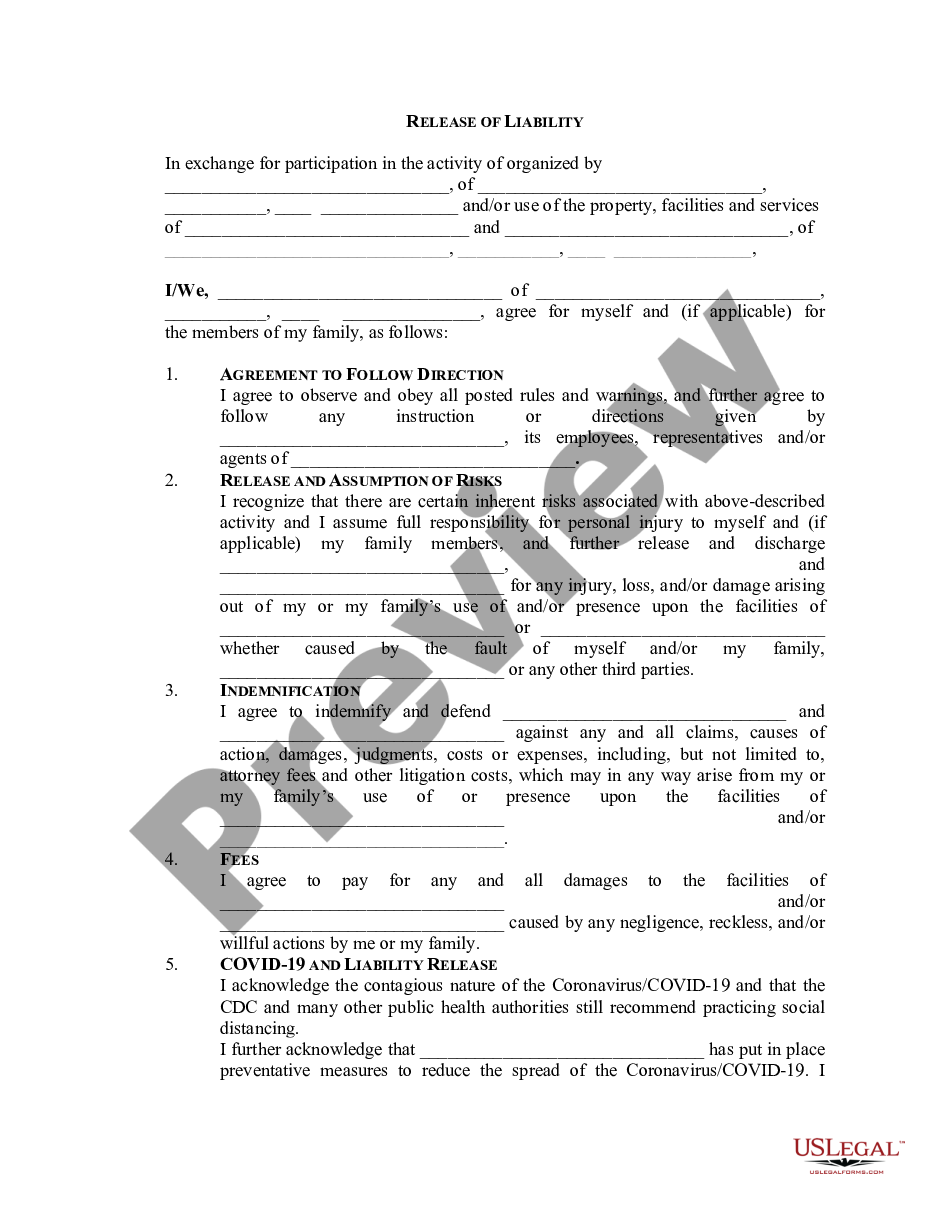

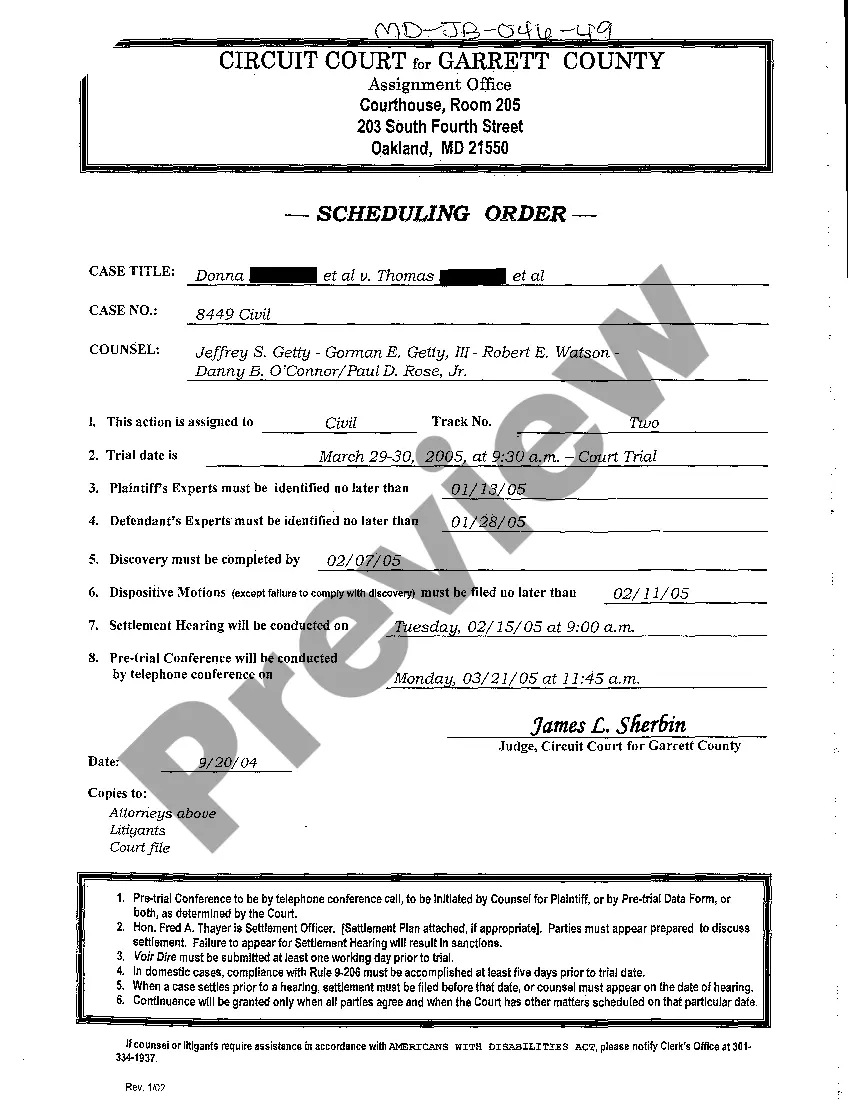

This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

South Dakota Correction to Mineral Deed As to Interest Conveyed

Description

How to fill out Correction To Mineral Deed As To Interest Conveyed?

US Legal Forms - one of many biggest libraries of legal kinds in the States - gives a variety of legal record layouts you may obtain or produce. Making use of the web site, you may get a huge number of kinds for organization and person uses, sorted by classes, claims, or keywords.You will discover the most up-to-date types of kinds such as the South Dakota Correction to Mineral Deed As to Interest Conveyed within minutes.

If you currently have a membership, log in and obtain South Dakota Correction to Mineral Deed As to Interest Conveyed from the US Legal Forms catalogue. The Down load option will show up on each form you view. You have accessibility to all earlier downloaded kinds from the My Forms tab of the account.

In order to use US Legal Forms the first time, listed below are easy recommendations to obtain started:

- Make sure you have picked out the proper form to your metropolis/county. Click the Preview option to examine the form`s content. Browse the form description to actually have selected the right form.

- If the form does not suit your specifications, make use of the Search industry at the top of the screen to obtain the one that does.

- When you are content with the form, validate your choice by visiting the Buy now option. Then, select the prices prepare you favor and supply your references to register to have an account.

- Procedure the transaction. Make use of credit card or PayPal account to complete the transaction.

- Select the formatting and obtain the form in your gadget.

- Make alterations. Fill up, modify and produce and indication the downloaded South Dakota Correction to Mineral Deed As to Interest Conveyed.

Each template you included in your money lacks an expiry particular date and it is yours for a long time. So, in order to obtain or produce one more duplicate, just go to the My Forms area and click on around the form you want.

