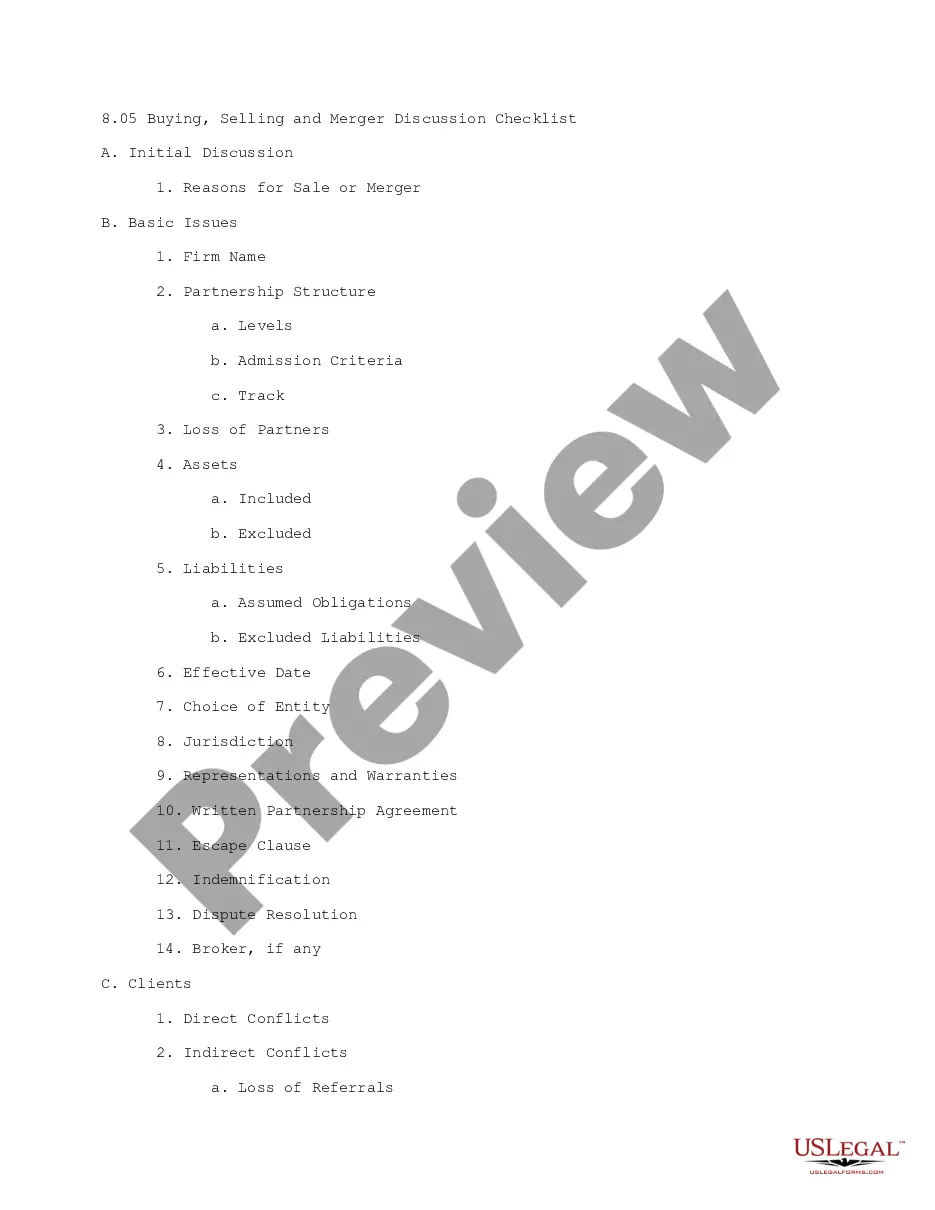

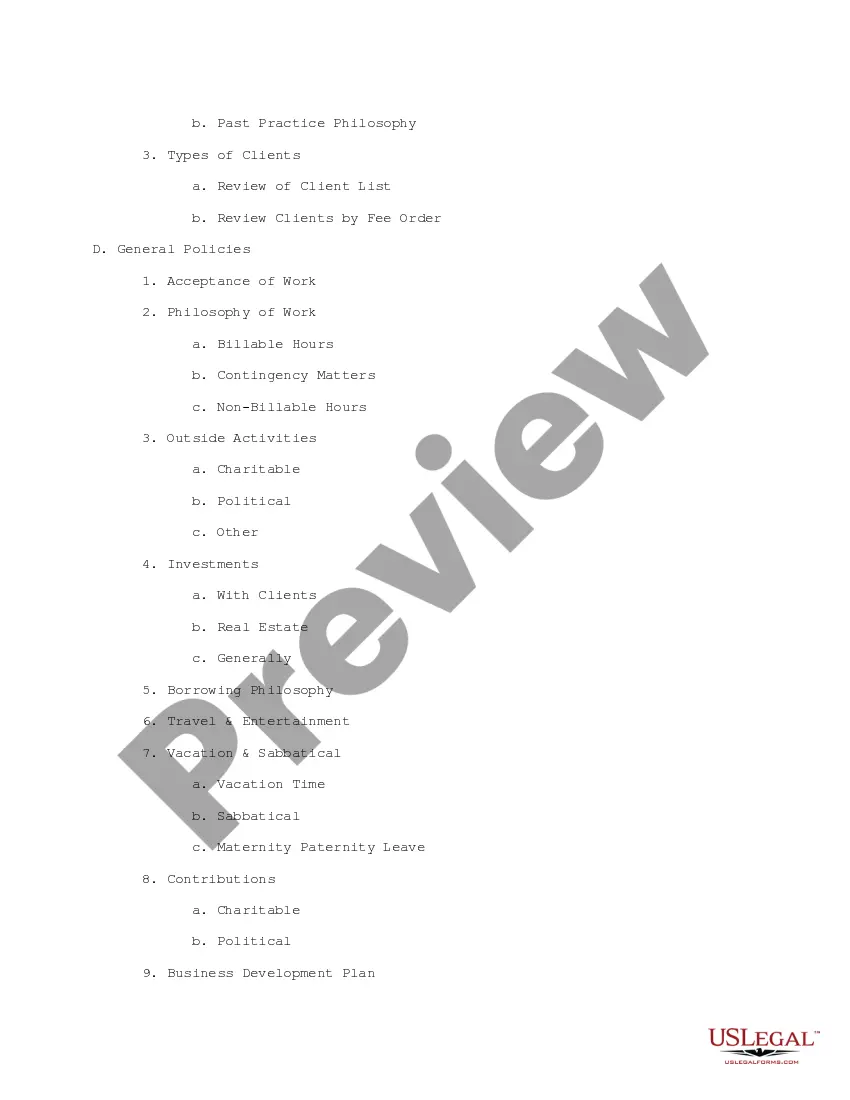

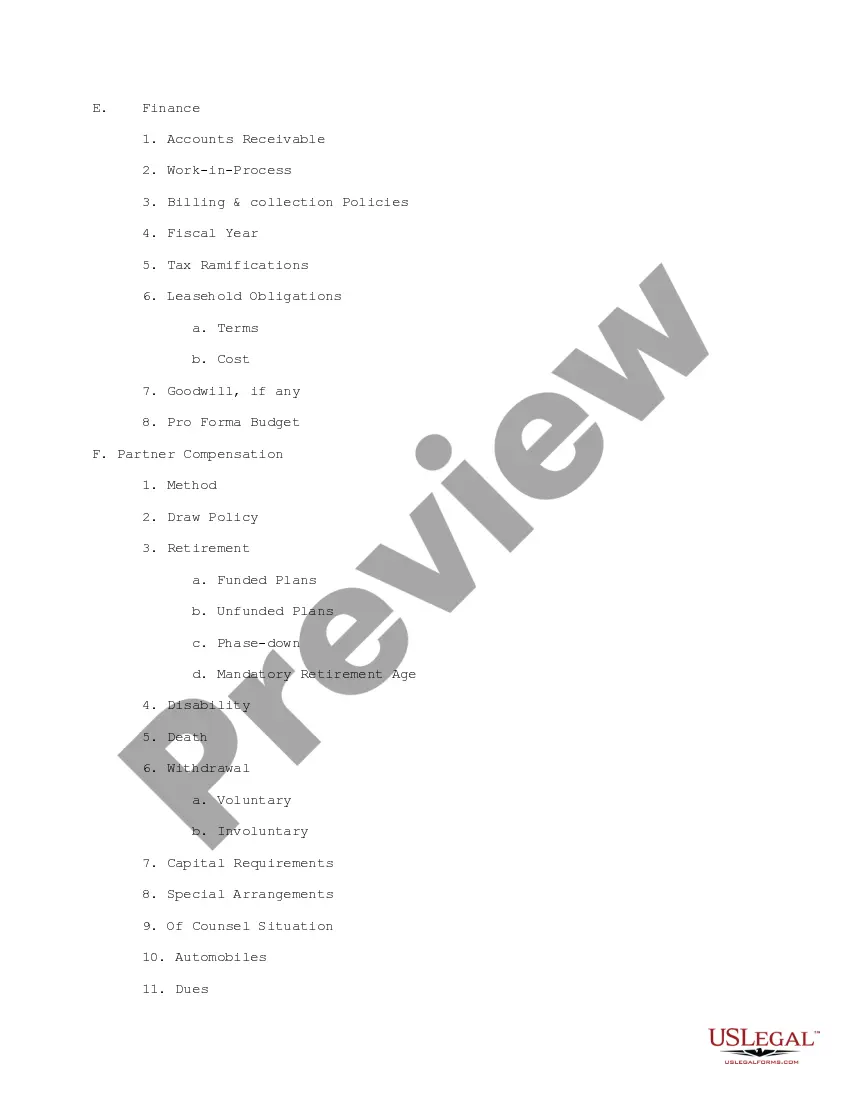

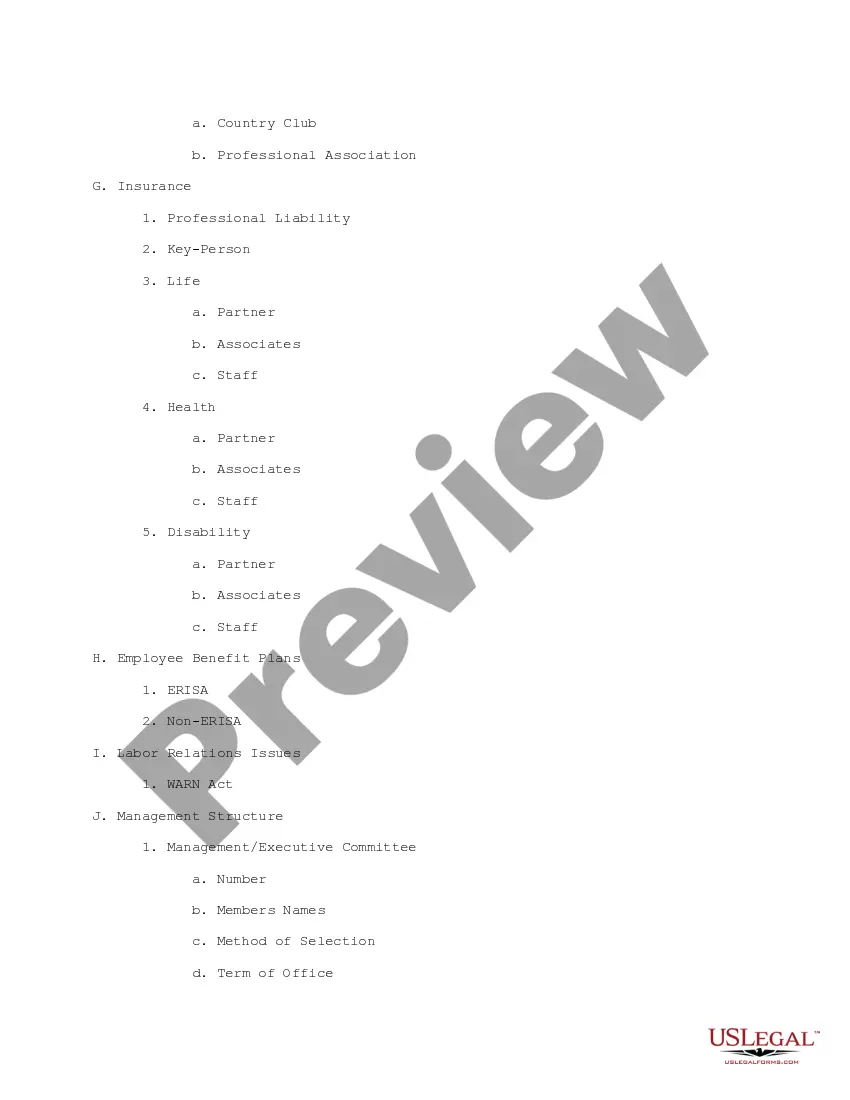

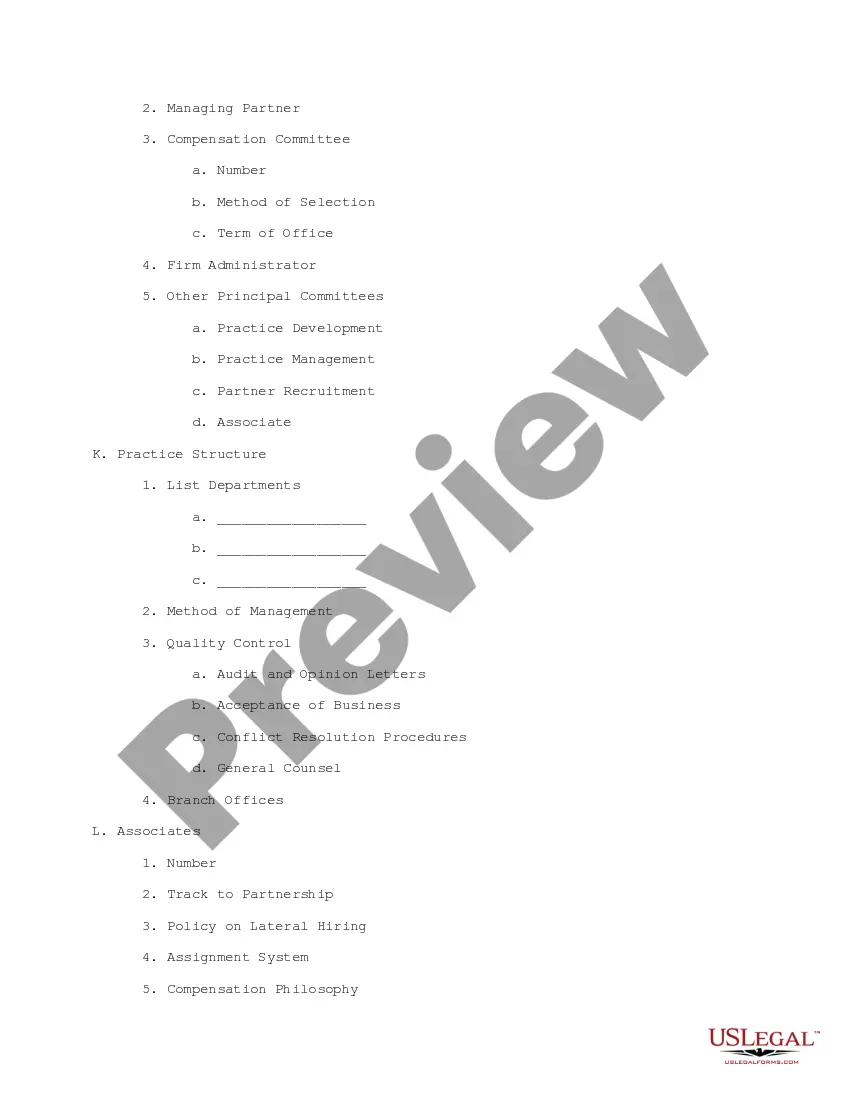

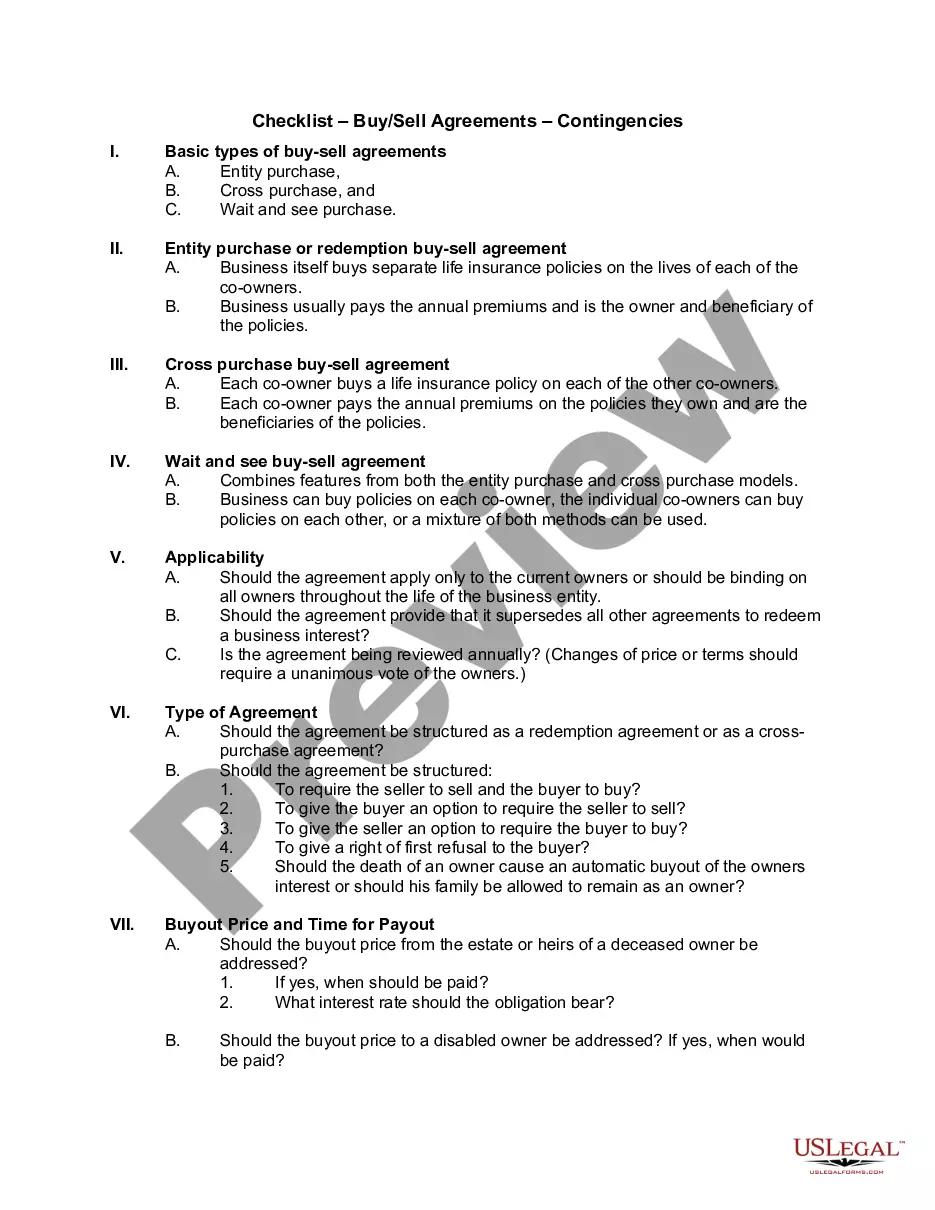

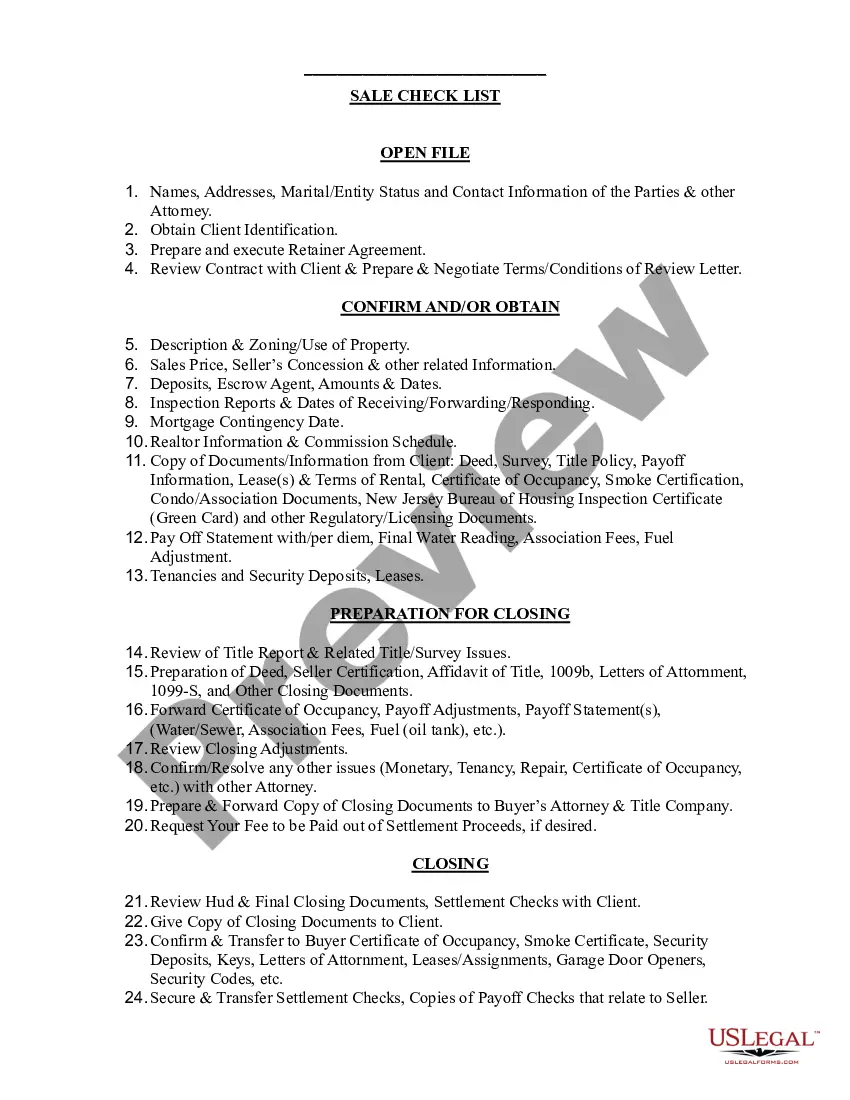

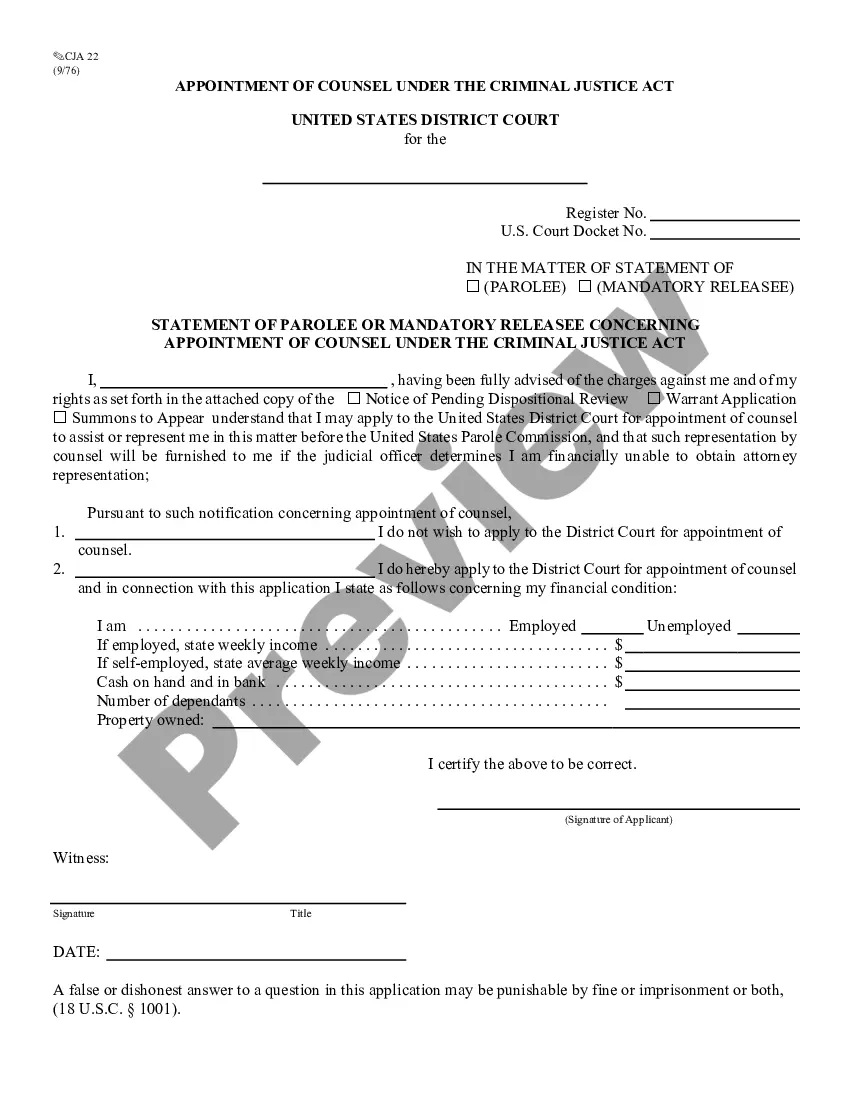

