South Dakota Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease

Description

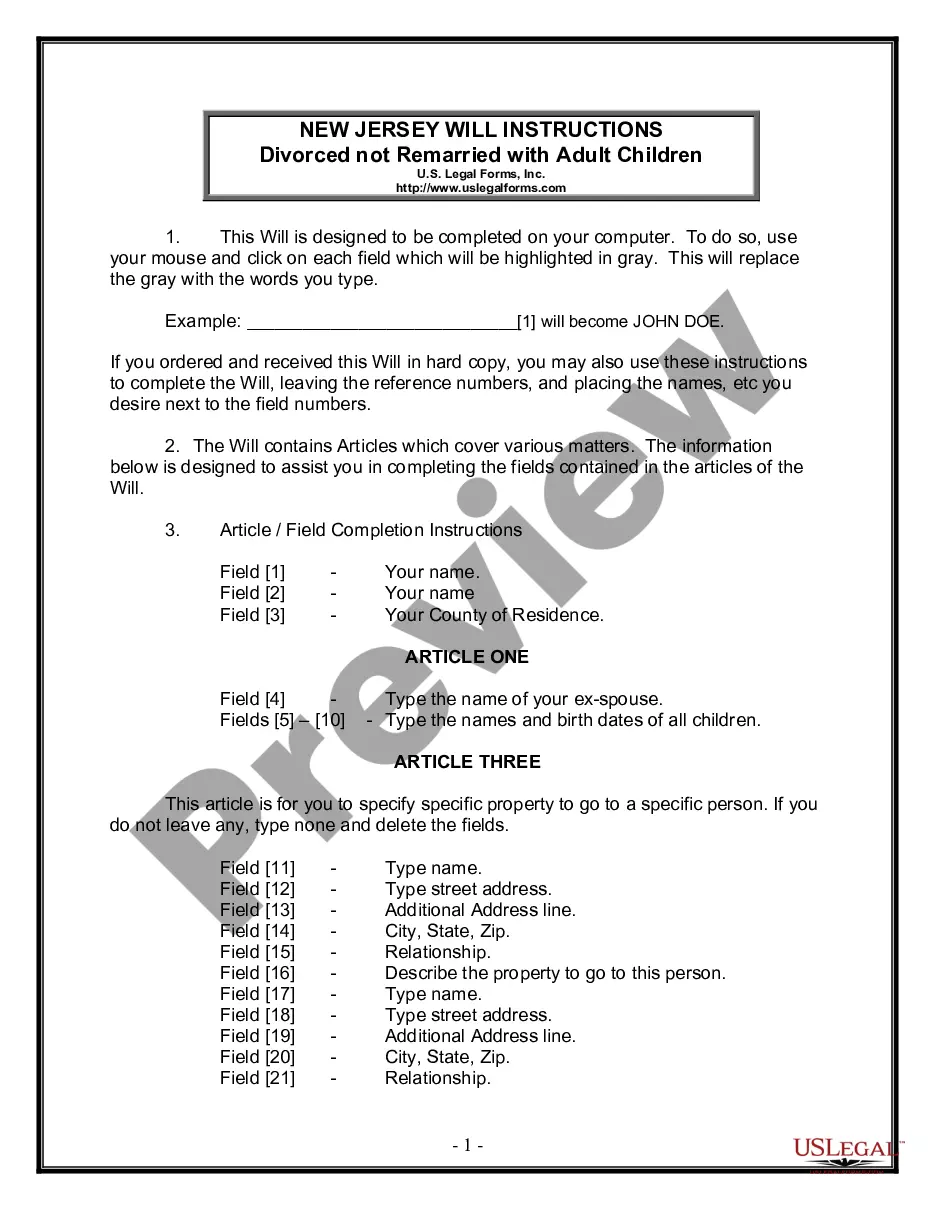

How to fill out Ratification Of Oil, Gas And Mineral Lease By Mineral Owner, Paid-Up Lease?

You are able to invest hrs on the web searching for the authorized document template that meets the federal and state requirements you require. US Legal Forms provides a huge number of authorized varieties that happen to be analyzed by specialists. It is simple to download or produce the South Dakota Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease from the assistance.

If you already have a US Legal Forms profile, you can log in and click the Download switch. Next, you can full, change, produce, or indicator the South Dakota Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease. Each authorized document template you buy is your own eternally. To obtain an additional duplicate for any acquired kind, check out the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms web site the very first time, follow the easy instructions listed below:

- Initially, be sure that you have chosen the correct document template to the state/metropolis of your liking. Look at the kind description to make sure you have chosen the right kind. If readily available, make use of the Preview switch to check from the document template also.

- If you would like get an additional model in the kind, make use of the Search field to discover the template that meets your needs and requirements.

- After you have found the template you want, click on Purchase now to proceed.

- Find the pricing program you want, enter your accreditations, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal profile to cover the authorized kind.

- Find the formatting in the document and download it in your system.

- Make modifications in your document if necessary. You are able to full, change and indicator and produce South Dakota Ratification of Oil, Gas and Mineral Lease by Mineral Owner, Paid-Up Lease.

Download and produce a huge number of document web templates utilizing the US Legal Forms web site, that offers the largest variety of authorized varieties. Use skilled and condition-distinct web templates to tackle your company or specific needs.

Form popularity

FAQ

A ratification of an existing Texas oil and gas lease usually executed by a non-participating royalty interest owner or a non-executive mineral interest owner. It can be used for transactions involving business entities or private individuals.

The Mineral Leasing Act "establishes qualifications for leases, sets out maximum limits on the number of acres of a particular mineral that can be held by a lessee, and prohibits alien ownership of leases except through stock ownership in a corporation." Conditions of a lease under the Mineral Leasing Act vary based on ...

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

: a deed by which a landowner authorizes exploration for and production of oil and gas on his land usually in consideration of a royalty.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Oil, gas, and mineral lease (?OGML?) disputes arise between the mineral rights owner (?lessor?) and the companies that leased those rights (?lessee?). A typical OGML will be ?Paid-Up,? meaning an amount of money is paid when the OGML is executed; that money is the only guaranteed payment.

The BLM issues a competitive lease for a 10-year period. BLM State Offices conduct lease sales quarterly when parcels are eligible and available for lease. Each State Office publishes a Notice of Competitive Lease Sale (Sale Notice), which lists parcels to be offered at the auction, usually 45 days before the auction.

In addition to a signing bonus, most lease agreements require the lessee to pay the owner a share of the value of produced oil or gas. The customary royalty percentage is 12.5 percent or 1/8 of the value of the oil or gas at the wellhead.