Gain access to the South Dakota Correction to Mineral Deed As to Interest Conveyed with US Legal Forms, by far the most considerable catalogue of legal record layouts. Use a huge number of skilled and express-distinct layouts that meet your business or person needs and specifications.

Form popularity

FAQ

This would include actual ?deeds? such as warranty deed, quit claim deed, grantor's deed, sheriff's deed, trustee's deed, executor's deed, administrator's deed, mineral deed and similar deeds.

In South Dakota, the median property tax rate is 1.17% of assessed home value, ing to the Tax Handbook. South Dakota offers a property tax homestead exemption for homeowners 70 or older (or surviving spouses), which delays payment of property taxes until the property is sold.

Reviewed by Susan Chai, Esq. A South Dakota (SD) Quitclaim Deed is a legal document that transfers whatever ownership interest in a property one person (the grantor) has, if any, to another person (the grantee).

The cost of transfer taxes in South Dakota is $0.50/$500 of the home's sale value. Most real estate transfers will be charged this tax, but there are some exceptions. Exceptions include, but are not limited to, transfers between spouses, foreclosure, distribution of estates, divorces, or pure gifts.

A transfer tax is charged by a state or local government to complete a sale of property from one owner to another. The tax is typically based on the value of the property. A federal or state inheritance tax or estate tax may be considered a type of transfer tax.

Signing Requirements for South Dakota Deeds. A South Dakota deed must include the current owner's original signature. The owner's signature should be dated. A deed transferring real estate owned by two or more owners must include all co-owners' signatures?unless only one owner is transferring an interest.

You must be 65 years of age or older OR disabled (as defined by the Social Security Act). You must own the home or retain a life estate in the property. Un-remarried widow/widowers of persons previously qualified may still qualify in some circumstances. Income and property value limits apply.

Any fee originating from the sale of real property sold in the state of South Dakota, regardless of the broker's or agent's residence, is subject to sales tax. Municipal sales tax applies to any sale of real property located within the municipality's limits.