South Dakota Acoustical Contractor Agreement - Self-Employed

Description

How to fill out Acoustical Contractor Agreement - Self-Employed?

If you need to aggregate, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and convenient search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the South Dakota Acoustical Contractor Agreement - Self-Employed with just a few clicks.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the South Dakota Acoustical Contractor Agreement - Self-Employed. Each legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and obtain, and print the South Dakota Acoustical Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the South Dakota Acoustical Contractor Agreement - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

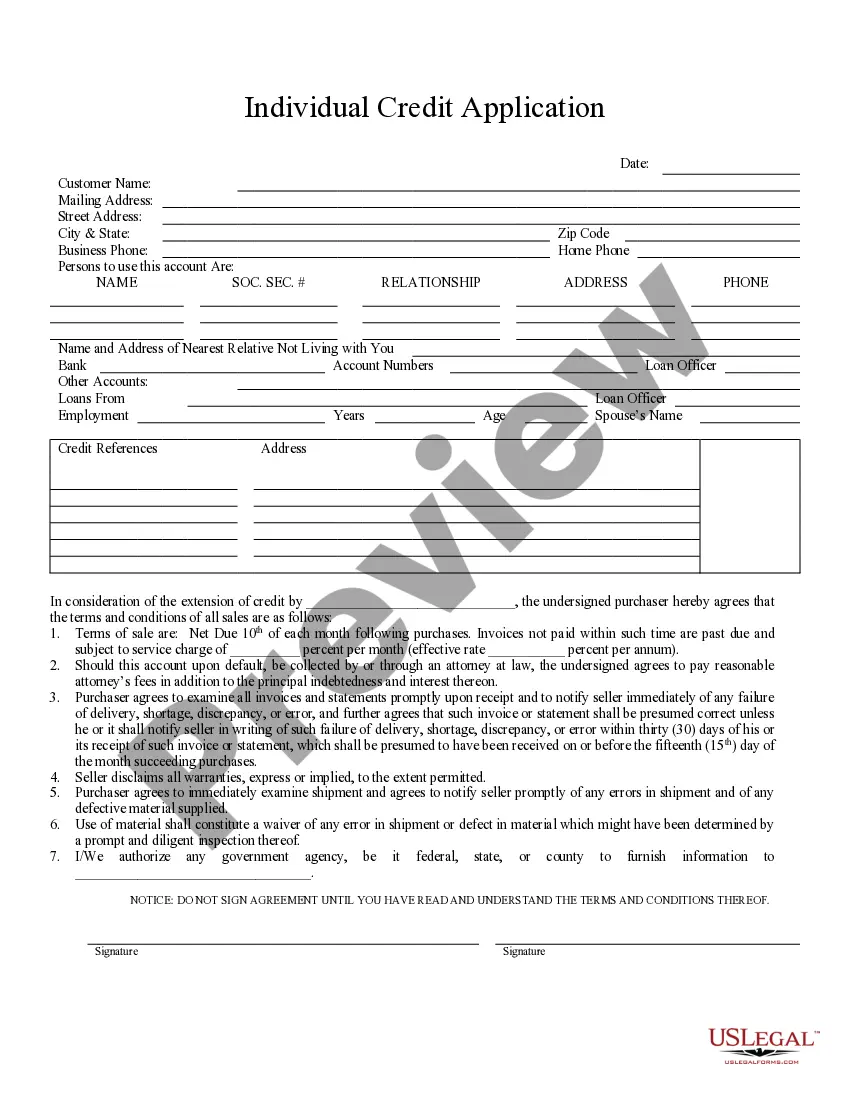

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

Yes, an independent contractor is classified as self-employed. This classification refers to individuals who manage their business operations, meaning they are responsible for their own taxes and financial liabilities. Utilizing a South Dakota Acoustical Contractor Agreement - Self-Employed helps formalize this arrangement, ensuring both parties are on the same page regarding expectations.

To qualify as self-employed, an individual must operate a business, earn income without traditional employment benefits, and be responsible for their expenses and taxes. This status allows for greater freedom in work decisions but also entails significant responsibilities. Establishing clear terms in a South Dakota Acoustical Contractor Agreement - Self-Employed can support your self-employment journey.

While both terms can be used interchangeably, 'self-employed' often conveys a broader sense of independence. An 'independent contractor' specifically denotes a professional working under a contractual agreement. Understanding these distinctions can help you better describe your work situation. A solid South Dakota Acoustical Contractor Agreement - Self-Employed can enhance this professional identity.

Receiving a 1099 form typically indicates that you are self-employed. This form reports income earned outside of traditional employment. As a self-employed individual, you must manage your own tax obligations. Thus, it’s beneficial to use a South Dakota Acoustical Contractor Agreement - Self-Employed for clarity on income expectations.

Yes, an independent contractor is indeed considered self-employed. This status means they operate their own business and are responsible for their own expenses and taxes. Being classified as self-employed provides certain flexibilities and responsibilities. Therefore, using a South Dakota Acoustical Contractor Agreement - Self-Employed can help establish this relationship clearly.

Writing an independent contractor agreement involves outlining the terms and conditions of the work relationship. Begin with clear definitions of the services provided, payment terms, and deadlines. Include clauses on confidentiality and termination, ensuring both parties agree. A well-drafted South Dakota Acoustical Contractor Agreement - Self-Employed can help clarify expectations.

In South Dakota, a contractor license is generally required for those undertaking construction work. However, specific requirements can vary by city or county. It’s vital to check your local regulations. Understanding these rules is essential for ensuring compliance while using a South Dakota Acoustical Contractor Agreement - Self-Employed.