South Dakota Chef Services Contract - Self-Employed

Description

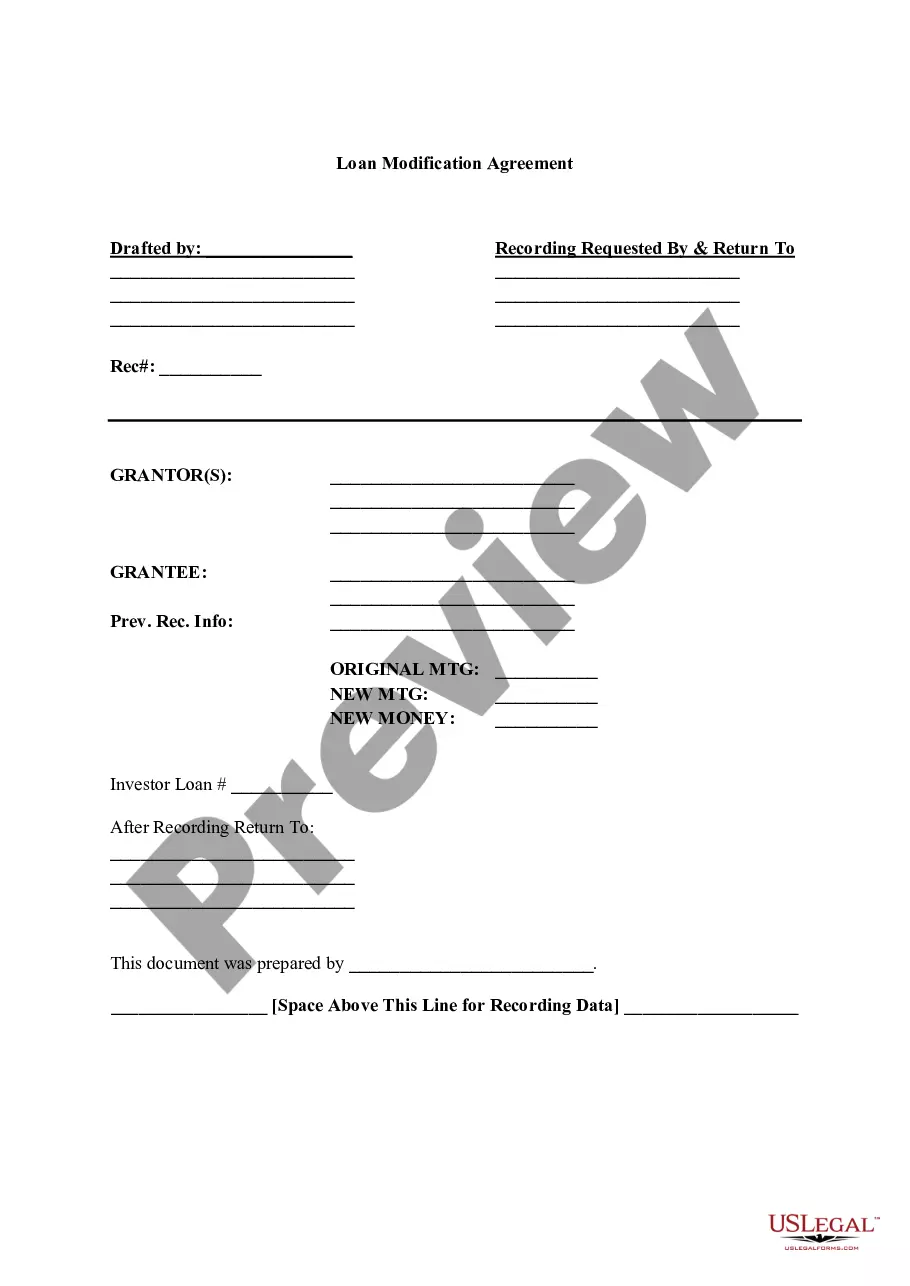

How to fill out Chef Services Contract - Self-Employed?

Selecting the appropriate legal document template can be challenging. Naturally, there are many designs accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website. This service offers a vast array of templates, such as the South Dakota Chef Services Contract - Self-Employed, which can be utilized for both business and personal purposes. All of the forms are vetted by professionals and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to obtain the South Dakota Chef Services Contract - Self-Employed. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your locality/county. You can review the form using the Preview button and examine the form description to confirm this is indeed the correct one for you. If the form does not satisfy your needs, use the Search area to find the right form. Once you are confident that the form is appropriate, click the Get now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received South Dakota Chef Services Contract - Self-Employed.

Ensure that your legal documents are properly prepared and compliant by relying on US Legal Forms.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to obtain professionally crafted paperwork that meets state requirements.

- The platform offers a user-friendly interface for easy navigation.

- All templates are reviewed for accuracy and compliance.

- Access your forms anytime from your account.

- Get started with your legal documentation needs today.

Form popularity

FAQ

Yes, South Dakota requires most businesses to obtain a business license, but specifics may vary by county and city. As a self-employed chef, be sure to check local regulations to ensure you meet all licensing needs. Utilizing the South Dakota Chef Services Contract - Self-Employed can aid in setting up your business and understanding its legal requirements.

Yes, South Dakota has cottage food laws that allow individuals to prepare and sell specific homemade foods without needing a commercial license. This is beneficial for self-employed chefs who wish to operate a small food business. Familiarizing yourself with these laws can help you utilize the South Dakota Chef Services Contract - Self-Employed effectively.

In South Dakota, many small projects can be completed without a contractor's license, such as minor renovations or repairs. If you're working under the South Dakota Chef Services Contract - Self-Employed, you may focus on culinary services rather than construction. Always verify with local regulations what activities require licenses to ensure compliance.

A contractor typically manages larger projects requiring specific skills and permits, while a handyman can handle small repairs and maintenance tasks. In the context of chef services, understanding this distinction can help clarify your role and responsibilities under the South Dakota Chef Services Contract - Self-Employed. If uncertain, consider legal guidance to understand which classification fits your work.

Many states in the U.S. do not require a license for general contractors, including South Dakota. However, it's important to research this aspect thoroughly, as each state has different regulations depending on the scope of work. For self-employed chefs, knowing these details can shape your business strategy, particularly concerning the South Dakota Chef Services Contract - Self-Employed.

In South Dakota, you generally do not need a contractor license to operate as a self-employed individual for chef services. However, it is essential to check local regulations, as cities or counties may have their own requirements. Always ensure compliance with applicable laws to avoid any legal pitfalls. Understanding the South Dakota Chef Services Contract - Self-Employed can help clarify what is needed.

Yes, you can make food from your home to sell, provided you adhere to South Dakota's cottage food law. This includes following safety guidelines and restrictions on the types of food you can sell. Using a South Dakota Chef Services Contract - Self-Employed can help you formalize your home-based food business and ensure it operates within the law.

Home rule in South Dakota allows local governments to create their own laws and regulations, including those related to food service. This means that rules may vary by city or county. When crafting a South Dakota Chef Services Contract - Self-Employed, you should consider local regulations to ensure full compliance.

To sell homemade food in South Dakota, you need to comply with local health regulations and adhere to the cottage food law. It’s crucial to label your products properly and keep your kitchen sanitary. Utilizing a South Dakota Chef Services Contract - Self-Employed can guide you through the necessary steps to ensure you meet all legal requirements.

In South Dakota, specific contractor licenses may be required based on your industry and the services you provide. While some work requires licensing, many independent culinary services do not. Consulting a South Dakota Chef Services Contract - Self-Employed can help clarify what licenses might apply to your business.