South Dakota Self-Employed Business Development Executive Agreement

Description

How to fill out Self-Employed Business Development Executive Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive variety of legal document templates that you can download or print.

Through the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly access the latest templates such as the South Dakota Self-Employed Business Development Executive Agreement in seconds.

Review the form summary to confirm you've picked the right one.

If the form doesn't meet your needs, use the Search box at the top of the screen to find one that does.

- If you have an account, sign in to download the South Dakota Self-Employed Business Development Executive Agreement from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple instructions to get started.

- Ensure you have selected the correct form for your city/county.

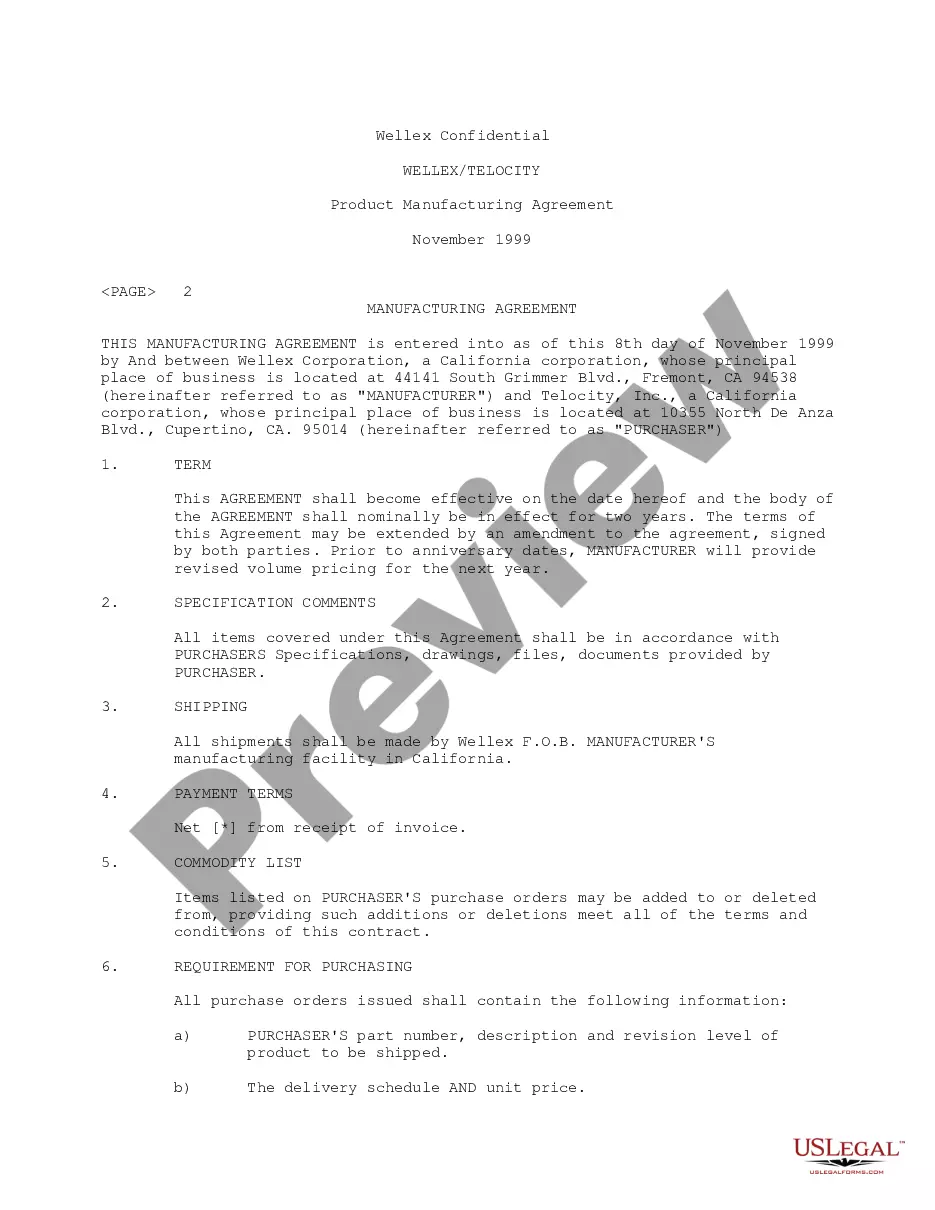

- Click on the Preview button to check the content of the form.

Form popularity

FAQ

Yes, non-compete clauses are legal in South Dakota; however, they must comply with state regulations regarding reasonableness and necessity. The South Dakota Self-Employed Business Development Executive Agreement can guide you in crafting agreements that are both legal and effective. It’s wise to use such agreements carefully to prevent potential disputes. If you need assistance, exploring resources like uslegalforms can offer valuable templates and guidance.

In South Dakota, noncompete agreements are generally enforceable, but they must meet specific criteria to protect both parties. The South Dakota Self-Employed Business Development Executive Agreement can help structure your agreements to comply with local laws. It is crucial to ensure that the terms are reasonable in duration and scope. Legal advice can further clarify how these agreements work in your specific situation.

Several states have enacted laws to ban non-compete clauses, aiming to promote employee mobility and fair competition. These states include California, North Dakota, and South Dakota, where the South Dakota Self-Employed Business Development Executive Agreement can provide clarity on business practices. If you are considering entering a contract, it's essential to understand local regulations. Always consult legal resources or experts to navigate these laws effectively.

Filling out an independent contractor agreement, such as the South Dakota Self-Employed Business Development Executive Agreement, requires careful attention to detail. Start by including the names and addresses of all parties involved. Next, clearly outline the scope of work, payment terms, and the duration of the agreement. Finally, ensure that both parties review and sign the document to create a legally binding contract.

To file UCC forms in South Dakota, you need to complete the appropriate forms and submit them to the South Dakota Secretary of State's office. You can file online, by mail, or in person at the office. Ensuring that your UCC filings are accurate is crucial for those engaged in a South Dakota Self-Employed Business Development Executive Agreement, as it protects your business interests and establishes your secured transactions. Utilizing uslegalforms can streamline your filing process and provide you with easy access to the necessary forms.

The 183 day rule in South Dakota refers to how the state determines residency for tax purposes. If an individual spends more than 183 days in South Dakota within a year, they may be considered a resident for tax obligations. This rule is particularly important for those entering into a South Dakota Self-Employed Business Development Executive Agreement, as it can impact how income is reported and taxed. Understanding your residency status can help you make informed decisions about your business operations.

The self-employment tax in South Dakota is based on your net earnings from self-employment. This tax covers Social Security and Medicare contributions. When structuring a South Dakota Self-Employed Business Development Executive Agreement, understanding your tax obligations helps you manage your finances effectively and ensures compliance with federal requirements.

In South Dakota, whether you need a business license depends on the nature of your business and location. Some cities or counties may have specific licensing requirements. When entering into a South Dakota Self-Employed Business Development Executive Agreement, you should check local regulations to ensure your business operates legally.

Yes, South Dakota does require a contractor license for specific contractor services. However, requirements vary depending on the type of work being performed. For individuals entering into a South Dakota Self-Employed Business Development Executive Agreement, it is crucial to verify licensing requirements to ensure compliance with state regulations.

The purpose of business development is to identify and pursue opportunities to enhance a company's growth and profitability. It involves establishing strategic partnerships, expanding market reach, and improving product offerings. In the context of a South Dakota Self-Employed Business Development Executive Agreement, effective business development accelerates success by aligning both parties’ efforts toward common goals.