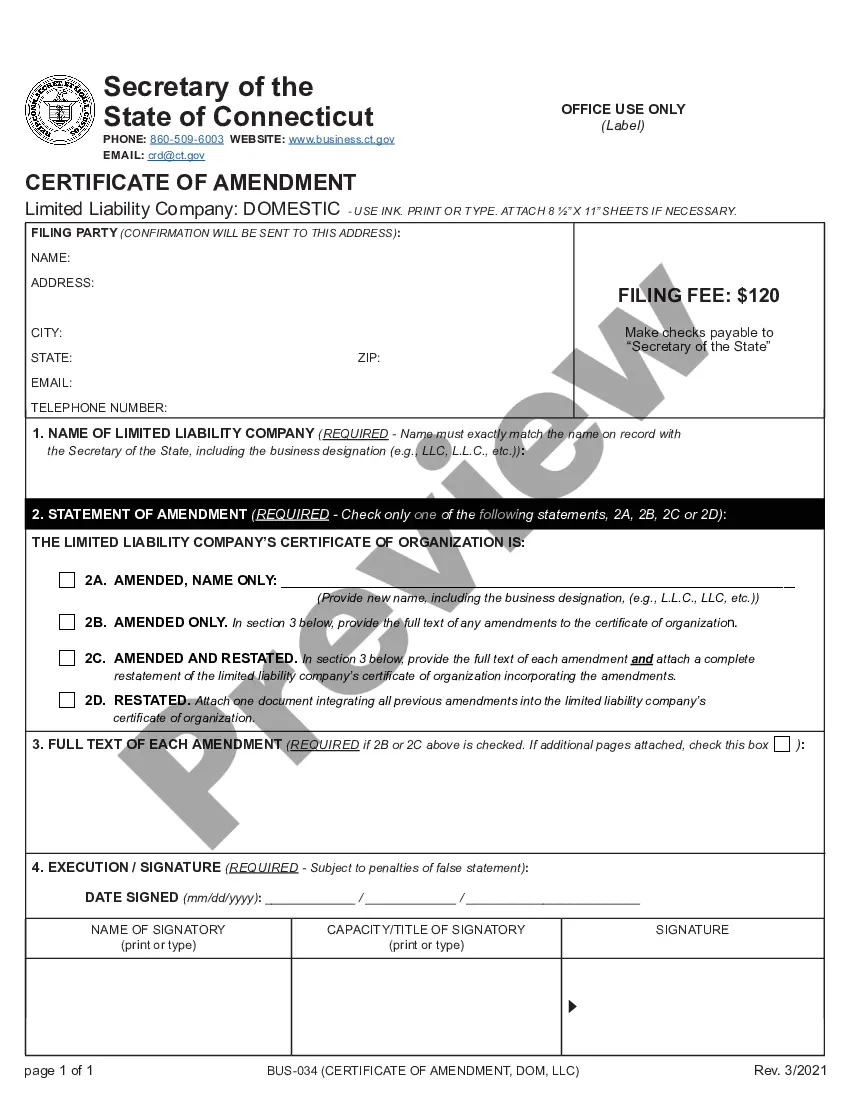

The first step is to file a form called the Amended Articles of Organization with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in South Dakota. The filing fee for the Amended Articles of Organization in South Dakota is $60.

Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. A partnership does not pay tax on its income but "passes through" any profits or losses to its partners. Partners must include partnership items on their tax or information returns.

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

General partnership (GP) Any profits and losses from the partnership are taken into account on the individual partners' income tax returns while the business itself often pays no separate income tax. Because South Dakota has no individual state income tax, tax liability for partnerships may be delightfully small.