This is a checklist for the discussion of buying, selling, or merger of a law firm. Each category (clients, finance, partner compensation, etc.) is broken into sub-categories as a way of bringing to mind all issues to be discussed.

South Dakota Buying, Selling and Merger Discussion Checklist

Description

How to fill out Buying, Selling And Merger Discussion Checklist?

Finding the right lawful papers template can be a struggle. Of course, there are tons of themes accessible on the Internet, but how will you discover the lawful develop you want? Use the US Legal Forms internet site. The support provides a huge number of themes, like the South Dakota Buying, Selling and Merger Discussion Checklist, which can be used for company and personal requirements. All of the forms are checked by pros and satisfy federal and state demands.

When you are presently registered, log in to the profile and then click the Down load option to find the South Dakota Buying, Selling and Merger Discussion Checklist. Make use of profile to look from the lawful forms you might have bought previously. Proceed to the My Forms tab of your own profile and have yet another backup in the papers you want.

When you are a new user of US Legal Forms, listed below are easy recommendations for you to follow:

- Initially, make certain you have selected the proper develop for the metropolis/area. You can check out the shape using the Preview option and read the shape explanation to guarantee this is the right one for you.

- If the develop does not satisfy your preferences, make use of the Seach industry to find the proper develop.

- When you are certain the shape is acceptable, select the Buy now option to find the develop.

- Opt for the pricing strategy you desire and type in the needed details. Build your profile and buy the order utilizing your PayPal profile or Visa or Mastercard.

- Select the submit formatting and down load the lawful papers template to the gadget.

- Complete, change and print and indicator the acquired South Dakota Buying, Selling and Merger Discussion Checklist.

US Legal Forms is the largest library of lawful forms for which you can find numerous papers themes. Use the service to down load skillfully-made paperwork that follow status demands.