South Dakota Self-Employed Lighting Services Contract

Description

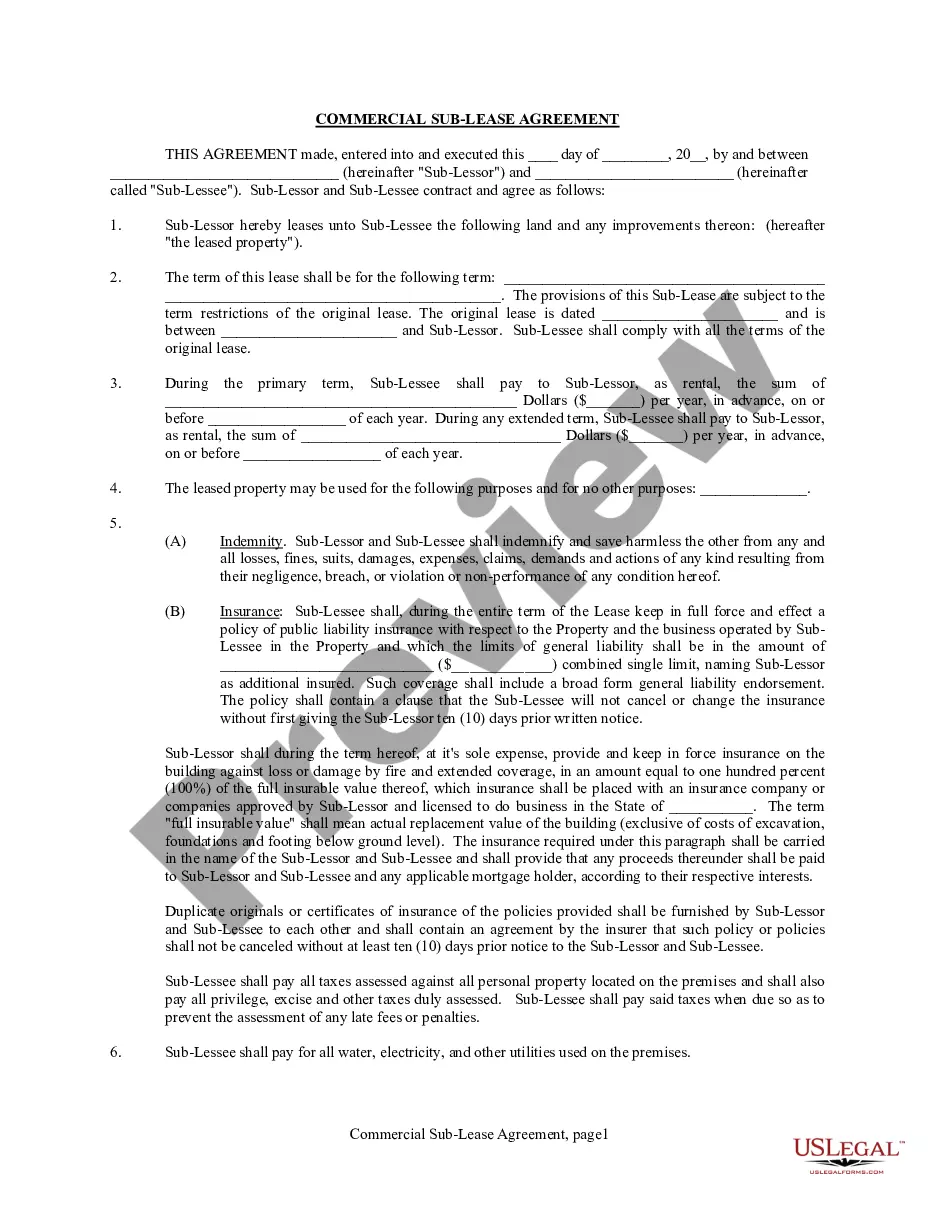

How to fill out Self-Employed Lighting Services Contract?

Finding the correct legal document template can be a challenge. Naturally, there are numerous templates available online, but how can you locate the specific legal form you need? Utilize the US Legal Forms platform. The service offers a vast array of templates, including the South Dakota Self-Employed Lighting Services Contract, suitable for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the South Dakota Self-Employed Lighting Services Contract. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are some simple instructions you can follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Buy now button to obtain the form. Choose the pricing plan you want and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template for your records. Fill out, modify, print, and sign the acquired South Dakota Self-Employed Lighting Services Contract.

Leverage US Legal Forms for all your legal document needs to ensure compliance and ease of use.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Use the service to obtain well-crafted paperwork that adheres to state requirements.

- The platform provides easy navigation for users.

- Templates are regularly updated to comply with legal standards.

- Customer support is available for any inquiries.

- Users can manage their documents efficiently through their accounts.

Form popularity

FAQ

Several states do not mandate a contractor's license for general contracting work. States like Wyoming, Montana, and Alaska allow self-employed individuals to operate without a formal license in various capacities. However, regulations can differ significantly across states, so it is crucial to research local laws. For guidance on contracts like a South Dakota Self-Employed Lighting Services Contract, uslegalforms offers valuable resources and templates.

Engaging in contractor work without the necessary licenses can lead to legal repercussions in South Dakota. While some services may not require a license, others do, and failing to comply can result in fines or penalties. Always verify the specific requirements for your line of work, especially when dealing with South Dakota Self-Employed Lighting Services Contract. Uslegalforms can assist you in understanding these legalities thoroughly.

The primary difference lies in the level of control and relationship with the client. A contractor generally works under the direction of the employer, while an independent contractor operates with more autonomy. For those in the lighting services industry, a South Dakota Self-Employed Lighting Services Contract clearly defines this independent status, helping to protect your interests and clarify expectations.

Independent contractors in South Dakota must comply with federal and state regulations. They need to obtain any necessary licenses and permits for their work, especially in specialized fields like lighting services. Additionally, having a South Dakota Self-Employed Lighting Services Contract is crucial to outline the terms of the engagement, ensuring both parties understand their rights and obligations.

Contract labor in South Dakota is generally not subject to sales tax unless it involves the provision of tangible goods. If you engage in contract labor under a South Dakota Self-Employed Lighting Services Contract, you can benefit from this tax exemption. However, it is always best to consult with a tax professional to ensure you are fully compliant with state tax laws.

In South Dakota, many services are exempt from sales tax, including most personal and professional services. This exemption can be advantageous for self-employed individuals working under a South Dakota Self-Employed Lighting Services Contract. However, some services related to tangible goods may still be taxable, so it is crucial to review your service offerings carefully.

Yes, South Dakota does require certain contractors to obtain a license, particularly for specialized trades. If you are offering electrical lighting services, you may need to meet specific licensing requirements under your South Dakota Self-Employed Lighting Services Contract. It is wise to check with local authorities to ensure that you fulfill all necessary licensing obligations.

Service contracts in South Dakota are usually not taxable unless they involve the sale of tangible personal property. Therefore, if you are providing lighting services under a South Dakota Self-Employed Lighting Services Contract, you may not need to worry about sales tax on your service fees. Always consider reviewing your contract details and state regulations as laws can change.

South Dakota does not typically tax most professional services, which includes many consulting and advisory services. This can provide a significant advantage for those operating under a South Dakota Self-Employed Lighting Services Contract. It is advisable to keep updated on any changes to tax regulations that might affect your business.

In South Dakota, service labor is not generally subject to sales tax, which can be beneficial for self-employed individuals. However, if your services include tangible goods or materials, those may be taxable. When working under a South Dakota Self-Employed Lighting Services Contract, it is important to clarify what aspects of your service may incur sales tax to maintain compliance.