South Dakota Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

Are you presently in a situation where you require documentation for both business or personal purposes almost every day.

There is an abundance of legitimate document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the South Dakota Carrier Services Contract - Self-Employed Independent Contractor, designed to comply with state and federal requirements.

Once you obtain the right form, click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and make the payment using PayPal or a credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you will be able to download the South Dakota Carrier Services Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it matches the appropriate city/state.

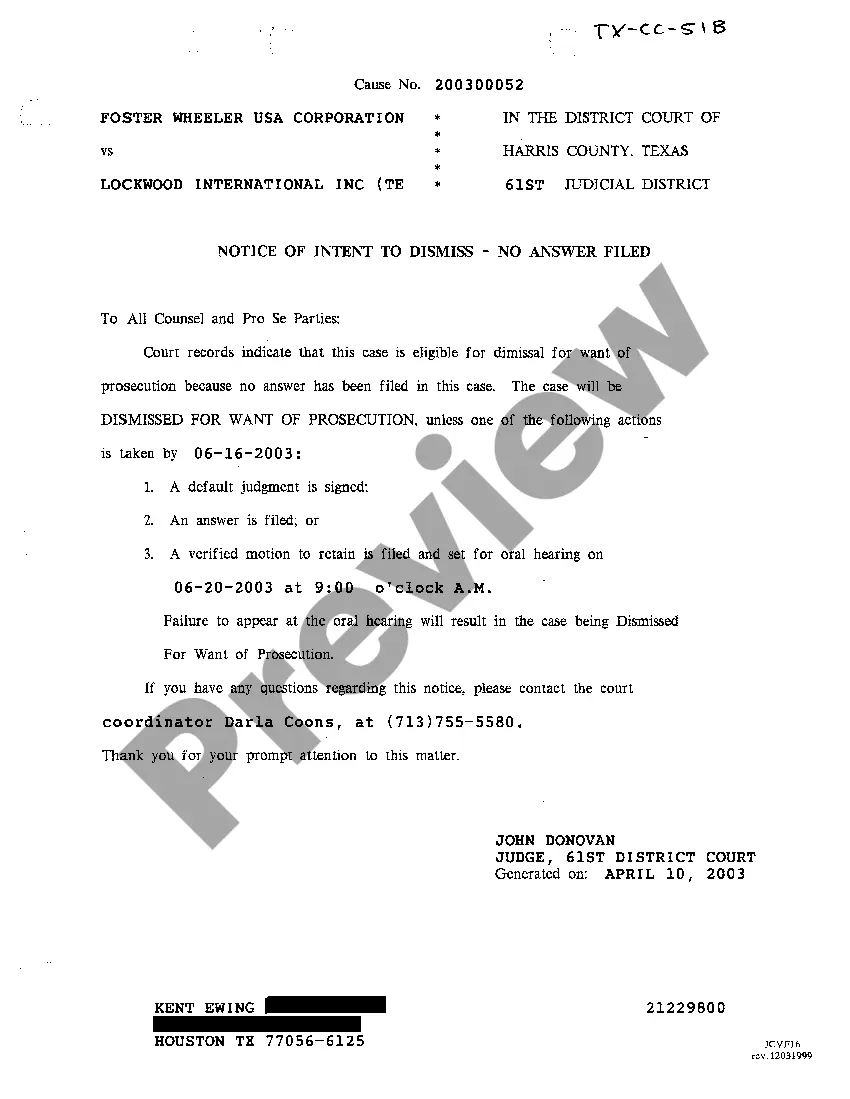

- Utilize the Preview button to review the document.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are searching for, use the Lookup field to locate the form that suits your needs and requirements.

Form popularity

FAQ

Self-employment tax in South Dakota mirrors the federal self-employment tax rate, which is 15.3%. This tax applies to net earnings from self-employment, including income from a South Dakota Carrier Services Contract - Self-Employed Independent Contractor. You must report this income accurately to ensure compliance with tax regulations. For assistance in managing your taxes, you might consider resources available on the US Legal Forms platform.

In South Dakota, many services are subject to sales tax. However, the tax applies specifically to certain services and may not encompass all types of services. If you are working under a South Dakota Carrier Services Contract - Self-Employed Independent Contractor, it is crucial to understand which services are taxable. For precise information, consult a tax professional or refer to state tax guidelines.

An independent contractor generally needs to complete forms like the IRS W-9 for tax purposes and any contractual documents relevant to their services. If you're engaging in a South Dakota Carrier Services Contract - Self-Employed Independent Contractor, ensure you are compliant with state-specific requirements. Platforms such as uslegalforms provide a variety of forms to help streamline this process.

When filling out an independent contractor form, gather all necessary information such as personal details, tax identification number, and nature of services. Each section should be completed accurately, particularly in compliance with any local laws pertaining to the South Dakota Carrier Services Contract - Self-Employed Independent Contractor. Using a standard form from resources like uslegalforms can simplify this process.

Filling out an independent contractor agreement involves entering specific details, such as the contractor's name, address, and the services they will provide. Make sure to include start dates, payment terms, and any special provisions unique to the South Dakota Carrier Services Contract - Self-Employed Independent Contractor. Always review the document carefully to ensure that all information is accurate and complete.

To write an independent contractor agreement, start by defining the parties involved and the scope of work. Specify payment details, timelines, and any relevant business regulations, especially if you are using a South Dakota Carrier Services Contract - Self-Employed Independent Contractor. It is advisable to consult templates or platforms like uslegalforms for accurate language and structure.

employed contract, particularly a South Dakota Carrier Services Contract SelfEmployed Independent Contractor, should outline the specific services provided, payment terms, and deadlines. Additionally, include sections on confidentiality, termination clauses, and any obligations both parties must fulfill. This clarity helps prevent misunderstandings and ensures both parties are aligned and protected legally.

To gain authorization, you typically need to meet legal requirements, such as registering your business and obtaining the necessary licenses. Understanding local laws is vital to prevent complications. A South Dakota Carrier Services Contract - Self-Employed Independent Contractor helps lay down the framework for your compliance as you start your independent career.

Yes, South Dakota requires certain types of contractors to hold a license. Depending on the nature of your services, you may need to complete specific qualifications. A South Dakota Carrier Services Contract - Self-Employed Independent Contractor can provide guidance on these requirements, ensuring you remain compliant.

Working as an independent contractor in the U.S. involves defining your services, finding clients, and managing contracts effectively. You should also be familiar with tax regulations and business licenses. Completing a South Dakota Carrier Services Contract - Self-Employed Independent Contractor can streamline your process, making it easier to start your independent journey.