South Dakota Self-Employed Ceiling Installation Contract

Description

How to fill out Self-Employed Ceiling Installation Contract?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad selection of legal document templates that you can download or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of documents such as the South Dakota Self-Employed Ceiling Installation Contract in just a few moments.

If you have an account, Log In and download the South Dakota Self-Employed Ceiling Installation Contract from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved forms in the My documents section of your profile.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Make sure you have selected the correct form for your city/county. Click the Review button to check the contents of the form. Read the form summary to ensure that you have chosen the right document. If the form doesn't meet your needs, use the Search box at the top of the screen to find the one that does. If you are satisfied with the document, confirm your choice by clicking the Get now button. Then, choose the payment plan you desire and provide your information to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Select the format and download the document to your device. Make edits. Fill out, modify, print, and sign the saved South Dakota Self-Employed Ceiling Installation Contract. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the document you need.

- Access the South Dakota Self-Employed Ceiling Installation Contract with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

The choice between forming an LLC and remaining an independent contractor depends on your individual needs. An LLC can provide liability protection and may have tax advantages, especially for those involved in a South Dakota Self-Employed Ceiling Installation Contract. However, some independent contractors prefer the simplicity of not forming an LLC, so weigh your options carefully and consider your long-term goals.

No, you do not need to have an LLC to be a contractor, but it can be beneficial. An LLC can help separate your personal and business finances, which is particularly useful for someone working under a South Dakota Self-Employed Ceiling Installation Contract. Ultimately, the decision should be based on your business goals and risk tolerance.

To become a 1099 independent contractor, you will first need to register your business and obtain any necessary licenses. For those aiming to work under a South Dakota Self-Employed Ceiling Installation Contract, ensure you understand the IRS rules regarding independent contractors. Once registered, you can start providing services and will receive a 1099 form from clients for tax purposes.

While it is not mandatory for a contractor to form an LLC, doing so can provide several benefits. An LLC can protect your personal assets and offer tax advantages for those engaged in a South Dakota Self-Employed Ceiling Installation Contract. Additionally, clients may view an LLC as a sign of professionalism and trustworthiness.

Yes, South Dakota requires specific contractor licenses for various trades, including ceiling installation. If you plan to enter into a South Dakota Self-Employed Ceiling Installation Contract, you should familiarize yourself with the licensing requirements to ensure compliance. This will help you avoid potential legal issues and establish credibility with your clients.

Arkansas does require certain contractors to have a license, depending on the type of work they perform. However, if you are focusing on a South Dakota Self-Employed Ceiling Installation Contract, you'll want to ensure you meet South Dakota's specific licensing requirements. It's important to research and comply with the regulations in the state where you plan to operate.

As an independent contractor, you need to have a solid understanding of your business model and the specific requirements for your trade. For those involved in a South Dakota Self-Employed Ceiling Installation Contract, this includes having the right tools, knowledge of installation techniques, and compliance with local regulations. Additionally, you may want to consider obtaining a business license and establishing a reliable customer base.

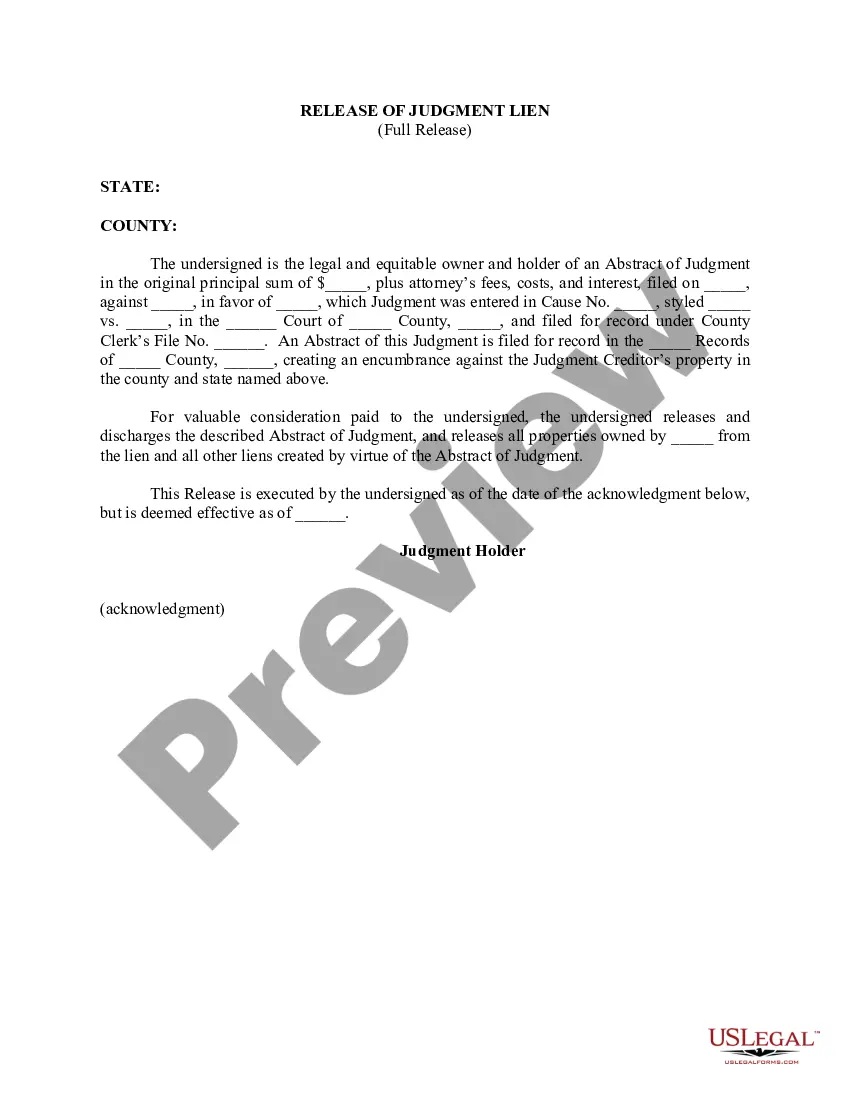

An independent contractor in South Dakota should complete a South Dakota Self-Employed Ceiling Installation Contract to outline the terms of their work. This contract includes essential elements such as project scope, payment terms, and deadlines. By using this contract, you protect your interests and ensure clarity between you and your client. Additionally, you can find user-friendly templates on the US Legal Forms platform to assist you in creating a comprehensive contract.

The self-employment tax in South Dakota consists of Social Security and Medicare taxes for individuals who work for themselves. As of now, the rate is 15.3% on your net earnings from self-employment. When working on your South Dakota Self-Employed Ceiling Installation Contract, it's essential to set aside funds to cover these taxes. A good practice is to consult a tax professional to help you manage your obligations effectively.

In South Dakota, construction labor is generally not subject to sales tax. However, this can vary based on specific circumstances and the type of work performed. If you are self-employed and engaged in ceiling installation, understanding these nuances is crucial. Make sure to stay informed about tax regulations to ensure compliance while working on your South Dakota Self-Employed Ceiling Installation Contract.