South Dakota Professional Fundraiser Services Contract - Self-Employed

Description

How to fill out Professional Fundraiser Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of forms such as the South Dakota Professional Fundraiser Services Contract - Self-Employed in just a few seconds. If you already have a monthly subscription, Log In and download the South Dakota Professional Fundraiser Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms within the My documents tab of your account.

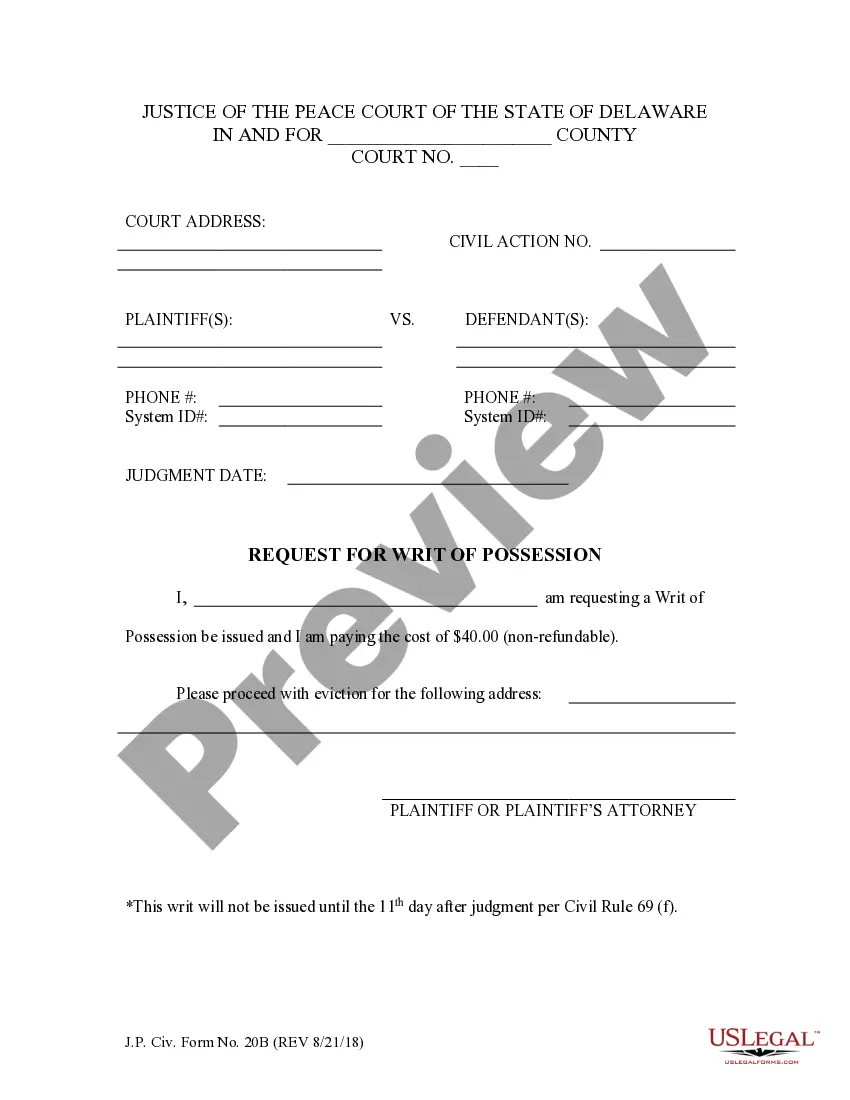

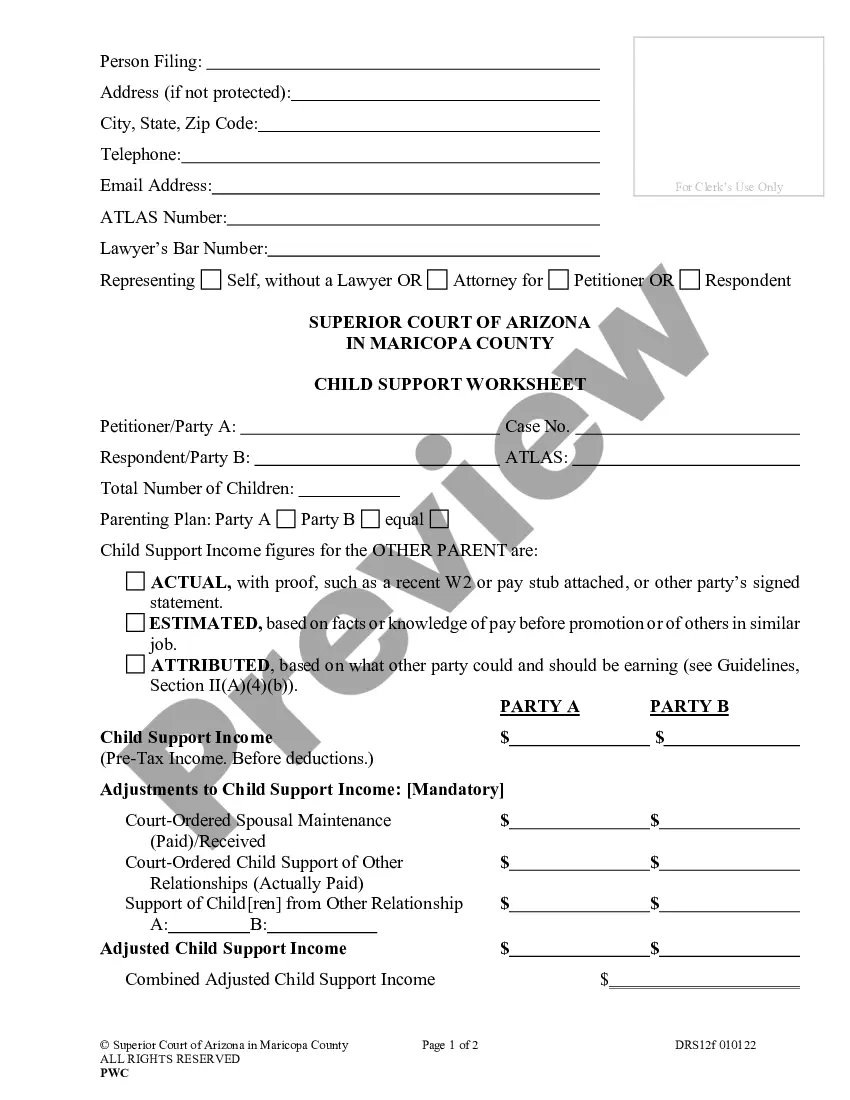

To use US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your region/state. Click the Preview button to review the form's content. Check the form details to make sure you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved South Dakota Professional Fundraiser Services Contract - Self-Employed.

- Every template you added to your account does not have an expiration date and is yours permanently.

- If you wish to download or print another copy, simply visit the My documents section and click on the form you want.

- Access the South Dakota Professional Fundraiser Services Contract - Self-Employed with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Enjoy the convenience of having legal forms readily available at your fingertips.

- Easily manage and organize your legal documents within your account.

Form popularity

FAQ

To start a non-profit in South Dakota, you must first choose a unique name for your organization that aligns with your mission. Next, you need to file articles of incorporation with the South Dakota Secretary of State and obtain your Employer Identification Number (EIN) from the IRS. Once those steps are completed, create a governance structure and draft bylaws for your organization. Finally, consider utilizing a South Dakota Professional Fundraiser Services Contract - Self-Employed to help with fundraising efforts and ensure compliance with state regulations.

A contract fundraiser is a professional hired to raise funds for a nonprofit organization or a charity under a formal agreement. The South Dakota Professional Fundraiser Services Contract - Self-Employed outlines the responsibilities and expectations of both the fundraiser and the organization. This type of contract ensures compliance with local laws and provides a structure for managing donations, reporting requirements, and compensation. Using a professional service like US Legal Forms can simplify creating and managing these contracts effectively.

A professional fundraiser is an individual or organization that provides fundraising services to charities or nonprofits, often involving strategies to enhance donor engagement and revenue generation. They are typically well-versed in the legal and ethical aspects of fundraising, including donation management. Engaging a South Dakota Professional Fundraiser Services Contract - Self-Employed can bring expertise and structure to your fundraising efforts, helping you achieve your financial goals.

