South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Advertising Executive Agreement - Self-Employed Independent Contractor?

Are you currently in a position where you need documents for both business or personal purposes almost continuously.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor, created to comply with state and federal regulations.

Select the pricing plan you prefer, enter the necessary information to create your account, and process the payment using your PayPal or Visa or MasterCard.

Choose a suitable file format and download your copy. Retrieve all the document templates you have purchased from the My documents list. You can obtain an additional copy of the South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor anytime you need. Just click the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

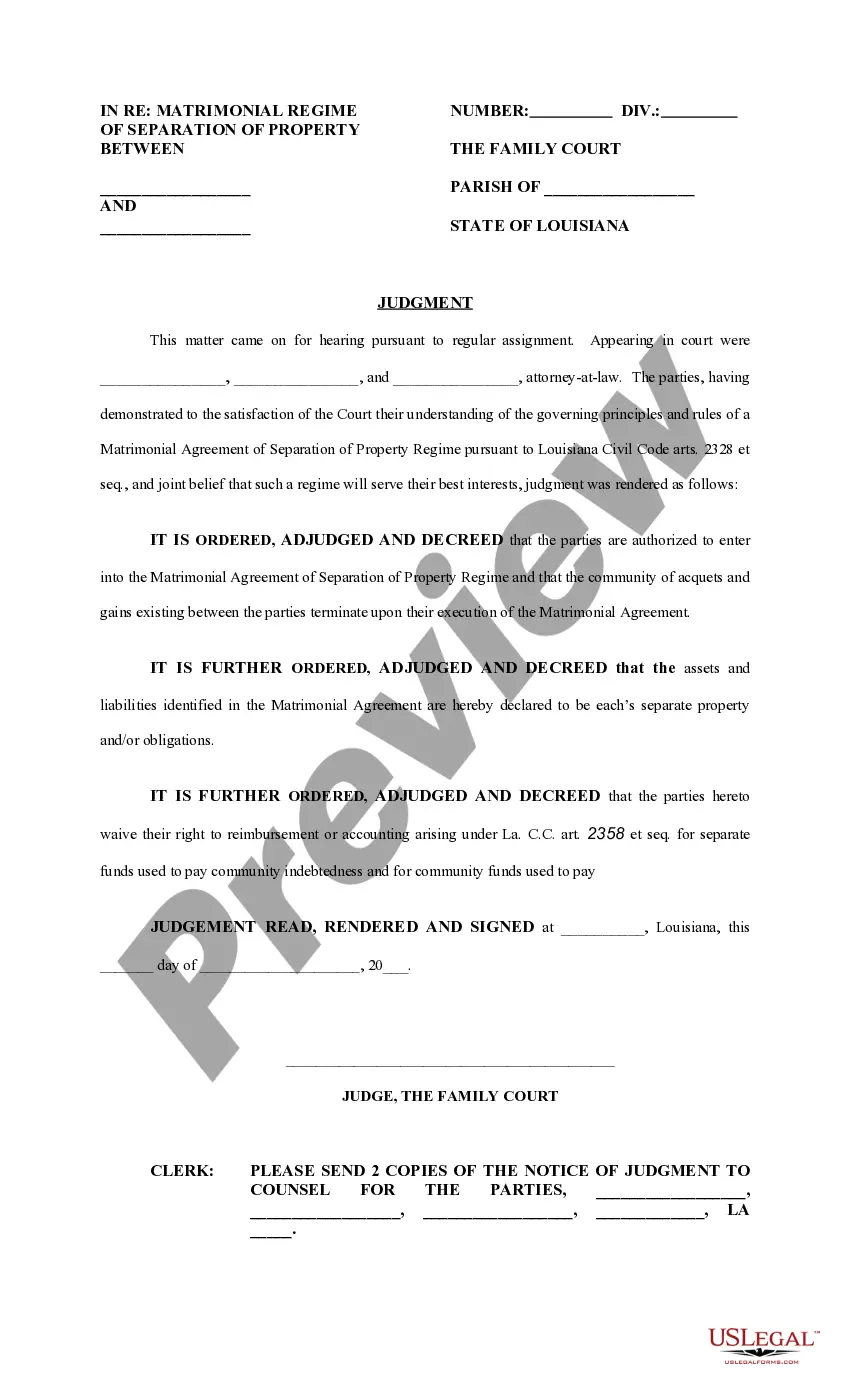

- Use the Review button to evaluate the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you need, utilize the Search section to find the form that matches your needs and criteria.

- Once you find the correct form, click Acquire now.

Form popularity

FAQ

Yes, Non-Disclosure Agreements (NDAs) can apply to independent contractors. When signing a South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor, NDAs protect sensitive information shared during the course of a project. Make sure any NDA is included in your agreement to secure proprietary information and foster trust between you and your client.

If you get hurt while working under a South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor, you typically do not qualify for workers' compensation benefits. Instead, you may need to pursue personal injury claims if your injury results from negligence. Always ensure you have adequate health insurance to cover any medical expenses that may arise.

If you break a South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor, you may face legal consequences, including potential lawsuits. The other party may seek damages due to non-compliance with the agreed terms. Therefore, it’s advisable to understand each clause in your agreement to avoid unintended breaches.

To protect yourself as an independent contractor, always have a clear South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor in place. This document should specify your rights and obligations, ensuring you receive timely payments and proper credit for your work. Additionally, consider obtaining liability insurance to safeguard against potential disputes.

To create a South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor, start by clearly outlining the roles and responsibilities of both parties. Include details such as payment terms, project deadline, and conditions for termination. You can use templates from platforms like USLegalForms to ensure you cover all necessary aspects comprehensively.

When becoming a self-employed independent contractor, you typically need to complete a South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor. This agreement outlines your obligations, compensation, and the nature of your relationship with the company. Additionally, you may need to file tax forms such as a W-9 to report your earnings, along with any necessary business licenses depending on your specific work. For ease and guidance, consider using uslegalforms to access the right documents and ensure compliance with South Dakota laws.

Writing an independent contractor agreement is straightforward. Begin by determining essential details like project scope and payment terms. Then, draft the South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor with clear sections outlining responsibilities, deadlines, and rights of both parties. You can simplify this process by using resources like uslegalforms, which provides templates to ensure you cover all necessary aspects.

Yes, non-disclosure agreements are relevant and beneficial for independent contractors. If your work involves sensitive information, a non-disclosure agreement can protect your business interests. In the context of the South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor, you can include a confidentiality clause to ensure that the contractor understands their responsibility to keep your proprietary information confidential.

Filling out an independent contractor agreement involves several steps. Start with the contractor's full name and contact information. Next, specify the scope of work, payment terms, and duration of the contract in the South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor. Finally, both parties should sign and date the document to make it legally binding, ensuring you both understand the terms.

When employing an independent contractor, you need to prepare a few key documents. Primarily, a well-structured South Dakota Advertising Executive Agreement - Self-Employed Independent Contractor is essential. This agreement outlines the terms of the work, payment details, and confidentiality clauses, ensuring transparency for both parties. Additionally, you should consider obtaining relevant tax forms, such as the W-9 form, to comply with tax regulations.