A professional fundraiser is someone or a firm hired to solicit donations on behalf of a nonprofit organization. They often possess skills that help them connect with potential donors effectively and understand the laws surrounding fundraising. Utilizing a South Dakota Professional Fundraiser Services Contract - Self-Employed ensures compliance and professionalism in your fundraising endeavors.

The 80/20 rule for nonprofits suggests that 80% of your contributions typically come from 20% of your donors. Understanding this ratio can greatly improve fundraising strategies, allowing nonprofits to focus their efforts where they will yield the greatest return. For those considering a South Dakota Professional Fundraiser Services Contract - Self-Employed, knowing this rule helps target key donor relationships for stronger fundraising outcomes.

The rule of 7 in fundraising states that potential donors need to interact with your message at least seven times before they are likely to make a contribution. This principle highlights the importance of consistent communication and engagement. By utilizing platforms like USLegalForms, a South Dakota Professional Fundraiser Services Contract - Self-Employed can streamline outreach efforts to ensure donor connections happen repeatedly and effectively.

The 33% rule reiterates that nonprofits should strive to maintain financial efficiency by ensuring that no more than one-third of their income goes toward fundraising expenses. This principle encourages organizations to maximize the resources they allocate to their missions. For those utilizing a South Dakota Professional Fundraiser Services Contract - Self-Employed, following this rule can lead to better financial health and sustainability.

The self-employment tax in South Dakota, like in other states, consists of Social Security and Medicare taxes, totaling approximately 15.3% of your net earnings. As a self-employed individual, understanding this tax is crucial for financial planning, especially if you are offering services under a South Dakota Professional Fundraiser Services Contract - Self-Employed. Consulting tax professionals can be beneficial in navigating these obligations.

A professional fundraiser is often referred to as a fundraising consultant or campaign manager. These experts specialize in planning and executing successful fundraising campaigns, helping nonprofits raise funds effectively. If you are considering a South Dakota Professional Fundraiser Services Contract - Self-Employed, engaging a professional can elevate the success of your fundraising efforts.

Nonprofits typically fall into three categories: 501(c)(3) organizations focused on charitable purposes, 501(c)(4) entities which promote social welfare, and 501(c)(6) organizations that support business leagues and trade associations. Each type has its unique requirements and benefits under IRS rules. When forming a nonprofit, consider whether a South Dakota Professional Fundraiser Services Contract - Self-Employed aligns with your organization’s structure and goals.